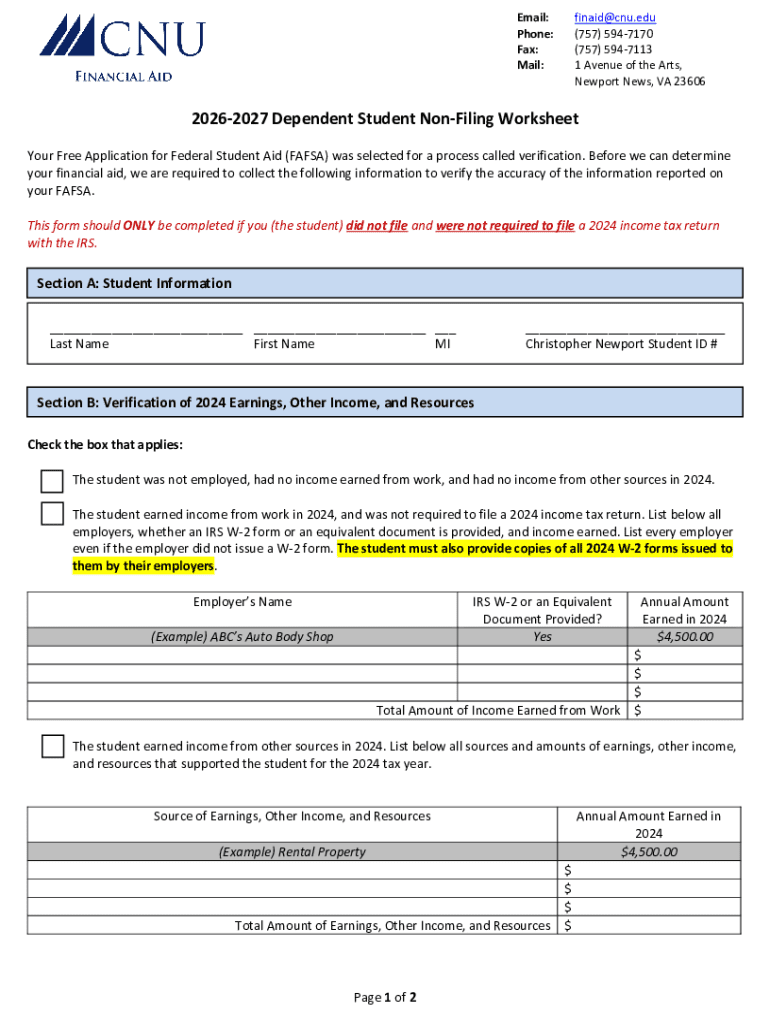

Get the free 2024-2025 Dependent Student Non-Filing Worksheet

Get, Create, Make and Sign 2024-2025 dependent student non-filing

Editing 2024-2025 dependent student non-filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024-2025 dependent student non-filing

How to fill out 2024-2025 dependent student non-filing

Who needs 2024-2025 dependent student non-filing?

