IRS Instructions 1099-CAP 2025-2026 free printable template

Get, Create, Make and Sign IRS Instructions 1099-CAP

How to edit IRS Instructions 1099-CAP online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 1099-CAP Form Versions

How to fill out IRS Instructions 1099-CAP

How to fill out instructions for form 1099-cap

Who needs instructions for form 1099-cap?

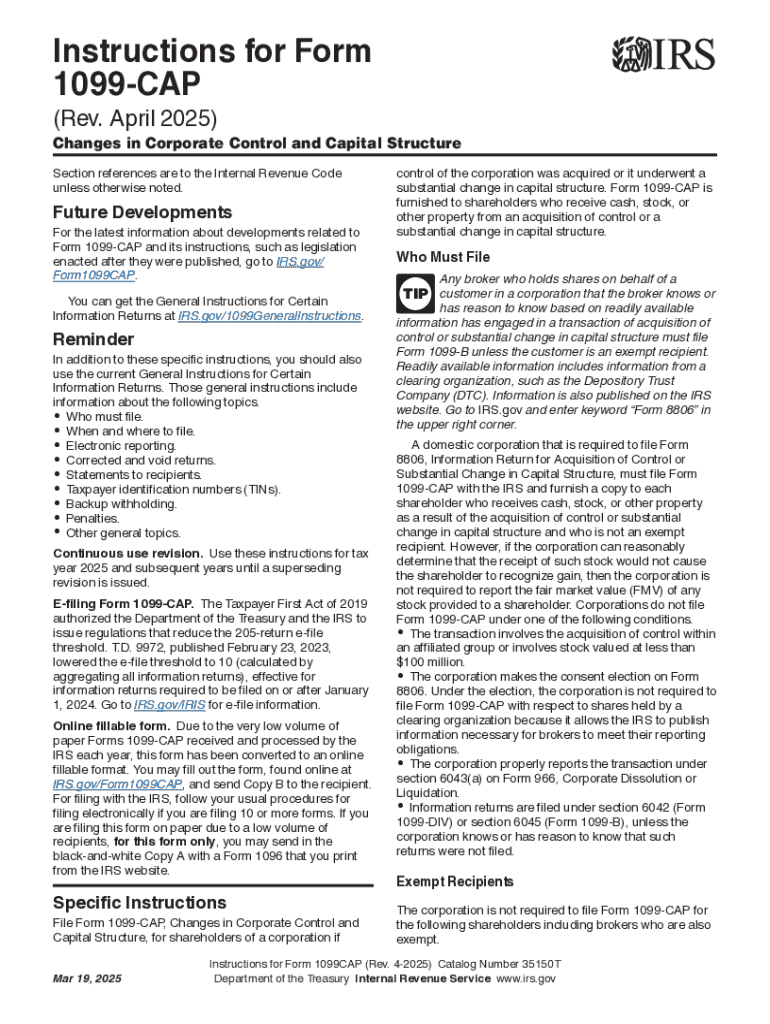

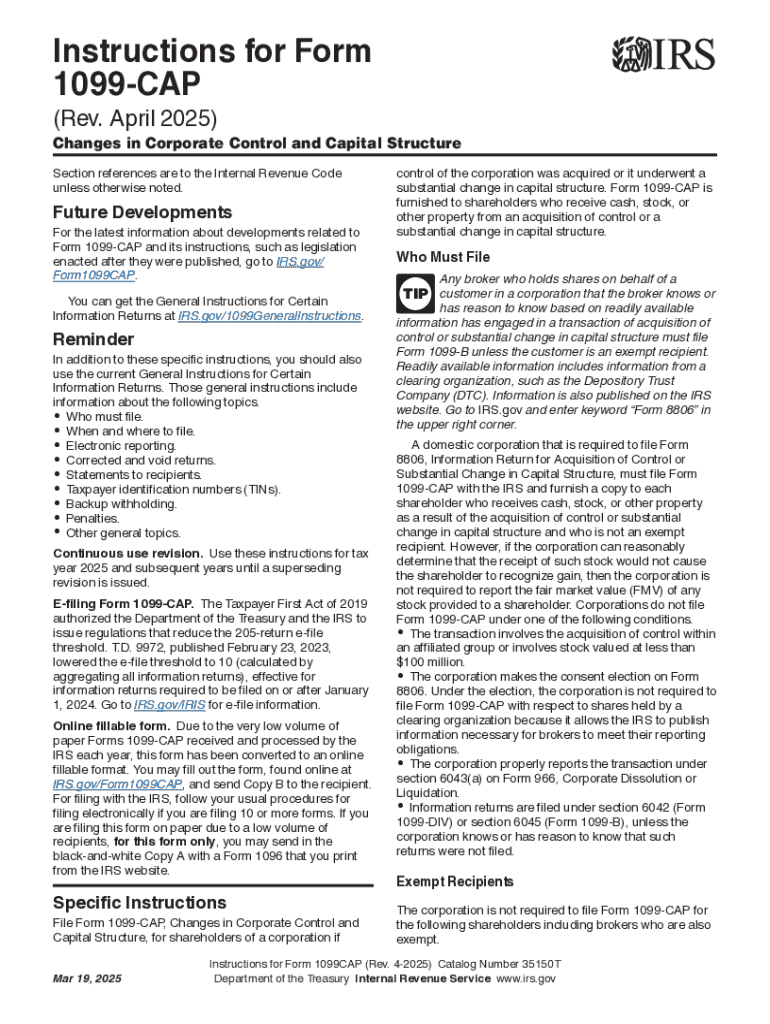

Instructions for Form 1099-CAP

Understanding Form 1099-CAP

Form 1099-CAP, officially known as the 'Changes in Corporate Ownership' form, is utilized to report certain payments made upon a corporation's sale, exchange, or liquidation. The Internal Revenue Service (IRS) mandates this form to ensure proper reporting of income that shareholders might receive from these transactions. It's important for corporations to understand when they are required to issue this form, especially during significant changes in ownership or capital structure.

Certain scenarios necessitate the issuance of Form 1099-CAP. If a corporation experiences a change in control that results in the issuance of a notice to shareholders regarding at least $600 in reportable payments, this form must be filed. This could include capital gains, asset redistributions, or any other form of income reported to shareholders during such transitions.

Importance of Form 1099-CAP for tax filers

Tax filers must take Form 1099-CAP seriously, as it often indicates taxable income that must be reported. Shareholders typically receive this form if they were part of a corporation that underwent significant transactions as mentioned. Missing this form or neglecting to include the reported income can lead to discrepancies in tax filings, potentially attracting penalties or audits.

