Get the free Debt Setoff (DSO) Program

Get, Create, Make and Sign debt setoff dso program

Editing debt setoff dso program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out debt setoff dso program

How to fill out debt setoff dso program

Who needs debt setoff dso program?

Understanding the Debt Setoff DSO Program Form: A Comprehensive Guide

Understanding the debt setoff DSO program

Debt setoff is a financial mechanism commonly employed by state agencies to recover overdue debts by offsetting them against any payments owed to individuals or businesses. The Debt Setoff DSO Program is a structured initiative designed specifically to facilitate this process, allowing creditors to reclaim money through legal means. This program streamlines the effective handling of defaults, ensuring that obligations are honored while providing a clear framework for debtors.

The primary purpose of the DSO Program is to collect overdue debts efficiently and effectively, allowing state agencies to recoup funds owed to them. By utilizing this program, debtors can often resolve their outstanding obligations with minimal hassle. Key benefits include reducing the amount of time spent on collections and alleviating the burden on state resources. Whether you are a debtor looking to settle your obligations or a state agency seeking effective collection methods, the DSO Program offers a valuable resource.

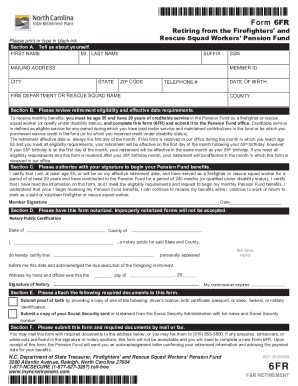

Eligibility requirements for the debt setoff program

To participate in the Debt Setoff DSO Program, both individuals and businesses must meet specific eligibility standards. Generally, individuals seeking to clear personal debts or obligations can enroll in this program, as can businesses facing outstanding financial obligations from contracts or services. The fundamental requirement is that participants must have documented debts that are collectible through setoff.

Financial criteria typically include a review of the debtor's financial statements, tax filings, and other relevant documentation. Agencies often require proof of the debts owed, which can include invoices, contracts, or settlement agreements. Exceptions can arise in cases of financial hardship, making it crucial for applicants to fully understand the nuances of their obligations.

Step-by-step guide to completing the debt setoff DSO program form

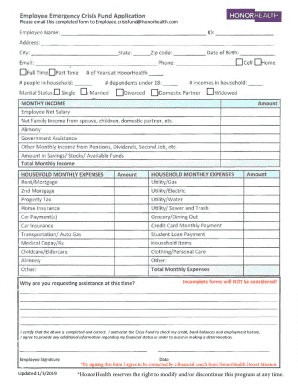

Filling out the Debt Setoff DSO Program Form can seem daunting, but breaking it down into manageable steps can significantly ease the process. The first step involves gathering necessary information and documents to support your application. This includes personal identification, financial statements, and proof of debts and obligations, which are critical for demonstrating your eligibility.

Next, you will fill out the form itself. Carefully entering details such as personal information, contact information, and specifics about your debts is key. Common mistakes to avoid include omitting information and not double-checking for accuracy. Once completed, it's essential to edit and review your form thoroughly, ensuring all details are correct before submission.

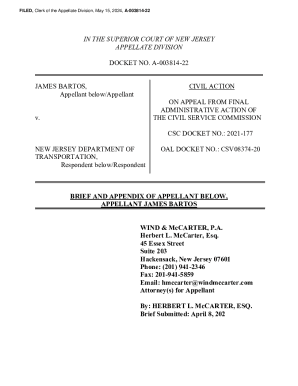

Submitting the debt setoff DSO program form

Once you’ve completed and reviewed the Debt Setoff DSO Program Form, the next step is submission. Depending on your preference, forms can typically be submitted online through platforms such as pdfFiller or via traditional methods like mail or in-person submission at designated offices. Choosing the online route often leads to faster processing times, while in-person options might be necessary for those with specific concerns.

After submitting the form, you will likely receive a notification regarding your application status. It's essential to be mindful of processing timeframes, which can vary based on the volume of applications received. Staying proactive in checking the status of your submission is advisable, ensuring that any follow-ups required on your part are managed promptly.

