Get the free wolfsberg-group-correspondent-banking- ...

Get, Create, Make and Sign wolfsberg-group-correspondent-banking

How to edit wolfsberg-group-correspondent-banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wolfsberg-group-correspondent-banking

How to fill out wolfsberg-group-correspondent-banking

Who needs wolfsberg-group-correspondent-banking?

Navigating the Wolfsberg Group Correspondent Banking Form: A Comprehensive Guide

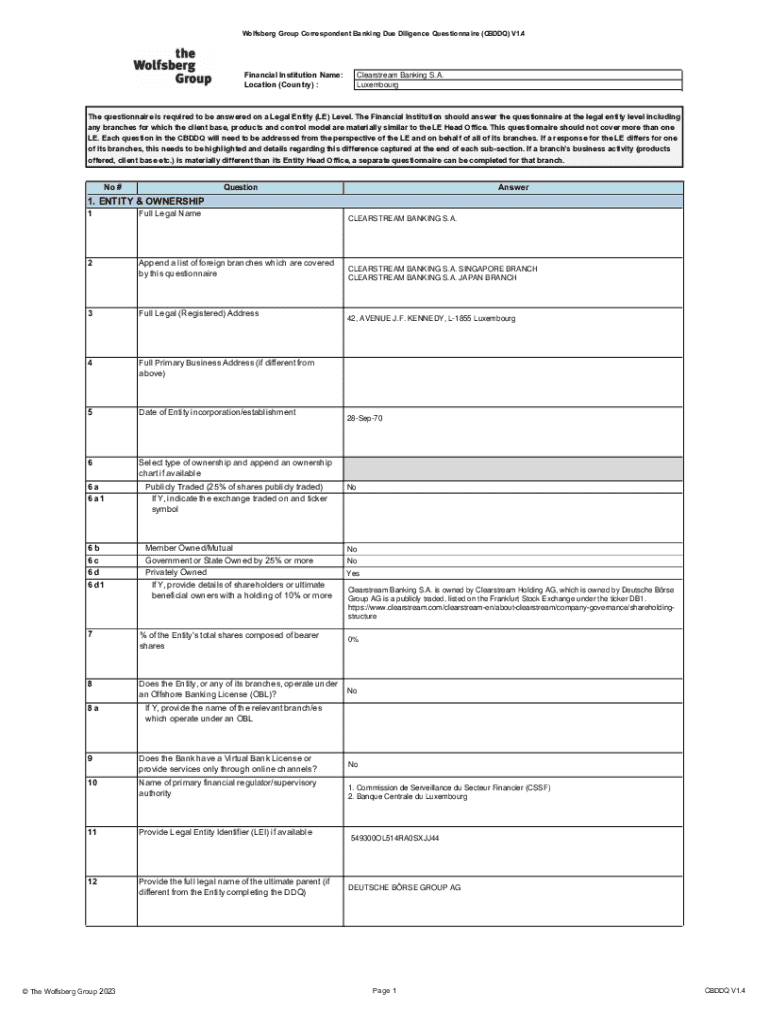

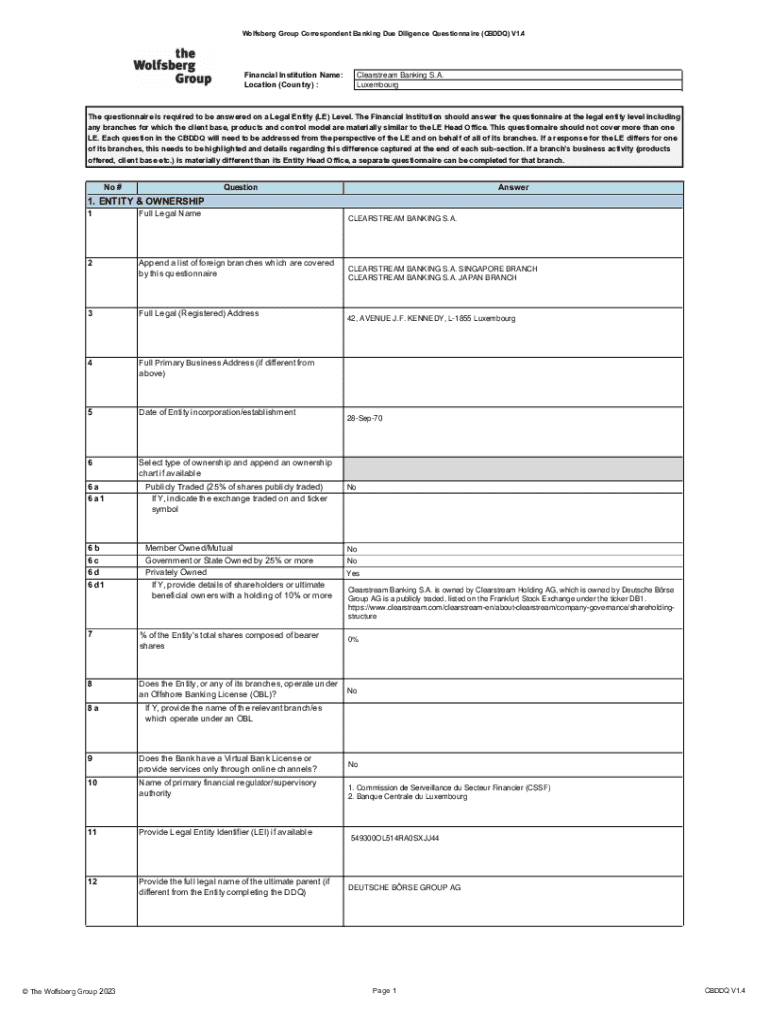

Understanding the Wolfsberg Group Correspondent Banking Form

Correspondent banking plays a crucial role in the global financial system, enabling banks to offer services in markets where they don't maintain a physical presence. This allows banks to process international transactions efficiently, offering a seamless flow of funds across borders. The Wolfsberg Group, a coalition of global banks, has been instrumental in establishing standards to combat money laundering and terrorism financing, particularly within the domain of correspondent banking.

The Wolfsberg Group Correspondent Banking Form was developed as part of these efforts to ensure compliance and due diligence in the correspondent banking sector. Its purpose is to collect vital information about banks and their operations, ultimately enhancing transparency and risk management for financial institutions engaged in these transactions.

Key elements of the Wolfsberg Group Correspondent Banking Form

Filling out the Wolfsberg Group Correspondent Banking Form requires specific and structured information. The form is designed to capture essential details that help institutions assess the risks associated with their correspondent banking relationships. The completeness and accuracy of the information provided directly impact compliance management and regulatory alignment.

To facilitate understanding, the form includes specific terminology and definitions. A glossary helps clarify terms that may be unfamiliar to some users, aiding the completion process and ensuring that all information is accurately reported.

How to fill out the Wolfsberg Group Correspondent Banking Form

Filling out the Wolfsberg Group Correspondent Banking Form may initially seem daunting, but a structured approach can simplify the process. Here’s a step-by-step guide to help you accurately provide the required information.

Utilizing digital tools such as pdfFiller can greatly enhance this process. Features like auto-fill capabilities, collaboration tools, and eSignature options make it easier to complete and finalize the form, streamlining the submission process while maintaining high compliance standards.

Editing and adjusting the Wolfsberg Group Correspondent Banking Form

