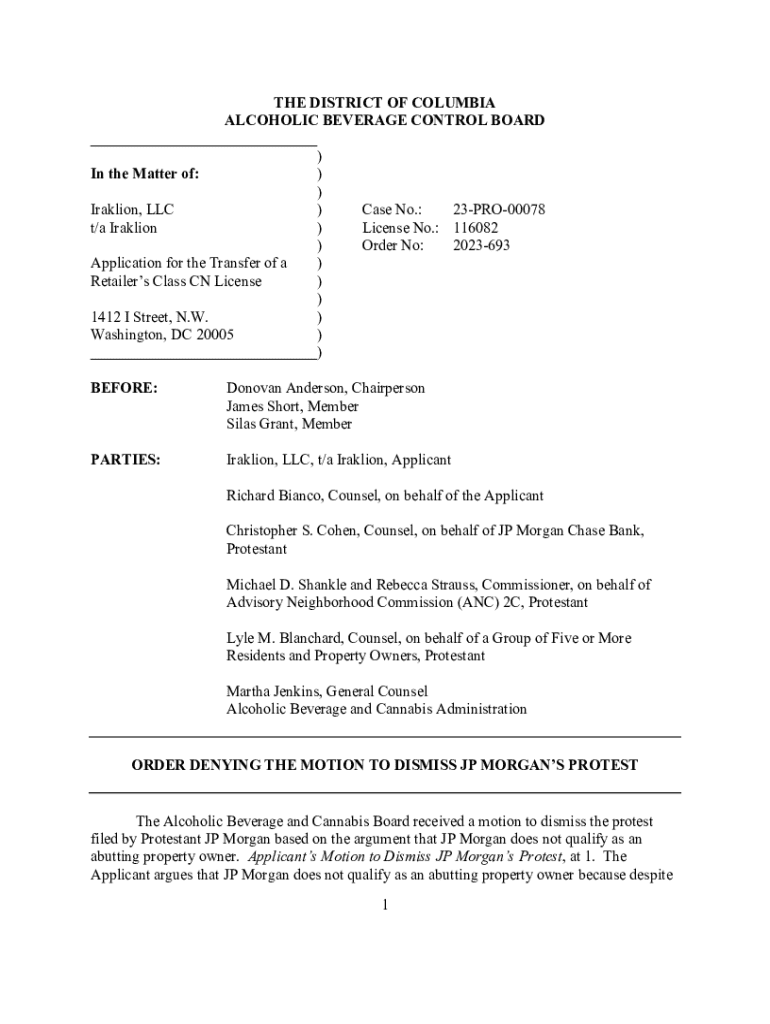

Get the free JP Morgan, prior property owners fight D.C. strip club

Get, Create, Make and Sign jp morgan prior property

Editing jp morgan prior property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out jp morgan prior property

How to fill out jp morgan prior property

Who needs jp morgan prior property?

JP Morgan Prior Property Form: A Comprehensive How-to Guide

Understanding the JP Morgan Prior Property Form

The JP Morgan Prior Property Form is a vital document in the realm of property transactions, especially for potential buyers and real estate investors. This form serves to establish the historical ownership and financial obligations tied to a property, ensuring transparency during transactions. Its primary purpose is to gather all essential information regarding prior property ownership, enabling banks, buyers, and sellers to assess the property’s background comprehensively.

This form is critical in property transactions as it encapsulates crucial details that affect the buying process. Buyers need to be aware of any liens, mortgages, or other obligations associated with the property. Not only does this form protect buyers from unexpected issues, it also aids in streamlining the transaction process.

Types of information required

Accessing the JP Morgan Prior Property Form

Accessing the JP Morgan Prior Property Form is straightforward. It can typically be found directly through the JPMorgan Chase official website, where users can download a PDF version of the form. This convenience allows users to fill out the form at their own pace, ensuring accuracy in the information provided.

Besides the JP Morgan website, alternative sources may include official bank branches or real estate offices. It's crucial to ensure that the version obtained is up-to-date, as outdated forms can lead to complications in transactions.