FAQs about the debt setoff DSO program

Many individuals and businesses have questions about the Debt Setoff DSO Program. A frequent concern involves the implications of submitting an incorrect form. If your form contains errors, it is usually possible to amend it; however, initial denials may delay your overall response. Checking the status of your application is straightforward; most agencies will provide a tracking mechanism or notification system.

Additionally, it's crucial to know whether you can withdraw your application after submission. Generally, withdrawals are permitted within a specific timeframe. Lastly, participants often wonder about fees—typically, participation in the DSO Program is free of charge, but any recovery fees may depend on the nature of the debts involved.

Troubleshooting common issues with the debt setoff DSO program form

Encountering issues while dealing with the Debt Setoff DSO Program Form is not uncommon. Technical difficulties can arise during submission, particularly online through various platforms like pdfFiller. If you experience problems, review your internet connection and ensure browsers are updated. Contacting support through the platform you are using is a viable option if the problem persists.

Another common issue is related to eligibility or documentation. If your application is denied, it's important to ascertain the reasons and address any deficiencies. Documenting your next steps can significantly help in overcoming obstacles and successfully participating in the program. Read closely the information provided from the agency concerning eligibility to avoid future denials.

Additional tools and resources for managing your debt

Managing debt effectively requires leveraging various tools that facilitate the process. pdfFiller stands out as a robust option for document management, allowing users to create, edit, and sign documents securely online. The platform simplifies debt management workflows through its intuitive interface, enabling individuals and teams to be organized and informed throughout the debt resolution process.

In addition to traditional document management, interactive tools like budgeting templates and debt repayment calculators can be highly beneficial. These resources assist users in visualizing their financial landscape, directing their focus on meeting obligations while maintaining regular payments. Such strategic planning can maximize the chances of successfully navigating the setoff process without undue stress.

User testimonials and success stories

Many users have pointed out how the Debt Setoff DSO Program transformed their financial situations. Participants have shared testimonials highlighting their successful experiences of eliminating overdue debts through effective use of the program combined with user-friendly tools like pdfFiller. Individuals frequently mention how easy it was to navigate the form submission process through the platform, leading to swift resolutions of their debts.

These success stories not only reflect the positive impact of the DSO Program but also underscore the necessity of efficient document management. Users find value in the collaboration tools within pdfFiller, which enhance teamwork, especially for businesses where multiple signatures or confirmations are required during the debt resolution process. Such feedback serves to reinforce the effectiveness of utilizing these combined resources.

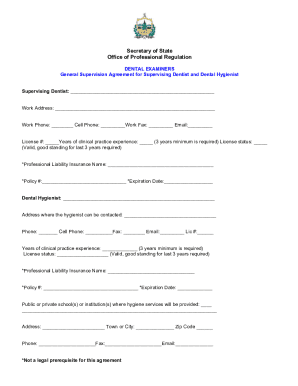

Collaborating with professionals for your financial needs

While the Debt Setoff DSO Program is highly accessible, seeking help from financial advisors or legal experts may be beneficial, particularly when complex issues arise. Financial professionals can provide tailored advice based on individual circumstances, guiding participants through the nuances of debt management, including potential ramifications of setoff procedures.

Finding accredited debt relief services and professionals is crucial to ensure that you are receiving reputable guidance. Many resources, including online databases and recommendations from trusted sources, can help identify qualified experts in your area.

Keeping track of your financial progress

Monitoring your financial health post-participation in the Debt Setoff DSO Program is vital. Staying informed about any changes to your obligations or financial status can empower you to maintain control over your finances effectively. Keeping accurate records and understanding your current debts helps preempt any potential issues that may arise in the future.

pdfFiller offers tools that assist with tracking financial progress, whether through document management or data aggregation. Utilizing such resources can streamline your financial oversight, providing ongoing clarity and reducing stress related to debt. Such management strategies play a crucial role in ensuring that your financial health stays on track even after participating in a debt resolution program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send debt setoff dso program to be eSigned by others?

Can I sign the debt setoff dso program electronically in Chrome?

How do I fill out debt setoff dso program on an Android device?

What is debt setoff dso program?

Who is required to file debt setoff dso program?

How to fill out debt setoff dso program?

What is the purpose of debt setoff dso program?

What information must be reported on debt setoff dso program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.