Get the free TEMPLATE DEED OF GIFT (PAPERS AND OTHER ...

Get, Create, Make and Sign template deed of gift

How to edit template deed of gift online

Uncompromising security for your PDF editing and eSignature needs

How to fill out template deed of gift

How to fill out template deed of gift

Who needs template deed of gift?

Understanding the Template Deed of Gift Form: A Comprehensive Guide

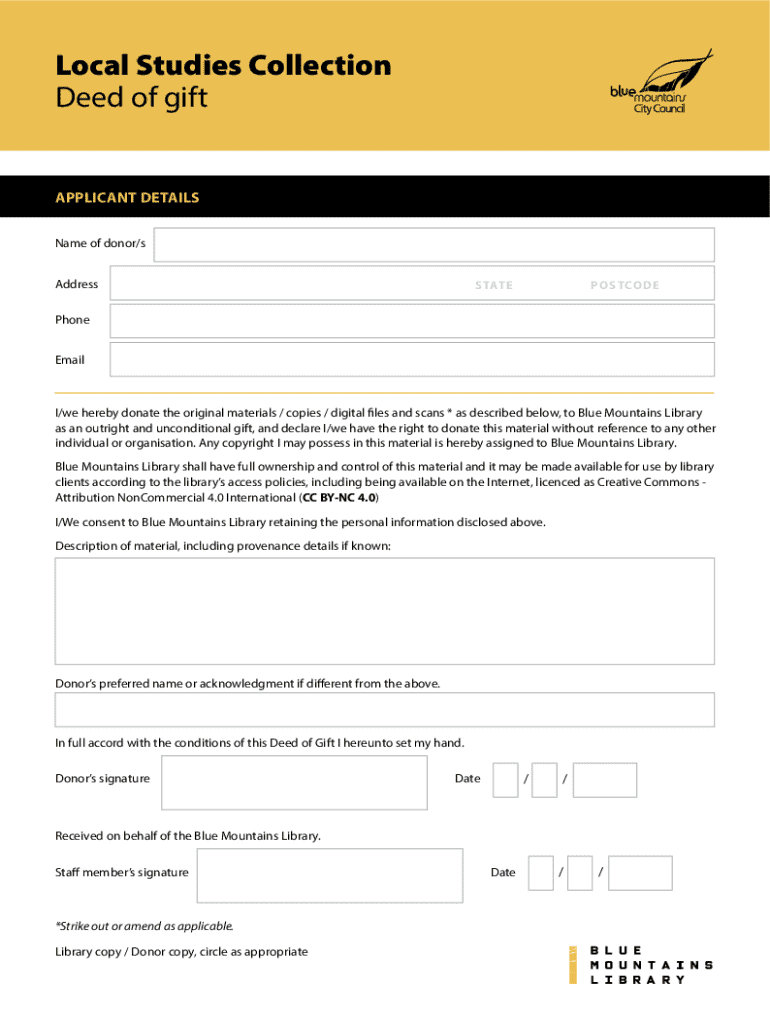

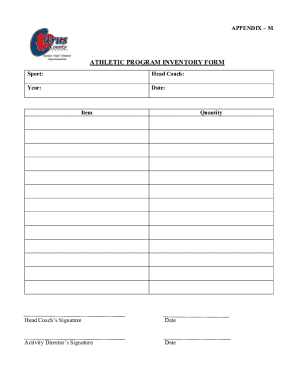

Overview of the deed of gift form

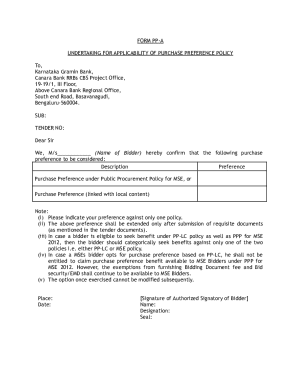

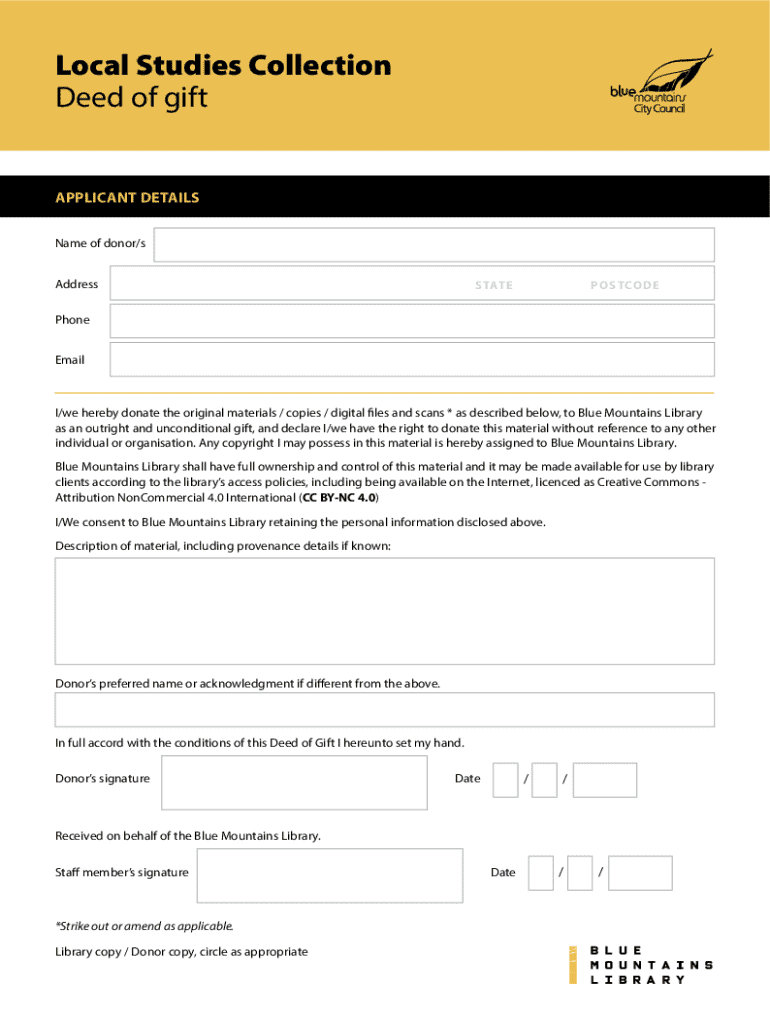

A deed of gift form is a legal document that serves to formalize the transfer of ownership of assets from a donor to a recipient, without any expectation of payment in return. This form is vital for documenting gifts, ensuring that the transfer adheres to legal standards, and preventing future disputes regarding the ownership of the gifted item. Specific guidelines must be followed to ensure that the deed of gift is binding and adheres to my state’s regulations.

Proper documentation is crucial when gifting property or valuables to ensure clarity regarding the intent of the donor and the rights of the recipient. Without adequate documentation, misunderstandings can arise, potentially leading to complex legal issues. Common scenarios that necessitate a deed of gift include family members transferring property, individuals gifting valuable items to friends, or organizations transferring assets to a nonprofit.

Key components of a deed of gift form

Understanding the essential components of a deed of gift form is crucial for accurately completing it. The primary elements include:

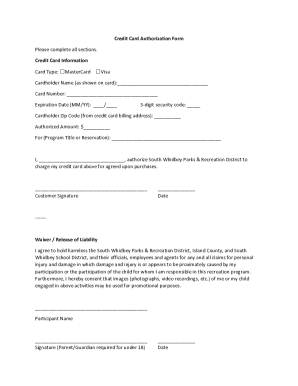

Step-by-step guide to filling out the deed of gift form

Filling out a deed of gift form can be straightforward if you follow these steps carefully: 1. **Gather Required Information:** Collect all necessary details about the donor and the recipient, including proper addresses and identification numbers if applicable. 2. **Selecting the Right Template:** Choose a template deed of gift form that suits the type of gift you are making. pdfFiller offers a range of templates customizable for various gifting scenarios. 3. **Complete the Form Fields:** Enter the gathered information into the form, ensuring each field is filled accurately to avoid legal complications. - *Tips for Ensuring Accuracy and Completeness:* Double-check all entries for spelling and accuracy. 4. **Review Terms and Conditions:** Before finalizing the document, review the terms related to the gift to confirm that both parties agree with the stipulations outlined.

Editing and customizing your deed of gift form

Customizing your deed of gift form is straightforward using pdfFiller, which allows users to edit PDF documents easily. You can make necessary amendments by accessing the form and updating relevant fields as needed. Here are a few options to consider:

