Get the free Dane County Tax Deeded Property

Get, Create, Make and Sign dane county tax deeded

Editing dane county tax deeded online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dane county tax deeded

How to fill out dane county tax deeded

Who needs dane county tax deeded?

Dane County Tax Deeded Form: A How-To Guide

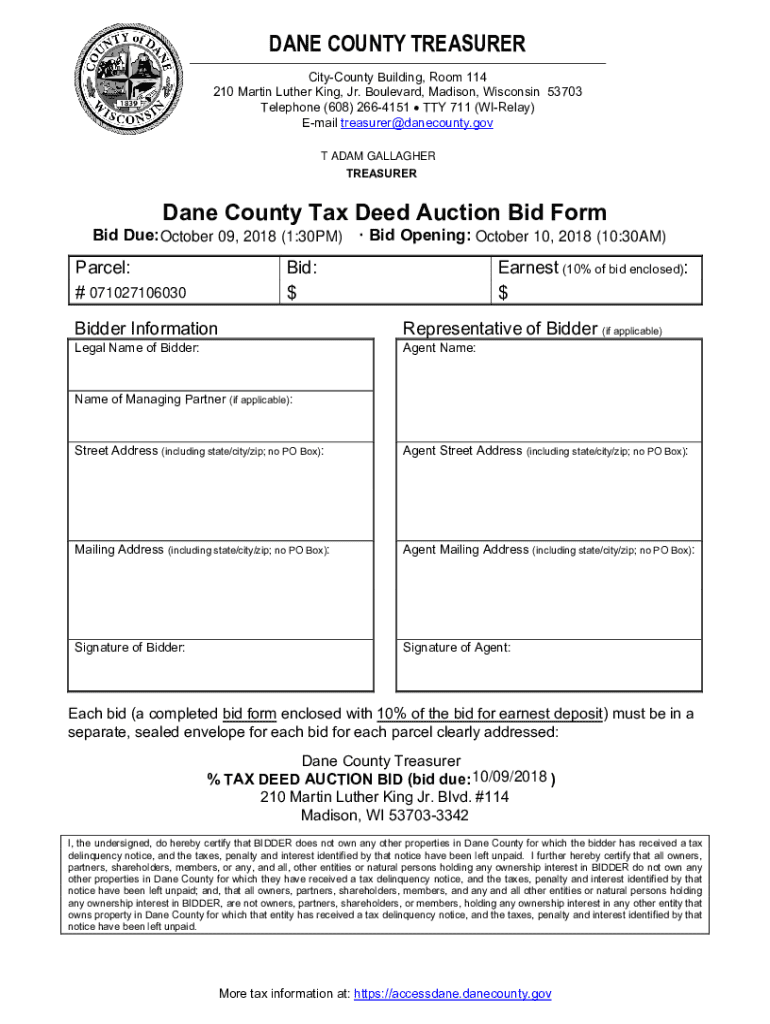

Understanding tax deeded forms in Dane County

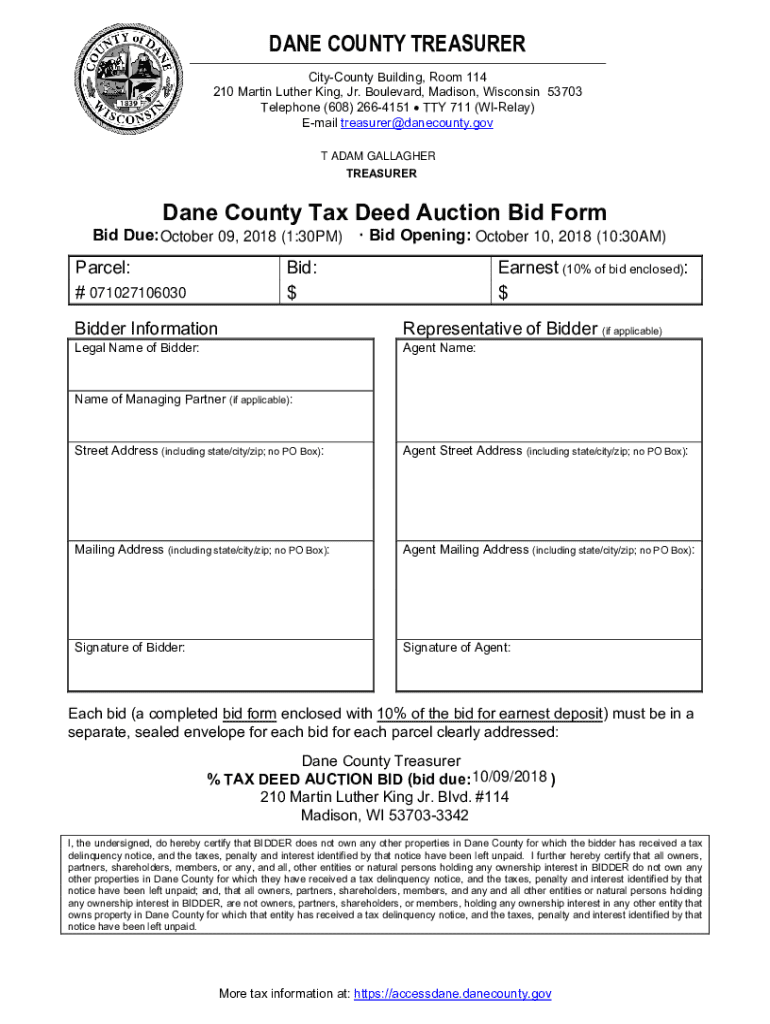

A tax deeded form represents a crucial document for property ownership in Dane County, Wisconsin. This form is executed when property is acquired from a tax foreclosure auction, typically due to unpaid property taxes. Understanding this form is essential as it directly impacts property rights and the legal standing of ownership after a successful auction.

Specifically, in Dane County, the use of tax deeded forms stems from the broader context of state tax law and local statutes that govern how properties can be sold when taxes remain unpaid. This legal framework ensures that the rights of both the county and the taxpayers are duly respected.

Preparing for the tax deed auction

Before participating in a Dane County tax deed auction, thorough research on available properties is essential. The Dane County Treasurer's Office provides an updated list of properties available for tax deed auctions, often accessible through their official website. This list includes important details such as the parcel listing, location, and any unique legal issues attached to the properties.

When reviewing potential properties, consider the following factors: the condition of the property, its location with respect to amenities, and any outstanding legal issues such as liens or easements. A well-rounded evaluation will position you to make informed bids during the auction.

Furthermore, understanding the distinction between tax liens and tax deeds is critical. A tax lien gives the holder the right to collect back taxes owed, while a tax deed signifies that ownership of the property has transferred due to the lien being foreclosed. Buyers in tax deed auctions should be keenly aware of how these elements play into their future ownership responsibilities.

The auction process for tax deeded properties

The tax deed auctions in Dane County are typically conducted in a straightforward manner, either in person or online, depending on the current regulations and circumstances. Each auction usually follows a set schedule, which can be found on the Dane County Treasurer's Office site, detailing the dates and times for each bidding event. During the auction, registered bidders will compete to purchase properties that have been identified on the tax deed list.

To participate, individuals must register ahead of time. Registration usually requires identification and may include a small fee. It's essential for bidders to prepare their documentation early to avoid any last-minute complications on the auction day.

