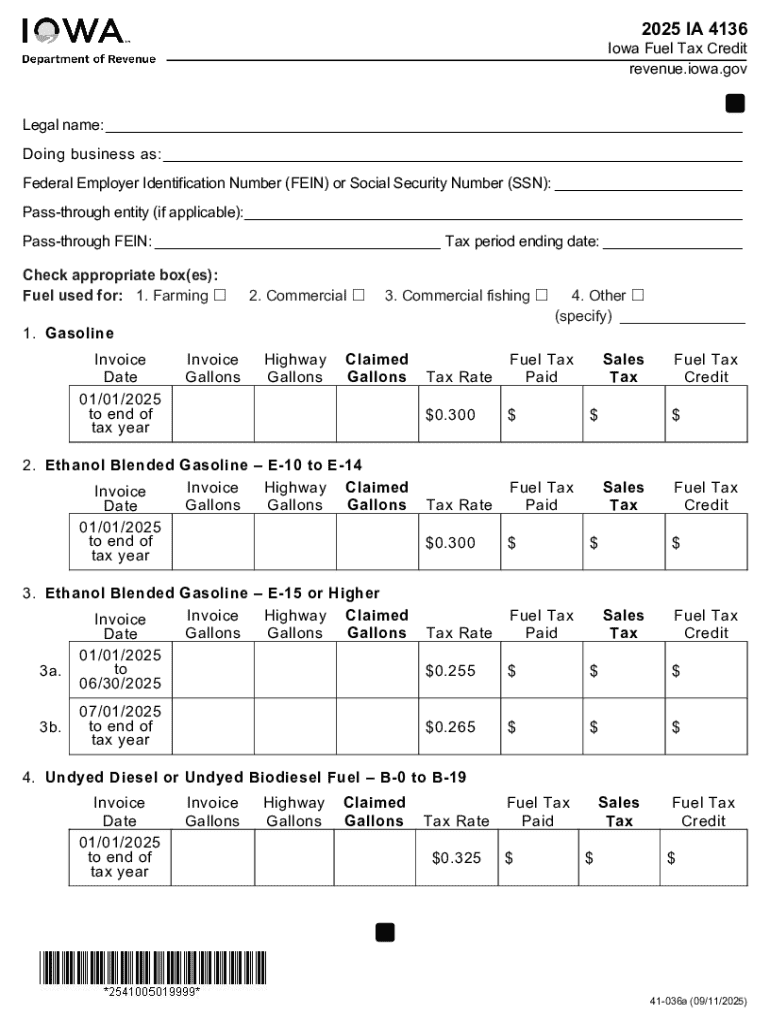

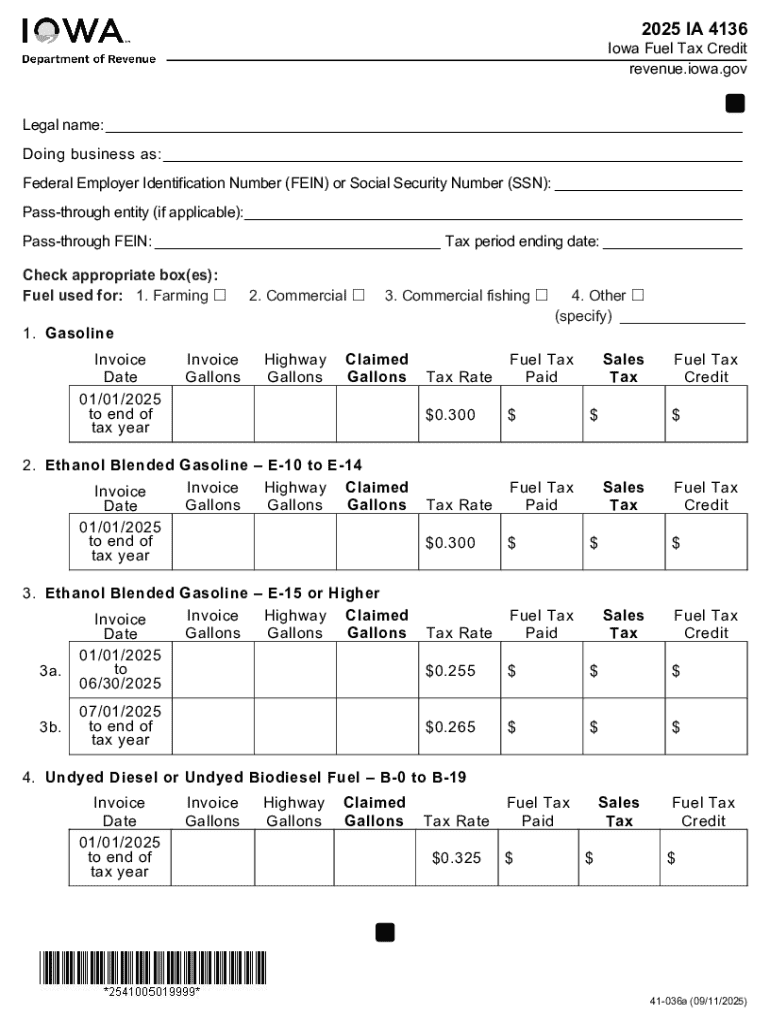

Get the free Federal Employer Identification Number (FEIN) or Social Security Number (SSN):

Get, Create, Make and Sign federal employer identification number

Editing federal employer identification number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal employer identification number

How to fill out federal employer identification number

Who needs federal employer identification number?

