Get the free alabama department of revenue sales, use & business tax ...

Get, Create, Make and Sign alabama department of revenue

How to edit alabama department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alabama department of revenue

How to fill out alabama department of revenue

Who needs alabama department of revenue?

A comprehensive guide to Alabama Department of Revenue forms

Overview of Alabama Department of Revenue forms

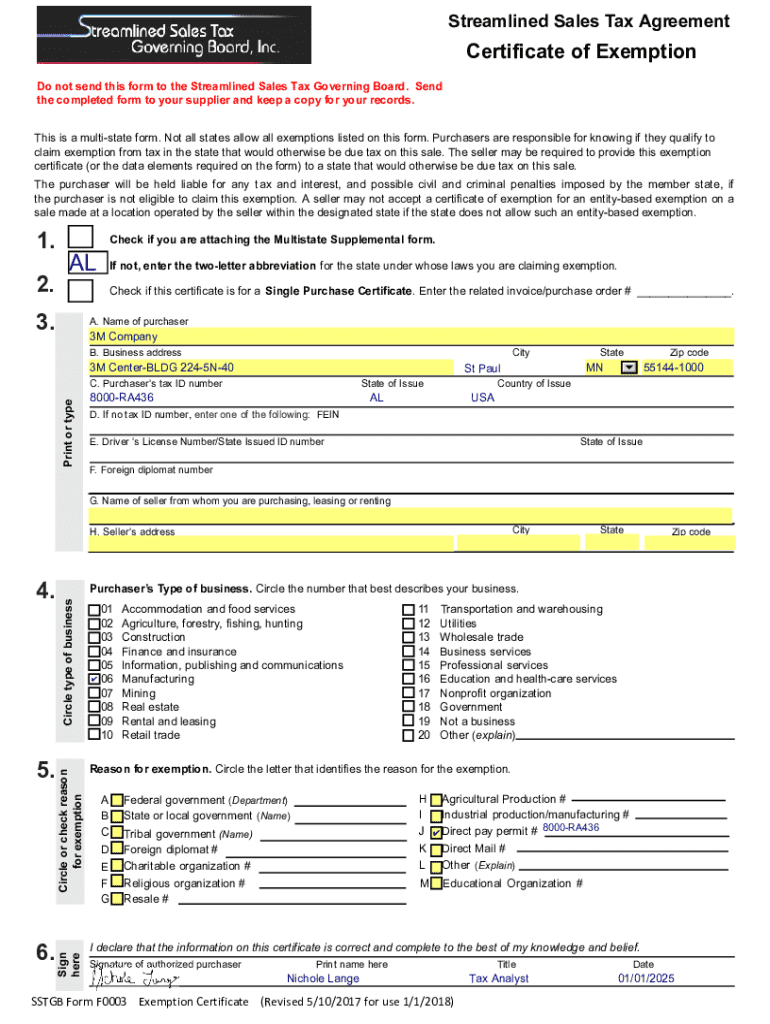

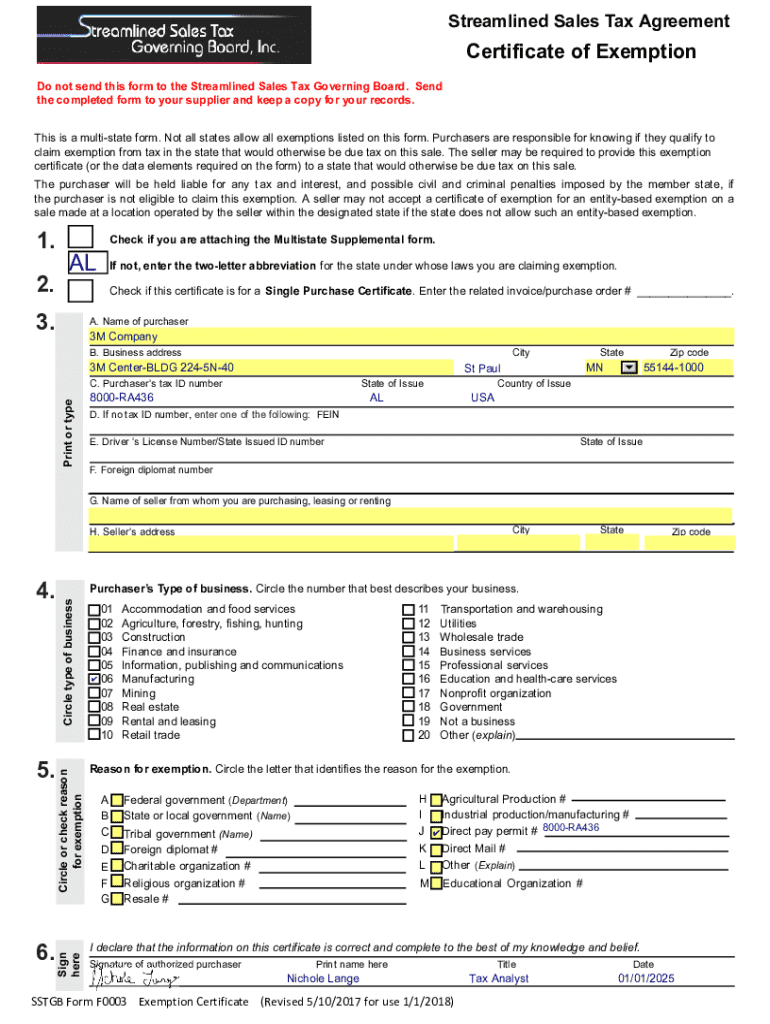

The Alabama Department of Revenue (ADOR) is responsible for collecting and managing state taxes and facilitating revenue collection for local governments. Understanding the purpose and correct usage of Alabama Department of Revenue forms is crucial for both individuals and businesses to ensure compliance with state regulations.

Using the correct forms can significantly affect the outcome of tax filings and business operations. The right documentation is essential for fulfilling tax obligations, applying for licenses, and even in scenarios like property assessments. ADOR provides a variety of forms tailored for personal income tax, business tax requirements, and permits, allowing users to navigate their specific needs efficiently.

Navigating the Alabama Department of Revenue forms

Accessing Alabama Department of Revenue forms online is straightforward. The official ADOR website provides a centralized platform where users can easily find the specific forms they need by utilizing the search bar or browsing through categorized sections. Accuracy in selecting the appropriate form ensures smooth processing of submissions, reducing the chances of errors and delays.