Understanding the 2 Dependent Student Non-Filing Form

Understanding the 2 dependent student non-filing form

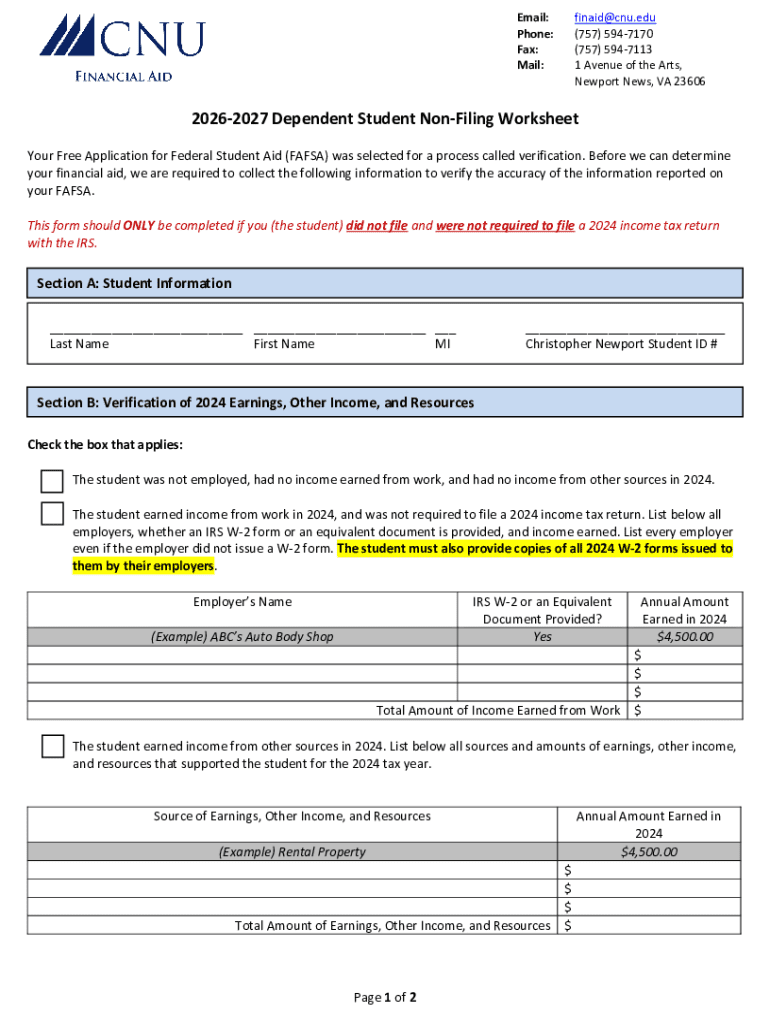

The 2 dependent student non-filing form is a critical document for students who are considered dependents according to federal financial aid guidelines. This form serves to indicate a student's eligibility for federal financial aid, particularly when the parents are not required to file an income tax return. Its primary purpose is to streamline the financial aid process by clarifying the financial status of the student’s household.

Understanding who needs to file this form is essential. Generally, dependent students are those who meet specific criteria set forth by the Department of Education. These criteria typically include age, relationship to the parents, and financial dependence. Situations that may require a non-filing form include circumstances in which the parents have little to no income, making it unnecessary for them to file a federal tax return for the given year. For many students, securing financial aid can hinge on the accurate submission of this form.

Key information required on the non-filing form

To effectively complete the 2 dependent student non-filing form, specific information is required. Personal details such as the student’s name, address, and Social Security number must be accurately filled out. Additionally, parent details, including names and Social Security numbers, are necessary as well, as this information helps establish the student’s eligibility for financial aid.

Financial details are also integral to this form. The form clarifies income eligibility criteria, ensuring that students who may not have parents who file taxes are still considered for state and federal aid. 'Non-filing' refers to situations where parents have an income below the minimum threshold that necessitates filing federal taxes. This criterion is pivotal in determining which students are eligible for grants and subsidized loans, impacting their overall budgets for education.

How to obtain the non-filing form

Obtaining the 2 dependent student non-filing form can be done through various channels. Official sources, like the IRS and financial aid offices at educational institutions, are the most reliable places to start. The IRS provides necessary documentation, while university financial aid offices can provide guidance tailored to specific institutional requirements.

Alternatively, accessing the form online has never been easier. Particularly, platforms like pdfFiller offer the option to fill out forms in a digital format. To access the form from pdfFiller, simply navigate to their website, search for the dependent student non-filing form, and download it in a user-friendly PDF format. This process can usually be completed in a few straightforward steps, making it a convenient option for students and parents alike.

Completing the 2 dependent student non-filing form

Filling out the 2 dependent student non-filing form may seem daunting, but following a step-by-step approach can simplify the process. Begin by entering personal information about the student: full name, permanent address, and Social Security number. Next, provide accurate details about parental income or clearly indicate non-filing status by adhering to the instructions provided with the form.

Finalizing the form requires certifications and signatures from both the student and the parents. This step is essential in attesting to the authenticity of the information provided. To avoid common mistakes, ensure that all fields are filled correctly, review any dollar amounts entered, and double-check names and Social Security numbers. Inaccuracies can lead to delays in processing and potential issues with financial aid eligibility.