Complete Guide to the Federal Employer Identification Number Form

Understanding the Federal Employer Identification Number (EIN)

A Federal Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses and organizations for tax purposes. Often referred to as a federal tax identification number, the EIN is crucial for a wide range of business activities, including hiring employees, opening business bank accounts, and applying for various licenses and permits. Without an EIN, businesses may face challenges navigating the often complex world of taxation and compliance.

The IRS plays a central role in assigning EINs, as it manages the application process and maintains records. It’s essential to understand that the EIN is distinct from other personal tax identifiers like the Social Security Number (SSN) and the Individual Taxpayer Identification Number (ITIN). While an SSN is used for individuals, the EIN is specifically for business entities.

Who needs to apply for an EIN?

Not every individual or business needs an EIN; however, certain eligibility criteria dictate who must apply. Generally, anyone starting a business, hiring employees, or operating as a corporation or partnership must secure an EIN. This requirement extends to various business structures, including limited liability companies (LLCs) and non-profits. Special cases, such as estates or trusts that must file tax returns, also require the acquisition of an EIN.

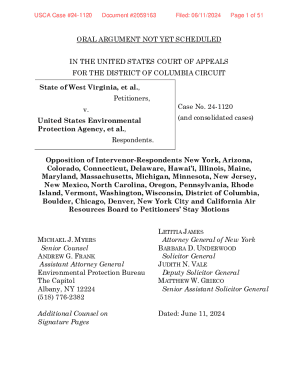

Overview of IRS Form SS-4

Form SS-4 is the official application form used to apply for an EIN. This document serves multiple purposes, including determining the legitimacy of the business and ensuring compliance with tax obligations. When completing Form SS-4, applicants must provide specific details, including the legal name of the entity, the type of entity applying, and the reason for obtaining the EIN.

The form itself is structured into multiple sections, each requiring particular sets of information. It’s essential to be accurate, as any discrepancies may lead to processing delays. The critical sections of the Form SS-4 cover the applicant information, the entity type, and information specific to additional entities, partnerships, LLCs, and more.

Step-by-step guide to filling out Form SS-4

Before diving into the details of filling out Form SS-4, it’s essential to gather all necessary information. This includes the legal name of the business, mailing address, type of entity, and the reason for applying. Inaccuracies can lead to processing delays or rejections.

Ensure that each section is complete and accurate, as this forms the foundation for your EIN application. Utilize official IRS guidelines for reference, and take care to avoid common mistakes, such as incorrect entity types or missing information.

Different methods for submitting Form SS-4

There are multiple submission methods available for Form SS-4, allowing flexibility depending on your preference and urgency. Each method has its pros and cons, so it’s essential to choose based on your needs and timelines.

Consider the urgency of your EIN requirement when selecting the method. The online application process is usually the fastest and most efficient, providing immediate feedback once submitted.

Tracking your EIN application status

Once you’ve submitted your Form SS-4, tracking the status of your EIN application is important. In many cases, the IRS provides a tracking status for applications submitted online, which allows applicants to see how far along their application is in the processing queue.

Processing times can vary based on the method of submission. Online applications are generally processed much faster than those sent by mail, which can take several weeks. Factors affecting processing times may include the volume of applications at the IRS and the completeness of your application.

What to do after receiving your EIN

Receiving your EIN is just the first step. Once you have this identifier, it’s vital to organize your EIN documentation carefully. Store this information in a secure, accessible location, as it will be needed for various business activities and tax obligations.

Understanding your responsibilities as an EIN holder is crucial, as failure to comply with tax regulations can lead to significant penalties.

Managing your EIN: Changes and updates

As businesses evolve, the information associated with EINs may need to be updated. It’s essential to recognize situations that require an update, such as changes in business structure, ownership, or name. Reporting these changes to the IRS ensures that your documentation remains accurate.

Maintaining accurate records is crucial for compliance and ensuring your business operations run smoothly.

Enhancing your document management with pdfFiller

pdfFiller simplifies the management of important documents, including the federal employer identification number form. With its cloud-based platform, users can easily edit PDFs, eSign, collaborate, and manage their EIN forms efficiently. Features include the ability to capture signatures electronically, share documents with team members, and securely store all documents in one platform.

Collaboration tools are particularly valuable when multiple team members are involved in EIN applications. No longer do you need to juggle multiple file formats or platforms; pdfFiller centralizes it all, ensuring a streamlined process that increases efficiency and accuracy.

Additional considerations and FAQs

As you navigate the world of EINs and Form SS-4, questions may arise. Common queries involve how long it takes to receive an EIN and whether a sole proprietorship needs one. Generally, businesses expecting to hire employees or operate officially should acquire an EIN, even sole proprietorships, if certain conditions apply.

It’s also common to encounter misconceptions about EIN applications. For example, many assume they only need one EIN throughout the lifespan of their business, while the reality is that changes in business structure could necessitate a new EIN.

Explore more IRS and legal forms

Understanding the federal employer identification number form is just one aspect of operating a business in compliance with IRS regulations. There are many other IRS forms and legal documents that your business may encounter. pdfFiller empowers users to seamlessly manage these forms from the same intuitive platform, ensuring that all your document needs are met efficiently.

Taking the time to understand these forms can streamline business processes, helping you avoid penalties and ensuring smooth operations. By incorporating document management solutions like pdfFiller, businesses can easily navigate the complexities of EIN applications and maintain compliance with legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my federal employer identification number in Gmail?

How can I fill out federal employer identification number on an iOS device?

Can I edit federal employer identification number on an Android device?

What is federal employer identification number?

Who is required to file federal employer identification number?

How to fill out federal employer identification number?

What is the purpose of federal employer identification number?

What information must be reported on federal employer identification number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.