Get the free Sales & Use, Rental, Lodging Taxes - Tax Office

Get, Create, Make and Sign sales amp use rental

Editing sales amp use rental online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sales amp use rental

How to fill out sales amp use rental

Who needs sales amp use rental?

Your Complete Guide to the Sales and Use Rental Form

Understanding the Sales and Use Rental Form

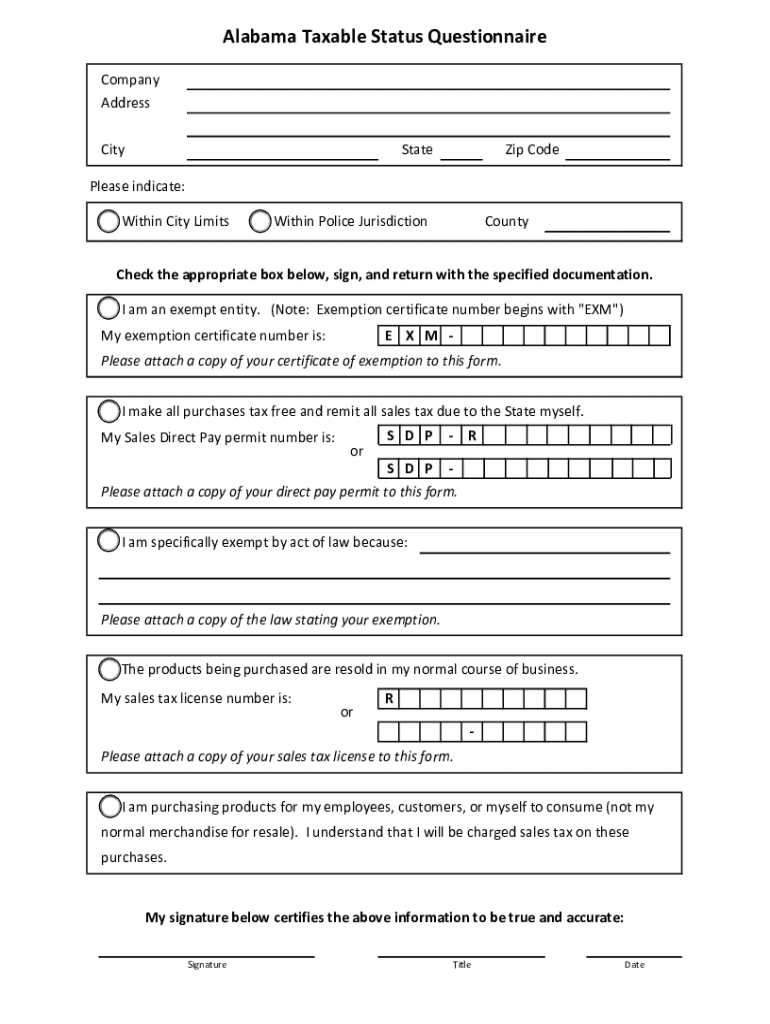

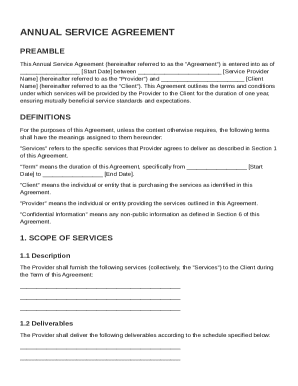

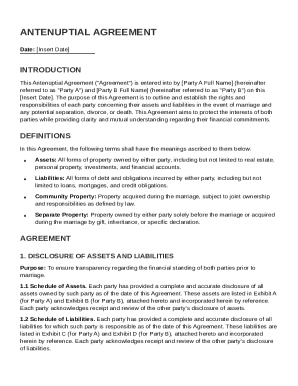

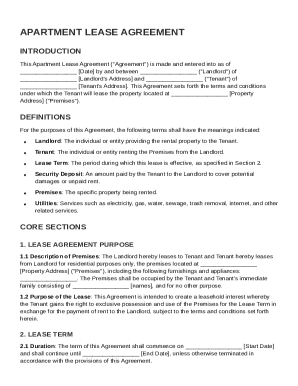

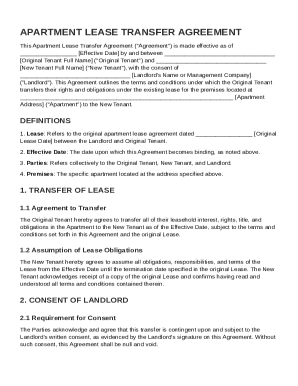

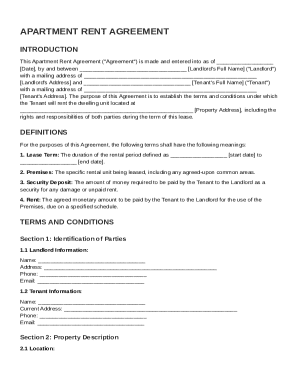

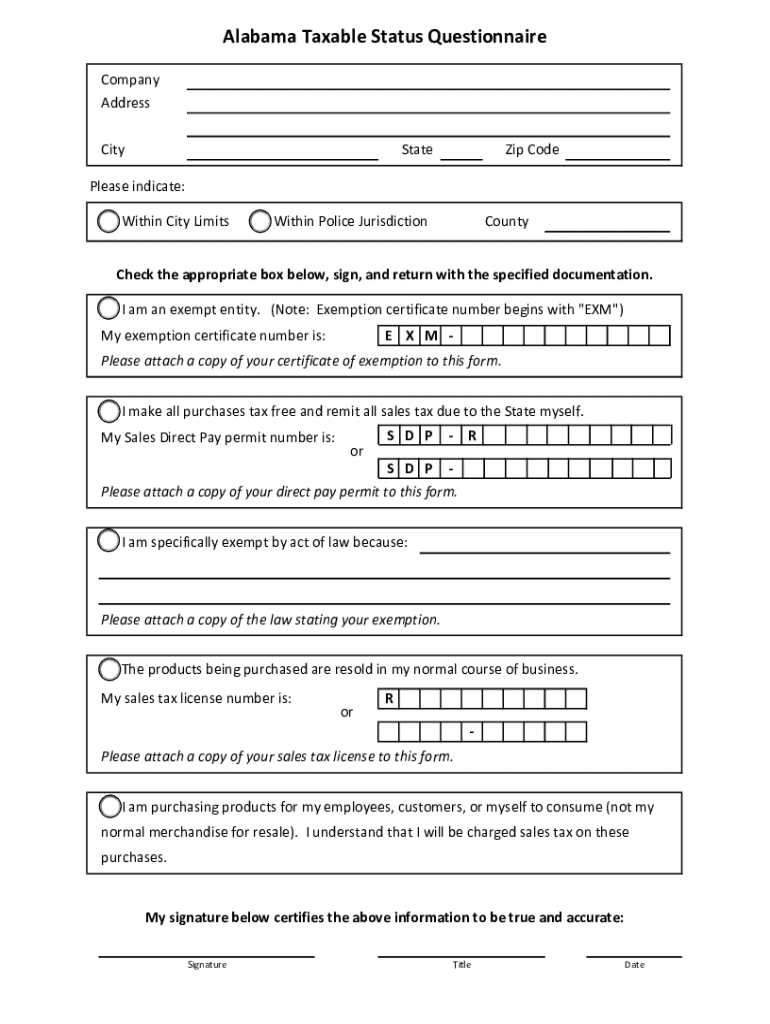

The Sales and Use Rental Form is a critical document that outlines details regarding rental transactions involving taxable personal property, services, or leases. This form acts as a legal agreement between the lessor and lessee, ensuring that all relevant rental information is captured in compliance with tax regulations. Its importance cannot be overstated, as it prevents disputes over payment responsibility and ensures appropriate tax compliance.

This form finds application in numerous scenarios such as apartment rentals, equipment leasing, and various short-term rental agreements. By documenting the sales and use tax obligations clearly, it serves as a vital tool for both individuals and businesses engaged in rental transactions.

Key components of the Sales and Use Rental Form

The Sales and Use Rental Form comprises several essential components that each play a significant role in the rental process. First, the Renter Information section gathers crucial details like the renter’s name, contact information, and past rental history. This section helps define the parties involved in the agreement, setting the groundwork for responsibility.

