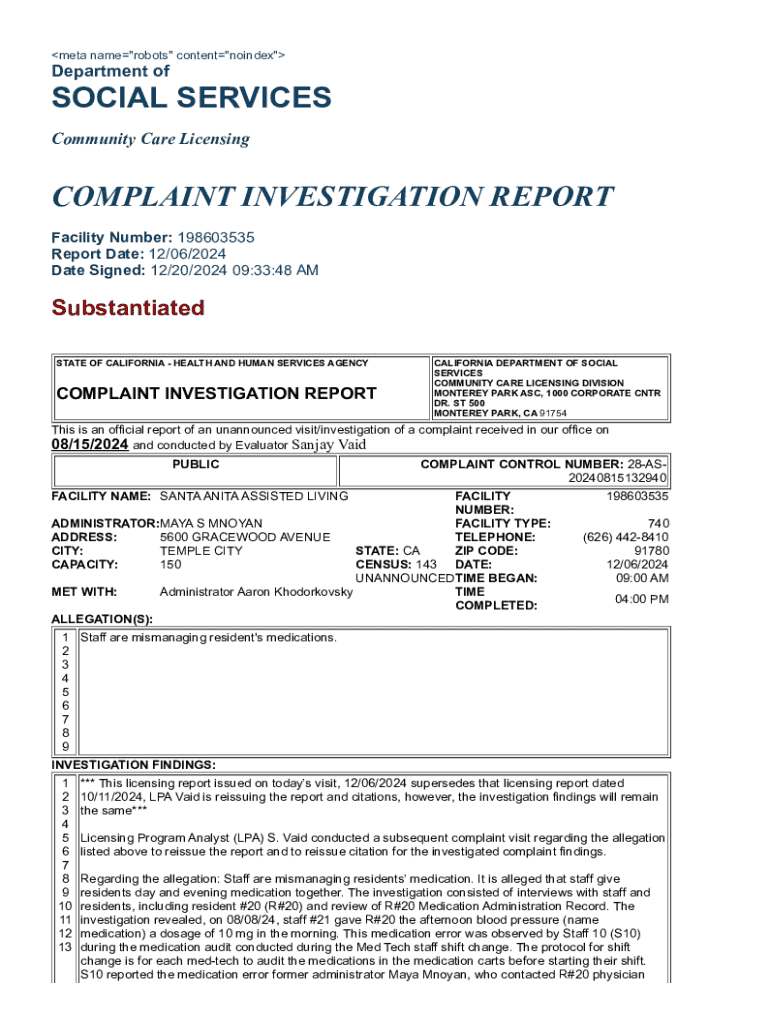

Get the free ST 500

Get, Create, Make and Sign st 500

How to edit st 500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out st 500

How to fill out st 500

Who needs st 500?

ST 500 Form - How-to Guide

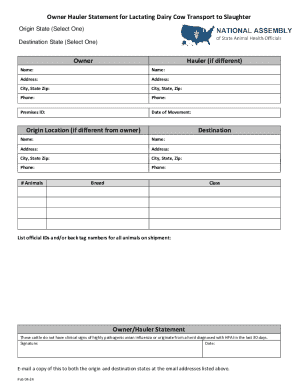

Overview of the ST 500 Form

The ST 500 Form serves a crucial role in the realm of sales tax compliance, particularly for businesses operating in jurisdictions where sales tax is applied. This form is primarily used to report and remit sales tax collected from customers to the state. Understanding the definition and purpose of the ST 500 Form is essential for ensuring compliance with local tax regulations.

In many states, the requirement to file the ST 500 Form maintains the integrity of the tax system. Taxpayers, especially retailers and service providers, need to be diligent in filing this form as failure to do so can result in penalties or interest on unpaid taxes. Additionally, correctly utilizing the ST 500 Form helps businesses track their sales tax liabilities accurately.

Key features of the ST 500 Form

The ST 500 Form comprises several sections that streamline the filing process for both individuals and businesses. Key sections typically include details about the taxpayer, sales transactions, and the specific tax amount due. Understanding each section is vital to ensuring the accuracy of the information submitted, which directly impacts a taxpayer's compliance standing.

Attention must be paid to notable fields such as total gross sales, taxable sales, exempt sales, and total sales tax collected. Each of these fields requires precise data entry; inaccuracies can lead to complications, including penalties and interest charges. Understanding these key features not only assists in accurate filing but also provides insights into a business's sales tax performance over a reporting period.

