Get the free Tax Resources for USDA Program Participants Farmers.gov

Get, Create, Make and Sign tax resources for usda

How to edit tax resources for usda online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax resources for usda

How to fill out tax resources for usda

Who needs tax resources for usda?

Tax resources for USDA form

Understanding USDA forms and their importance

USDA forms play a critical role in agricultural taxation, offering a structured way for farmers and ranchers to report their income, expenses, and claim relevant tax deductions. The USDA (United States Department of Agriculture) oversees various programs intended to aid agricultural operations, and understanding their forms is essential for maintaining compliance and maximizing potential benefits.

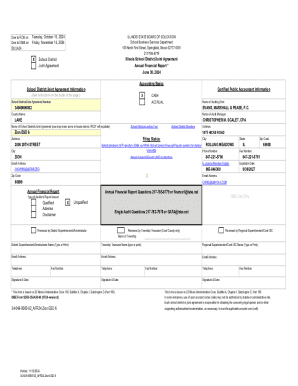

Among these forms, several stand out for tax filing purposes. The most commonly used forms include Form 1040 Schedule F, which details profit or loss from farming activities, and Form 4562, used for depreciation and amortization of assets. Additionally, there are other forms specifically designed for various USDA programs that may apply depending on your situation.

Key tax resources for farmers and ranchers

Access to tax resources is crucial for farmers and ranchers navigating the complexities of USDA forms. The USDA’s official website offers a dedicated section for tax resources, where users can find downloadable forms, guidelines, and instructions tailored to various agricultural tax situations.

Locally, USDA offices provide personalized assistance and access to tools that can simplify tax obligations. These offices often hold workshops and information sessions to help growers understand eligibility for programs and ensure they are taking advantage of available tax resources.

Preparing your USDA forms

Preparation is key when it comes to filling out USDA forms. Start by gathering all necessary documentation, which includes detailed financial records of your income and expenses. Effective record-keeping throughout the year can make this process much easier and less stressful come tax season.

Supporting documents, such as receipts, invoices, and contracts, are also essential for substantiating your claims. When it comes to completing the forms, understanding the process for each specific USDA form is vital. For example, Form 1040 Schedule F requires breakdowns of all farm-related income, as well as the expenses associated with it.

Utilizing pdfFiller for USDA form management

pdfFiller is an invaluable resource for managing USDA forms digitally. With pdfFiller, users can create, edit, and sign documents from the comfort of their own computers or devices. Start by importing existing USDA forms into pdfFiller, making use of the software’s features to streamline the documentation process.

Editing and customizing forms becomes hassle-free, allowing users to fill in the necessary information quickly. Furthermore, pdfFiller’s e-signature capabilities facilitate the signing of USDA forms electronically, further simplifying the submission process. Collaboration features also enable users to work closely with tax professionals or advisors without hassle.

Deadline management and filing tips

Deadlines are crucial in the agricultural sector, and knowing when to file your USDA forms can help you avoid penalties. Generally, the deadline for filing your federal tax return, including applicable USDA forms, falls on April 15th. However, some farmers may have additional deadlines depending on specific agricultural programs or local regulations.

To manage deadlines effectively, consider setting up reminders in your digital calendar or scheduling time each week to prepare your documents. Organizing your submission process ahead of time allows you to gather all necessary information and submit the forms accurately and on time.

FAQs about USDA tax resources

When it comes to navigating USDA forms, many common questions arise. A frequently asked question is: 'What forms do I need for my farm business?' The answer typically varies by individual circumstances, but Form 1040 Schedule F is essential for most operations. Additionally, farmers may inquire about how to qualify for USDA tax credits, which often depend on enrolment in specific programs or adherence to conservation practices.

For complex tax situations, it’s advisable to consult a tax professional who specializes in agricultural taxes. Their expertise can help ensure compliance while maximizing your tax deductions and credits.

Staying informed: Future tax changes and updates

The agricultural tax landscape can change, and being proactive in remaining informed about USDA tax regulation changes is vital for farmers and ranchers. Keeping abreast of these updates can impact the eligibility for certain deductions, credits, and forms.

Subscribing to USDA newsletters or alerts can be an effective way to stay informed about tax updates relevant to farmers. Local agricultural tax workshops and webinars also offer opportunities to gain insights from experts and stay compliant with evolving regulations.

Additional support and networking opportunities

Connecting with other farmers can provide valuable insights and shared experiences related to USDA forms. Networking can foster opportunities to learn how others have addressed similar tax challenges or taken advantage of tax resources. Social media platforms and local agricultural associations often create forums to share knowledge.

Moreover, there are numerous resources for further learning, including online courses and webinars designed to enhance understanding of agricultural taxes and the use of relevant USDA forms. Utilizing these opportunities can lead to more efficient tax preparation and greater success.

Conclusion and next steps

Efficient tax preparation based on USDA forms is essential for every farmer and rancher. By leveraging digital solutions like pdfFiller, you can streamline your document management process and ensure that all forms are completed accurately.

Start by exploring the available resources, gathering necessary documentation, and utilizing technology to facilitate your form management. This proactive approach will improve compliance and may even increase your tax savings, allowing you to focus more on what you love — farming.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax resources for usda to be eSigned by others?

Can I edit tax resources for usda on an iOS device?

Can I edit tax resources for usda on an Android device?

What is tax resources for USDA?

Who is required to file tax resources for USDA?

How to fill out tax resources for USDA?

What is the purpose of tax resources for USDA?

What information must be reported on tax resources for USDA?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.