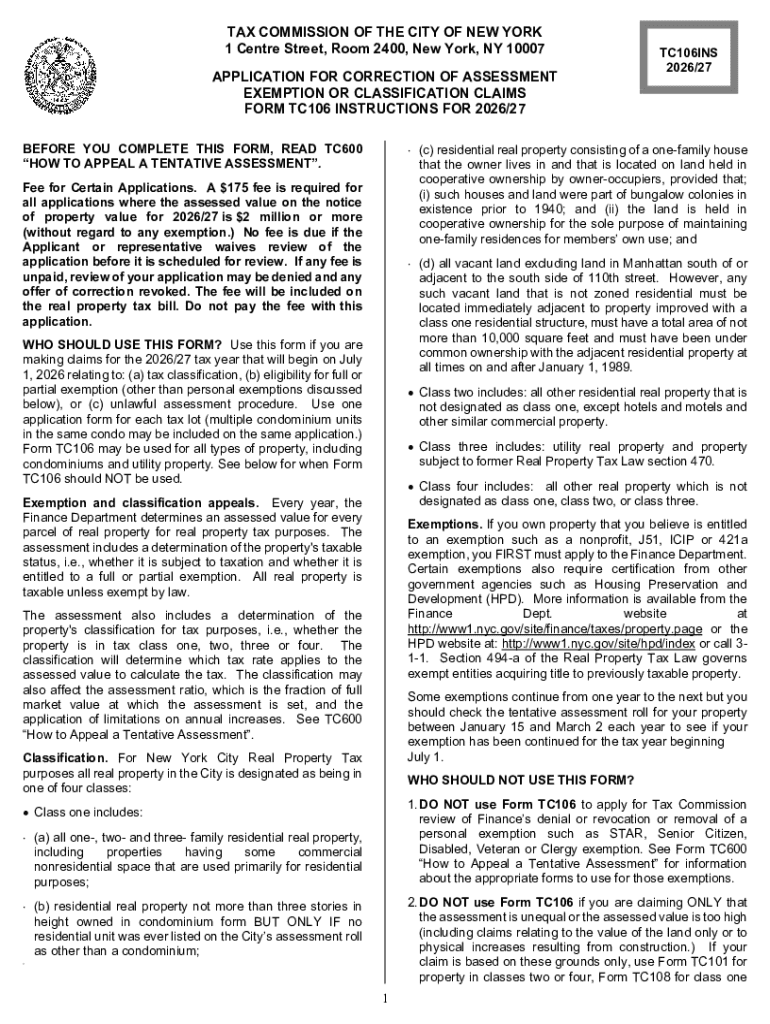

Get the free nyc tax commission forms - fill online, printable, fillable ...

Get, Create, Make and Sign nyc tax commission forms

Editing nyc tax commission forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc tax commission forms

How to fill out nyc tax commission forms

Who needs nyc tax commission forms?

