Get the free Homestead tax reduction available to qualifying homeowners

Get, Create, Make and Sign homestead tax reduction available

How to edit homestead tax reduction available online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homestead tax reduction available

How to fill out homestead tax reduction available

Who needs homestead tax reduction available?

Homestead Tax Reduction Available Form: Your Comprehensive Guide

Understanding the Homestead Tax Reduction Program

The Homestead Tax Reduction Program is a beneficial initiative designed primarily for homeowners, allowing them to reduce their property tax burden significantly. It aims to provide financial relief, making homeownership more accessible for individuals and families. This program is particularly relevant in states like Oregon, where property taxes can significantly impact the financial stability of residents.

To be eligible for the Homestead Tax Reduction, applicants need to meet specific criteria, which vary by state or locality. Generally, homeowners must occupy the property as their primary residence and meet certain income thresholds. Factors like age, disability status, or veteran status can also influence eligibility. Being aware of these requirements is crucial for potential applicants.

Participating in the Homestead Tax Reduction Program yields several benefits, including reduced property tax payments, which can free up funds for essential expenses. Additionally, it promotes community stability and aids in keeping housing affordable for low- and moderate-income families.

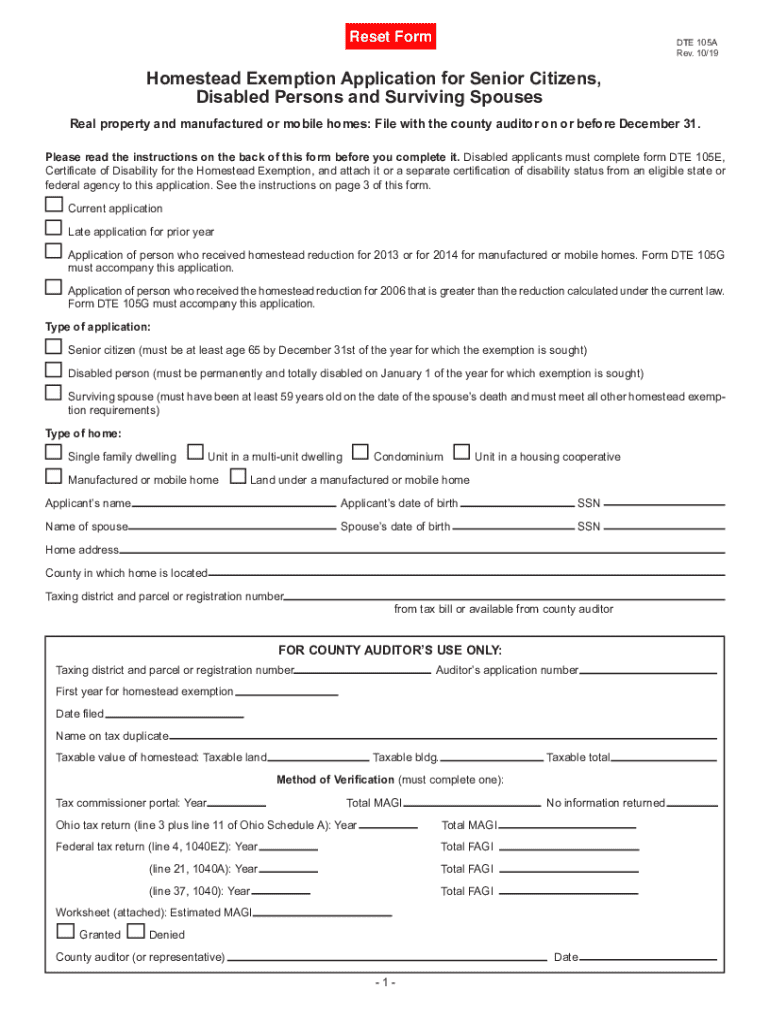

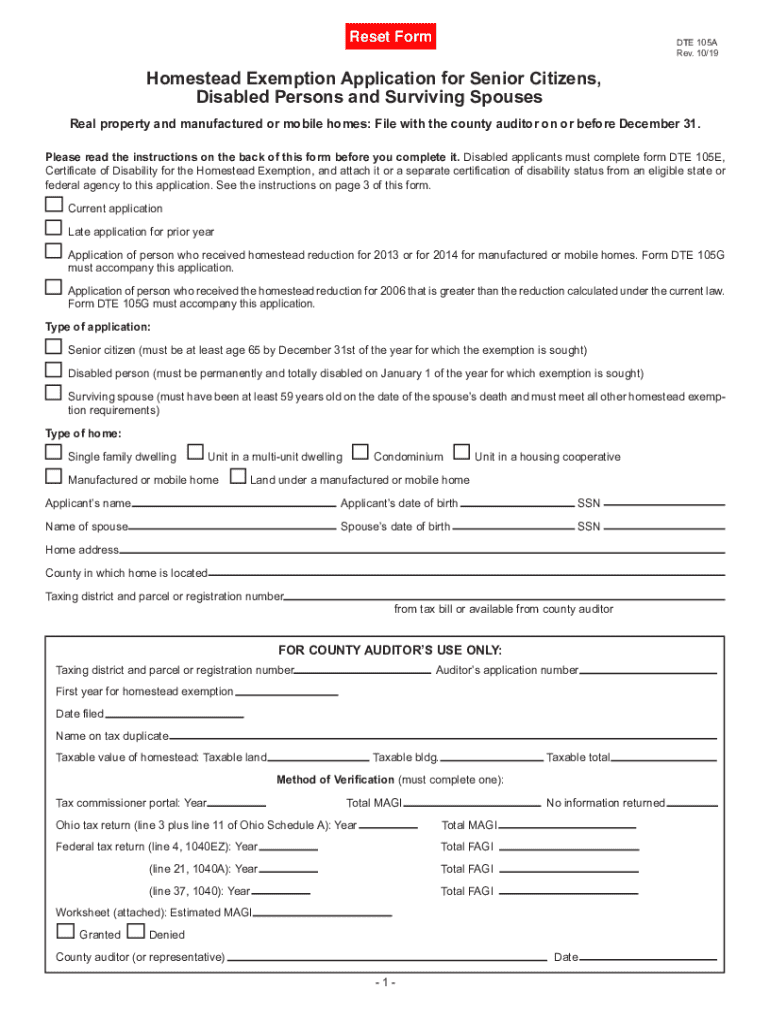

Key components of the Homestead Tax Reduction form

