Get the free Tax and Assessment Reports - Umatilla County

Get, Create, Make and Sign tax and assessment reports

How to edit tax and assessment reports online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax and assessment reports

How to fill out tax and assessment reports

Who needs tax and assessment reports?

Tax and Assessment Reports Form: A Comprehensive How-to Guide

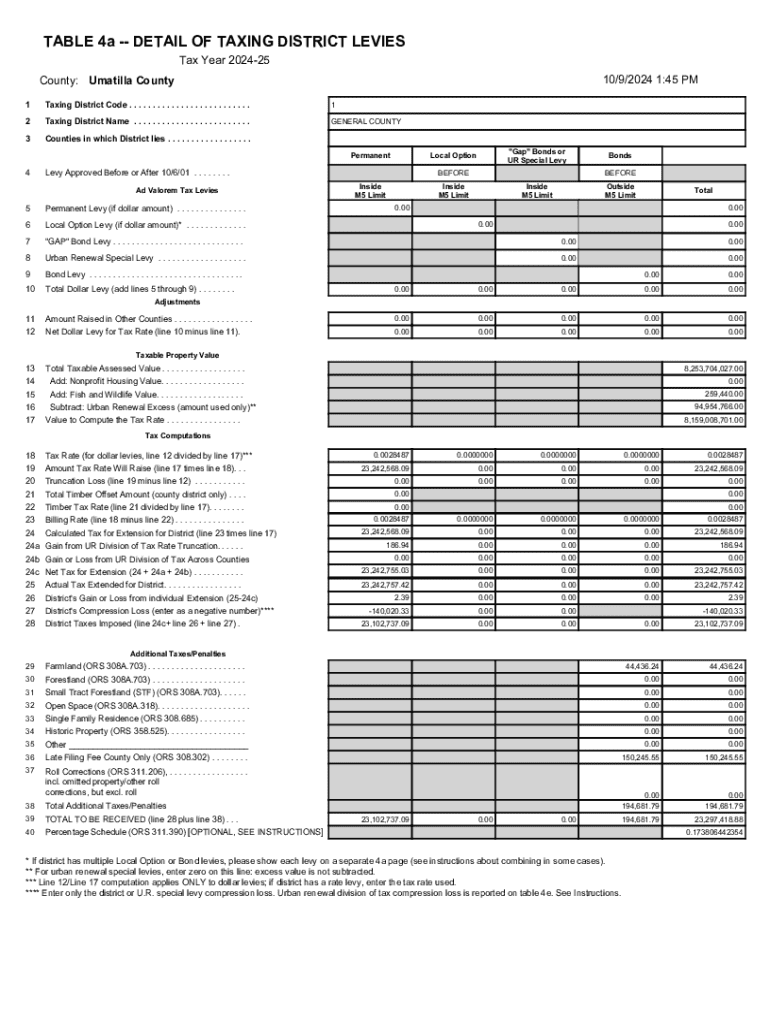

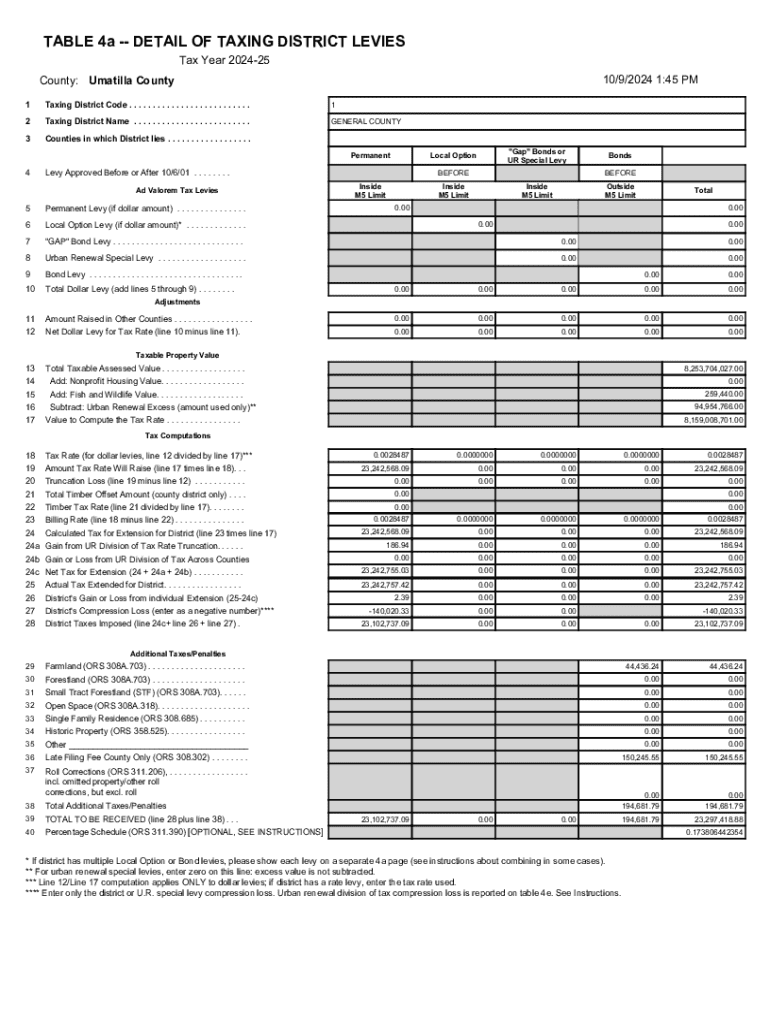

Understanding Tax and Assessment Reports

Tax and assessment reports play a critical role in the financial ecosystem, providing detailed insights into an individual's or entity's tax obligations. This comprehensive overview encompasses not just the amounts owed but also the assessments made by relevant authorities, highlighting the importance of accurate reporting and proper documentation.

Understanding these reports is essential for effective financial planning. They inform taxpayers about their responsibilities and ensure that they are complying with local laws and regulations. The information contained within tax and assessment reports can substantially influence investment decisions, property acquisitions, and overall financial strategies.

The Tax and Assessment Reports Form

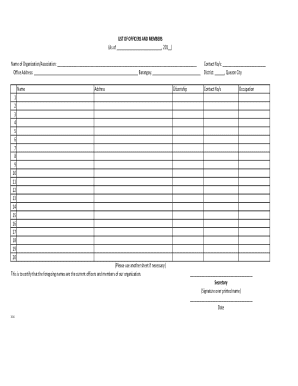