NYC Tax Commission Forms Guide

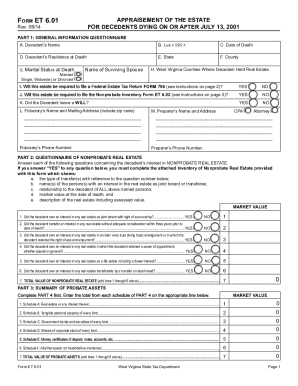

Understanding the NYC Tax Commission Forms

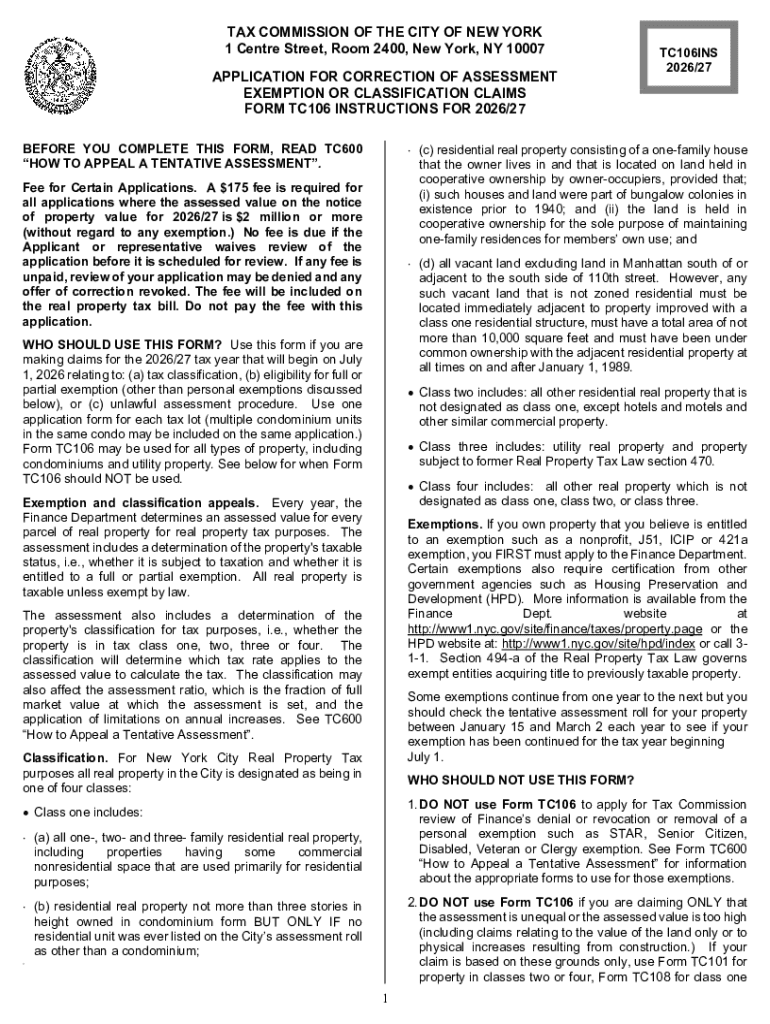

The NYC Tax Commission plays a crucial role in the assessment of property and business taxes across the five boroughs of New York City. This commission handles several essential forms that taxpayers must complete to ensure compliance with city regulations. From property tax exemptions to business tax filings, understanding these forms is vital for anyone who engages with NYC's tax system. Accurate tax documentation is not just a matter of compliance; it can significantly impact your financial obligations.

Incorrect or incomplete forms can lead to fines, delays, or unfavorable tax assessments. It’s important to familiarize yourself with the various types of forms handled by the NYC Tax Commission, such as property tax review forms or commercial business tax forms, to avoid unnecessary complications.

Accessing NYC Tax Commission Forms

Obtaining NYC Tax Commission forms is straightforward with several options available for access. The most convenient way is through online resources available on the NYC Tax Commission website. You can download and print various forms directly from their pages or access interactive tools that guide you through the filling process.

In-person offices also provide forms, allowing you to ask questions directly to a representative for specific guidance. It’s useful to confirm the office hours before visiting. Note that forms can come in both printable and electronic formats, giving you flexibility in how you complete your filings.

Remember key deadlines for form submissions to avoid late fees, which can add unnecessary costs to your tax obligations.

Comprehensive list of NYC Tax Commission forms

Navigating through the maze of forms can be daunting. Here’s a structured list that distinguishes the essential forms you may need to familiarize yourself with based on your situation, whether you're a property owner, running a business, or filing personal income tax.

Understanding these categories will help streamline your filing process and ensure that you submit all necessary documentation.

