Get the free I 519

Get, Create, Make and Sign i 519

Editing i 519 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i 519

How to fill out i 519

Who needs i 519?

519 Form - Your Comprehensive How-to Guide

Overview of the 519 form

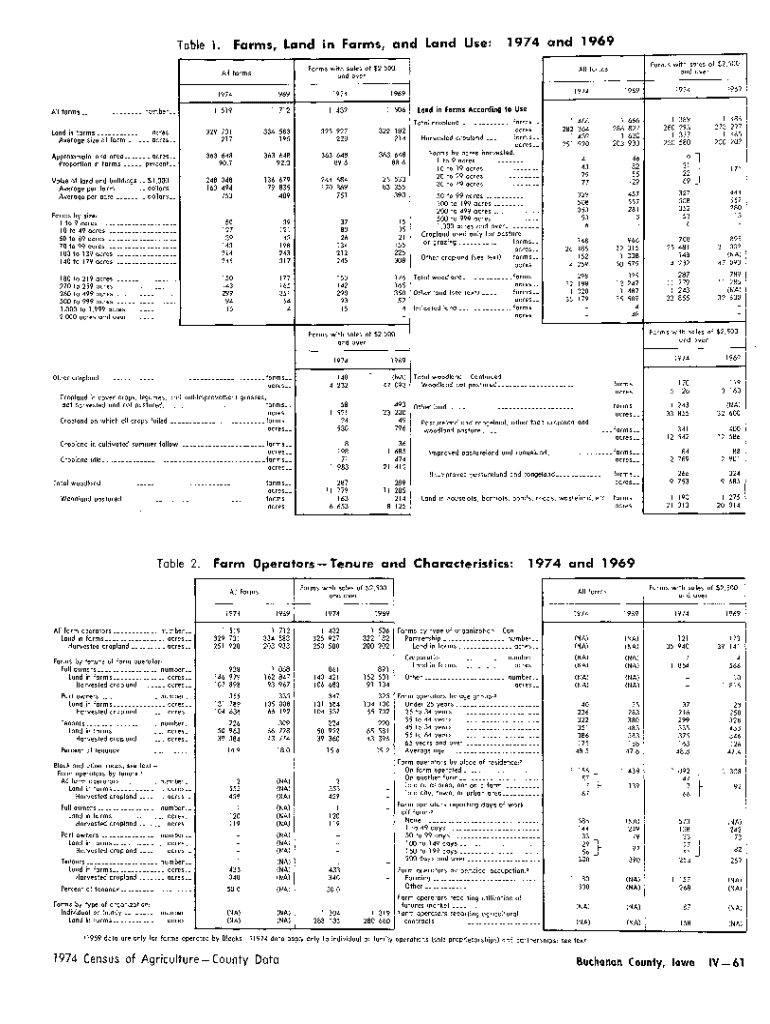

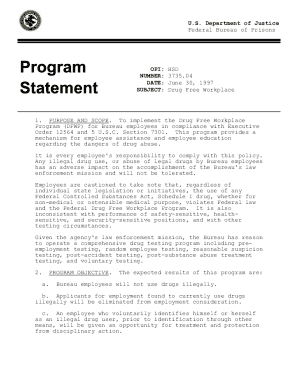

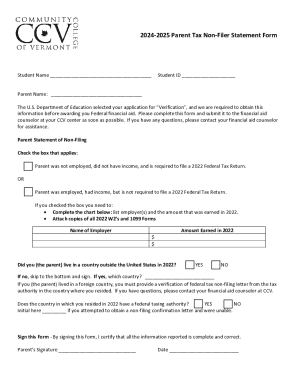

The i 519 form is a specific tax form used primarily for certain financial reporting requirements in the United States. Its main purpose is to report various income and deductions, enabling taxpayers to accurately calculate their tax obligations for the year. Properly submitting the i 519 form can impact the tax liability determined by the IRS, making its accuracy crucial for both individuals and organizations.

Understanding the importance of the i 519 form is vital for anyone engaging in financial transactions that require reporting. By ensuring this form is filled out correctly, individuals and businesses can secure their rights to deductions and avoid potential disputes with tax authorities. This includes accurately detailing income sources, which can vary significantly based on job, investment income, and other financial activities.

Anyone who engages in taxable financial activities needs to file the i 519 form. This encompasses freelancers, business owners, and even employees with additional income streams. Knowing who needs to provide this information can help ensure compliance and smooth interactions with the IRS.

A deep dive into the 519 form structure

The i 519 form is structured into several key sections that each serve a distinct purpose in the overall reporting process. Understanding this breakdown is essential for accurate submission. The primary sections include:

Each section is critical, as missing or incorrect information could lead to delays in processing or even potential fines. The structure allows the IRS to efficiently evaluate an individual’s tax situation, thus emphasizing the necessity of meticulous documentation.