The tax and assessment reports form is designed to streamline the collection and submission of tax-related information. It serves as a standardized method to present assessments and tax data, making the process more efficient for both taxpayers and tax authorities.

Key features of the tax and assessment reports form include a user-friendly interface that simplifies the input of essential data. Each field in the form is carefully structured to gather necessary information without overwhelming the user, allowing for accurate assessments to be completed in a timely manner.

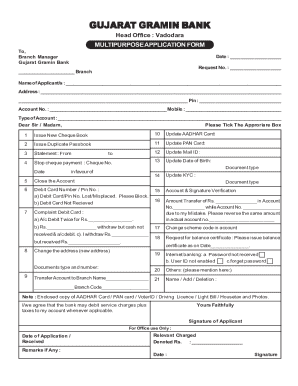

How to Access the Tax and Assessment Reports Form

Accessing the tax and assessment reports form is straightforward, particularly through the pdfFiller platform. The following detailed steps will guide you in navigating to the form, ensuring that you can begin your tax reporting process without delays.

The pdfFiller website is designed with user convenience in mind, and locating the tax and assessment reports form can be achieved quickly. Additionally, various formats are supported for this form, allowing flexibility based on your needs.

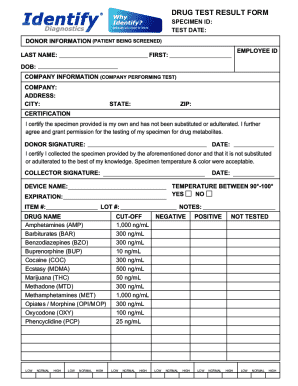

Filling Out the Tax and Assessment Reports Form

Successfully filling out the tax and assessment reports form begins with gathering all necessary information. Accuracy in this step is crucial, as it sets the foundation for your entire tax reporting process.

