Get the free i; 1

Get, Create, Make and Sign i 1

How to edit i 1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i 1

How to fill out i 1

Who needs i 1?

Comprehensive Guide to the 1 Form: Everything You Need to Know

Overview of the 1 form

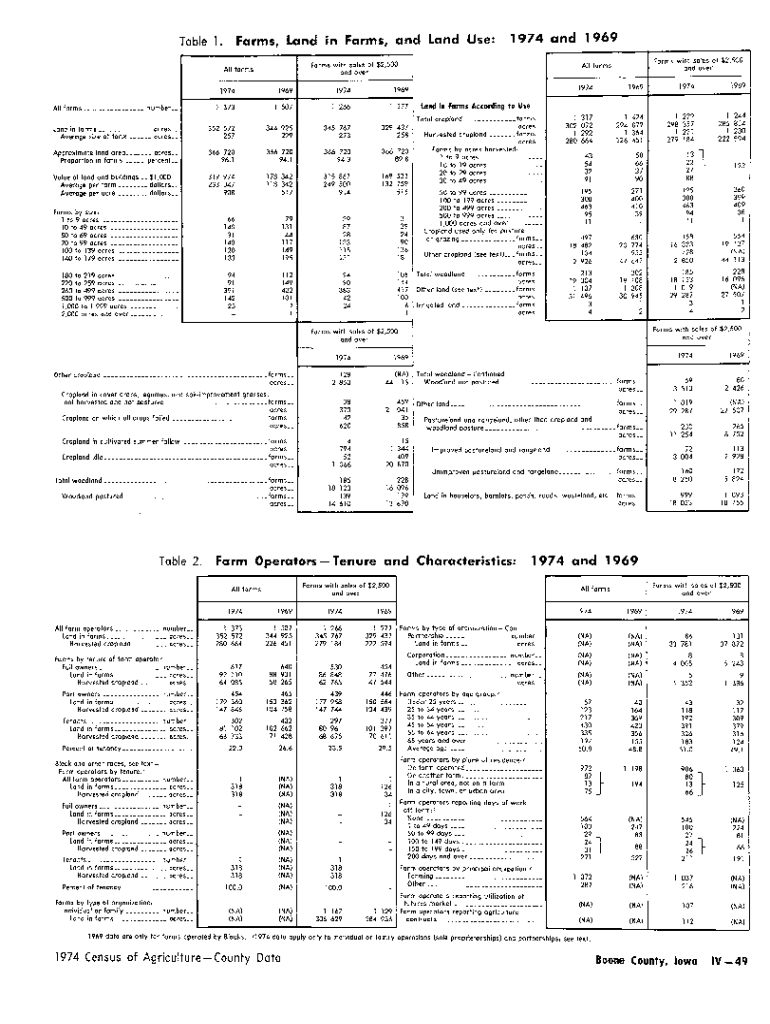

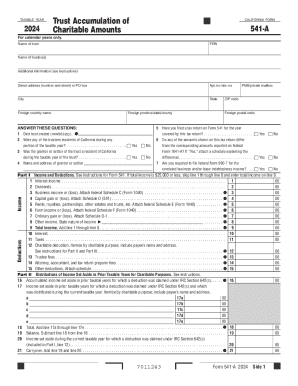

The i 1 Form is an essential tax document utilized primarily by certain taxpayers in the United States, particularly in relation to periodic general excise tax returns. Understanding what the i 1 Form is and its purpose can simplify the filing process significantly. This form is crucial for helping tax authorities track revenue generated by businesses and ensure compliance with state tax laws.

The i 1 Form serves as a vital instrument for tax reconciliation, enabling taxpayers to report their gross income, deduct any applicable exemptions, and accurately calculate their tax liability. Without careful usage of this form, businesses may face penalties or miscalculations that can lead to significant financial repercussions. Thus, its importance transcends just being a form—it's a critical accountability tool.

Where to find the 1 form

Accessing the i 1 Form is straightforward, as it’s available through multiple platforms. The most efficient way to download the i 1 Form is through pdfFiller, a user-friendly platform that offers not only the form but also useful tools to edit, sign, and collaborate. Users can quickly locate the i 1 Form by searching within the pdfFiller database, making it easily accessible.

Alternately, the form can also be found on official state tax website portals or financial institutions’ resources. These sources typically provide the latest versions of the i 1 Form to ensure compliance with any recent changes in tax legislation. It's crucial to confirm that the version in use matches the regulatory requirements relevant to your fiscal period.

Step-by-step guide to filling out the 1 form

Filling out the i 1 Form may seem daunting, but breaking it down into manageable sections can simplify the process significantly. The required information largely falls into three categories: personal details, financial information, and additional necessary data. Each of these categories plays a critical role in ensuring that the form is completed accurately.

Begin with personal details, which typically include your name, address, and taxpayer identification number. Next, the financial section requires a comprehensive breakdown of your income, including gross receipts and deductions. Finally, ensure that you provide any other necessary information to complete the form, such as signatures and dates.

Section-by-section breakdown

The first part of the i 1 Form is the header, which contains fields that require essential identifiers such as your name and taxpayer ID. Ensure that these fields are filled out correctly to avoid processing delays. In the body of the form, you will enter your financial data, detailing your earnings and applicable deductions. Thoroughly review this section, as inaccuracies here can lead to tax discrepancies.

