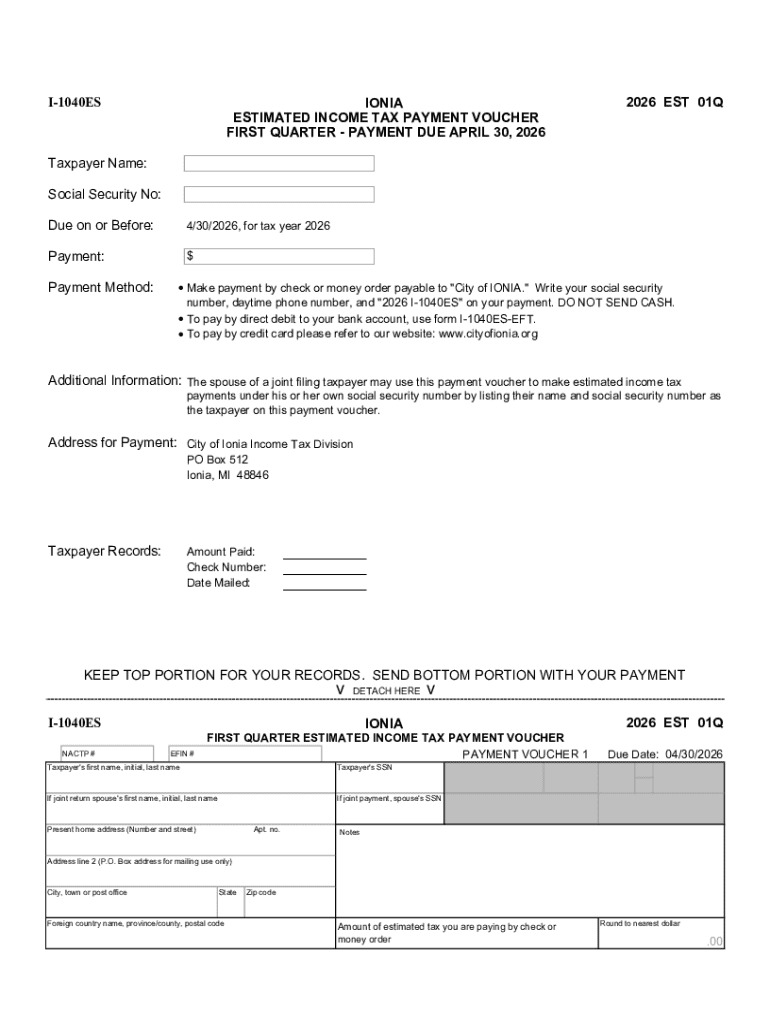

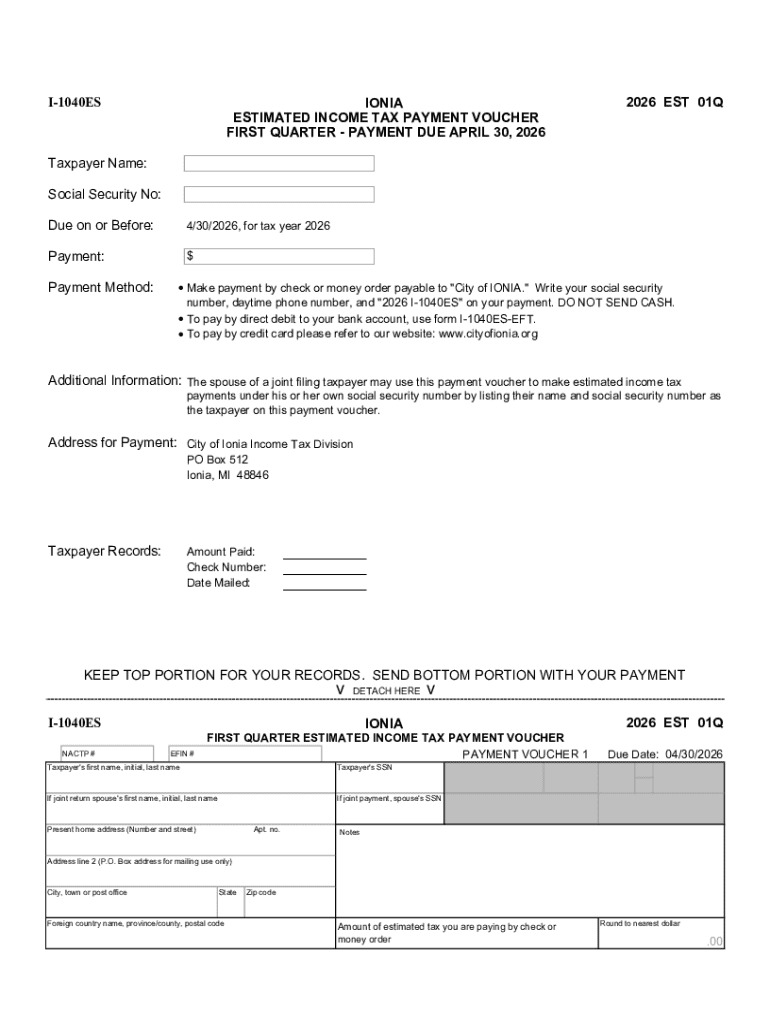

Get the free I-1040ES 2026 EST 01Q Taxpayer Name: Social Security No

Get, Create, Make and Sign i-1040es 2026 est 01q

How to edit i-1040es 2026 est 01q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i-1040es 2026 est 01q

How to fill out i-1040es 2026 est 01q

Who needs i-1040es 2026 est 01q?

