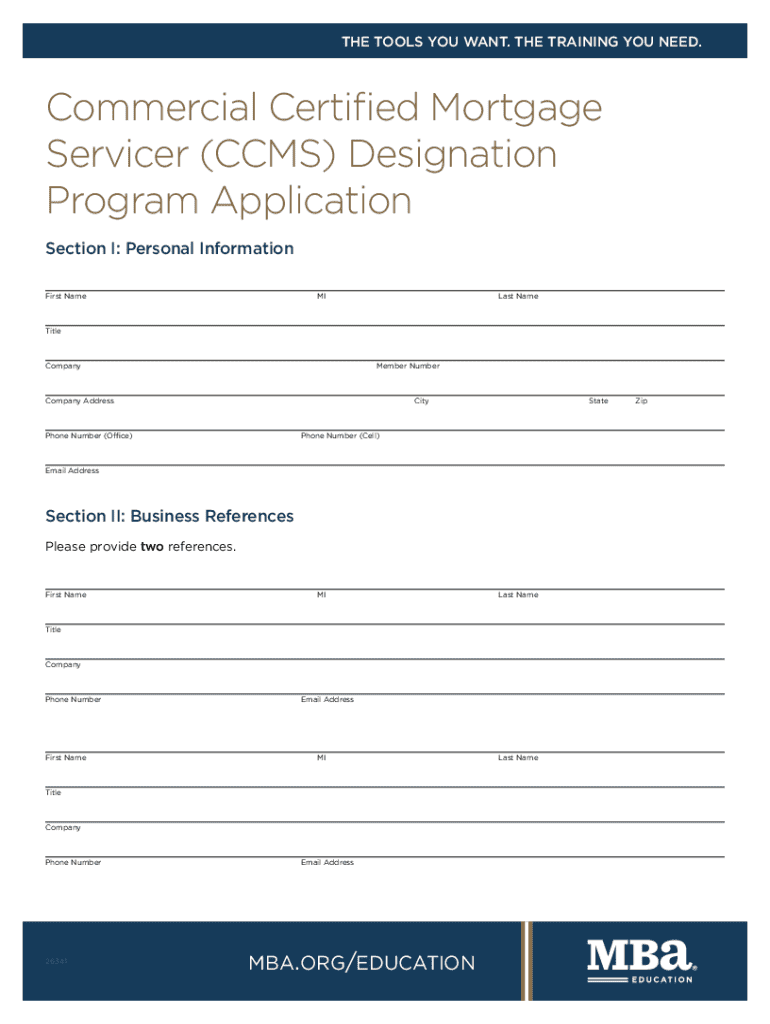

Get the free Commercial Mortgage Servicer: Level I Certificate Package

Get, Create, Make and Sign commercial mortgage servicer level

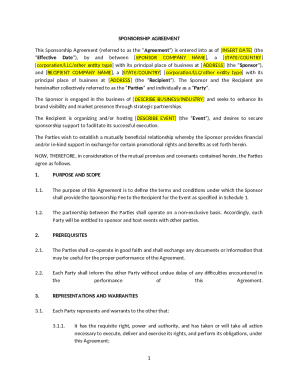

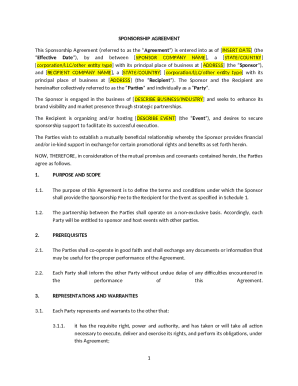

Editing commercial mortgage servicer level online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial mortgage servicer level

How to fill out commercial mortgage servicer level

Who needs commercial mortgage servicer level?

Commercial Mortgage Servicer Level Form - How-to Guide

Overview of commercial mortgage servicer level forms

A commercial mortgage servicer level form is a crucial document used in the mortgage servicing industry. Its primary purpose is to outline the terms and details of a commercial mortgage loan, facilitating effective communication between the borrower and the lender. By clarifying the obligations and expectations of both parties, this form ensures that the loan servicing process runs smoothly and efficiently.

These forms are vital not only for compliance with regulations but also for protecting the rights and interests of both parties involved in the loan agreement. They are an essential component of the mortgage servicing process, helping to streamline operations and promote transparency.

Key components of commercial mortgage servicer level forms

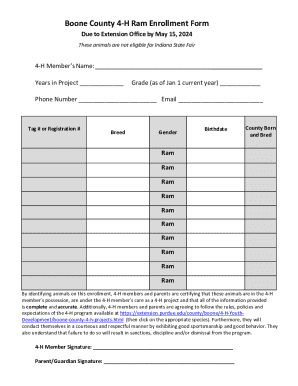

Understanding the key components of commercial mortgage servicer level forms is essential for proper completion and compliance. Each form typically includes critical information which helps define the agreement between borrower and lender.