Detailed guidance on each section of the form is essential to avoid common pitfalls. Key areas to focus on include personal identification, property information, and income details, each of which plays a significant role in determining your tax obligations.

Common mistakes to avoid

In the midst of compiling tax documents and information, it's easy to overlook key elements of the tax and assessment reports form. This oversight can lead to compliance issues or incorrect assessments, which may have significant repercussions.

Understanding common pitfalls can help you fill out your forms more accurately. Overlooking key fields or entering inaccurate information can not only delay processing times but may also attract penalties from tax authorities.

Editing and customizing your tax and assessment reports form

After filling out your tax and assessment reports form, you may want to make adjustments or include additional information. pdfFiller provides comprehensive editing tools that empower users to personalize their forms easily.

Text editing, formatting, and customization features allow for a polished and professional appearance. Adding images or signatures is also seamless, accommodating diverse needs that may arise when creating tax documents.

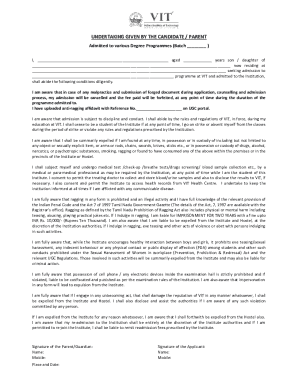

Signing the tax and assessment reports form

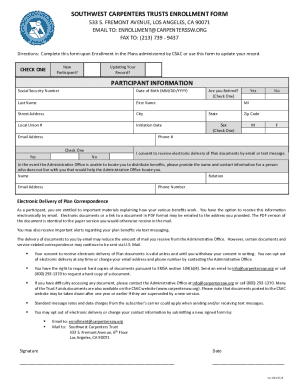

Once your tax and assessment reports form is complete, the next step involves signing it. pdfFiller offers various options for eSigning, integrating digital signature technologies that comply with legal standards.

Security measures for eSigning ensure the integrity of your submissions. This includes the ability to verify signatures, tracking the confirmation process, and maintaining an audit trail.

Submitting the tax and assessment reports form

Submitting the completed tax and assessment reports form is your final step, and it can be done online or via traditional physical filing. Choosing the right method could depend on factors such as urgency and personal preference.

Once submitted, tracking the status of your submission is crucial for peace of mind. Understanding how to verify submission outcomes and established timelines for processing can aid in effectively managing your tax responsibilities.

Managing and storing your tax and assessment reports

Post-submission, managing and storing your tax and assessment reports is crucial for future reference. Implementing best practices for document management will help you stay organized, ensuring easy access when needed.

Utilizing cloud-based storage solutions offered by pdfFiller ensures that your records are secure yet easily accessible. Furthermore, understanding local records retention policies will enable you to keep compliant with regulations regarding document lifespan.

Additional tools and resources on pdfFiller

The pdfFiller platform isn't just about forms; it offers a suite of interactive tools for tax management. From calculators and estimators to help you determine tax liabilities to comprehensive tutorials guiding you through the process, these resources are invaluable.

Accessing additional resources like frequently asked questions can clarify doubts and enhance your understanding, ensuring you navigate tax matters with confidence.

Support and contact information

Navigating the complexities of tax forms can raise questions and concerns. pdfFiller offers robust support to ensure you have the assistance you need throughout the process.

Contacting customer support is easy, with various options available such as phone, email, and chat. Engaging with the community and forums can also provide a wealth of shared knowledge from other users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax and assessment reports without leaving Google Drive?

How do I edit tax and assessment reports online?

Can I edit tax and assessment reports on an iOS device?

What is tax and assessment reports?

Who is required to file tax and assessment reports?

How to fill out tax and assessment reports?

What is the purpose of tax and assessment reports?

What information must be reported on tax and assessment reports?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.