Get the free SAL Table 4A - Detail of Taxing District Levies (Excel ...

Get, Create, Make and Sign sal table 4a

How to edit sal table 4a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sal table 4a

How to fill out sal table 4a

Who needs sal table 4a?

A comprehensive guide to the Sal Table 4A form

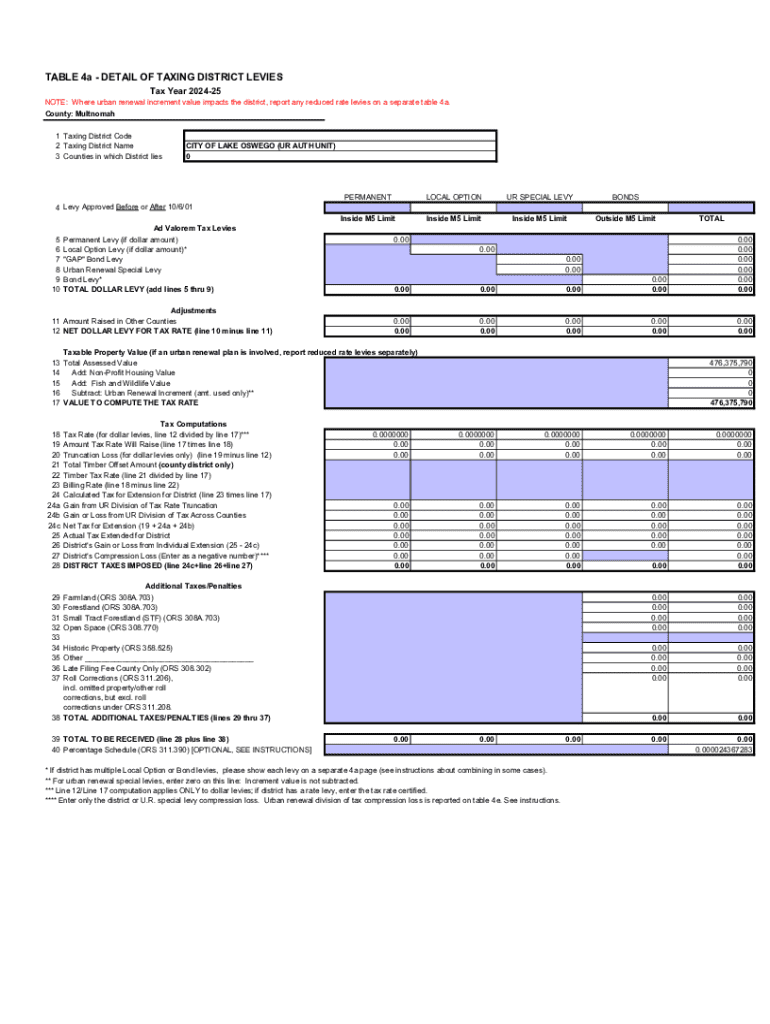

Overview of Sal Table 4A Form

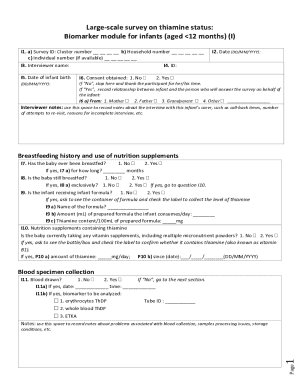

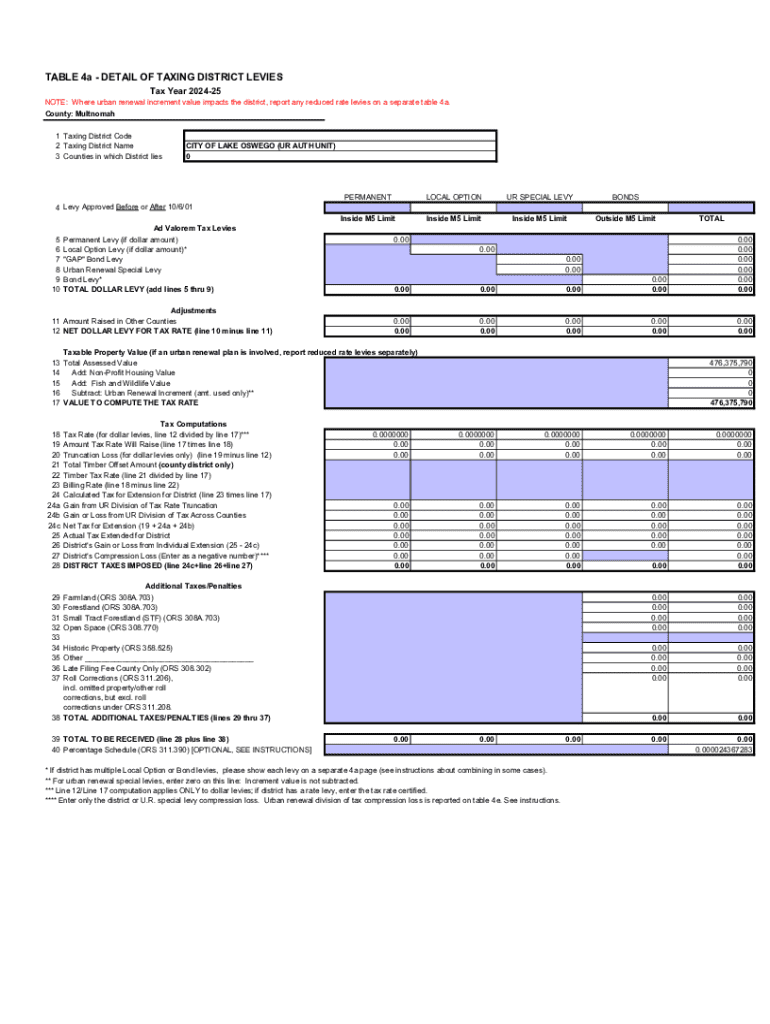

The Sal Table 4A form is a critical document used primarily within property assessment and taxation frameworks. It serves as a means to report and assess property values accurately, ensuring fairness in taxation and compliance with local regulations. Accurate completion of this form is essential, as it impacts property tax calculations and can affect funding for local services.