Understanding the categories of forms available at ADOR can simplify the process. Users will encounter several types, including personal tax forms tailored for residents, business tax forms necessary for commercial operations, and various licenses and permits related to business activities or professional practices. It’s important to familiarize yourself with these categories to avoid choosing incorrect forms.

While filling out these forms, key considerations include accurate reporting of all information, comprehension of form instructions, and awareness of deadlines. Incomplete or incorrect submissions can lead to delays or tax violations, making it imperative that users approach the form-filling process with diligence and care.

Step-by-step guide to filling out Alabama Department of Revenue forms

Gathering required information

Before starting to fill out any form, it’s vital to gather all necessary information. For individuals, this typically includes personal details such as your name, current address, and Social Security Number (SSN). For businesses, you will need specific information like the Employer Identification Number (EIN) and details regarding your business structure, whether it's a sole proprietorship, corporation, or partnership.

Understanding the required sections

Many Alabama Department of Revenue forms share common sections. Generally, you will be required to complete your personal or business details, income sources, and any deductions or exemptions applicable. While most forms provide transparent instructions, some may include unique requirements, so always read them carefully.

Utilizing interactive tools available on pdfFiller

For those who want to streamline their documentation processes, pdfFiller provides an array of interactive tools. Its template library offers ready-to-use forms that can be easily accessible. Additionally, pdfFiller's auto-fill feature saves time by pre-filling recurrent information, and the eSignature tool allows for seamless digital signing of your completed forms.

