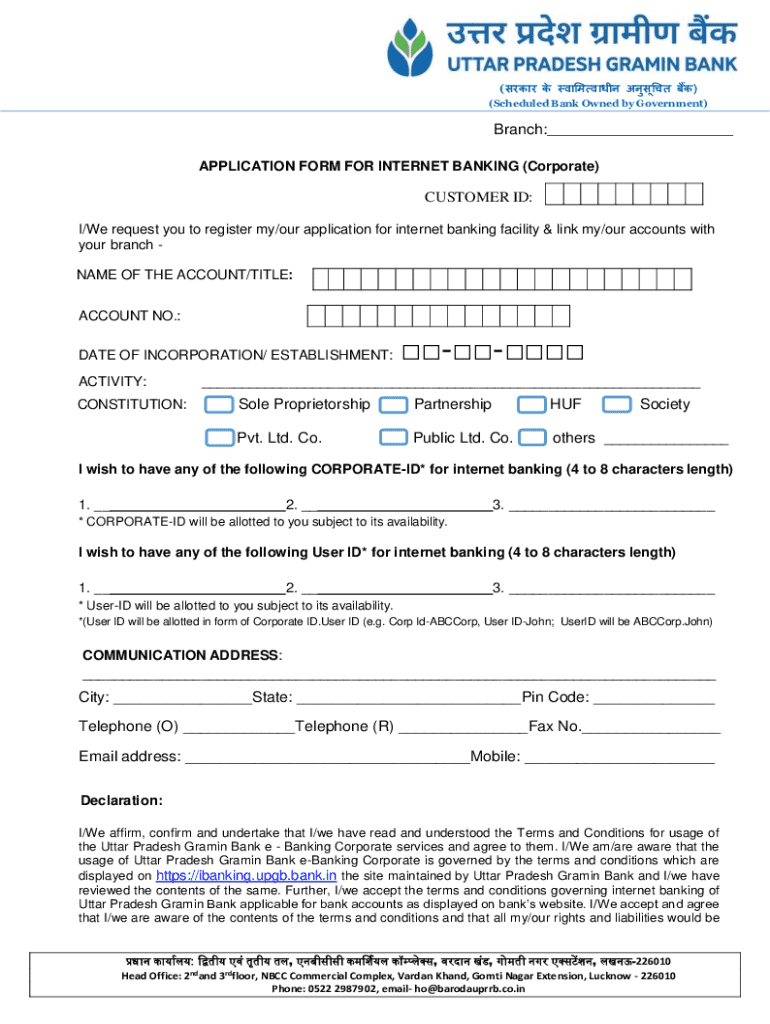

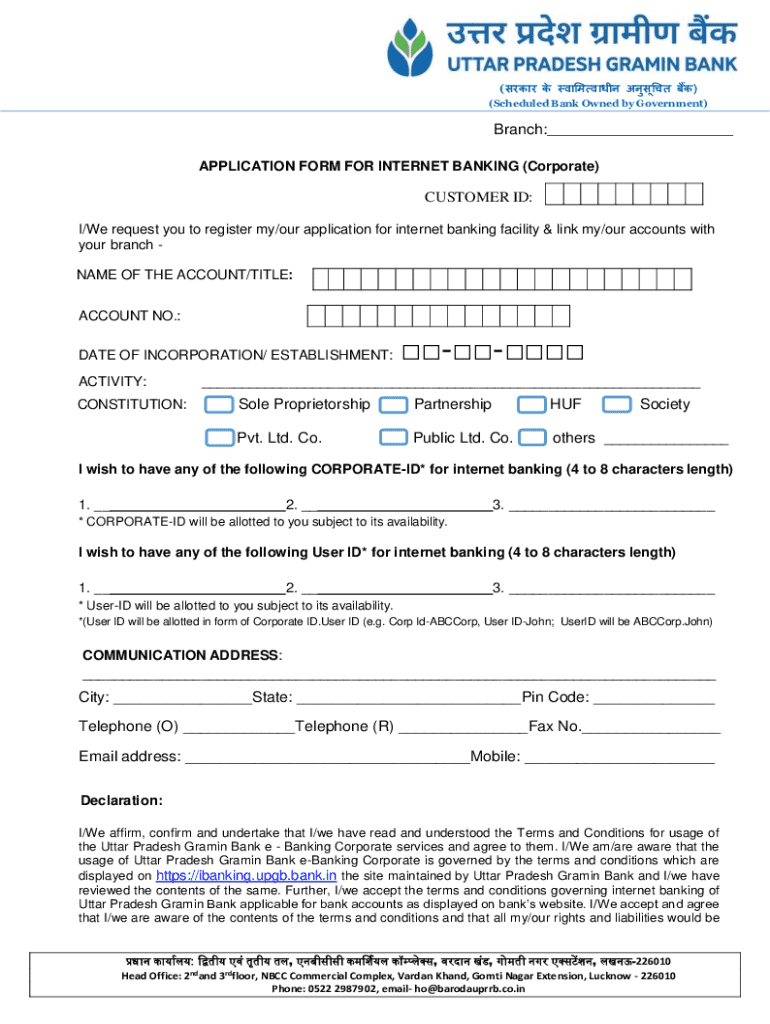

Get the free Internet Banking Application Form for CORPORATE USERS

Get, Create, Make and Sign internet banking application form

Editing internet banking application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out internet banking application form

How to fill out internet banking application form

Who needs internet banking application form?

