Get the free THE DISTRICT OF COLUMBIA ALCOHOLIC ...

Get, Create, Make and Sign form district of columbia

Editing form district of columbia online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form district of columbia

How to fill out form district of columbia

Who needs form district of columbia?

Understanding the District of Columbia Form: A Comprehensive Guide

Overview of the District of Columbia Form

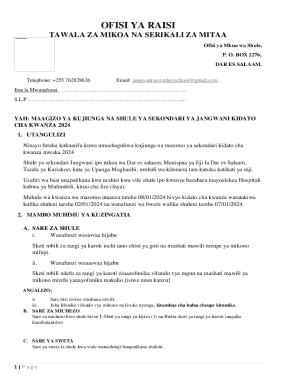

The District of Columbia Form refers to various documents required for administrative and legal purposes within Washington, D.C. These forms are fundamental for individuals, businesses, and non-profit organizations engaged in activities subject to local governance and regulations. The significance of these forms cannot be overemphasized, as they facilitate compliance with local laws, enabling individuals and organizations to fulfill their tax obligations, secure permits, and conduct business legally.

Generally, forms vary depending on the purpose, whether for individual income taxes, business taxation, or documentation required by non-profits. Understanding the specific requirements and appropriate usages of these forms is essential for a smooth interaction with government entities. Accurate completion and timely submission of the District of Columbia Form can save individuals and organizations from potential penalties and ensure compliance with local regulations.

Types of District of Columbia Forms

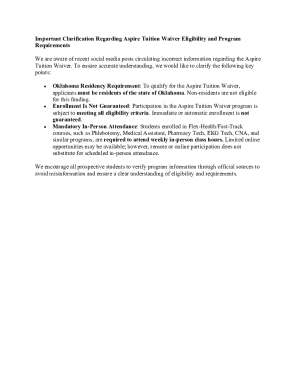

The District of Columbia offers a variety of forms aimed at different user groups. Understanding these forms and their respective requirements is crucial for proper compliance and efficiency in document management.

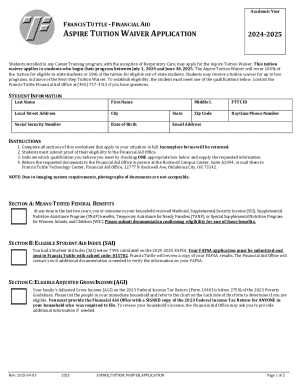

Individual forms

Individual forms generally encompass the district income tax forms that residents must complete annually. These forms include the basic income tax forms and any additional schedules necessary for reporting specific income types or deductions.

Eligibility criteria for individuals often revolves around income levels and residency status. Understanding the specific forms applicable based on individual circumstances is key to successful form submission.

Business forms

Businesses operating in Washington, D.C., need to complete various forms, including business income tax forms and registration documents. These forms ensure compliance with business regulations and tax laws.

Requirements for business applications typically include proof of business registration, identification, and financial documentation, ensuring all businesses operate within legal frameworks.

Non-profit and government forms

Non-profit organizations and government entities in D.C. also have specific forms tailored to their needs. This often includes tax exemption applications and compliance forms necessary to maintain non-profit status.

Understanding these forms will not only facilitate smoother operations for non-profits but also ensure compliance with state and federal regulations.

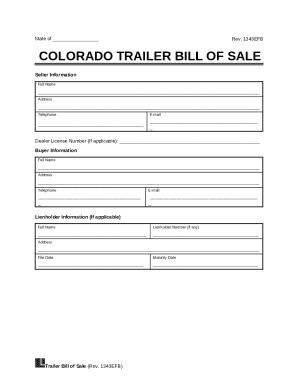

Step-by-step guide to filling out the District of Columbia Form

Filling out the District of Columbia Form can be streamlined by following a structured approach. Below are the essential steps to ensure accurate completion of any form.

Gather required information

Begin by collecting all necessary documents and information that will be needed to complete the form. This includes personal identification, previous tax documents, and financial statements.

