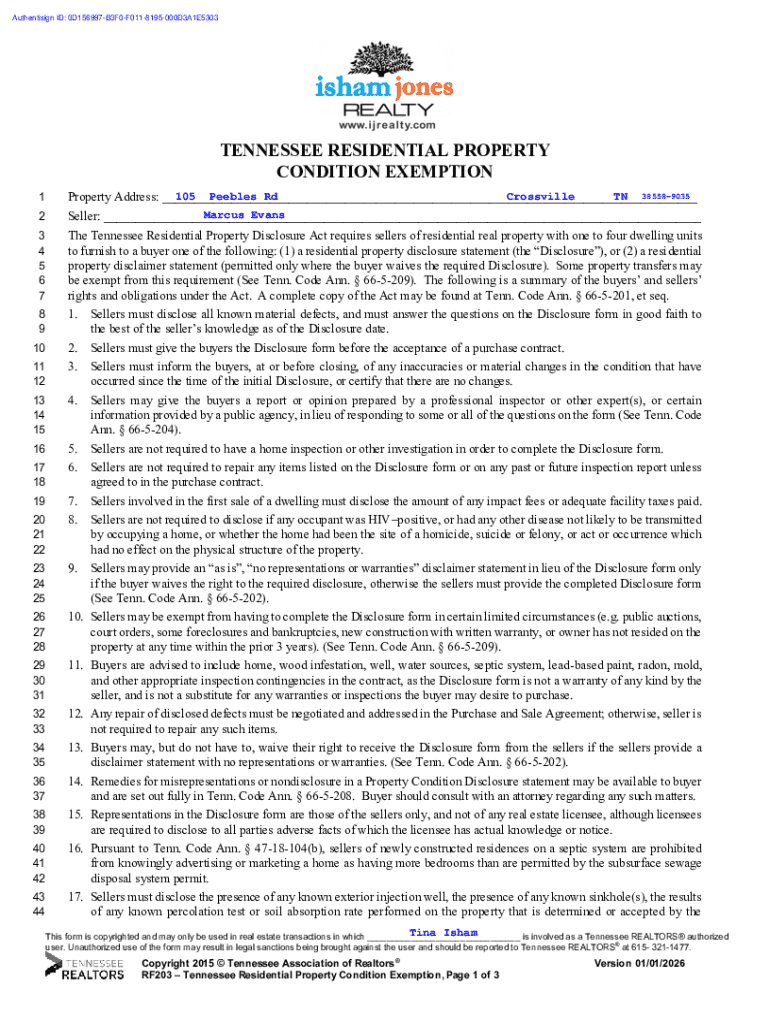

Get the free Property-Condition ExemptionTennessee REALTORS

Get, Create, Make and Sign property-condition exemptiontennessee realtors

Editing property-condition exemptiontennessee realtors online

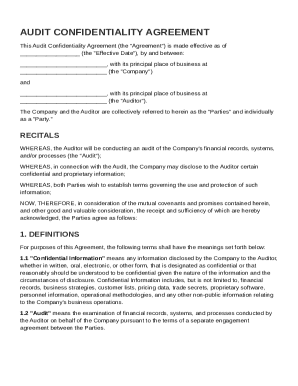

Uncompromising security for your PDF editing and eSignature needs

How to fill out property-condition exemptiontennessee realtors

How to fill out property-condition exemptiontennessee realtors

Who needs property-condition exemptiontennessee realtors?