Navigating PDFfiller tools

PDFfiller provides excellent tools for editing PDFs, including the JP Morgan Prior Property Form. Users can easily upload the downloaded PDF to the PDFfiller platform for editing. The interface is user-friendly, allowing users to add text, insert annotations, or modify existing content seamlessly.

Step-by-step instructions for filling out the form

Filling out the JP Morgan Prior Property Form requires meticulous attention to detail. Start with the heading section and personal details. Accurate information is vital here, as errors can lead to delays or miscommunication in property transactions. It's advisable to double-check the spelling of names and contact details to avoid any issues.

Next, provide a detailed description of the property. This includes the property type (residential, commercial, etc.), location, and any pertinent characteristics. A thorough property description helps stakeholders understand the context of the ownership and potential value.

Financial information is equally critical. You should include current mortgages, liens, and any other financial obligations tied to the property. Presenting this information accurately is fundamental to securing financing or assessing the property’s market value.

Tips for ensuring completeness

Editing and customizing the JP Morgan Prior Property Form

Once you have entered the required information in the JP Morgan Prior Property Form, the next step is to ensure it’s polished and ready for submission. PDFfiller allows users to utilize various editing tools that facilitate this process. You can annotate important sections, highlight key information, or even add notes where necessary. This functionality is incredibly beneficial, especially if multiple people are collaborating on the form.

Additionally, PDFfiller enables users to easily add or remove sections of the form, customizing it to fit specific needs or requirements. This flexibility ensures that users can mold the form to any unique situation that may arise during property transactions.

Collaboration features

Signing the JP Morgan Prior Property Form

Entering a legally binding agreement necessitates signing the JP Morgan Prior Property Form. PDFfiller offers an electronic signing tool that streamlines this process. To eSign the document, follow the step-by-step guidance provided on the platform, ensuring that you understand the legal implications of your electronic signature.

It's important that any electronic signature used complies with local regulations regarding its acceptance in property transactions. Upon completion of the signing process, users can proceed to securely send the form to relevant parties, minimizing the risk of document loss or unauthorized access.

Sending the form securely

Managing your completed JP Morgan Prior Property Form

Proper management of your completed JP Morgan Prior Property Form is pivotal. Once finalized, saving and archiving the document should follow best practices to ensure easy retrieval. It's advisable to save different versions of the form, especially if any changes are made over time.

Utilizing cloud storage solutions not only provides accessibility from various devices but also ensures that sensitive documents are well-protected against loss. Additionally, maintaining records of all forms submitted can serve as a valuable reference for future real estate endeavors.

Accessing and modifying future forms

Frequently asked questions about the JP Morgan Prior Property Form

As users navigate their property transactions, certain common queries often arise regarding the JP Morgan Prior Property Form. For instance, one might wonder what to do if they lose the form after submission. In such cases, contacting JP Morgan's customer service is imperative to obtain a replacement or to confirm the submission status.

Another frequent concern involves correcting errors post-submission. If mistakes are recognized after the form has been sent, reach out to JP Morgan for specific steps on rectifying such issues. Ensuring that all information is accurately represented is crucial for a smooth transaction process.

Contacting JP Morgan for support

Leveraging PDFfiller for other property management needs

The versatility of PDFfiller extends beyond just the JP Morgan Prior Property Form. Users can find various other relevant forms vital for different property transactions within the platform. From lease agreements to property sale contracts, PDFfiller provides an all-encompassing document solution, making it an essential tool for individuals and teams involved in real estate.

By utilizing PDFfiller, users can effortlessly manage their documentation needs in real estate, ensuring efficiency and organization in their property transactions. Through seamless editing, signing, and collaboration, PDFfiller empowers users to focus on what truly matters — successful property management and transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute jp morgan prior property online?

Can I create an electronic signature for the jp morgan prior property in Chrome?

How can I fill out jp morgan prior property on an iOS device?

What is jp morgan prior property?

Who is required to file jp morgan prior property?

How to fill out jp morgan prior property?

What is the purpose of jp morgan prior property?

What information must be reported on jp morgan prior property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.