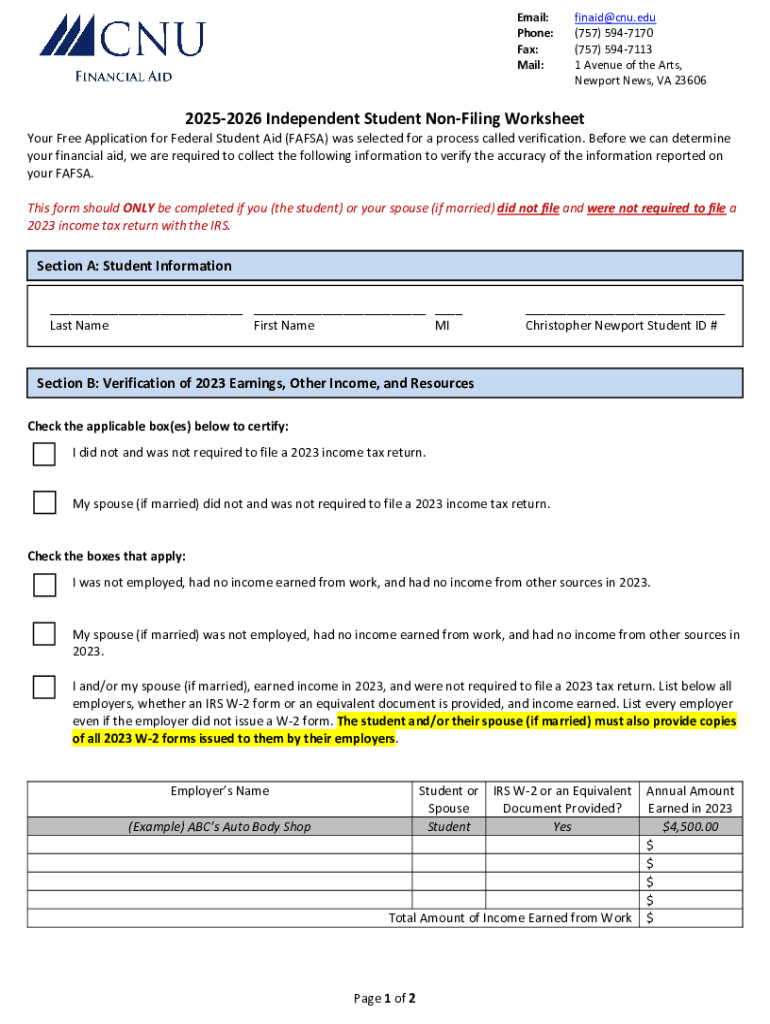

Get the free 2025-2026 Independent Student Non-Filing Worksheet

Get, Create, Make and Sign 2025-2026 independent student non-filing

How to edit 2025-2026 independent student non-filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 independent student non-filing

How to fill out 2025-2026 independent student non-filing

Who needs 2025-2026 independent student non-filing?

Understanding the 2 Independent Student Non-Filing Form

Overview of the 2 Independent Student Non-Filing Form

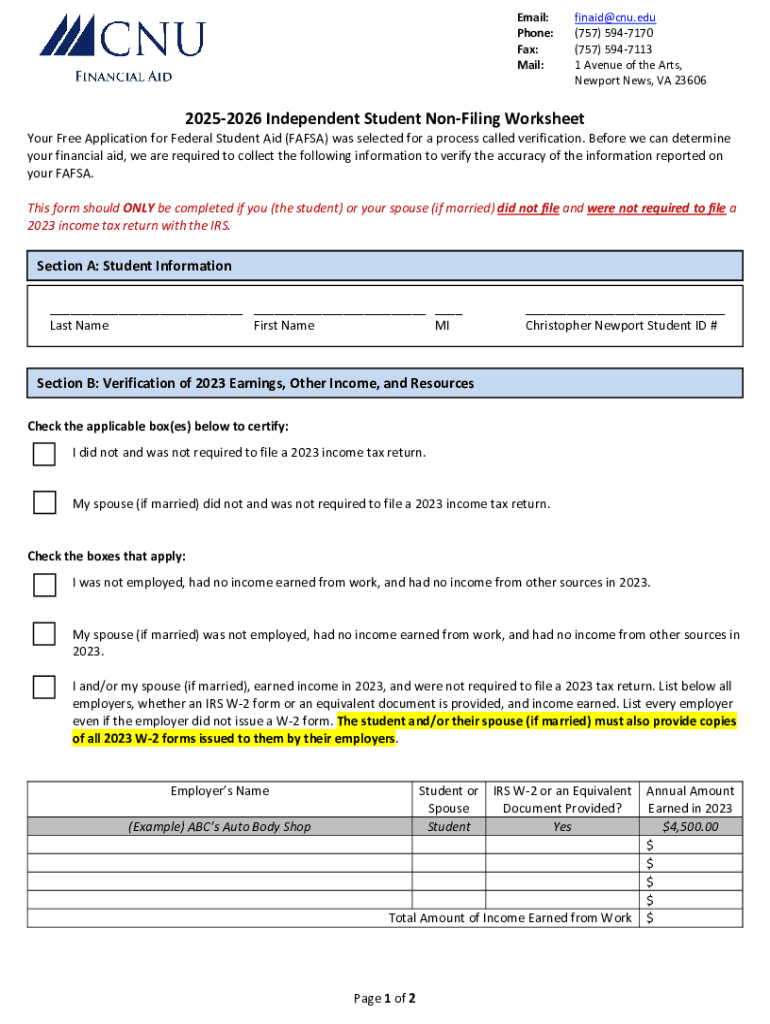

The 2 Independent Student Non-Filing Form serves a vital function for students who do not meet the income thresholds necessary for filing federal tax returns. Created for individuals navigating the complexities of financial aid applications, this form is integral for confirming a student’s financial situation when aid eligibility is assessed. By declaring non-filing status, students can streamline their financial aid process, ensuring a more efficient and accurate assessment of their financial need.