Completing the homestead tax reduction available form involves providing various essential details. The form typically includes a Personal Information Section where you will be required to submit your name, address, and contact details. Following this, applicants must fill out the Property Information Section, detailing specifics about the property, including its address, type, and assessed value.

The Income and Employment Details section is equally important; it requires information about your employment status, sources of income, and total earnings. This data helps determine eligibility and the extent of the tax reduction. Each component is critical, as missing any information can delay processing or result in application denial.

Applicants will also need to provide supporting documentation, including proof of residence, such as utility bills or bank statements. Furthermore, income verification documents may be required, which could include pay stubs or tax returns to corroborate financial information.

Step-by-step guide to filling out the homestead tax reduction form

Filling out the Homestead Tax Reduction Form can seem daunting, but by following a structured approach, individuals can ensure accuracy and efficiency. Begin by gathering all necessary information and documentation. This step is crucial as it sets the stage for completing the form without errors.

Next, proceed to fill out the Personal Information Section accurately. It’s essential to double-check the details before moving to the next section to avoid mistakes. After that, move on to the Property Information Section, ensuring that all entries are precise and correspond with official records.

Provide detailed Information regarding Income and Employment to ensure clarity. After completing the entire form, review all entries meticulously for any discrepancies or missing information. Finally, submit the form according to your local guidelines. Consider tracking your application post-submission to stay updated on its processing status.