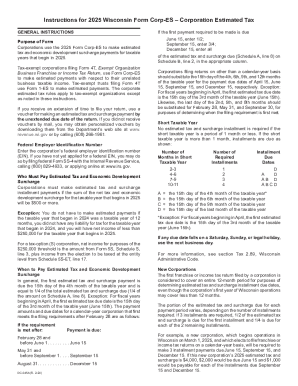

Detailed instructions for completing the 519 form

Filling out the i 519 form can seem daunting, but following these step-by-step instructions can simplify the process significantly. Before you start, collect all necessary information and documentation that you'll need.

These steps not only streamline the process but also decrease the likelihood of errors, ultimately guiding you toward compliance with IRS regulations.

Interactive tools for filling out the 519 form

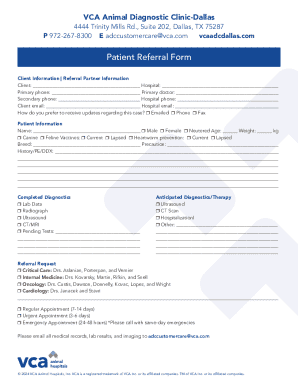

Utilizing pdfFiller can transform the often tedious process of completing the i 519 form into a swift and user-friendly experience. With advanced calculation tools available, users can make informed entries without the hassle of manual computations.

Take advantage of pdfFiller's user-friendly editing features, which allow you to make corrections or modifications easily. The platform supports quick annotation of any areas requiring attention, ensuring clarity throughout the document. This ease of access is essential for individuals and teams alike, promoting seamless collaboration whether you’re working from a shared office or remotely.

To save and edit your form efficiently, simply utilize the intuitive interface to download your completed file or convert it to a zip file for easy storage. These features enhance the overall document management experience and help to keep your records tidy and organized.

Electronic submission and esigning of the 519 form

Once the i 519 form is filled out correctly, the next step is submission. Electronic submission is highly encouraged for its speed and efficiency. Follow these guidelines for eSigning the i 519 form:

This systematic approach ensures that your i 519 form is not only well-prepared but also efficiently managed from submission to status tracking.

Managing your 519 form with pdfFiller

The management of your i 519 form doesn’t end with submission. Utilizing pdfFiller allows you to store and organize your forms securely in the cloud, making access easy at any time or location. With cloud storage, you can keep all your important documents in one place, enhancing both accessibility and security.

For teams, pdfFiller promotes collaboration by allowing multiple users to access and work on the document simultaneously. The collaboration features can significantly reduce turnaround time on tasks that require input from various contributors.

Moreover, security and privacy measures in document management are critical. pdfFiller implements robust encryption techniques ensuring that your files remain safe from unauthorized access, providing peace of mind as you manage sensitive data.

Troubleshooting common issues with the 519 form

Even with careful preparation, issues can arise while completing the i 519 form. Here are some frequently encountered problems and solutions:

If issues persist, seeking professional help may be advisable. Tax professionals can provide insights into specific disputes, while pdfFiller’s customer support team is readily available to assist you with any technical difficulties encountered along the way.

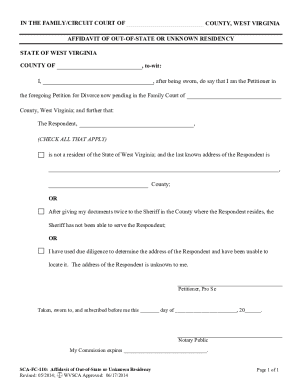

Related forms and documentation

The i 519 form is often part of a network of related tax forms that serve various purposes within the IRS system. It is essential to recognize how these forms interconnect and relate to your overall financial reporting.

Completing related forms accurately enhances overall compliance and readiness for any IRS inquiries, ensuring you maintain a smooth administrative path.

Best practices for filing the 519 form

To ensure a successful filing experience with the i 519 form, adopt these best practices:

Implementing these tips can lead to a streamlined process, preventing unnecessary stress down the line.

User testimonials and success stories

Many users of pdfFiller have experienced significant improvements in their form management processes, especially when it comes to the i 519 form. For instance, one user shared how using pdfFiller's interactive tools simplified their entire filing process, allowing them to focus on accuracy rather than getting bogged down in form formatting.

Another user highlighted the collaborative aspect of pdfFiller. They noted how their team could work together in real-time, making updates instantly and reducing the time spent going back and forth through email. Overall, these testimonials reflect the efficiency and peace of mind users gain when managing the i 519 form through pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my i 519 in Gmail?

How can I edit i 519 on a smartphone?

Can I edit i 519 on an iOS device?

What is i 519?

Who is required to file i 519?

How to fill out i 519?

What is the purpose of i 519?

What information must be reported on i 519?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.