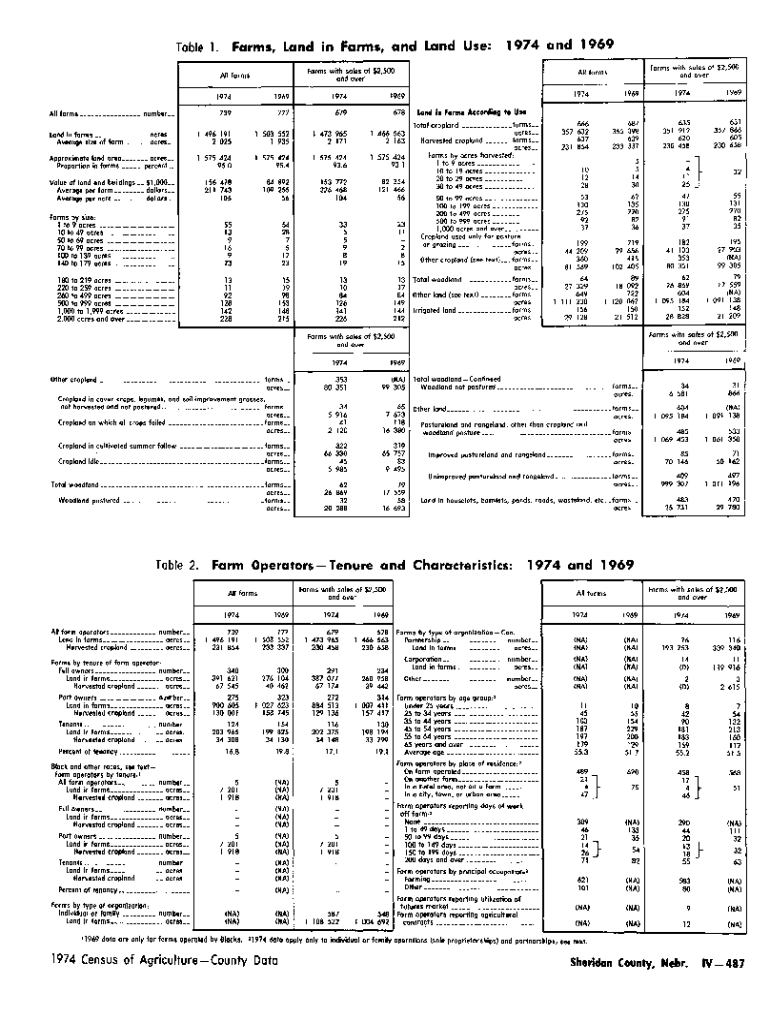

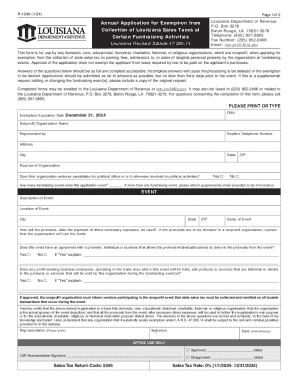

Get the free s of $2,500

Get, Create, Make and Sign s of 2500

Editing s of 2500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out s of 2500

How to fill out s of 2500

Who needs s of 2500?

Comprehensive Guide to the s of 2500 Form

Understanding the s of 2500 form

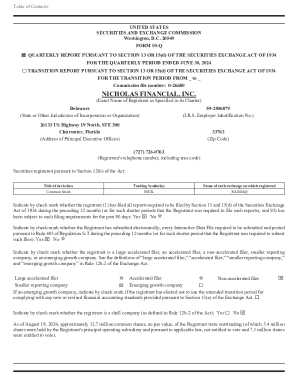

The s of 2500 form is a crucial document used by individuals and organizations to report tax information to the appropriate revenue departments, such as the Colorado Department of Revenue. It serves the purpose of collecting necessary financial data to assess your income tax obligations accurately.

Key components of the s of 2500 form include personal identification details, financial information detailing incomes and deductions, and additional disclosures related to grants or other taxable events. Each section is designed to capture specific data that affects tax calculations.

Who needs to complete the s of 2500 form?

Persons required to fill out the s of 2500 form typically fall into two categories. Firstly, individual taxpayers in Colorado must complete it when filing their income tax returns. Secondly, organizations or businesses that provide grants or other financial services may also be obligated to submit this form to document payments made to individuals.