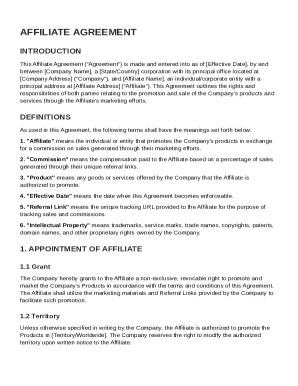

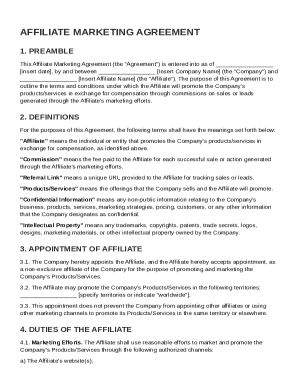

Common types of forms and their specific instructions

Income tax forms

Among the plethora of forms offered by the Alabama Department of Revenue, income tax forms are among the most frequently used. Users must provide necessary supporting information alongside their forms. For example, Form 40, the Alabama Individual Income Tax Return, requires extensive documentation to ensure accurate filing.

Business and license forms

Business license forms, such as those for sales tax registration, are vital for legal compliance within the state. These forms require specific details regarding business ownership, structure, and expected revenue for effective processing.

Property tax forms

Property tax forms often vary depending on the type and location of the property. Users should conduct thorough research on the types of property tax forms available, including assessments and exemption applications based on state guidelines.

Key tips for successfully managing Alabama revenue forms

Accurate management of Alabama Department of Revenue forms is crucial for efficient compliance. One of the best practices includes double-checking your entries to minimize errors. Implementing systems for saving and securely storing copies is advisable, which can be facilitated using pdfFiller.

In navigating complex tax situations such as claims, audits, or appeals, understanding the steps required is essential. pdfFiller can aid in collaborating seamlessly with tax professionals by sharing documents easily, thus ensuring that assistance is just a few clicks away.

Special considerations for unique situations

Certain users may encounter unique circumstances requiring careful handling of their forms. Non-residents or foreign entities may have specific forms designated for tax compliance, ensuring they adhere to state laws. For those needing to correct or amend previous filings, understanding the correct protocols is crucial to avoid penalties.

Additionally, guidelines regarding late filings can help alleviate stress during hectic tax seasons. Seeking the correct form to address penalties or requesting adjustments is vital, and consulting the ADOR website can offer clarity.

Frequently asked questions (FAQs) about Alabama Department of Revenue forms

When dealing with the Alabama Department of Revenue forms, various questions may arise. One common inquiry is how to determine which form to use. The answer lies in assessing personal or business needs outlined in the ADOR’s catalog of forms, efficiently guided by designated categories on the government website.

Another frequent concern users face involves changing information after submission. It’s advisable to follow specific procedures outlined on the ADOR site to amend submitted documents to ensure compliance. Furthermore, tracking the status of a form submission can also be done using tools available on the ADOR website, making the process transparent and reassuring.

About pdfFiller: your comprehensive document solution

pdfFiller offers a streamlined solution for filling out Alabama Department of Revenue forms by providing an efficient platform for document editing, eSignature, and collaboration. Users engaged in the form-filling process find benefits beyond mere completion — pdfFiller ensures accessibility and clarity, which enhances overall productivity.

Success stories from users illustrate the effectiveness of pdfFiller. Many have shared their experiences of how the platform simplified their document management processes, ultimately improving navigation through tax compliance and business requirements.

Contact information for assistance

When faced with questions about Alabama Department of Revenue forms, the ADOR website is a primary resource. The site features a comprehensive help section, where users can find detailed information or submit inquiries through the contact form. For specific situations that may require additional guidance, reaching out directly to representatives through listed contact details can further illuminate complex scenarios and provide assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit alabama department of revenue from Google Drive?

Where do I find alabama department of revenue?

How do I complete alabama department of revenue on an iOS device?

What is Alabama Department of Revenue?

Who is required to file Alabama Department of Revenue?

How to fill out Alabama Department of Revenue?

What is the purpose of Alabama Department of Revenue?

What information must be reported on Alabama Department of Revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.