Step-by-step instructions for completing the ST 500 Form

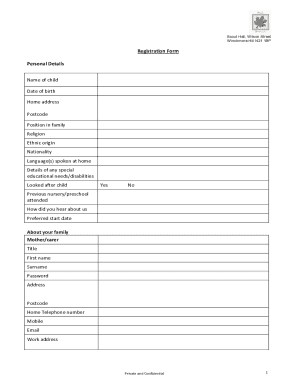

Step 1: Gather required information

Before you commence filling out the ST 500 Form, it is essential to gather all necessary documents. This typically includes sales receipts, records of any exempt sales, and previous sales tax returns. Organized documentation will greatly simplify the process of entering accurate data.

A useful tip is to create a checklist of the specific documents required. This might include bank statements, invoices, and any correspondence with tax authorities pertaining to your sales tax account. By organizing your information in advance, you will minimize errors during the filling process.

Step 2: Fill out the ST 500 Form

Filling out the ST 500 Form can initially seem daunting, but following a structured approach can ease the task. Start with entering your taxpayer information accurately, followed by detailing total gross sales, taxable sales, and exempt sales in the respective fields.

Be vigilant while inputting figures. A common mistake is transposing numbers, especially when dealing with large amounts. Utilizing a calculator or spreadsheet can help reduce errors. Remember, each value directly influences your total sales tax due, so accuracy is paramount.

Step 3: Review your form

Once you have completed the ST 500 Form, it's crucial to conduct a thorough review. Create a checklist to cross-reference details you entered against your documentation. Ensure that your total calculations add up correctly, as discrepancies could lead to inquiries or audits.

Taking an extra moment to double-check for accuracy can save you from potential compliance issues. This step is not merely a formality; it's a safeguard against costly mistakes.

How to submit the ST 500 Form

Methods of submission

Submitting your ST 500 Form can be done either electronically or via mail, depending on the regulations in your jurisdiction. Electronic submissions are often preferred for their speed and convenience. To submit online, log into your tax portal where you can upload your completed ST 500 Form.

If opting for mail-in submission, ensure you're sending it to the correct address as directed on your form. Use a secure mailing method to avoid delays in delivery. It’s important to follow the specific requirements listed for return envelopes to ensure proper processing of your tax return.

Submission deadlines

Be mindful of submission deadlines, as the timely filing of the ST 500 Form is critical to avoiding late fees. Generally, these forms are due quarterly, but specifics can vary by state. Regularly check your local tax authority for the most current deadlines and schedules.

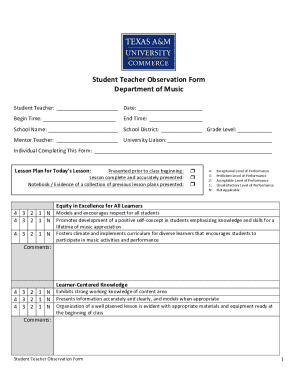

Interactive tools for filling out the ST 500 Form

pdfFiller offers a suite of interactive tools specifically designed to simplify the process of completing the ST 500 Form. Utilizing cloud-based solutions enables users to access their forms from anywhere, allowing for greater flexibility in document management.

With pdfFiller, you can edit, eSign, and collaborate on the ST 500 Form securely. It’s beneficial to leverage pdfFiller's features, like real-time updates and digital signatures, ensuring that your documents are not just completed but also compliant and ready for submission.

Common questions and troubleshooting

As you navigate the filing of the ST 500 Form, questions may arise. Common inquiries often include concerns about tax exemptions, recalculating due amounts, and correcting errors on forms after submission. If you encounter issues such as discrepancies or late filings, a direct line of communication with state tax offices can provide clarification and solutions.

For additional support, reaching out to tax professionals or utilizing tax forums can also yield helpful insights. Always ensure that you are referencing the most current guidelines or updates to the ST 500 Form, which may change periodically.

Managing your ST 500 Form with pdfFiller

One of the standout features of pdfFiller is its ability to manage documents in a cloud-based environment. This functionality ensures that users can access their ST 500 Form from anywhere, facilitating on-the-go edits and submissions.

Additionally, pdfFiller offers collaborative tools ideal for teams. Users can share documents with colleagues, enabling simultaneous editing. Security measures in place, such as encryption and secure access, protect sensitive financial information, giving users peace of mind.

Final thoughts on the ST 500 Form

Staying updated on filing requirements related to the ST 500 Form is not only wise but necessary. The landscape of tax compliance can shift quickly, and being informed helps avoid unnecessary penalties and interest associated with late filings.

Embracing tools like pdfFiller for document management can streamline your filing experience tremendously. By leveraging its capabilities, you create an efficient process that alleviates the stress of paperwork, allowing you to focus on what matters most: your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in st 500 without leaving Chrome?

How do I complete st 500 on an iOS device?

How do I edit st 500 on an Android device?

What is ST 500?

Who is required to file ST 500?

How to fill out ST 500?

What is the purpose of ST 500?

What information must be reported on ST 500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.