Recognizing who can benefit from this form is essential. Typically, independent students — those not relying on parental support — should utilize this form if their income is below the filing threshold set by the IRS. By doing so, they can present their financial circumstances clearly to their educational institution, helping to secure necessary funding to continue their studies.

Eligibility criteria

An independent student is defined as a person who is not financially dependent on their parents or guardians and meets specific criteria set forth by the FAFSA guidelines. This could include being over 24 years old, married, a veteran, or leading a household with dependents. Eligible candidates for the 2 Independent Student Non-Filing Form must also adhere to financial thresholds that indicate they do not need to file a federal income tax return.

These thresholds could change yearly, so it’s crucial to verify your specific situation against the current IRS guidelines. For instance, if an independent student earns below a certain income level – for 2025, this is expected to be set around $12,400 – they would reasonably qualify to submit the non-filing form. Furthermore, unique situations such as being a recent high school graduate or facing unforeseen circumstances may also qualify a student for this essential documentation.

Document preparation essentials

Before initiating the process for the 2 Independent Student Non-Filing Form, it’s vital to gather required documents. You will need to prepare a valid form of identification, perhaps a driver’s license or state ID, along with the previous year’s financial information to support your claims. In cases where some income is earned, proof, such as pay stubs or bank statements, may also be necessary.

Additionally, accessing the form through pdfFiller requires technological considerations. Ensure you are using a supported browser, such as Chrome, Firefox, or Safari, and have a stable internet connection for a smooth experience.

Step-by-step instructions for completing the form

Completing the 2 Independent Student Non-Filing Form involves several key steps to ensure accuracy and completeness. Following this systematic approach helps students mitigate common errors and accelerates the submission process.

Step 1: Gather Necessary Information - Start by compiling personal information such as your name, date of birth, Social Security number, and contact information. Also gather exact income details, including any earnings, unemployment benefits, or other income sources.

Step 2: Navigating to the pdfFiller Platform - Access the 2 Independent Student Non-Filing Form via pdfFiller. If you don't already have an account, create one or log in to an existing account to get started.

Step 3: Filling Out the Non-Filing Form – Carefully fill out each section. This includes a personal details section, an income declaration, and electronic signature section for finalizing the document. Be meticulous to avoid any oversight.

Step 4: Reviewing the Completed Form - Before submitting, review your form thoroughly. Look for inconsistencies or missing information. Utilize best practices like taking breaks to ensure your review is accurate.

Step 5: Submitting the Form - Choose your submission method wisely. Submit the form either online within the pdfFiller platform or by printing it for offline submission, and ensure you confirm receipt of your submission.

Editing and managing your non-filing form

Once you’ve submitted your 2 Independent Student Non-Filing Form, you may find that you need to edit or make updates. PdfFiller makes this process convenient, as users can return to modify submitted forms directly on the platform.

To track changes and maintain version control, pdfFiller supports features that allow you to see previous versions of your document. Implementing a version control system ensures that important changes are documented and retrievable.

Streamlining collaboration and sharing

Collaboration can be crucial during the preparation process, especially if you’re seeking feedback or assistance from peers or advisors. With pdfFiller’s collaboration tools, you can easily invite others to review your form, providing a seamless experience.

Consider setting access permissions to secure your personal information during the review process. This ensures that sensitive data remains confidential while allowing for effective collaboration.

Frequently asked questions (FAQs)

Navigating the submission process can lead to common questions. One frequent concern involves issues with accessing the form or input errors. PdfFiller offers troubleshooting resources that can help mitigate these frustrations.

Delays in processing your non-filing form can also raise red flags. Students are encouraged to follow up with their educational institutions if there's a significant lag in response times. If a submission is rejected, understanding the reason is crucial. Typically, this might stem from incorrect income thresholds or missing documentation – areas that require careful attention during the preparation stages.

Beyond the non-filing form: additional resources

Understanding the 2 Independent Student Non-Filing Form is only the beginning. Students might encounter additional forms or documents required for their financial aid journey. Identifying related forms and templates on pdfFiller can enhance your experience.

Additionally, financial aid offices often provide extensive FAQs and resources for students navigating these hurdles. Engaging with educational advising services can also shed light on further steps necessary for funding applications.

Utilizing pdfFiller’s unique features for document management

PdfFiller goes beyond offering just a platform for forms. Its eSignature capabilities enable faster approvals, allowing students to expedite their financial aid applications by securing necessary signatures swiftly and efficiently.

Real-time editing features allow users to make adjustments promptly, and tracking changes maintains transparency throughout the document management process. Moreover, security measures inherent in pdfFiller ensure that sensitive information is protected, fostering peace of mind while managing essential documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2025-2026 independent student non-filing online?

How do I edit 2025-2026 independent student non-filing online?

How do I edit 2025-2026 independent student non-filing in Chrome?

What is 2025-2026 independent student non-filing?

Who is required to file 2025-2026 independent student non-filing?

How to fill out 2025-2026 independent student non-filing?

What is the purpose of 2025-2026 independent student non-filing?

What information must be reported on 2025-2026 independent student non-filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.