Submitting the non-filing form

Once the 2 dependent student non-filing form is complete, the next step is submission. Instructions for submitting the form typically vary based on the institution and can be done electronically or via traditional mail. For electronic submissions, make sure the form is uploaded through the specified financial aid portal provided by your school’s financial aid office. Alternatively, paper submissions should be directed to the appropriate department within the institution.

It is vital to keep an eye on submission deadlines, which are crucial for financial aid discussions. Before sending off your non-filing form, confirm that all documentation accompanies the submission. Following submission, it is advisable to track your submission’s status. Schools have different methods for monitoring form processing, so make sure to familiarize yourself with the procedures specific to your institution to ensure everything is received and processed correctly.

Important policies and procedures

Understanding the verification process surrounding the 2 dependent student non-filing form is essential. The verification process is instituted by the Department of Education to ensure accuracy in financial aid applications. If selected for verification, students and their parents may be required to submit additional documentation to confirm the information stated on the form, such as bank statements or proof of income.

Moreover, retaining copies of submitted forms is not just a good practice—it's a responsibility of every applicant. Keeping these records will serve you well, particularly in case of discrepancies or if the institution requests additional proof later. It’s recommended to maintain such documentation for at least five years, as this ensures compliance with regulations and safeguards against potential queries.

Special circumstances

While the 2 dependent student non-filing form is designed for traditional dependent statuses, there are instances where the non-dependent students might seek similar documentation under unique circumstances. This could involve situations such as emancipated minors or students who take care of themselves financially. Students who do not qualify as dependents must understand that they have different forms and processes to initiate their financial aid applications.

Additionally, some students may seek a dependency override, a process which allows students to apply for aid without parental information when they find themselves in exceptional circumstances. To request a dependency override, specific documentation, including letters from social workers or counselors detailing the student's situation, may be required. Such scenarios typically involve evidence of abusive homes or neglect.

Utilizing pdfFiller for your non-filing process

Using pdfFiller can significantly enhance the efficiency of your experience with the 2 dependent student non-filing form. This cloud-based platform allows users to edit, fill, and electronically sign documents seamlessly. By leveraging the tools available on pdfFiller, you can collaborate with parents and school advisors to ensure all information is accurate and promptly submitted.

The interactive features of pdfFiller are beneficial, as they provide easy ways to communicate and resolve questions during the form-filling process. With features that enable document sharing and commenting, parents can review and contribute their insights directly. This streamlines the process, making it easier to finalize the necessary documentation while maintaining an organized record of communications.

FAQs about the 2 dependent student non-filing form

There are many questions that arise regarding the 2 dependent student non-filing form. One common concern is regarding parental situations; for instance, ‘What if my parents are separated or divorced?’ In such cases, the student generally needs to provide information for the parent primarily responsible for their financial support. Additionally, questions about how to handle financial support from non-parental sources often occur. Income from relatives or family friends may need to be disclosed depending on the school's financial aid policies.

In instances where applicants face difficulty with the form or submission process, seeking help should be prioritized. Many schools have financial aid counselors who assist in these situations, and online resources can also provide valuable insights. Understanding your institution's policy and familiarizing yourself with potential issues can ease stress and increase the likelihood of a successful submission.

Ensuring compliance and accuracy

Maintaining accuracy when completing the 2 dependent student non-filing form is crucial. Any discrepancies between submitted information and actual financial data can lead to significant repercussions for financial aid eligibility. Single errors could result in denied applications or delayed funding—challenges students do not want to face, particularly as they approach the start of an academic year.

Before submitting, prepare a final checklist to confirm all elements are in order. Key items to review include correct identification of parent information, comprehensive income details or confirmation of non-filing, and ensured signatures are duly added. By allocating extra attention at this stage, students can avoid unnecessary difficulties and ensure that their financial aid applications proceed without complication.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024-2025 dependent student non-filing in Gmail?

How do I complete 2024-2025 dependent student non-filing online?

Can I edit 2024-2025 dependent student non-filing on an Android device?

What is 2024-2025 dependent student non-filing?

Who is required to file 2024-2025 dependent student non-filing?

How to fill out 2024-2025 dependent student non-filing?

What is the purpose of 2024-2025 dependent student non-filing?

What information must be reported on 2024-2025 dependent student non-filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.