Get the free Corporate and Partnership Estimated Tax Payment

Get, Create, Make and Sign corporate and partnership estimated

Editing corporate and partnership estimated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate and partnership estimated

How to fill out corporate and partnership estimated

Who needs corporate and partnership estimated?

Comprehensive Guide to Corporate and Partnership Estimated Form

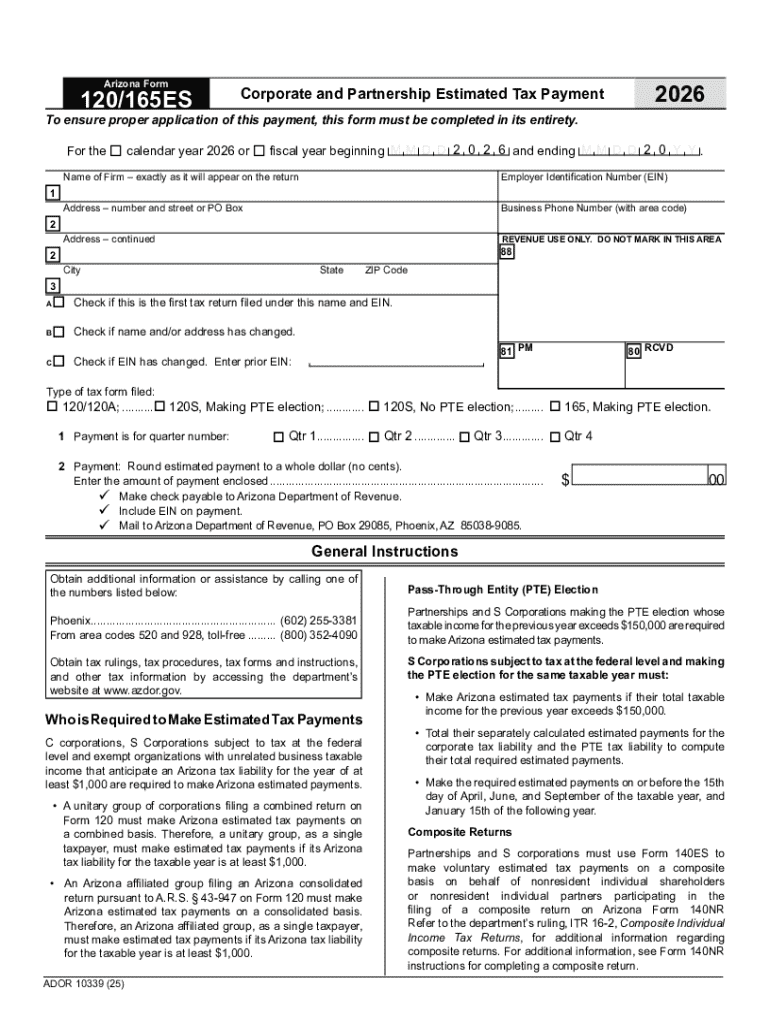

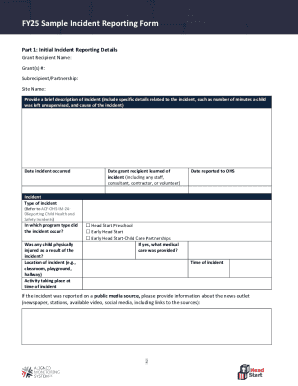

Overview of corporate and partnership estimated form

The corporate and partnership estimated form serves a vital role in the tax filing process, ensuring businesses actively manage their tax liabilities throughout the fiscal year. Unlike standard tax returns filed at year-end, these estimated payments allow entities to pay taxes on revenue as they earn income. This proactive approach is essential for corporations and partnerships alike, enabling them to avoid large tax bills and potential penalties at the end of the year.

Corporations and partnerships have different obligations when it comes to estimated tax payments. Specifically, corporations must take into account their expected tax liabilities, while partnerships distribute income amongst partners, who then report income on their individual tax returns. Understanding these distinctions ensures that businesses comply effectively with federal and state taxation systems.