Signing the deed of gift form

Signing the deed of gift is a critical step in making the gift legally binding. Various signing options are available, especially with advancements in technology. Here are key aspects to consider:

Frequently asked questions (FAQ)

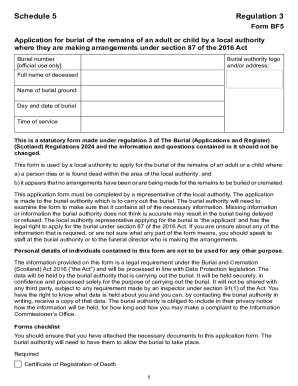

When dealing with legal forms like a deed of gift, questions frequently arise regarding the execution and implications of such documents. Here’s a look at some common inquiries about the template deed of gift form: - **What Happens After the Form is Completed?** Once the Deed of Gift form is fully signed and dated, the recipient officially becomes the owner of the asset. - **Can the Deed of Gift be Revoked?** Under certain circumstances, a deed of gift may be revoked, often requiring a written notice and possibly additional documentation depending on local laws. - **Are There Tax Implications to Consider?** Yes, gifts can have tax implications for both the donor and recipient, including potential gift tax liabilities depending on the value of the assets involved.

Gift revocation process

Understanding the process of revocation is essential for both donors and recipients. The gift revocation process allows individuals to reclaim ownership of an asset under certain conditions. Here’s how it works:

Real-life examples of deed of gift forms

To provide more clarity on how a deed of gift form functions, let’s explore some real-life examples. These situations illustrate the utility of the template deed of gift form in practical terms:

Common mistakes to avoid

When working with the template deed of gift form, it's easy to make mistakes that could lead to complications. Be vigilant to avoid the following common pitfalls:

Additional tools and features on pdfFiller

pdfFiller enhances the experience of creating and managing a deed of gift form. In addition to straightforward editing capabilities, pdfFiller offers several tools designed to streamline your document workflow:

Connecting with pdfFiller support

Navigating complexities related to a deed of gift form? pdfFiller provides comprehensive support to assist users in addressing queries and resolving issues efficiently. Here’s how you can access support:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my template deed of gift directly from Gmail?

How do I edit template deed of gift online?

How do I fill out the template deed of gift form on my smartphone?

What is template deed of gift?

Who is required to file template deed of gift?

How to fill out template deed of gift?

What is the purpose of template deed of gift?

What information must be reported on template deed of gift?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.