Get the free Checklist of Common Tax Return Errors - Sycamore ...

Get, Create, Make and Sign checklist of common tax

Editing checklist of common tax online

Uncompromising security for your PDF editing and eSignature needs

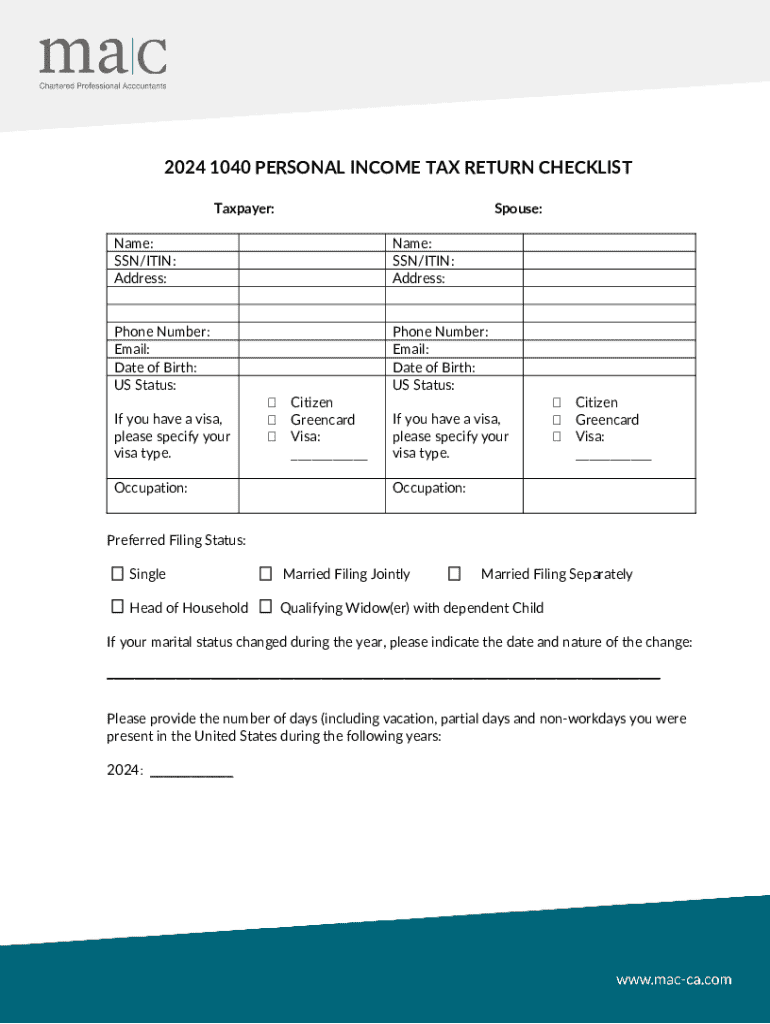

How to fill out checklist of common tax

How to fill out checklist of common tax

Who needs checklist of common tax?