Key features of the filing process

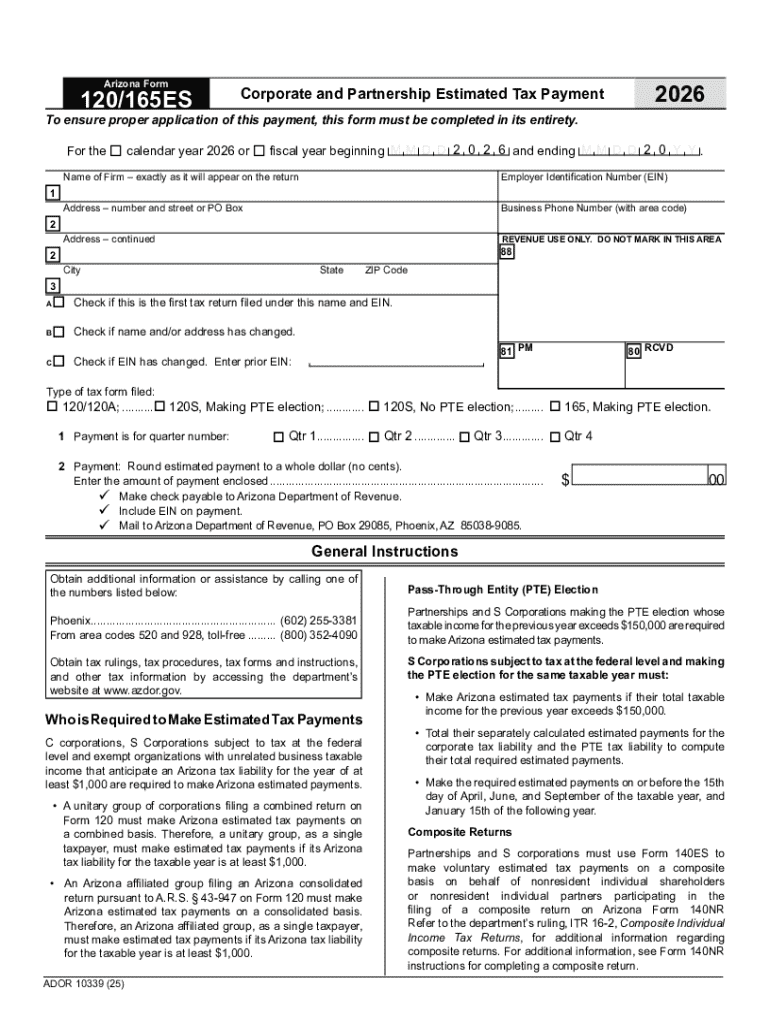

Successfully filing the corporate and partnership estimated form requires awareness of critical timelines and accurate data collection. Estimated payments are typically made on a quarterly basis, with deadlines falling on April 15, June 15, September 15, and December 15. Each of these dates represents the final day to submit payments that cover the corresponding quarter's expected tax liability.

Understanding estimated tax payments

Understanding who needs to file estimated tax payments is crucial for compliance. Companies expected to owe at least $500 or partnerships anticipating tax liabilities not covered through withholding should file estimates. The payment amounts are typically calculated based on last year’s tax return or projected current year income, which requires careful forecasting.

Calculating these estimates can pose difficulties. Businesses can utilize prior year tax returns for estimates or project each quarter's income based on anticipated contracts, sales forecasts, or other revenue streams. However, it’s essential to be cautious of tax implications related to underpayment or overpayment.

Step-by-step instructions for completion

Filling out the corporate and partnership estimated form can be straightforward with the right approach. First, access the form on pdfFiller, where it’s easily searchable on their platform. From there, you can navigate through the document library to locate any essential forms needed for tax season.

Once you have the correct form, start entering the identification information. This includes your business's name, Employer Identification Number (EIN), and address. Following that, you need to provide anticipated income details, along with the estimation section where you will calculate and enter your anticipated payment amounts.

Common mistakes to avoid

Businesses often miss opportunities to optimize their estimated payments due to misreporting income or overlooking important deductions. Ensure your team takes the time to accurately forecast income for each quarter, as false projections can lead to financial strain and unexpected tax liabilities.

Another frequent misstep involves ignoring state-specific obligations, especially if your business operates in multiple states, such as Georgia. Each state may have distinct filing requirements and deadlines that should align with federal obligations. Missing these deadlines can result in added penalties, so using a timeline or calendar reminder in conjunction with pdfFiller can be advantageous.

Benefits of using pdfFiller for document management

pdfFiller stands out as a cloud-based platform that streamlines the onboarding of business forms. The platform enhances the overall experience by allowing users to edit documents in real-time and collaborate effectively with team members. This capability is especially beneficial in maintaining accuracy across estimated payments and other important tax documents.

Accessing pdfFiller from anywhere also allows businesses to remain efficient. This means you can manage important documents, including state-specific forms and corporate tax filings, from any location. The cloud storage included in the platform ensures your documents are securely backed up and easily accessible when needed.

Accessing additional support and resources

When navigating the complexities of corporate and partnership estimated forms, utilizing reliable support mechanisms is imperative. pdfFiller provides a range of customer support options, including live chat, email, and an extensive FAQ library, ensuring users have the help they need at their fingertips.

Additionally, access to tutorials and video guides simplifies the learning process, allowing users to efficiently leverage pdfFiller’s various features. Participating in community forums can also empower users to share experiences and seek advice from peers who have navigated similar challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit corporate and partnership estimated online?

How do I make edits in corporate and partnership estimated without leaving Chrome?

How can I edit corporate and partnership estimated on a smartphone?

What is corporate and partnership estimated?

Who is required to file corporate and partnership estimated?

How to fill out corporate and partnership estimated?

What is the purpose of corporate and partnership estimated?

What information must be reported on corporate and partnership estimated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.