Get the free Pub. KS-1526 Sales and Use Tax for Motor Vehicle Transactions ...

Get, Create, Make and Sign pub ks-1526 sales and

How to edit pub ks-1526 sales and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pub ks-1526 sales and

How to fill out pub ks-1526 sales and

Who needs pub ks-1526 sales and?

Understanding the Pub KS-1526 Sales and Form: A Comprehensive Guide

Understanding Pub KS-1526

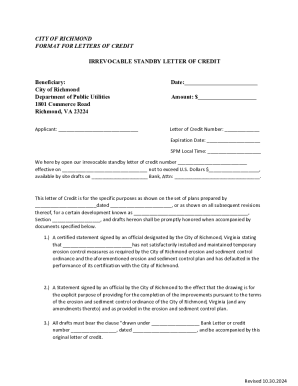

Pub KS-1526 is a crucial form for reporting sales tax transactions in Kansas, particularly relating to motor vehicle sales. This form is essential for both dealers and individual sellers, as it ensures compliance with state laws regarding sales tax collection and remittance. The importance of accurately filling out this form cannot be overstated; errors or omissions can lead to significant financial repercussions, including audits or penalties.

The key objectives of the Pub KS-1526 include capturing accurate sales data, ensuring proper tax rates are applied, and maintaining transparency in transactions. Additionally, this form is a vital tool for the Kansas Department of Revenue, allowing them to track sales and ensure that the correct tax revenue is allocated to the state.