Internet Banking Application Form: A Comprehensive How-to Guide

Understanding internet banking applications

Internet banking has revolutionized the way individuals and businesses manage their finances. Offering convenience, efficiency, and a broad array of services, it allows users to execute transactions from the comfort of their homes. This is where the internet banking application form comes into play, serving as the vital first step for many users craving seamless banking experiences. A well-prepared application is crucial, not only for timely access to services but also for ensuring compliance with banking regulations.

When comparing internet banking applications to traditional methods, the advantages are clear. Online banking applications are often faster, requiring less physical documentation and allowing for immediate processing via secure online channels. They contribute to a more eco-friendly banking environment by reducing paper usage and create opportunities for digital support that often outpace traditional customer service.

Key components of the internet banking application form

Filling out your internet banking application form accurately is crucial to ensure a smooth account opening process. Typically, these forms require several key components. Firstly, personal information is fundamental. This includes your full name, residential address, contact particulars, and any identification numbers as mandated by your banking institution. You will also need to provide valid identification and verification documents, which may include a driver’s license or social security card.

Next, financial information is collected. This often covers your employment details—the name of your employer, your job title, and the duration of your employment, as well as your income sources and amounts. This information helps banks assess your financial standing and suitability for banking services.

Furthermore, there are account preferences you should indicate. This entails specifying the type of internet banking services you require, like checking and savings account services, and preferences for security features, such as two-factor authentication or transaction alerts.

Step-by-step process to fill out the application form

To get started, gather all necessary documents and information before you access your internet banking application form. This checklist typically includes identification (like a passport or driver’s license), proof of income (pay stubs or tax returns), and your social security number. Being well-prepared ensures a hassle-free application process.

Next, access the application form on the pdfFiller platform. Simply navigate to pdfFiller’s website and search for the internet banking application form. User-friendly navigation tools on the site will guide you to locate the correct form quickly. Familiarizing yourself with the interface will enhance your experience.

Once you have the form open, begin completing each section meticulously. Start with the personal information section, making sure all details are precise. Moving on to the financial section, provide accurate figures regarding your employment and income. When selecting account preferences, weigh your lifestyle and security needs to pick options that serve you best.

After filling out the form, reviewing and editing is your next step. Double-checking for accuracy is paramount, as even minor errors can delay your application. Utilize the interactive editing tools available on pdfFiller, which provide a seamless editing experience to ensure every detail is perfect before submission.

Signing and submitting your internet banking application

Once your application form is complete and reviewed, it's time to sign and submit. With pdfFiller, you can easily add an electronic signature. This feature not only simplifies the signing process but also adheres to legal standards for digital documents. Ensure that you follow safety protocols for submitting sensitive information. Common submission methods include emailing your application, directly uploading it on the bank’s website, or visiting a branch in-person.

Tracking your application status

After submitting your application, tracking its status can provide peace of mind. Most banks offer online portals where users can monitor the progress of their applications. Timing can vary based on the bank, but it usually takes between a few days to a couple of weeks. If there are issues or delays, reaching out to customer service can clear up any confusion.

FAQs about internet banking applications

Navigating the world of internet banking applications often raises questions. For example, what happens if your application is denied? Understanding the specific denial reasons can help you address them before reapplying. Another common inquiry is whether you can amend your application after submission; this typically depends on the bank’s policies. Security measures for online applications—such as encryption and regular audits—are designed to protect users' data during this process. Lastly, it’s essential to clarify any potential fees associated with internet banking services, as they can vary by institution.

Maximizing your internet banking experience

Once your application is approved, you can unlock a range of extensive features that enhance your banking experience. Take advantage of alerts and notifications that notify you of transactions or low balances, ensuring you’re always in control. Efficiently managing your accounts can also be maximized through online budgeting tools that many banks provide.

pdfFiller further enhances this experience with unique features such as collaboration tools useful for both individuals and business banking teams. The cloud storage benefits mean you can access your documents from anywhere, making financial management convenient. Fully utilizing these resources helps transform your banking practices into a seamless and engaging experience.

Troubleshooting common application problems

Technical issues may arise during the application process, such as problems accessing the form or loss of internet connection. Solutions usually involve refreshing the page or checking your internet connection. If your application is rejected, understanding the underlying reasons for rejection helps formulate corrective measures for reapplication. Lastly, knowing how to reach out for customer support via pdfFiller ensures you always have access to assistance whenever needed.

Additional forms and applications related to internet banking

The landscape of internet banking does not end with an application form; various other forms and applications are accessible through pdfFiller. This includes applications for loans, credit cards, and setting up automatic payments or transfers. Each form is specifically designed to ensure users can navigate their banking needs efficiently and effectively. Resources are available for users looking to learn more about all related banking services.

The future of internet banking and application processes

Looking ahead, internet banking is on the brink of transformation with emerging trends emphasizing security, efficiency, and enriched user experience. Innovations in digital applications and document management systems promise to refine banking processes. pdfFiller remains dedicated to adapting to these trends, ensuring that users are provided with cutting-edge solutions for their banking needs while maximizing data security and user satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send internet banking application form to be eSigned by others?

How can I edit internet banking application form on a smartphone?

How do I fill out internet banking application form on an Android device?

What is internet banking application form?

Who is required to file internet banking application form?

How to fill out internet banking application form?

What is the purpose of internet banking application form?

What information must be reported on internet banking application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.