Editing and managing your homestead tax reduction form with pdfFiller

With pdfFiller, accessing the homestead tax reduction available form is incredibly straightforward. Simply visit the website and utilize their search feature to locate the specific form you need. Once you access the form, pdfFiller provides a user-friendly interface for editing your document.

The platform offers various interactive editing features, such as adding text, checkboxes, and dropdown menus. You can easily input or modify essential information without dealing with cumbersome paper forms. Additionally, eSignature options allow you to sign the document digitally, streamlining the entire process.

Collaborating on your form is also simple with pdfFiller. The team features enable sharing with other members or stakeholders, allowing for real-time edits and communication, making it an excellent choice for facilitated collaboration.

Frequently asked questions about the homestead tax reduction

A common question surrounding the homestead tax reduction program concerns eligibility. Homeowners often wonder about the specific criteria that determine whether they qualify for reduced taxes. Eligibility typically depends on residency status, income level, and sometimes age or veteran status.

Another area of confusion may arise regarding tax benefits. Some individuals mistakenly believe that participating in the Homestead Tax Reduction will affect other tax exemptions. However, these benefits can often be layered, and individuals should clarify with local tax authorities for guidance.

Finally, what should you do if your application is denied? It’s crucial to understand your right to appeal the decision. Start by reviewing the reasons for denial, then gather any additional documentation to support your case before reapplying or appealing the outcome.

Interactive tools for estimating your tax reduction

Estimating your potential tax reduction can be made easy with interactive tools such as tax reduction calculators available online. Using these tools, homeowners can input their financial details, and the platform will estimate potential property tax savings.

It's essential to recognize that various scenarios can affect eligibility and the extent of tax benefits. For instance, changes in income, a property's assessed value, or the homeowner's status (like becoming a veteran) can significantly impact potential reductions.

Contacting support for assistance

If you need assistance during the application process, reaching out to pdfFiller support is a straightforward process. Their support team can help address any technical difficulties you may encounter while filling out or submitting the form.

Alternatively, local government offices are invaluable resources for anyone seeking help with homestead tax queries. Staff at these offices can provide updated information on program requirements and assist with any paperwork. Engaging with financial advisors is also an option; they can offer personalized advice based on individual circumstances and local regulations.

Testimonials and success stories

Many individuals have shared real-life experiences regarding the Homestead Tax Reduction Program. Beneficiaries often highlight how this initiative has helped ease their financial burdens, allowing them to allocate resources toward other essential needs such as healthcare, education, or saving for retirement.

Additionally, users of pdfFiller frequently praise how the platform has facilitated their application process. The ease of filling out, editing, and submitting forms, combined with user-friendly features, has significantly improved their experience with governmental applications.

Additional insights on property tax exemptions

Beyond the Homestead Tax Reduction Program, several tax exemption programs are available to alleviate financial pressures on homeowners. For instance, older adults or disabled individuals may qualify for different forms of property tax exemptions, which can further reduce their liabilities.

Understanding the differences between various programs can empower homeowners in making informed decisions. For example, property tax exemptions may vary based on residency, age, or health conditions, so it's crucial to explore all options that may apply to your situation.

Remaining informed about policy changes

Staying updated on changes to tax reduction laws is essential for homeowners seeking to maximize their tax benefits. Regularly checking official websites and subscribing to newsletters from local tax authorities can provide valuable insights on any pending changes that could impact eligibility or benefits.

In conclusion, ensuring that you are aware of policy updates and verifying information through trusted sources will help navigate the complexities of property tax exemptions effectively. Knowledge is a powerful tool when it comes to managing homeownership costs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete homestead tax reduction available online?

How do I make edits in homestead tax reduction available without leaving Chrome?

How do I fill out homestead tax reduction available on an Android device?

What is homestead tax reduction available?

Who is required to file homestead tax reduction available?

How to fill out homestead tax reduction available?

What is the purpose of homestead tax reduction available?

What information must be reported on homestead tax reduction available?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.