Completing the Dane County tax deeded form

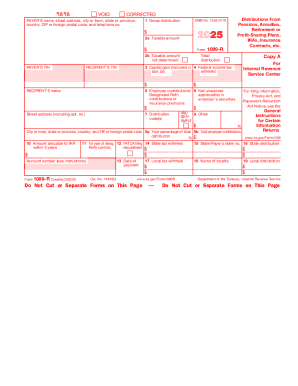

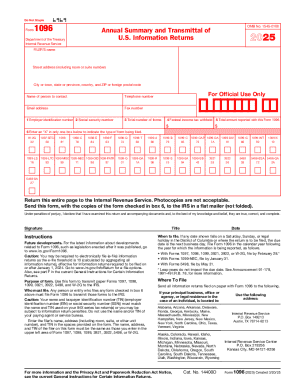

Once you've successfully bid on and acquired a property through the tax deed auction, the next step involves completing the Dane County tax deeded form. This form is not only a record of transaction but also a necessary step for legally transferring property ownership. The form typically includes sections that request specific information, including property details, bidder information, and confirmation of payment.

Filling out the tax deeded form requires careful attention to detail. Each section must be accurately completed to avoid delays in processing. Common mistakes to watch for include incorrect parcel numbers, missing signatures, and inaccurate property descriptions.

Using tools like pdfFiller can enhance your experience when managing these forms. pdfFiller allows users to edit and sign forms easily while ensuring secure cloud-storage access to all documentation.

After the auction: what to do next

After winning a property at the auction, the next critical step is finalizing the tax deed transfer. This involves submitting the completed tax deeded form to the Dane County Treasurer's Office along with any required fees. It’s important to follow up on processing timelines, which can vary but typically take several weeks.

New property owners should also be aware of their ongoing obligations. This includes understanding any property taxes that may be due from that point forward, as well as requirements for maintaining the property in good legal standing. Effective property management often requires diligent tracking of tax obligations and maintenance responsibilities.

Additional considerations and resources

Navigating the post-auction landscape may involve dealing with former property owners. It's vital to understand the implications of ownership for past owners, including their rights and considerations following an auction. While previous owners may possess limited recourse, ensuring communication and following local regulations can mitigate potential disputes.

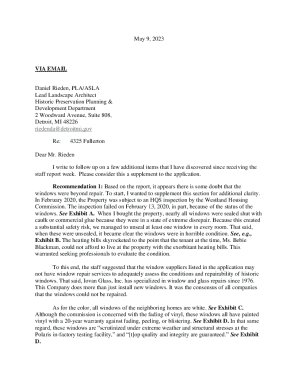

Legal assistance can be crucial for anyone facing complexities associated with tax deed issues. Consulting with a property attorney can clarify rights, obligations, and potential disputes that may arise. It’s also essential for new property owners to consider the impact of extreme weather on their property, particularly during winter months when cold weather cultivates additional maintenance needs. Being proactive in protecting properties, like winterizing plumbing, can save significant costs down the line.

Utilizing pdfFiller for document management

Managing tax deed forms can be streamlined significantly using pdfFiller. This platform offers various tools that simplify the creation, editing, and signing processes for tax deeded forms. Users particularly appreciate the seamless cloud-based access, allowing them to work on their documents from anywhere, without the need for cumbersome physical storage.

Moreover, pdfFiller enhances collaborative efforts with features that support teamwork during the form-filling process. This capability is particularly useful for agencies or teams comprising multiple individuals who need to contribute information to the same document. The ability to track changes and manage submissions ensures a smooth and efficient process.

Frequently asked questions about tax deeded forms

As interest grows in tax deed auctions, so do common questions regarding the process and implications of tax deeded forms. Some individuals often wonder what consequences they face if they don’t complete the form by the scheduled deadline. Late submissions can result in significant complications and delays in property ownership transfer, underscoring the importance of timely documentation.

Another common question involves the ability to contest a tax deed after acquisition. While challenging the auction’s outcome can be complicated, knowing the potential avenues for dispute can empower buyers. Understanding these processes ensures prospective bidders are making informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the dane county tax deeded in Chrome?

How do I complete dane county tax deeded on an iOS device?

Can I edit dane county tax deeded on an Android device?

What is dane county tax deeded?

Who is required to file dane county tax deeded?

How to fill out dane county tax deeded?

What is the purpose of dane county tax deeded?

What information must be reported on dane county tax deeded?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.