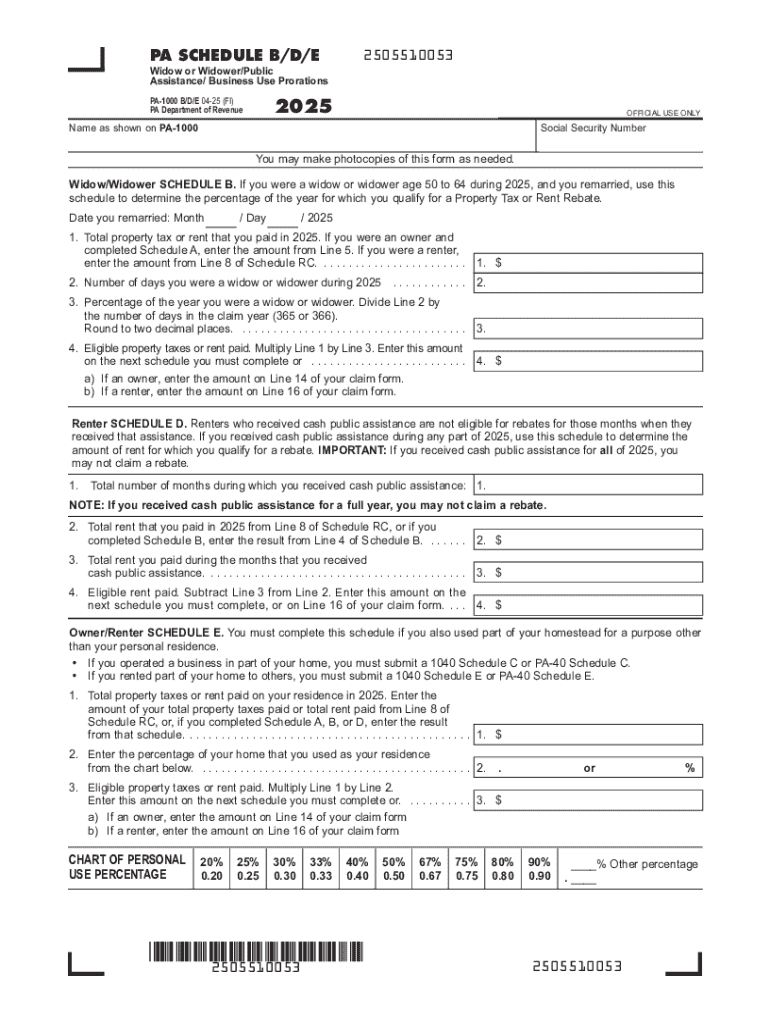

Get the free 2025 PA Schedule B/D/E - Widow or Widower/Public Assistance/Business Use Prorations ...

Get, Create, Make and Sign 2025 pa schedule bde

How to edit 2025 pa schedule bde online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 pa schedule bde

How to fill out 2025 pa schedule bde

Who needs 2025 pa schedule bde?

