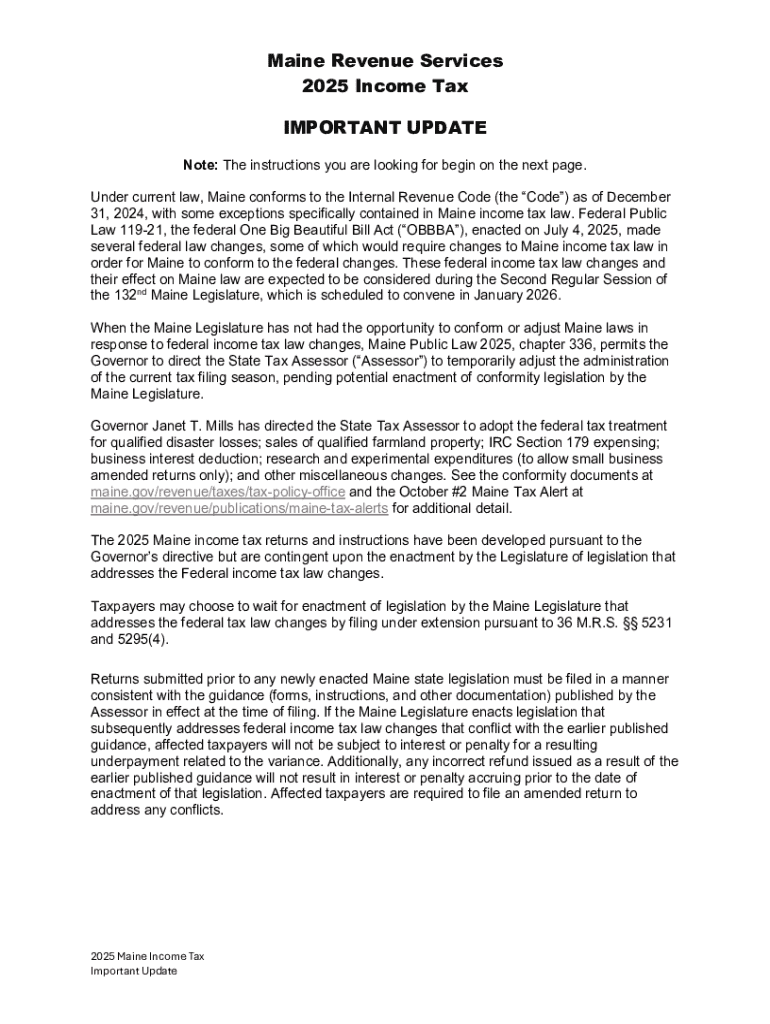

Get the free Maine Revenue Services 2025 Income Tax IMPORTANT UPDATE

Get, Create, Make and Sign maine revenue services 2025

How to edit maine revenue services 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maine revenue services 2025

How to fill out maine revenue services 2025

Who needs maine revenue services 2025?

Your Guide to the Maine Revenue Services 2025 Form

Overview of Maine Revenue Services 2025 Form

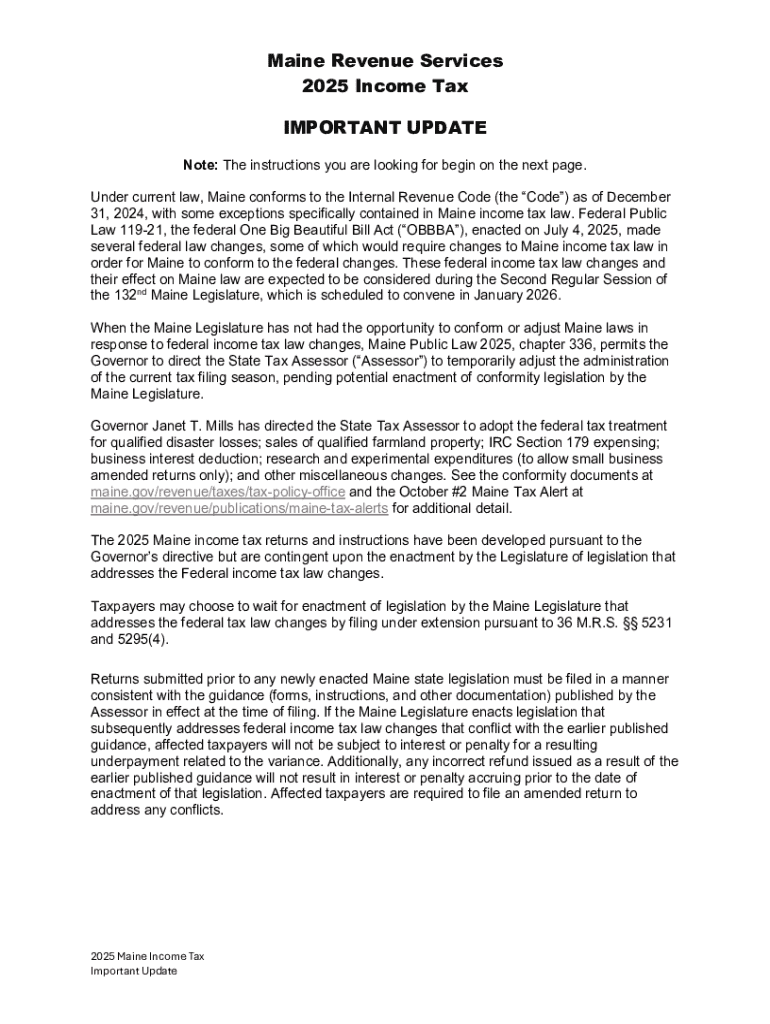

The Maine Revenue Services 2025 Form is a crucial document for all residents and businesses in Maine, designed to facilitate the accurate reporting of income and the payment of state taxes. Its primary purpose is to ensure compliance with Maine's tax laws while optimizing tax obligations for individuals and companies. Completing this form correctly is essential for avoiding penalties and ensuring eligibility for various tax credits.