Your Complete Guide to the Property-Condition Exemption Tennessee Realtors Form

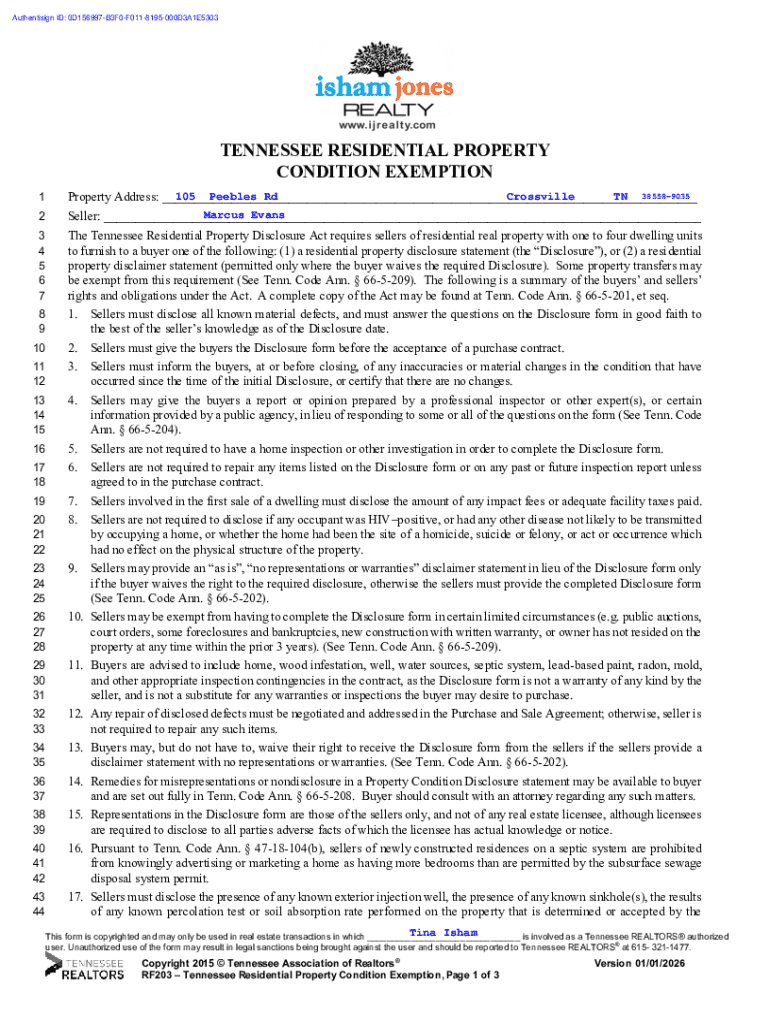

Understanding the property-condition exemption in Tennessee

The property-condition exemption in Tennessee provides specific allowances for property owners regarding the disclosure of a property's condition. This exemption is crucial as it helps streamline the buying and selling process, particularly for properties that may have minor deficiencies or wear and tear. For realtors, understanding this exemption is essential, as it not only protects their clients but also enhances the trust and transparency in real estate transactions.

Legally, the framework surrounding the property-condition exemption is rooted in state laws that differentiate between residential and commercial properties, outlining what conditions might qualify for exemptions. It is imperative for both realtors and property owners to grasp these regulations so that they are adequately equipped to navigate the complexities involved in property sales.

Eligibility criteria for property-condition exemption

Understanding who can apply for the property-condition exemption is essential for realtors. Generally, individual homeowners can apply directly; however, realtors and agents can also file on behalf of their clients. This dual approach allows flexibility in managing property sales.

Eligibility for the exemption is contingent upon certain conditions, including the specific characteristics of the property in question. For instance, older homes or those characterized by routine wear may qualify. Key documentation required includes proof of property ownership and detailed inspection reports to verify the conditions being claimed.

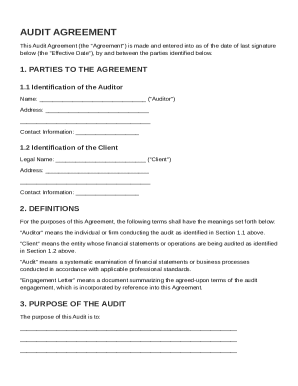

Overview of the Tennessee Realtors Form

The Tennessee Realtors Form, specifically designed for property-condition exemptions, serves a pivotal role in the application process. Its primary purpose is to collect necessary information regarding the property's current condition and ownership details. Successfully completing this form is a vital step for both property owners and realtors to initiate the exemption process.

Key information required on the form includes property specifications, owner information, and assessments of the property's condition. Each section is designed to gather comprehensive data that supports the case for exemption, thereby ensuring that the application is as robust as possible.

