Get the free 2024 tax return checklist mac llp

Get, Create, Make and Sign 2024 tax return checklist

How to edit 2024 tax return checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax return checklist

How to fill out 2024 tax return checklist

Who needs 2024 tax return checklist?

2024 Tax Return Checklist Form: Your Comprehensive Guide

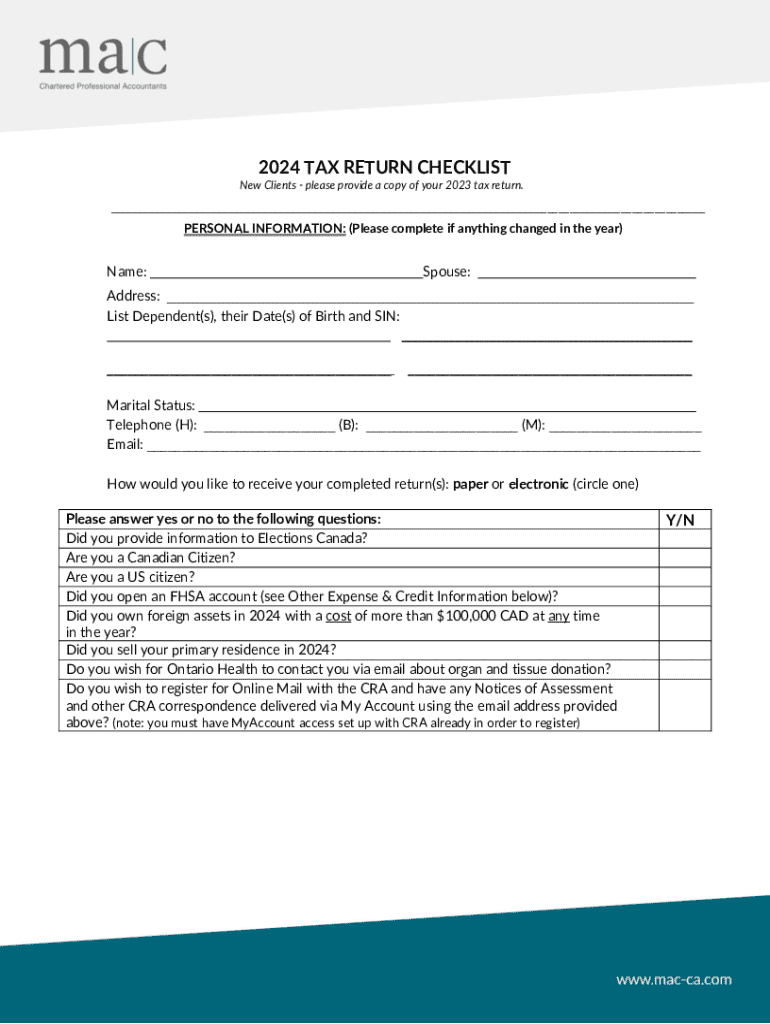

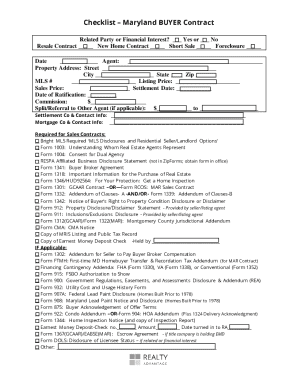

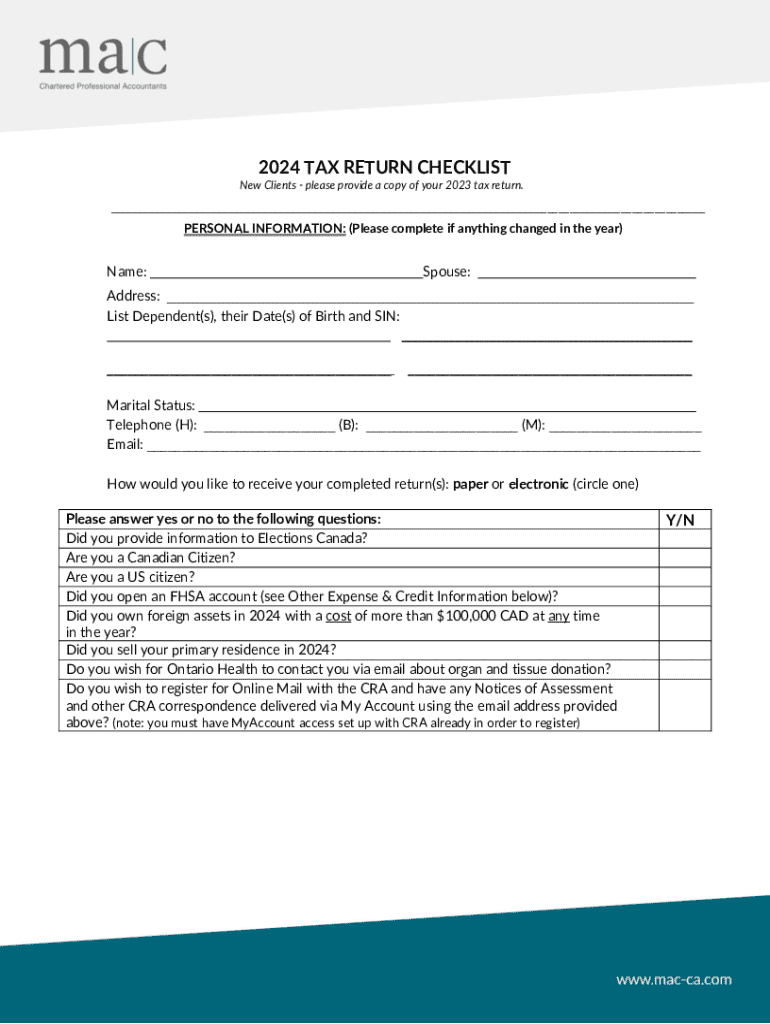

Understanding the 2024 tax return checklist form

The 2024 tax return checklist form is an essential tool designed to guide taxpayers through the complex process of preparing their tax returns. This checklist helps individuals and teams categorize necessary information efficiently, ensuring that no critical details are overlooked.

Utilizing a checklist simplifies the often daunting tax filing process, particularly in a year with various changes and updates. Taxpayers can approach their obligations with clarity and confidence, leading to a smoother filing experience.

For 2024, several modifications in tax legislation and forms are expected. Staying informed about these changes will be instrumental in ensuring accurate filings and maximizing benefits.

Key components of the 2024 tax return checklist

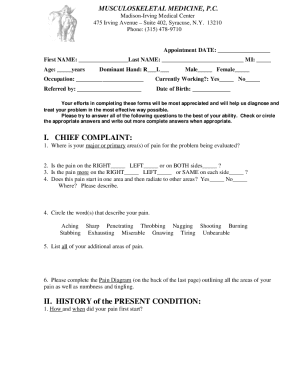

A well-structured tax return checklist includes various components crucial for accurate tax preparation. Each section of the checklist is designed to ensure that all necessary data is gathered and reported correctly.

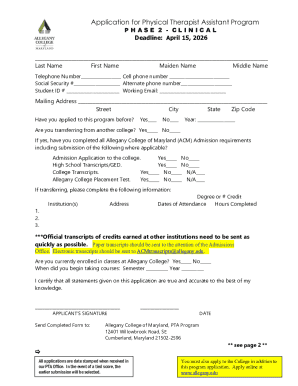

Step-by-step preparation process

Following a step-by-step process enhances organization and reduces errors when preparing your tax return. Begin by gathering necessary documents, which lay the foundation for your filing.

After your checklist is completed and documents gathered, it's time to move on to filling out the actual tax forms. This stage may feel overwhelming, but with the proper tools and guidance, you'll be well-equipped for success.