Next, the Property Details section provides a thorough description of the property being rented, such as its location, size, and any unique features. The Rental Terms section outlines the duration of the rental, payment schedule, and the total rental amount. As important as these details are, incorporating clear Sales and Use Tax Information ensures that both parties understand any taxes applicable to the rental, preventing misunderstandings at a later stage.

Preparing to fill out the Sales and Use Rental Form

Before diving into filling out the Sales and Use Rental Form, it is essential to have all necessary documents at your fingertips. Gathering previous rental agreements can provide a basis for terms or formatting that has been effective in the past. If applicable, ensure you have a tax identification number ready, as well as identification documents such as a driver’s license.

Being prepared not only streamlines the filling process, it also enhances accuracy. It’s recommended to double-check all information for compliance, especially related to tax details. Taking a moment to verify each piece of data can save significant issues down the road.

Step-by-step instructions to complete the form

Completing the Sales and Use Rental Form may seem daunting at first, but breaking it down into manageable steps can help. Start with Step 1 by inputting your Renter Information. Enter your name, contact details, and any relevant rental history that might be necessary for the lessor's understanding.

In Step 2, you'll detail Property Information. Be specific about the property being rented—describe its features, location, and terms. Moving on to Step 3, specify the Rental Terms which will include the duration of the lease, total rental amount, and payment schedule.