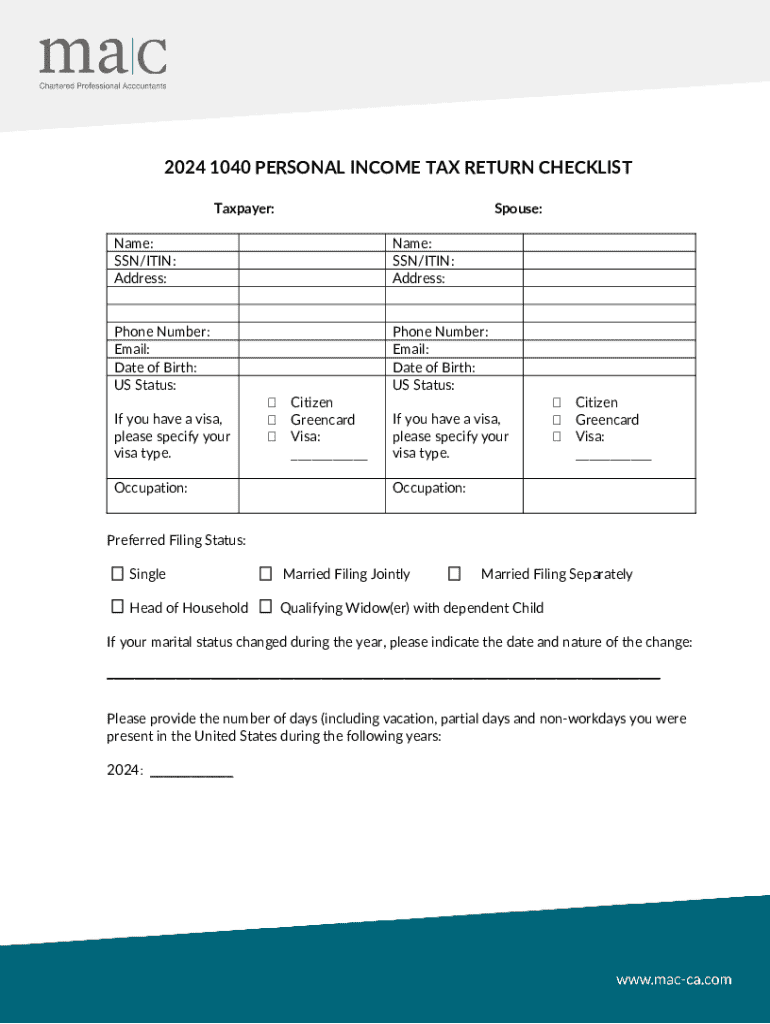

Checklist of Common Tax Forms

Understanding the importance of tax forms

Tax forms are indispensable tools for financial documentation, playing a crucial role in accurately reporting income and expenses to the IRS. They serve as a verification mechanism for both taxpayers and the government, ensuring transparency and compliance in the tax system. Missing or inaccurate forms can lead to penalties, delays in refunds, and potential audits, making it essential for individuals to understand their obligations.

Filing taxes can be daunting, but being aware of the right documents can simplify the process significantly. Each form has a specific purpose, and understanding these can make tax time less stressful. This guide outlines the essential forms that you need to be aware of and offers a systematic approach to managing your tax documentation.

Key tax forms to know

A checklist of common tax forms includes several vital documents that cater to various aspects of personal finance. Here's an overview:

Documenting expenses

Understanding which expenses are deductible is key to maximizing your tax return. Deductible expenses can significantly lower taxable income, allowing for greater savings. Here's what qualifies:

To account for these expenses appropriately, forms like Schedule A (for itemized deductions) and Form 8283 (for non-cash charitable contributions) come into play. Organizing records for these forms is essential to ensure proper reporting and to claim maximum deductions.

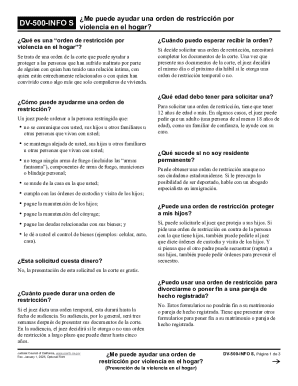

Specialized tax documents

Navigating the specialized documents that pertain to tax credits, deductions, and health coverage is vital in today's tax landscape. For example, the Earned Income Tax Credit (EITC) offers significant financial relief for eligible families, which many overlook.

The eligibility criteria for the EITC are based on income and family size, so understanding these can help families gain valuable tax refunds. The 1095-A form provides crucial information needed to complete tax returns accurately and avoid potential penalties.

Tools for managing your tax forms

Using tools like pdfFiller can streamline the management of your tax forms. This online platform allows for the easy creation, editing, and collaboration on tax documents.

Storing tax documents securely is also essential; best practices include backing up data both physically and digitally, and organizing files in clear folders to facilitate easy retrieval when needed.

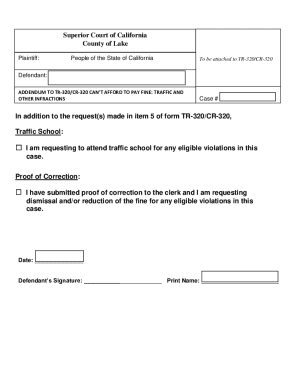

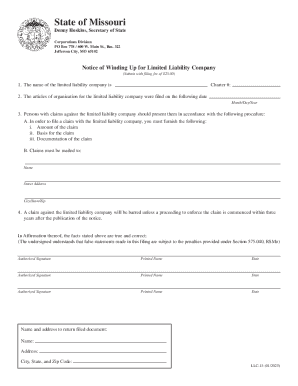

Step-by-step guide to filling out key forms

A comprehensive understanding of how to fill out major tax forms effectively can minimize errors and enhance compliance. Here are detailed instructions for three common forms:

Common FAQs about tax forms

Addressing common questions about tax forms can alleviate concerns. For example, individuals often ask about deadlines or penalties for late filing. Typically, the tax filing deadline is April 15, but checks for extensions or specific state requirements are crucial.

Using tax software can also optimize the filing process, though it's important to be aware of subtle inaccuracies that could affect returns.

Maintaining compliance and record-keeping

Establishing best practices for record retention is vital for compliance and organization. Generally, it is advisable to keep documents related to tax filings for seven years to provide sufficient coverage in case of audits.

Backup measures, such as using cloud storage, not only ensure documents are secure but also accessible from anywhere, aligning well with the platform capabilities offered by pdfFiller.

Conclusion and getting started with pdfFiller

Efficient management of tax forms is crucial in today’s financial landscape. pdfFiller empowers users to handle the entire process from document creation to e-signatures seamlessly.

With its array of features, users can simplify their tax filing experience and ensure compliance without the stress of manual processes. Exploring these capabilities can enhance your tax management efforts significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify checklist of common tax without leaving Google Drive?

How do I make changes in checklist of common tax?

How do I edit checklist of common tax on an Android device?

What is checklist of common tax?

Who is required to file checklist of common tax?

How to fill out checklist of common tax?

What is the purpose of checklist of common tax?

What information must be reported on checklist of common tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.