Various stakeholders need to utilize the Sal Table 4A form, including property owners, real estate professionals, and local government entities such as the Department of Revenue (DOR). Each party has a vested interest in ensuring that the data submitted is accurate and comprehensive, which is a fundamental element in maintaining transparent tax assessments.

Navigating the Sal Table 4A form

Understanding the layout and sections of the Sal Table 4A form is crucial for its effective use. The form typically comprises three key sections: Identifying Information, Assessment Details, and Property Information. Each section carries specific data requirements that need to be fulfilled accurately.

It’s worth noting that the Sal Table 4A form may exist in various formats and versions depending on the jurisdiction, so users should ensure that they have the correct one based on their geographic location.

Step-by-step instructions for filling out the Sal Table 4A form

Filling out the Sal Table 4A form can seem daunting at first, but with proper preparation, the process can be streamlined. Before starting, gather any necessary documents such as prior tax assessments, property deeds, and any existing reports related to the property. Understanding the terminology used in the form will also assist in minimizing errors.

Common mistakes include omitting essential information or providing inaccurate assessments. It is advisable to review the form multiple times and, if possible, have a colleague or professional review the submissions before finalizing.

Interactive tools and features

Utilizing interactive fields in pdfFiller simplifies the completion of the Sal Table 4A form. Interactive features enable users to fill out fields seamlessly, reducing the likelihood of errors. One of the promising enhancements pdfFiller offers is its auto-fill capabilities, which can pull data from previous submissions, thereby saving time and preventing redundant data entry.

Additionally, validation checks ensure that all necessary fields are completed and that the information entered meets local and regulatory requirements. These features significantly enhance the user experience by promoting a smoother workflow when managing important documents.

Editing and modifying your Sal Table 4A form

After submission, users might find it necessary to edit and update their Sal Table 4A form for various reasons such as changes in property value, additions or removals of improvements, or corrections based on feedback from local authorities. PdfFiller facilitates easy editing and modification of existing forms.

These features allow effective tracking of changes and ensure that the form reflects the most accurate and up-to-date information available.

Signing and sharing your Sal Table 4A form

Once the Sal Table 4A form is correctly completed, it’s essential to sign it. PdfFiller provides various options for electronically signing your form, which enhances convenience while still ensuring compliance with legal standards. Signatures can be drawn, typed, or uploaded as an image, giving users flexibility.

Sharing the completed form is also straightforward with pdfFiller. Users can directly email the document to relevant stakeholders or download it for physical submission. The platform’s robust security features ensure that the shared documents remain protected, offering peace of mind in confidential transactions.

Managing submitted forms and documentation

Effective document management is key after submission of the Sal Table 4A form. Users can easily track the status of their submissions through pdfFiller's dashboard, providing clear insights into whether the form is in processing, approved, or requires additional action.

This level of management ensures that users remain in control of their documentation and are able to respond swiftly to any requests that arise post-submission.

Troubleshooting common issues with Sal Table 4A form

Facing issues with the Sal Table 4A form can be frustrating, especially during critical submission periods. Common problems include form not submitting, errors in data entry, or difficulty in signing electronically. Users may benefit from reviewing the frequently asked questions section available on pdfFiller for immediate answers.

Being proactive about troubleshooting allows users to maintain momentum in their property assessment processes and minimize delays.

Best practices for document management using pdfFiller

To maximize efficiency in document management, employing best practices with pdfFiller can be incredibly beneficial. Organizing documents into clearly labeled folders allows easy access to files, significantly speeding up retrieval times. It is advisable to implement collaboration methods for teams working on property assessments to avoid duplicated efforts and streamline workflows.

Incorporating these practices within pdfFiller not only enhances productivity but also fosters a collaborative environment for property assessment and document management.

Additional features of pdfFiller for document creation

Beyond simply filling out the Sal Table 4A form, pdfFiller offers various additional features designed to enhance overall document creation and management. Integrations with other productivity tools streamline the workflow, allowing users to connect their forms with existing software such as accounting or project management solutions.

These features collectively position pdfFiller as a comprehensive tool for managing not just the Sal Table 4A form but a wide range of documentation needs.

User testimonials and success stories

Hearing from others who have successfully utilized the Sal Table 4A form through pdfFiller can provide motivation and confidence. Numerous individuals and organizations have reported smoother submission processes, reduced errors, and enhanced collaboration thanks to the platform.

These testimonials reiterate the platform's effectiveness and encourage potential users to consider pdfFiller as their document management solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out sal table 4a using my mobile device?

How do I edit sal table 4a on an iOS device?

How do I fill out sal table 4a on an Android device?

What is sal table 4a?

Who is required to file sal table 4a?

How to fill out sal table 4a?

What is the purpose of sal table 4a?

What information must be reported on sal table 4a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.