2025 PA Schedule BDE Form: How-to Guide

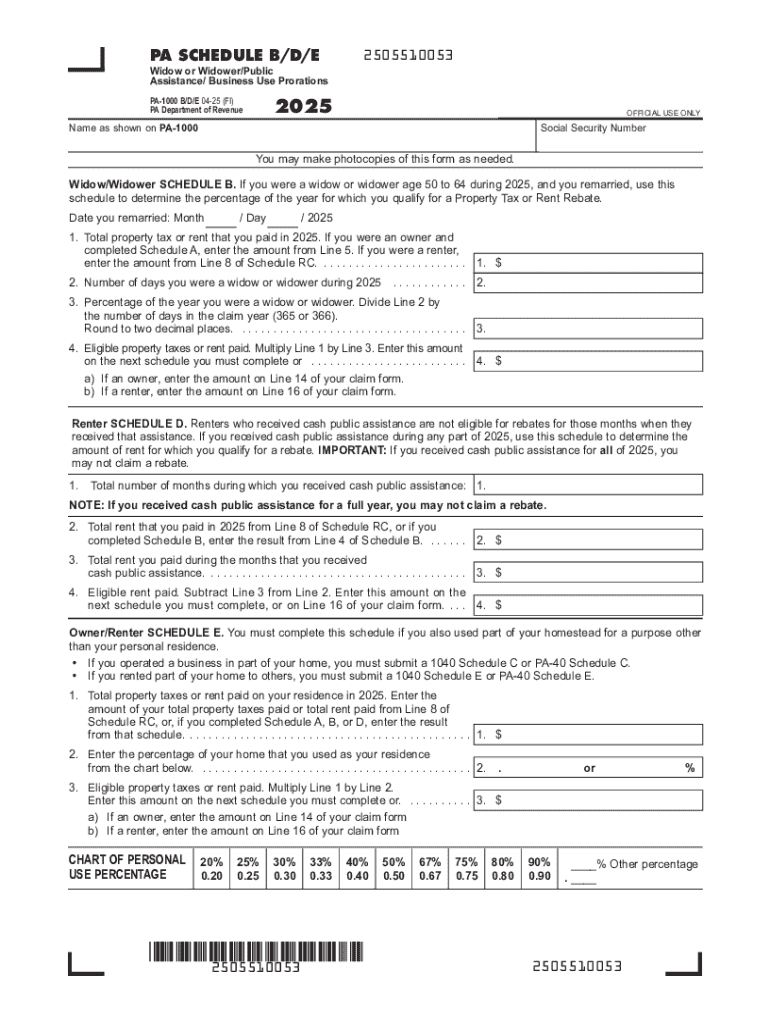

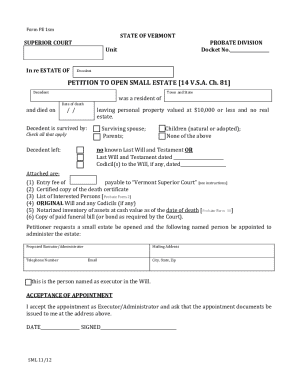

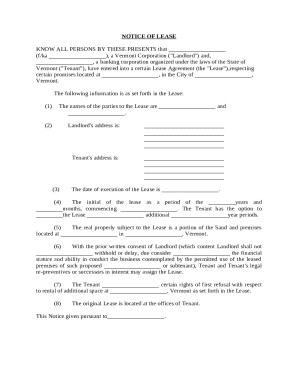

Understanding the 2025 PA Schedule BDE Form

The 2025 PA Schedule BDE Form is a crucial document for taxpayers who need to report specific details related to business income in Pennsylvania. It provides the state with information about income sources, expenses, and other deductions pertinent to business operations. This form significantly contributes to ensuring accurate tax report submissions, particularly for self-employed individuals and entities owning businesses. The importance of the Schedule BDE cannot be overstated; it helps taxpayers avoid penalties by ensuring compliance with state tax laws.

For the 2025 tax year, there are several updates to the Schedule BDE that taxpayers should be aware of. Changes may include new thresholds for income reporting, modifications to deductions available, or updates to filing procedures. Familiarizing oneself with these changes is essential for accurate and timely filing.

Eligibility criteria for using the 2025 PA Schedule BDE Form

Understanding who should file the Schedule BDE is essential. Typically, individuals and businesses that generate income through self-employment, partnerships, or pass-through entities must complete this form. This includes independent contractors, LLCs, and partnerships, among others. There's also the aspect of thresholds and exceptions; for instance, businesses earning below a specific income level might not need to file or could utilize a simplified form.

Further, some situations necessitate additional documentation. For example, if a business operates in multiple states or if there are discrepancies in reported income, supplementary forms or validations may be required. Keeping comprehensive records is vital for confirming eligibility during filing.

Key components of the Schedule BDE Form

The 2025 PA Schedule BDE Form includes several key sections that taxpayers need to complete. These components ensure that all required information is collected comprehensively. The form starts with personal information, where taxpayers must fill in their name, address, and Social Security Number or Employer Identification Number (EIN), ensuring that the form is tied directly to the correct taxpayer.

Income details are next, requiring an accurate report of earnings generated during the fiscal year. Taxpayers will also need to provide deductions and credits related to business expenses, including operational costs and specific sector-related deductions. Understanding how to determine gross receipts is critical; taxpayers must calculate all income received before any deductions to report precisely. Accurate calculations at this stage help prevent issues with the revenue department later.

Preparing to fill out the 2025 PA Schedule BDE Form

Preparation is a foundational step when filling out the 2025 PA Schedule BDE Form. Gather all relevant documents and information to streamline the process. Key documents include W-2 forms for employees, 1099s for freelancers or contractors, and prior year tax returns to provide context for your financial situation.