Common scenarios for using the s of 2500 form involve filing income tax returns, documenting payments exceeding the threshold set by the state's tax regulations, or when a person receives certain types of grants that must be reported.

Importance of accurate completion

Accurate completion of the s of 2500 form is critical as errors can lead to serious implications, including penalties from tax authorities or, worse, audits. Misreported amounts on the form can misrepresent one’s tax liabilities, potentially leading to the underpayment or overpayment of taxes.

Additionally, ensuring that this form meets legal compliance is vital. Inaccuracies or omissions may also hinder an individual's income tax account standing with the Colorado Department of Revenue, affecting eligibility for refunds or other tax credits.

How to access the s of 2500 form

Accessing the s of 2500 form is straightforward, especially via platforms like pdfFiller. Users can easily locate the correct template by searching for 's of 2500 form' on their dedicated webpage.

When looking for the form, ensure you select the current version aligned with the latest state tax guidelines. It's crucial to check for updates that may affect how the form should be filled out based on recent changes in tax law.

Navigating the format

The s of 2500 form is available in various formats to suit user preferences, including PDFs, Word documents, and more. To utilize the form offline, you can download it direct from pdfFiller, allowing for easy access and completion without an internet connection.

Step-by-step guide to filling out the s of 2500 form

Before you begin filling out the s of 2500 form, gather all necessary information and documents. It's essential to have documentation like prior year’s income tax returns, W-2s, 1099s, and any grant documentation ready to ensure all data is complete.

Filling out the form

As you fill out the s of 2500 form, pay special attention to required sections:

Common mistakes to avoid include omitting required details, providing inaccurate financial data, or failing to double-check entries. Take the time to review completed entries to ensure all information is precise, which can save significant trouble during submission.

Editing and reviewing the s of 2500 form

Utilizing pdfFiller’s editing features enhances the accuracy and clarity of your completed s of 2500 form. The platform provides tools that allow users to modify, reformat, or clarify entries directly within the PDF, ensuring a polished final document.

Error correction is streamlined—users can simply click to edit text, add comments, or highlight sections requiring attention. Collaborating with others, such as tax professionals or team members, can be made easy by inviting them to review the document within pdfFiller, allowing for real-time feedback.

Signing the s of 2500 form

Once your s of 2500 form is completed, the next step involves signing it. pdfFiller facilitates this via an electronic signature process that is user-friendly and legally valid in many jurisdictions, including Colorado.

To eSign, follow the intuitive prompts on pdfFiller, ensuring your digital signature is legally compliant. Users can opt for alternative signing methods as well, such as printing the form, signing it manually, and rescanning it. Weigh the pros and cons: electronic methods offer convenience, while paper methods might afford a sense of security for some.

Submitting the s of 2500 form

After completing and signing your s of 2500 form, take the time to review the submission guidelines specific to your situation. Ensure you know where to send the form—typically to the Colorado Department of Revenue—and be aware of any deadlines that may apply.

Follow-up procedures are important as well; track your submission through confirmation receipts or call centers if issues arise during processing. Knowing the status can alleviate concerns about whether your submission was received adequately.

Managing the s of 2500 form and related documents

Once you have submitted your s of 2500 form, proper management of the document is key. Store the completed form securely, ideally in a digital format using best practices such as password protection and cloud storage. pdfFiller offers integrated cloud storage features for easy retrieval.

Additionally, it’s wise to keep track of updates or changes to the s of 2500 form. Knowing how to modify the form for future submissions will save time. Version control is essential for ensuring that you’re always working with the most current document.

Conclusion and next steps

Leveraging the features available on pdfFiller can address ongoing documentation needs. Explore additional resources on s of 2500 forms or any other templates that can facilitate your ongoing tax management.

Organizing and maintaining accessibility of forms will enhance your overall efficiency. By adopting tips for efficient documentation management, you can streamline processes not only for the s of 2500 form but for other necessary documents, simplifying compliance and reducing future stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the s of 2500 in Chrome?

Can I create an electronic signature for signing my s of 2500 in Gmail?

Can I edit s of 2500 on an Android device?

What is s of 2500?

Who is required to file s of 2500?

How to fill out s of 2500?

What is the purpose of s of 2500?

What information must be reported on s of 2500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.