Completing the form

Next, start filling out the form. Carefully input your personal information, including your name, address, and tax identification number at the designated sections. For individuals, make sure to include accurate income figures and eligible deductions.

When detailing financial information, ensure that all figures are accurate and that no sources of income are omitted. Certain forms may require additional disclosures related to specific income types or deductions, so read each section thoroughly.

Review and verify your information

Before submitting, it's crucial to review the information entered in the form. Double-check for any typing errors, missing information, or incorrect financial entries. Common mistakes can often lead to processing delays or rejections, so taking a moment to ensure accuracy is well worth the effort.

Editing and managing your District of Columbia Form

Once the District of Columbia Form is completed, managing it effectively can save time and prevent issues in the future. Utilizing digital tools can significantly ease this process.

Utilizing PDF editing tools

pdfFiller offers robust features for editing PDF forms, making it easier to modify information or update details as necessary. Users can quickly access completed or template forms and make changes without needing to print and fill out new copies.

Editing a form with pdfFiller is simple: just upload your completed document into the platform, and use built-in tools to add annotations, modify text, or correct errors. This helps streamline the editing process for efficiency.

Adding signatures and collaborating

For collaborative projects or multiple signatory required forms, pdfFiller also provides options for eSigning and sharing documents securely. Team members can collaborate using cloud-based access, enabling seamless editing and review without the need for physical meetings.

To add a signature, simply use the eSignature feature to sign the document electronically, allowing easy tracking of who has signed and when.

Submitting the District of Columbia Form

Once the form is filled out and verified, the next crucial step is submission. Understanding the available options for submitting forms is essential to ensure they reach the appropriate authority.

Understanding submission options

Forms can typically be submitted via e-filing or traditional mail. E-filing is often faster, allowing for immediate confirmation of receipt, whereas mailing can take longer and may result in delays.

Confirmation of submission

After submission, tracking your application or form is essential. For e-filing, you can typically receive a confirmation email or message indicating that the form is successfully submitted. For mailed forms, keep a copy for your records and consider using a tracking service.

Common issues and solutions

Navigating through the form-preparation and submission process can sometimes lead to issues. Being aware of potential problems could greatly enhance your experience.

Troubleshooting form errors

If a form is rejected, identifying the reason is vital. Common pitfalls include missing signatures, incorrectly filled fields, or failure to attach required documents. Always check the guidelines provided with the form for specific requirements.

If rejection occurs, amend the identified issues promptly and resubmit. Utilize resources offered by pdfFiller for troubleshooting assistance, allowing for a quicker resolution.

Accessing support

For any difficulties in understanding forms or submission processes, various resources are available. The D.C. Department of Taxation and the official website offer forms and detailed guidance. Additionally, reaching out to customer support can provide personalized assistance.

Frequently asked questions (FAQs)

The District of Columbia Form can raise numerous questions based on varying user experiences. Addressing these queries helps clarify expectations and procedures.

Having clear answers to these questions enhances users' understanding, contributing to a smoother form management experience.

Additional tips for successful document management

Managing forms effectively, especially in a digital landscape, is crucial for both individuals and organizations. Digital document management pertains not only to storing files but also to organizing and protecting them.

By implementing these practices, users can enhance their efficiency while ensuring the security and compliance of their documents.

Conclusion: Streamlining your form experience with pdfFiller

Managing the District of Columbia Form can seem daunting at first, but utilizing a platform like pdfFiller empowers users to efficiently edit, eSign, and manage documents effortlessly. By leveraging cloud-based solutions, individuals and teams can mitigate common pitfalls associated with paper forms.

Embracing digital tools not only simplifies the form completion process but also enhances collaboration and efficiency, allowing users to focus on compliance and their core activities. Start utilizing pdfFiller today to streamline your document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form district of columbia?

How do I edit form district of columbia in Chrome?

How do I edit form district of columbia straight from my smartphone?

What is form district of columbia?

Who is required to file form district of columbia?

How to fill out form district of columbia?

What is the purpose of form district of columbia?

What information must be reported on form district of columbia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.