Essential components of Pub KS-1526

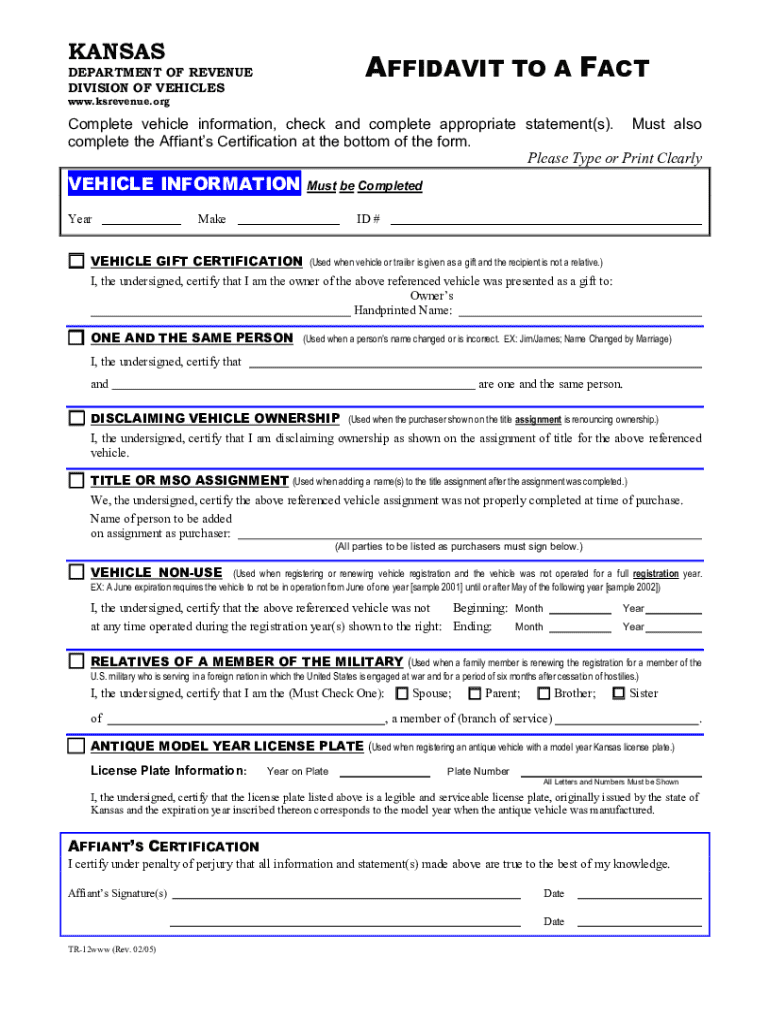

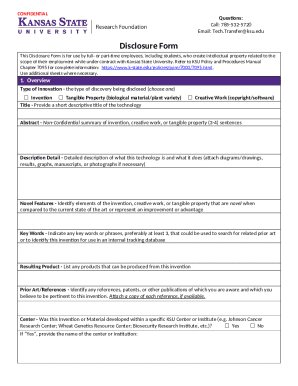

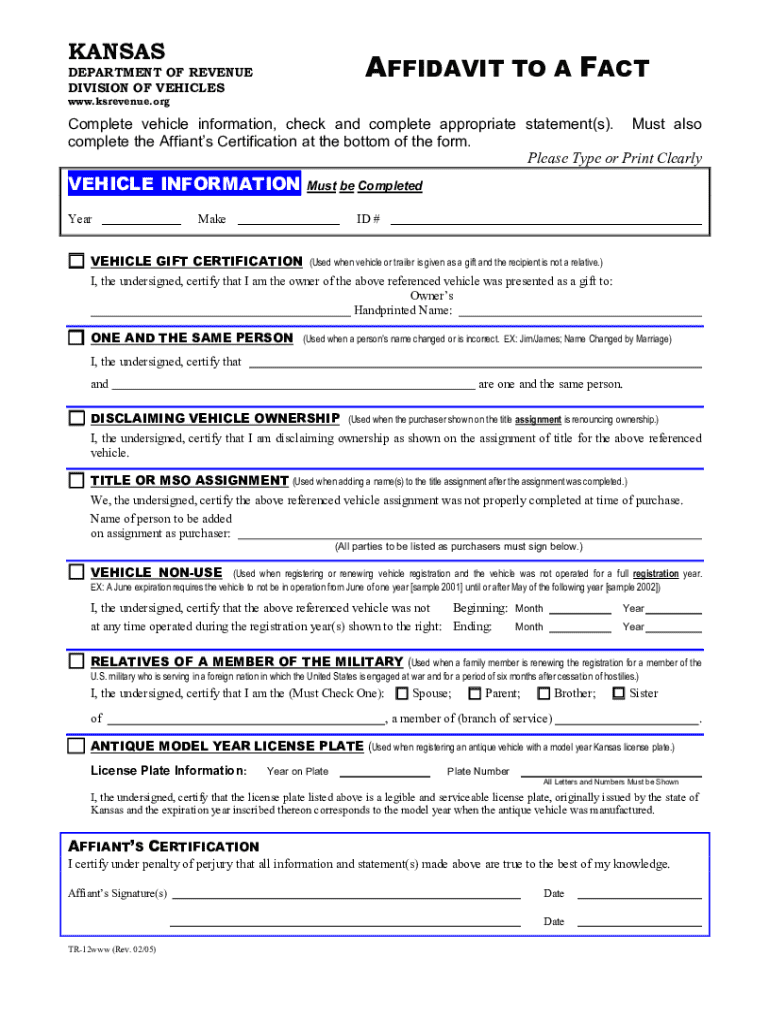

The layout of Pub KS-1526 is structured to facilitate the collection of vital information regarding sales transactions. The form typically includes various sections such as seller and buyer information, vehicle details, and sales price breakdowns. Understanding each section's requirements is crucial to ensure that all necessary data is entered accurately.

Key information that must be documented includes the buyer's and seller's names, addresses, and the identification number of the vehicle involved in the transaction. Common terminology includes terms like 'sales tax,' 'exemptions,' and 'transactions.' Each term carries specific implications under Kansas law, impacting how taxes are calculated and reported.

Step-by-step guide to filling out Pub KS-1526

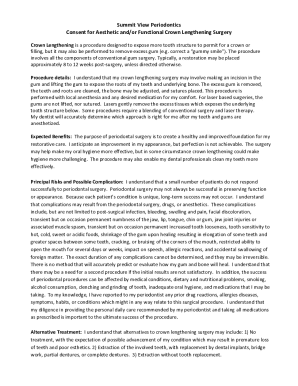

Before you begin filling out the Pub KS-1526 form, it is essential to prepare adequately. Gather all necessary documents, including the bill of sale, proof of payment, and any prior registrations. Being organized can help prevent common mistakes, such as missing signatures or incorrect vehicle information.

Here’s a detailed guide on how to complete each section:

Once you have completed the form, use the review checklist before submission to ensure that no sections are left incomplete and that all entries are accurate.