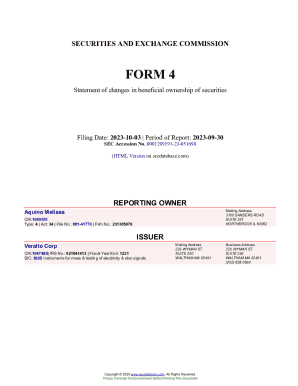

Utilizing pdfFiller for your 2024 tax returns

pdfFiller offers an array of features tailored to enhance your tax preparation experience in 2024. Users can edit PDFs, eSign documents, and collaborate effectively with tax professionals or team members.

Using pdfFiller not only streamlines the document creation process, it also offers a centralized platform for managing all tax-related documentation, giving you peace of mind.

Frequently asked questions about the 2024 tax return checklist

Tax seasons can spark a flurry of questions for individuals preparing their returns. Understanding common concerns can alleviate anxiety and facilitate smooth preparation.

Troubleshooting common issues

Addressing common issues proactively can prevent headaches during the filing process. Understanding potential mistakes and how to rectify them is key to a successful tax return.

Additional tools for an efficient tax season

Enhancing your tax filing experience can be achieved through various additional tools and resources available on pdfFiller. These resources are designed to maximize efficiency and minimize stress.

Related topics and further reading

Engaging with your finances on an ongoing basis can pave the way for smoother tax seasons in the future. It’s advisable to stay informed about various topics surrounding taxes.

Appendices

For practical application, the following appendices are provided to enhance your tax return preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 tax return checklist in Gmail?

How can I edit 2024 tax return checklist from Google Drive?

How do I make edits in 2024 tax return checklist without leaving Chrome?

What is 2024 tax return checklist?

Who is required to file 2024 tax return checklist?

How to fill out 2024 tax return checklist?

What is the purpose of 2024 tax return checklist?

What information must be reported on 2024 tax return checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.