For corporations, accurately completing and distributing Form 1099-CAP not only fulfills IRS requirements but also builds trust with shareholders. Ensuring that recipients have this form aids in their reporting and helps maintain clarity during tax season, thereby preventing future tax-related complications.

Key components of Form 1099-CAP

Form 1099-CAP has several fields that require accurate data entry. Typically, the first box captures the name and address of the corporation, followed by the taxpayer identification number (TIN). Subsequent fields report the income amounts designated to shareholders, including capital gains and losses and any applicable adjustment amounts. Each section is distinctly labeled to minimize confusion while filling out the form.

Understanding the terminology used in the form is crucial. You'll commonly encounter terms like 'distributions', which refer to the payments made to shareholders, and 'proceeds', denoting the income earned through these transactions. Knowledge of these terms can streamline the form completion process and ensure clarity when discussing tax implications with accountants or tax preparers.

Example of a completed Form 1099-CAP

To illustrate the proper use of Form 1099-CAP, let's consider a fictitious corporation, ABC Corp., which underwent a significant ownership change. ABC Corp. issued payments of $1,200 to its shareholders in connection with an asset sale. On completing the form, Section 1 would include ABC Corp.'s name and address, along with its TIN. In subsequent fields, the total amount paid to shareholders would be recorded, clearly reflecting the $1,200 as taxable income.

Labels on the form help differentiate what information goes where. For instance, Box 1 would show the total payment amount received, while Boxes 2 and 3 may detail capital gains or losses. Presenting a visual representation of this form alongside annotations explaining each section can be invaluable for first-time tax preparers or corporate shareholders familiarizing themselves with the IRS guidelines.