Additionally, organizing financial records is essential. Using digital platforms or financial software can help maintain an orderly log of income and expenses throughout the year, making tax preparation more manageable. It's advisable to categorize these records—for instance, separating income sources from various expenses—to simplify form completion.

Step-by-step instructions for completing the Schedule BDE Form

1. **Gather personal information:** Begin by confirming your identification details. This includes your legal name, address, Social Security Number, or EIN. Ensure these are current and match the records held by the IRS.

2. **Report your income:** In this step, accurately list all earnings. Include total revenue from all sources, along with any distributions from partnerships or pass-through entities. These figures need to reflect your gross receipts before deductions.

3. **Claim deductions:** Identify eligible deductions and credits that can reduce your taxable income. Common deductions include business supplies, travel expenses, and any other documentation proving operational costs. Avoid common mistakes, such as failing to include all receipts or miscalculating total amounts.

4. **Finalize your form:** After completing the form, take time to check calculations for accuracy and ensure no required fields are overlooked. Mistakes or missing information can delay processing and result in penalties.

Electronic vs paper filing of the 2025 PA Schedule BDE Form

Choosing between electronic and paper filing for the 2025 PA Schedule BDE Form can impact your filing experience significantly. eFiling offers numerous advantages, particularly through tools like pdfFiller. This platform provides cloud-based document management, ensuring that your form can be accessed from anywhere, facilitating easy updates and modifications.

Real-time collaboration and feedback are additional benefits of eFiling through pdfFiller. Stakeholders or financial advisors can access and provide input on your documents swiftly. To eFile with pdfFiller, navigate to the Schedule BDE template, edit the form with your details, and proceed with signing and submitting electronically. This method typically ensures faster processing of your submissions.

Common challenges and solutions when filing the Schedule BDE Form

When filing the Schedule BDE Form, various challenges can arise. Common errors include incomplete information, which can lead to rejected claims. Ensure you double-check each item on your form and verify that every necessary document is included before submission.

Miscalculation is another frequent issue. Errors in reporting income or deductions can severely impact owed taxes. To mitigate these problems, consider utilizing tax software or consulting with a tax professional who can offer additional guidance. Several resources are available for individuals facing difficulties, like helplines provided by the Pennsylvania Department of Revenue.

Post-filing: What to do after submitting your Schedule BDE Form

Once you've submitted your Schedule BDE Form, it's time to monitor your filing status. Pennsylvania's Department of Revenue provides an online tool to check the status of your tax returns, which can offer peace of mind regarding the processing of your submission.

Understanding what to expect is equally important. Processing times may vary, and you may receive notices concerning your filing within several weeks. Lastly, be prepared for potential audits, as the state may randomly select returns for review. Maintaining organized records can simplify this process significantly.

Additional features and tools from pdfFiller for your tax needs

pdfFiller offers several additional features tailored to assist with tax preparation beyond just the Schedule BDE Form. eSignature capabilities allow you to securely sign documents without needing to print or scan. The platform also includes PDF editing options, which can be incredibly useful for making real-time updates to your forms.

Furthermore, pdfFiller provides templates for various other tax forms, ensuring you can manage multiple submissions from a single platform. Enhancements in document organization and security measures ensure that your sensitive information remains protected, providing you with confidence in your financial documentation.

FAQs about the 2025 PA Schedule BDE Form

How often is the Schedule BDE updated? The Schedule BDE is typically updated annually to reflect changes in tax laws and regulations. It’s important to consult the latest version each filing season.

What happens if I made a mistake on my form? Mistakes can lead to processing delays. If you realize an error after filing, an amendment may be necessary, depending on the nature of the mistake.

Can I amend a previously submitted Schedule BDE? Yes, previous submissions can be amended by filing an amended return. It’s wise to do this as soon as any discrepancy is noticed to avoid future complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2025 pa schedule bde in Chrome?

Can I edit 2025 pa schedule bde on an Android device?

How do I fill out 2025 pa schedule bde on an Android device?

What is 2025 pa schedule bde?

Who is required to file 2025 pa schedule bde?

How to fill out 2025 pa schedule bde?

What is the purpose of 2025 pa schedule bde?

What information must be reported on 2025 pa schedule bde?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.