After filling out the Wolfsberg Group Correspondent Banking Form, there may be a need to make revisions. It’s essential to ensure that any edits comply with the regulatory standards required for accuracy and completeness. Within pdfFiller, users can easily revise forms without compromising the integrity of the information.

Interactive tools such as annotation, commenting, and version control help teams collaborate effectively, enhancing the form completion process and decreasing the risk of oversight.

Signing and sharing the Wolfsberg Group Correspondent Banking Form

The final steps after filling out the Wolfsberg Group Correspondent Banking Form involve eSigning and sharing the document. Electronic signatures have gained legal validity, streamlining the approval process.

Using secure sharing features also helps to maintain privacy and compliance regarding sensitive banking information. Ensure that sharing practices align with regulatory standards, safeguarding against potential breaches.

Managing your Wolfsberg Group Correspondent Banking Form post-completion

Once the Wolfsberg Group Correspondent Banking Form is completed and submitted, effective management of the document is crucial for future compliance assessments and audits. Proper storage and organization are fundamental to ensure easy retrieval when needed.

Tracking changes and audit trails is fundamental in the banking sector to enhance transparency and uphold due diligence policies.

FAQs about the Wolfsberg Group Correspondent Banking Form

Even after following the outlined procedures, questions might arise concerning the Wolfsberg Group Correspondent Banking Form. Addressing commonly asked questions can provide clarity and aid in the correct handling of the form.

These FAQs represent typical issues that financial professionals might encounter, emphasizing the importance of understanding the form and its requirements.

Additional tools and resources for correspondent banking compliance

Financial institutions must remain informed about evolving regulatory requirements in correspondent banking. Continuous education and awareness are paramount to ensure compliance and risk management efforts are kept up to date.

As the regulations within the banking sector continue to evolve, utilizing comprehensive platforms like pdfFiller can assist in navigating these changes efficiently, ensuring that compliance needs are met seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out wolfsberg-group-correspondent-banking using my mobile device?

Can I edit wolfsberg-group-correspondent-banking on an Android device?

How do I complete wolfsberg-group-correspondent-banking on an Android device?

What is wolfsberg-group-correspondent-banking?

Who is required to file wolfsberg-group-correspondent-banking?

How to fill out wolfsberg-group-correspondent-banking?

What is the purpose of wolfsberg-group-correspondent-banking?

What information must be reported on wolfsberg-group-correspondent-banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.