Handling complicated scenarios

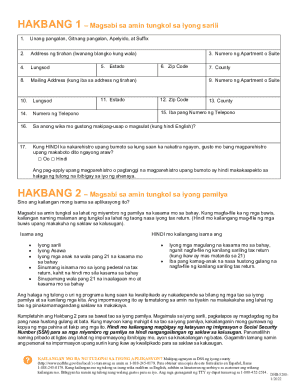

Certain sales scenarios can complicate the completion of Pub KS-1526, especially regarding sales made by non-dealers. If a transaction occurs between individuals rather than through a licensed dealer, specific requirements and documentation must be provided to ensure compliance with state law.

Additionally, vehicle leases and rentals have their tax implications. Reporting such transactions accurately is essential for both lessors and lessees to avoid potential legal issues. FAQs about these scenarios typically address concerns about tax obligations, documentation needed, and rates that apply.

Managing your documents on pdfFiller

pdfFiller provides a cloud-based document management solution that allows users to access, edit, and manage the Pub KS-1526 form seamlessly. This platform enables easy storage and retrieval of your completed forms, ensuring that essential information is always within reach.

With pdfFiller, collaboration becomes effortless. Teams can share forms with each other for review, allowing for smooth editing and collective input. Furthermore, the eSignature process offered by pdfFiller ensures that all signatures are valid and legally binding, which is a crucial aspect for forms requiring certification.

Tips for efficient management of Pub KS-1526

Effective management of the Pub KS-1526 form can streamline your compliance processes. Digital organization is crucial; ensure that all electronic copies are stored in a clear structure, such as by date or type of transaction. This makes it easier to retrieve documents when needed, especially during tax season.

Additionally, you should ensure compliance with Kansas sales tax regulations by staying updated on any changes in laws or tax rates. Understanding the best times to submit your form can also prevent delays in processing and any associated penalties.

Common misconceptions about sales reporting

Numerous misconceptions circulate around sales reporting, particularly concerning vehicle sales. Many individuals believe they can provide vague details during a sale without consequence. However, accurate reporting of sales is crucial for legal compliance and to avoid penalties from the Kansas Department of Revenue.

Understanding the tax obligations associated with the sale of vehicles is also vital. Without this knowledge, sellers may incorrectly report transactions, leading to potential audits or fines. Accurate reporting helps in maintaining a good standing with the state and ensures that all tax obligations are met without issue.

Troubleshooting common issues

While filling out the Pub KS-1526 form, common errors can arise, such as mismatched taxpayer IDs or incorrectly reported sales figures. Addressing these mistakes promptly is crucial. If your form is rejected, the first step is to carefully review the specific reasons for the rejection and rectify any inaccuracies before re-submitting.

For those who encounter persistent issues or uncertainties, seeking assistance is advisable. The Kansas Department of Revenue provides resources online, and forums may also exist where individuals can exchange guidance and support.

Advantages of using pdfFiller for Pub KS-1526

Utilizing pdfFiller for managing the Pub KS-1526 form comes with various advantages. The seamless integration of document management features ensures users can not only complete but also maintain their forms efficiently. This platform streamlines the entire process, from filling out forms to submitting them directly to the relevant authorities.

In addition to saving time with automated features, pdfFiller also enhances collaboration among teams. Real-time editing capabilities allow team members to work together, making adjustments or providing feedback without the hassle of back-and-forth emails. This functionality is particularly valuable when multiple stakeholders are involved in the sales transaction process.

Final thoughts on successful compliance with Pub KS-1526

Accurate preparation of the Pub KS-1526 form is essential for maintaining compliance with Kansas sales tax regulations. Users should prioritize understanding every aspect of the form and ensure that they utilize tools like pdfFiller effectively to simplify the preparation process. The value of correct documentation cannot be emphasized enough, as it protects against potential fines and establishes transparent dealings.

In a landscape where compliance is paramount, leveraging available tools can make the difference between a fuss-free experience and a costly oversight. As such, embracing digital solutions for managing documentation is not just beneficial, but necessary for those engaging in vehicle sales in Kansas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pub ks-1526 sales and for eSignature?

How can I get pub ks-1526 sales and?

How do I complete pub ks-1526 sales and on an Android device?

What is pub ks-1526 sales and?

Who is required to file pub ks-1526 sales and?

How to fill out pub ks-1526 sales and?

What is the purpose of pub ks-1526 sales and?

What information must be reported on pub ks-1526 sales and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.