Finally, the footer includes fields for your signature and submission details. This is an important part of the form, as it designates the form as valid. Always ensure that you've read through the completed form for clarity and accuracy before signing.

Editing the 1 form

Editing the i 1 Form is simple with pdfFiller’s editing tools, which allow users to modify text, add new sections, or remove unnecessary parts swiftly. The platform is designed to provide a seamless editing experience, ensuring that your information is accurately and clearly represented on the form without needing extensive technical knowledge.

To edit text, simply select the text box you wish to change and enter your data. If you need to add or remove sections, utilize the user-friendly interface to drag and drop additional text boxes or delete existing ones. Always remember to save your changes regularly to avoid losing any important edits and to maintain document integrity throughout the process.

Signing the 1 form

Signing the i 1 Form can be conveniently accomplished using eSignature options available on pdfFiller. With electronic signatures gaining compliance recognition globally, users can finalize documents quickly and securely. To apply an eSignature, simply navigate to the signature field, select your preferred signing method—whether drawing, typing, or uploading—and place it directly on the document.

Security considerations for eSigning are paramount. Ensure that you are accessing pdfFiller over a secure connection, and utilize any additional security features the platform offers, such as two-factor authentication, to protect sensitive information during the signing process.

Collaborating on the 1 form

Collaboration is integral when filling out the i 1 Form, especially for teams and businesses handling joint submissions. pdfFiller allows users to share the form easily with others, granting access through email or direct links. Collaborators can then view or edit the document based on the permissions set by the original user.

To enhance clarity and ensure effective collaboration, utilize the commenting feature within pdfFiller. This allows team members to leave feedback directly on the document, facilitating communication about specific entries or required changes before the final submission occurs.

Submitting the 1 form

Submitting the i 1 Form is a crucial step that can be executed through various methods, such as online, via mail, or fax, depending on the guidelines set by your tax authority. Ensure you adhere strictly to the submission instructions, as this can vary significantly by jurisdiction and can impact how your submission is processed.

Keep track of submission deadlines and verify that you send your form promptly to prevent any late filing penalties. After submission, it’s advisable to confirm receipt of the document, especially if submitting by mail or fax. Following up can be done by checking with the relevant tax office or using any provided tracking services.

Common mistakes to avoid with the 1 form

When completing the i 1 Form, several common pitfalls can lead to errors. Missing information, such as the taxpayer identification number, or incorrect entries in the financial section are prevalent mistakes that can delay processing. To minimize risks, it's essential to complete each section thoroughly and cross-reference your entries with any supporting documents.

Another frequent issue arises from misinterpretation of the instructions associated with the form. This can lead to filling out sections incorrectly or omitting necessary details. To ensure accuracy, double-check entries and consider completing a checklist before submission to verify that all required information is provided.

Frequently asked questions about the 1 form

Many users have questions regarding the i 1 Form, particularly about who needs to fill it out and what happens if you make a mistake after submission. Generally, business owners who have generated income subject to general excise tax will need to fill out this form. It is important to ensure that all details are filled in correctly to avoid complications.

If mistakes are made after submission, contact the relevant tax authority as promptly as possible to discuss rectification options. Many jurisdictions provide guidance on correcting forms or submitting additional information to rectify previous errors. Always maintain a copy of the submitted form for your records.

Additional tips for managing your 1 form

Post-filing, managing the i 1 Form effectively is crucial for long-term documentation needs. Utilize pdfFiller to securely store your forms in the cloud, allowing easy access whenever required. This accessibility ensures you can swiftly retrieve your document for future reference or updates without the hassle of physical storage.

Updating information on the i 1 Form should be done as necessary to reflect changes in your financial situation or regulatory requirements. pdfFiller supports quick edits, meaning that you can keep your records accurate and current over time, enhancing both compliance and personal record-keeping.

Related templates and forms

Understanding how the i 1 Form compares to other similar forms can provide additional context and aid users in navigating tax matters. For instance, forms such as the 1040 or various business registration documents may require overlapping information, particularly regarding taxpayer identification and income reporting.

pdfFiller offers a suite of templates that cater to diverse documentation needs, ensuring that users can address any form requirements effortlessly. By exploring related templates, users can streamline their documentation efforts and enhance efficiency in managing multiple forms.

Final words on seamless document management

Using pdfFiller to manage the i 1 Form makes document handling not just efficient but also effective. The platform’s integrated features empower users to edit, eSign, and manage documents seamlessly, simplifying the paperwork greatly. Anyone struggling with traditional forms will find pdfFiller's features invaluable for maintaining organization and clarity.

As you navigate your documentation needs, remember that the i 1 Form is just one component of your overall tax compliance strategy. Embrace the full potential of pdfFiller's capabilities to ensure that all your documents are well-organized and accessible from anywhere, enhancing your efficiency as a taxpayer in today’s digital age.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit i 1 online?

How do I edit i 1 in Chrome?

Can I edit i 1 on an Android device?

What is i 1?

Who is required to file i 1?

How to fill out i 1?

What is the purpose of i 1?

What information must be reported on i 1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.