-1040ES 2026 EST 01Q Form: A Comprehensive Guide

Overview of the -1040ES 2026 Form

The I-1040ES 2026 EST 01Q form is designed for estimated tax payments for the tax year 2026. It is mainly used by individuals who expect to owe tax of $1,000 or more when they file their 2026 federal income tax return. Making estimated tax payments helps avoid penalties and interest from the Internal Revenue Service (IRS) that can arise from underpayment throughout the tax year.

Every tax year brings its own set of changes, and 2026 is no exception. Key updates to the I-1040ES form reflect adjustments to tax brackets, changes in allowable deductions, and other tax code modifications that users need to be aware of to ensure compliance and accuracy.

Who needs to file the -1040ES 2026?

Individuals required to file the I-1040ES 2026 form generally include those who have self-employment income, rental income, or interest and dividend earnings exceeding certain thresholds. It’s important to understand that employees who have taxes withheld from their paychecks may not need to file estimated payments unless they fall into these categories.

Exemptions exist for individuals whose tax liability for the prior year was zero or who had an income below the minimum taxable threshold. Additionally, certain pensioners or those receiving Social Security benefits are also exempt, making it essential for taxpayers to recognize these nuances.

Understanding estimated tax payments

Estimated tax payments are quarterly tax payments made to the IRS throughout the tax year by individuals who expect to owe taxes. These payments are particularly crucial for those with income not subject to withholding, such as self-employed individuals and freelancers.

Unlike regular tax payments made when filing the annual tax return, estimated tax payments are on a quarterly basis, reducing the financial burden at year-end. Making timely estimated payments allows taxpayers to manage their cash flow better while ensuring compliance with tax obligations.

How to calculate your estimated tax payments

Calculating estimated tax payments can seem daunting, but it's a straightforward process. Here’s a structured approach:

1. First, determine your expected income for the year. This includes wages, self-employment income, and other revenue sources. You can obtain a rough estimate from your previous year's return or current financial outlook.

2. Subtract any allowable deductions such as student loan interest, retirement contributions, or education credits. This will help establish your taxable income.

3. Finally, apply the appropriate tax rates to your taxable income to calculate your estimated tax liability.

The IRS provides guidelines in Publication 505 and calculators on their website, which are invaluable tools for anyone unfamiliar with tax computations.

Form components and instructions

The I-1040ES 2026 form is comprised of several sections, each serving a purpose to facilitate accurate and effective tax reporting. Here's a breakdown:

1. Personal Information: This section asks for your name, address, and Social Security number. Ensure accuracy in this section to prevent any delays.

2. Estimated Tax Payment Details: Here, you’ll provide your total estimated tax for the year and indicate how much you’re paying with your I-1040ES.

3. Signature and Date Requirements: Do not forget to sign and date the form as it validates your submission.

Common mistakes include incorrect information in personal details and failure to sign the form, both of which can lead to delays or even penalties.

How to pay estimated taxes

Paying your estimated taxes can be done through various methods, making it convenient for taxpayers. The possible ways to pay include the IRS Direct Pay, Electronic Federal Tax Payment System (EFTPS), and traditional mail.

Online payments via IRS Direct Pay can be completed in a few simple steps, making it quick and secure. Alternatively, if you prefer sending checks, ensure that they're made payable to "United States Treasury" with the I-1040ES form included to ensure proper credit.

It is essential to adhere to payment deadlines to prevent penalties; the IRS schedules these dates, which typically fall on April 15, June 15, September 15, and January 15 of the following year.

How to check your estimated tax payments

Keeping track of estimated tax payments is crucial to ensure you've met your tax obligations. The IRS Online Account allows users to verify payment status, making it easier to monitor your contributions over the year.

Another useful practice is maintaining a personal record of payments made, including dates and amounts. This could be done using spreadsheet tools or financial apps that offer tracking features tailored to tax obligations.

Frequently asked questions (FAQs) about the -1040ES 2026

Many individuals have questions regarding their estimated tax payments. Here are some common inquiries:

Resources for assistance

Navigating the tax system can be perplexing, but the IRS offers numerous resources to assist taxpayers in meeting their obligations. The IRS website features comprehensive guides and FAQs that cater to various tax needs.

Additionally, pdfFiller provides a user-friendly platform to create, edit, and manage your tax forms with ease, ensuring that you have a streamlined approach to handling essential documents. Community forums and online help guides further enhance support when needed.

Key takeaways for filling out the -1040ES 2026

To ensure a successful filing of the I-1040ES 2026 form, it’s crucial to stay organized and informed. Review all guidelines thoroughly to understand new regulations that may affect your estimated payments.

Additionally, keep track of your income and expenses throughout the year, and utilize available tools to simplify your calculations. By following best practices, individuals can manage their tax obligations effectively and avoid common pitfalls associated with estimated payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in i-1040es 2026 est 01q?

How can I edit i-1040es 2026 est 01q on a smartphone?

Can I edit i-1040es 2026 est 01q on an Android device?

What is i-1040es 2026 est 01q?

Who is required to file i-1040es 2026 est 01q?

How to fill out i-1040es 2026 est 01q?

What is the purpose of i-1040es 2026 est 01q?

What information must be reported on i-1040es 2026 est 01q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.