Step-by-step instructions for filling out Form 1099-CAP

The first step in completing Form 1099-CAP is gathering necessary information. Collect details for the corporation, such as the company name, address, TIN, and specifics about the payments made to shareholders. Simultaneously, collate information on the recipients, including their names and TINs. Organizing this data systematically can streamline the completion process, ensuring efficiency.

Upon gathering the data, begin filling out the form. Start by entering the corporation's information in the designated fields. Next, input each shareholder's information along with the respective payments. Cross-check all entered amounts against your records to ensure accuracy before submission. Conclusively, consult the IRS guidelines for any additional instructions that may apply specific to your situation.

Common mistakes to avoid

Numerous pitfalls can arise when filling out Form 1099-CAP. Common errors include incorrectly entered TINs, mismatched names, and inaccurately reported payment amounts. These mistakes can lead to delays in processing by the IRS or even fines if the discrepancies are significant.

To mitigate these risks, double-check all entries against your source documents. Also, ensure that any changes in corporate structure or ownership are properly documented, as this can affect the information you report on the form. Implementing a checklist for reviewing each field can vastly improve accuracy and compliance.

Submitting Form 1099-CAP

Filing Form 1099-CAP is subject to specific requirements and deadlines established by the IRS. Corporations must submit the completed form to the IRS by January 31 following the tax year in which the payments were made. If the filing is electronic, the deadline may differ slightly, so it’s essential to verify the exact date each tax season.

Corporations are also required to provide a copy of Form 1099-CAP to the shareholder by the same deadline. When delivering, ensure that the distribution method (physical mail or electronic) conforms with IRS regulations. Keeping records of when and how the forms were sent is also advisable for compliance purposes.

Frequently asked questions about Form 1099-CAP

Errors after filing can be troubling. If an error is identified after submitting Form 1099-CAP, a correction can be filed by completing a new form with the correct information and marking it as 'corrected'. This will notify the IRS of the necessary changes and ensure that tax filings are adjusted accordingly.

If you didn’t receive a Form 1099-CAP but were expecting one, reach out to the corporation or payer responsible for issuing it. Always verify with them the accuracy of their records. Special considerations apply when distinguishing between corporate shareholders and individual shareholders, as these distinctions can affect how income is reported and any applicable taxes are assessed.

Managing your documents efficiently with pdfFiller

pdfFiller is an excellent tool for managing Form 1099-CAP efficiently. With capabilities to edit, sign, and collaborate on documents directly from a cloud-based platform, it simplifies the often complex task of tax preparation. Users can fill out the form in a guided environment that ensures accuracy and completeness.

Interactive features within pdfFiller allow users to make real-time edits, ensuring that all data remains current. The platform also supports team collaboration, making it easier to handle multiple forms and share pertinent information securely. With pdfFiller, every document is stored securely, enhancing accessibility and backup for tax purposes.

Take control of your tax preparation

After submitting Form 1099-CAP, ensure compliance by closely monitoring any responses from the IRS. Keeping a copy of the submitted form and correspondence allows you to quickly respond if further information is required. Staying organized during tax season can reduce stress and increase efficiency.

Leverage technology and platforms like pdfFiller to simplify future tax needs. Utilizing such tools for document creation and management can significantly decrease the manual workload and streamline the entire process. Explore other forms that pdfFiller supports to maximize your productivity in financial reporting.

People Also Ask about

Can I buy a house with a 1099a form?

How do I submit a 1099 to the IRS?

What is a 1099-cap change in corporate control and capital structure?

Is a 1099a a form of payment?

How do you fill out a 1099 step by step?

What is a 1099-cap form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS Instructions 1099-CAP without leaving Google Drive?

How can I send IRS Instructions 1099-CAP to be eSigned by others?

How can I fill out IRS Instructions 1099-CAP on an iOS device?

What is instructions for form 1099-cap?

Who is required to file instructions for form 1099-cap?

How to fill out instructions for form 1099-cap?

What is the purpose of instructions for form 1099-cap?

What information must be reported on instructions for form 1099-cap?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.