Step-by-step process for completing NYC Tax Commission forms

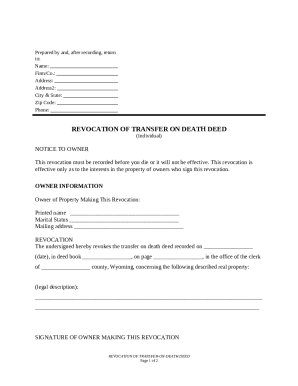

Successfully completing NYC Tax Commission forms requires a methodical approach. Begin by gathering all necessary documentation, which typically includes proof of income, property deeds, and previous tax returns. Each form comes with specific instructions detailing what information is required and how to present it.

Pay close attention to the structure and requirements of each form. Common mistakes include overlooking signature requirements or miscalculating figures, which can delay processing. Engaging interactive tools can simplify the completion process; for instance, leveraging pdfFiller allows you to edit and complete forms easily, providing a stress-free experience.

Specific instructions for editing and signing forms

Once you've downloaded the necessary forms, you can use pdfFiller to make editing a breeze. This platform simplifies editing PDFs, allowing you to highlight, annotate, and complete forms directly. eSignatures are also easily integrated into this process, making it simple to finalize your submissions electronically.

Utilizing features for team collaboration can enhance the form-filling experience. With pdfFiller's cloud-based access, multiple team members can collaborate in real-time, ensuring accuracy and reducing processing time.

Common queries about NYC Tax Commission forms

Taxpayers often have queries regarding the NYC Tax Commission forms, particularly concerning errors and submission processes. For instance, if you notice an error on your submitted form, it's crucial to contact the NYC Tax Commission immediately. They can guide you through the amendment process, ensuring that your tax records remain accurate.

Many individuals also want to know how to track the status of their submitted forms. The NYC Tax Commission provides resources on how to check your form status, usually through a dedicated webpage that asks for identification information. Lastly, be aware of the penalties for late submissions; they can escalate quickly if not addressed timely.

Tips for efficiently managing your tax documentation

Maintaining organized tax documentation is essential for managing your responsibilities effectively. Establishing a coherent filing system helps in quickly retrieving documents needed for form completion, audits, or inquiries. A mix of physical and digital storage solutions can provide flexibility while ensuring that nothing is lost.

Regular updates and maintenance of your tax files should be prioritized. Schedule annual reviews of your documents to discard outdated material and ensure that all necessary paperwork is retained. Utilizing cloud storage for digital files offers additional security and convenient access from anywhere.

Contact information for assistance

If you require further assistance regarding NYC Tax Commission forms, reaching out directly to the commission can provide you with answers tailored to your specific needs. The NYC Tax Commission has dedicated contacts available for inquiries, supported by detailed webpages that further elaborate on their services.

Additionally, various support resources, including language support services for non-English speakers, can ensure that all taxpayers have access to the essential information they require.

Additional information and updates

Staying informed about changes in tax laws or form requirements can significantly impact your filing process. The NYC Tax Commission periodically updates forms, which may incorporate changes following shifts in state law or city policy. It’s beneficial to subscribe to updates through their website or local tax seminars to remain abreast of the latest developments.

Moreover, upcoming workshops or seminars for tax preparation can provide valuable insights and guidance on filling out forms correctly. Such educational opportunities can empower taxpayers, ensuring they have a comprehensive understanding of their obligations.

User testimonials and success stories

Hearing from users who have effectively managed their NYC Tax Commission forms with pdfFiller can provide real-world context to the advantages of using modern document management solutions. Many teams have praised the efficiency of using pdfFiller for its straightforward interface, allowing for hassle-free collaboration and electronic signatures.

Case studies highlight scenarios where individuals and teams have drastically reduced processing times by utilizing interactive features of pdfFiller. Users often share how the platform's tools improved their confidence in handling tax documentation, ultimately leading to successful tax submissions and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nyc tax commission forms from Google Drive?

How do I edit nyc tax commission forms straight from my smartphone?

How do I edit nyc tax commission forms on an iOS device?

What is nyc tax commission forms?

Who is required to file nyc tax commission forms?

How to fill out nyc tax commission forms?

What is the purpose of nyc tax commission forms?

What information must be reported on nyc tax commission forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.