Step-by-step guide to completing the property-condition exemption form

Completing the property-condition exemption form can be straightforward if approached methodically. Begin by gathering necessary documentation, such as property records and comprehensive inspection reports that validate the claimed conditions.

Next, accurately fill out the form, paying close attention to detail in every section. Some common pitfalls to avoid include omitting necessary information or failing to provide adequate descriptions of the property's conditions. After completing the form, reviewing it for accuracy is crucial — double-checking each entry can prevent processing delays.

Interactive tools for managing your property-condition exemption

In today’s digital landscape, leveraging technology can significantly enhance the management of property-condition exemptions. pdfFiller provides a robust platform that enables users to edit and eSign documents seamlessly. This functionality is especially beneficial for realtors who might need to collaborate with multiple parties throughout the exemption process.

One useful feature is the ability to create a tracking system for your exemptions. By setting reminders for renewals and updates, property owners and realtors can stay on top of necessary paperwork and ensure compliance with all regulations, thereby minimizing any potential oversights.

Frequently asked questions

Understanding common inquiries surrounding the property-condition exemption can provide clarity to realtors and property owners alike. For instance, many wonder what happens to their exemption if the property condition changes. In such cases, it's crucial to report any significant alterations as these could influence eligibility.

Another frequent question relates to appeals — if a property-condition exemption is denied, it is indeed possible to appeal the decision. Realtors should be prepared to assist in this process by providing additional evidence or documentation to support the case. Additionally, users often ask about the duration of the exemption; it typically lasts for a specific period but requires annual or periodic reviews to remain valid.

Additional forms and resources for realtors

Beyond the property-condition exemption form, realtors should be familiar with other related documents that can aid in property management. For instance, maintenance request forms allow for streamlined communication regarding property upkeep, while property disclosure forms are essential for transparency in real estate transactions.

Moreover, numerous resources are available for realtors seeking insights into property conditions. Various training opportunities and workshops can be beneficial, as well as networking events that allow for knowledge exchange among industry professionals.

Staying updated on changes to property-condition exemption regulations

Keeping informed about changes in the regulations surrounding property-condition exemptions is vital for realtors. These laws can evolve, affecting exemption eligibility and requirements. Staying engaged with governmental updates and industry news ensures that realtors can provide clients with the most accurate guidance.

Resources such as government websites and newsletters from realtor associations are excellent tools for maintaining this knowledge. Subscribing to updates will keep realtors well-informed about any legislative changes or new best practices in the field.

Testimonials and case studies

Real-life examples provide valuable insights into the effectiveness of the property-condition exemption. Many Tennessee realtors have shared success stories where utilizing this exemption facilitated smoother transactions and quicker sales, particularly in markets where minor repairs were needed.

Case studies illustrate the tangible impact of exemptions on property sales, showcasing how understanding and leveraging this exemption can lead to successful outcomes. Realtors who actively utilize these exemptions often experience enhanced client satisfaction and improved reputation in the market.

Why choose pdfFiller for document management?

Opting for pdfFiller as your document management solution provides numerous advantages for realtors navigating the complexities of property-condition exemptions. This cloud-based platform enables seamless editing, eSigning, and collaboration, maximizing efficiency in managing documents.

Real estate professionals can benefit from pdfFiller's user-friendly interface, which enhances workflow and reduces the time spent on paperwork. The platform is equipped with features that simplify managing forms and keeping track of important deadlines, ensuring that you’re always ahead in the competitive real estate landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in property-condition exemptiontennessee realtors without leaving Chrome?

How do I edit property-condition exemptiontennessee realtors straight from my smartphone?

How do I fill out the property-condition exemptiontennessee realtors form on my smartphone?

What is property-condition exemptiontennessee realtors?

Who is required to file property-condition exemptiontennessee realtors?

How to fill out property-condition exemptiontennessee realtors?

What is the purpose of property-condition exemptiontennessee realtors?

What information must be reported on property-condition exemptiontennessee realtors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.