For Step 4, include any relevant Sales and Use Tax details, including the tax rate applicable to the rental. Lastly, Step 5 involves a thorough review of the form—verify accuracy of all entries and signatures before finalization, ensuring that everything aligns with your agreements.

Editing the Sales and Use Rental Form

Utilizing tools like pdfFiller can make editing the Sales and Use Rental Form a pain-free process. Features include the ability to easily edit fields and formatting as needed, making adjustments on the fly a breeze. Should any clarifications or notes be required, adding comments or annotations directly onto the form ensures all parties are updated.

When editing, keep best practices in mind: aim for clarity and professionalism in all entries. Clear, well-organized documents instill confidence in rental agreements, ensuring all parties are aware of their responsibilities without confusion.

Signing the Sales and Use Rental Form

The signing process is just as important as filling out the Sales and Use Rental Form correctly. With the growing trend of electronic signatures, understanding electronic signature laws is crucial for legality. Using pdfFiller, you can eSign the form securely, which provides time-saving benefits while ensuring the document's integrity through authentication.

Ensuring that the signing process is handled correctly reduces the risk of later disputes and confirms that all parties involved understand and agree to the terms of the rental. Incorporating tools that facilitate secure signing will streamline operations for both parties.

Collaborating on the Sales and Use Rental Form

Effective collaboration on the Sales and Use Rental Form is facilitated by features available through pdfFiller, enabling teams to share documents for feedback easily. The ability to track changes and revisions within the form encourages transparency among collaborators, making it easier to review and amend necessary information.

Promoting efficient communication is vital to ensuring that all collaborators remain aligned. Using clear notes and guidelines ensures that everyone understands their roles, ultimately resulting in a well-managed rental process. Keeping everyone on the same page can help avoid misunderstandings that could lead to issues down the line.

Managing your Sales and Use Rental Forms

Organizing and managing your Sales and Use Rental Forms is vital for streamlined operations. By utilizing pdfFiller's document storage capabilities, you can easily categorize and organize forms for quick access whenever needed. Setting reminders for rental renewals or expirations ensures you stay ahead of important dates and obligations.

Moreover, the cloud-based advantage of pdfFiller allows users to access their forms from anywhere at any time, bringing convenience to your rental management process. This flexibility proves invaluable, especially for individuals or teams administering multiple rental agreements simultaneously.

Common mistakes to avoid when using the Sales and Use Rental Form

When navigating the Sales and Use Rental Form, several common mistakes can arise. Individuals frequently overlook essential fields, such as tax details or signatures, which can lead to complications. Double-checking the form’s contents and ensuring that all areas are duly filled can significantly mitigate these risks.

Additionally, misunderstanding taxable amounts can cause errors during tax season. It’s crucial to stay informed about tax requirements relevant to your location or type of rental agreement. Taking the time to review each component can save future headaches, ensuring compliance and a smooth rental experience.

Frequently asked questions (FAQs)

Addressing common questions related to the Sales and Use Rental Form can guide users effectively. For instance, what happens if a mistake is made after signing the form? Typically, the best course of action is to amend the document by mutual agreement between parties to avoid disputes.

Another common query revolves around handling partial payments within the rental agreement. Clearly stipulating this in the rental terms section helps preempt confusion, ensuring both parties are aware of payment expectations. When it comes to tax season, individuals often wonder what documentation is necessary; keeping a record of all rental forms will streamline the tax filing process.

User testimonials and experiences

Real-world experiences illustrate the effectiveness of pdfFiller in managing the Sales and Use Rental Form. Users have expressed how not only did they streamline their rental agreements, but they also saw an increase in efficiency when managing multiple documents. The ability to access and edit forms from anywhere has proven invaluable for busy landlords juggling many tenants.

Furthermore, case studies highlight how pdfFiller has improved user experiences, such as minimizing errors and ensuring compliance through integrated editing tools. This added layer of accuracy means rental agreements can be processed and executed with confidence, benefiting lessors and lessees alike.

Interactive tools available

Embracing innovative features provided by pdfFiller can greatly enhance the rental agreement process. Tools like calculators help determine rental amounts based on properties, while templates ensure that users comply with standardized formats. Additionally, workflow automation can significantly speed up document processing, leaving more time for vital business functions.

By leveraging these interactive tools, individuals and teams can streamline their experiences, making it easier to draft, edit, and manage rental agreements efficiently. The simplicity provided by technology can bring peace of mind, allowing users to focus on other critical aspects of property management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sales amp use rental in Gmail?

How can I modify sales amp use rental without leaving Google Drive?

How do I complete sales amp use rental online?

What is sales amp use rental?

Who is required to file sales amp use rental?

How to fill out sales amp use rental?

What is the purpose of sales amp use rental?

What information must be reported on sales amp use rental?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.