These components include essential elements such as borrower and property information, loan specifics, the payment structure, and various schedules associated with the loan. By familiarizing yourself with common terminology, you can mitigate misunderstandings and ensure clarity in the mortgage lifecycle.

Step-by-step instructions for filling out the form

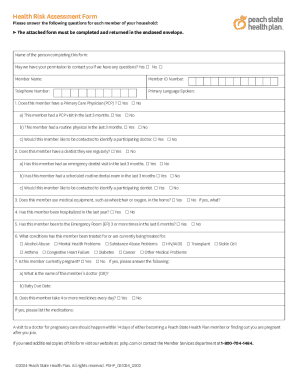

Completing a commercial mortgage servicer level form efficiently requires preparation and understanding. Start by gathering all necessary documentation, including your financial history, property appraisal, and identification. Familiarize yourself with the specific requirements to help streamline the process.

Once you have prepared, follow these detailed steps for filling out the form accurately:

For accuracy, double-check the entries for common mistakes such as typos or missing information. Ensuring compliance with lending regulations is equally important to prevent future complications.

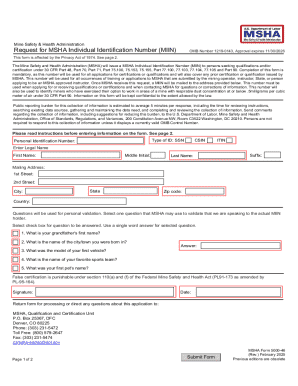

Editing and modifying commercial mortgage servicer level forms

Editing a commercial mortgage servicer level form can be necessary for adjustments during the loan life cycle. Utilizing tools like pdfFiller makes this process straightforward, allowing users to add or remove fields efficiently.

Once you have your form ready, collaborative editing features allow you to share the document with team members for input. Real-time collaboration fosters effective communication, ensuring all changes align with the lender's requirements.

eSigning and securing the form

eSigning plays a pivotal role in the modern mortgage process, allowing for swift and efficient execution of agreements. pdfFiller simplifies the eSigning process, providing users with a seamless way to sign documents anytime and anywhere.

Ensuring document security and privacy is paramount. Use best practices, such as password protection and secure storage solutions, to prevent unauthorized access or alterations to sensitive information.

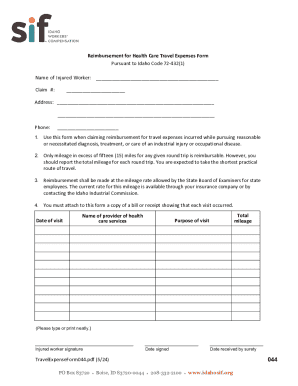

Managing and storing commercial mortgage servicer level forms

Effective document management is crucial in the realm of commercial mortgage servicing. pdfFiller offers solutions to organize documents systematically, making it easier for users to access essential forms when needed.

Strategies such as tagging and categorization not only streamline retrieval processes but also ensure that all team members can locate relevant documents without hassle. Integration with other tools and platforms can further enhance document workflows.

Troubleshooting common issues

While filling out or managing commercial mortgage servicer level forms, some users might encounter common issues. Being prepared to address these problems can ensure a smoother experience.

Common problems include missing information, unclear clauses, or difficulty in editing. Knowing how to troubleshoot these issues can help prevent delays in the mortgage process.

Regulatory considerations surrounding commercial mortgage servicing

Navigating the regulatory landscape surrounding commercial mortgage servicing is essential to ensure that forms adhere to local and federal laws. Familiarize yourself with relevant regulations to minimize the risk of legal complications.

Regulations such as the Dodd-Frank Act impact how mortgage servicing agreements are processed. Understanding these laws will allow you to stay compliant while using commercial mortgage servicer level forms.

Case studies and real-life applications

Various organizations have successfully utilized commercial mortgage servicer level forms to streamline their mortgage servicing processes. For instance, a regional bank minimized processing errors by implementing standardized forms across their lending teams.

Customer testimonials often highlight increased satisfaction from both borrowers and lenders when using a systematic approach to form management, such as the solutions offered by pdfFiller.

Contact and support options

For help or clarifications regarding commercial mortgage servicer level forms, pdfFiller offers a variety of support options. Users can reach out via live chat or email to get expert advice on their document-related queries.

Moreover, pdfFiller's resources and guides can provide additional assistance for users, ensuring they have the tools needed to navigate their document management challenges effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send commercial mortgage servicer level for eSignature?

How can I get commercial mortgage servicer level?

How do I make edits in commercial mortgage servicer level without leaving Chrome?

What is commercial mortgage servicer level?

Who is required to file commercial mortgage servicer level?

How to fill out commercial mortgage servicer level?

What is the purpose of commercial mortgage servicer level?

What information must be reported on commercial mortgage servicer level?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.