The importance of the Maine Revenue Services 2025 Form cannot be overstated; it serves as the foundation for the state's revenue collection, which funds public services and infrastructure vital to the community. Moreover, understanding the nuances of this form can significantly impact your financial situation, making it beneficial for taxpayers to stay informed.

Key changes in the 2025 version

Every year, the Maine Revenue Services introduces amendments and updates to its forms. In 2025, taxpayers will notice some significant changes, including adjustments in income brackets and deductions that directly affect tax liabilities. Additionally, clarifications on filing requirements have been implemented to streamline the process, making it easier for individuals and businesses alike to comply with state legislation.

Types of Maine Revenue Services Forms

Maine Revenue Services offers a range of forms tailored to various taxpayer categories. Understanding these forms is crucial, as each type caters to different needs and situations.

Individual income tax forms

The individual income tax forms are categorized into resident, nonresident, and part-year resident forms. Each type has specific eligibility criteria that determine who should use which form.

Corporate tax forms

Businesses in Maine must also navigate various corporate tax forms. The key forms serve different types of corporate structures and are associated with particular tax obligations. It's essential for corporations to be aware of key deadlines for submission to avoid penalties.

Essential steps for completing the Maine Revenue Services 2025 Form

Successfully completing the Maine Revenue Services 2025 Form involves several strategic steps. Careful attention to detail during each phase can prevent errors and ensure compliance.

Step 1: Gather required documentation

To complete the form accurately, start by gathering crucial documents such as proof of income, including W-2s and 1099s, and any relevant tax deductions like mortgage statements or charitable contributions. Organizing these documents ahead of time can facilitate a smoother filing process.

Step 2: Understand filing options

Taxpayers have the option to file electronically or via paper methods. Electronic filing has become increasingly popular due to its convenience and quicker processing times. However, some may still prefer paper filing for various reasons.

Step 3: Fill out the form accurately

As you begin filling out the Maine Revenue Services 2025 Form, pay close attention to details. Interactive fields within the digital version can help minimize common pitfalls. Always double-check entries to confirm completeness and accuracy.

Step 4: Review and edit using pdfFiller

Using pdfFiller for editing can streamline this process significantly. Utilizing its editing tools allows for easy corrections and adjustments. Additionally, pdfFiller allows for collaboration if you opt to have someone else review your form.

Step 5: eSign the document

When your document is complete, consider using pdfFiller's electronic signature feature for convenience. This method is legally recognized, ensuring your form is submitted officially without the need for physical printing.

Common errors and how to avoid them

Even experienced taxpayers can occasionally make errors on tax forms. Awareness of these common mistakes can help prevent them.

Missing or incorrect information

Missing or incorrectly inputted information is one of the most frequent mistakes. Ensuring all fields are filled out accurately is crucial.

Misunderstanding tax credits and deductions

Tax credits and deductions play a critical role in reducing the overall tax burden. Understanding what credits are available and how to claim them is vital. Utilize resources provided by Maine Revenue Services to navigate this aspect efficiently.

Deadlines and important dates for 2025 form submission

Filing deadlines are a crucial consideration for tax compliance. For the 2025 tax year, Maine Revenue Services traditionally aligns its deadlines with federal tax deadlines.

Frequently asked questions (FAQ)

Taxpayers often have questions as tax season approaches. Here are some commonly asked queries regarding the Maine Revenue Services 2025 Form.

What if need assistance with my 2025 form?

If you encounter difficulties, Maine Revenue Services offers support through their website and contact lines. Additionally, pdfFiller provides user support to assist with any issues related to form completion.

Can amend my 2025 form after submission?

Yes, it's possible to amend your tax return. You will need to follow specific procedures for amendments and provide relevant documentation to support any changes.

Additional features of pdfFiller for managing Maine Revenue Services forms

Using pdfFiller enhances the process of handling Maine Revenue Services forms significantly. Its cloud-based features ensure accessibility and security.

Benefits of using pdfFiller

The platform offers numerous tools for document management, including collaboration features for teams. This allows individuals to work together on forms seamlessly, resulting in better accuracy.

Ensuring document security

Security is a priority when dealing with sensitive personal information. pdfFiller employs robust security features, ensuring that your data remains safe throughout the preparation and submission process.

Tips for a smooth filing experience

Navigating tax season can be less stressful with a few best practices. Consider using tax software alongside the Maine Revenue Services 2025 Form for better accuracy and efficiency.

Furthermore, pdfFiller’s resources can help streamline your filing process, from document creation to eSigning, making it easier to maintain thorough records for future reference.

Conclusion of steps for filing the Maine Revenue Services 2025 Form

Completing the Maine Revenue Services 2025 Form requires diligence and precision. By following the outlined steps systematically, you can ensure a smooth filing experience. Taking advantage of pdfFiller's tools will further simplify this process, allowing you to focus on accurately reporting your income and fulfilling your tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my maine revenue services 2025 in Gmail?

How do I edit maine revenue services 2025 on an iOS device?

How do I complete maine revenue services 2025 on an iOS device?

What is maine revenue services 2025?

Who is required to file maine revenue services 2025?

How to fill out maine revenue services 2025?

What is the purpose of maine revenue services 2025?

What information must be reported on maine revenue services 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.