Get the free / 2C/ -C/'+

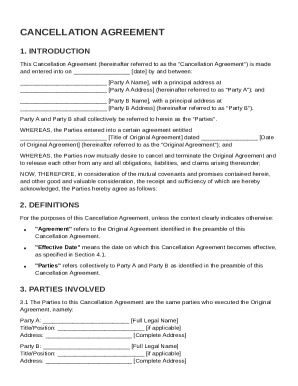

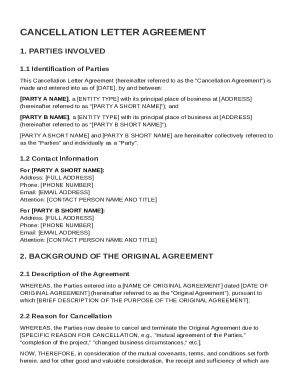

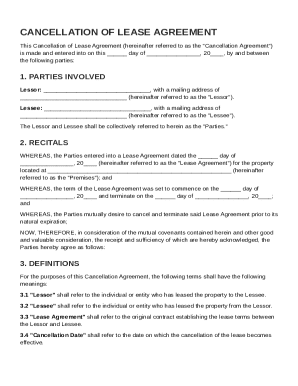

Get, Create, Make and Sign 2c -c039

Editing 2c -c039 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2c -c039

How to fill out 2c -c039

Who needs 2c -c039?

A comprehensive guide to the 2c -c039 form

Understanding the 2c -c039 form

The 2c -c039 form is an essential document designed for specific scenarios concerning payroll and taxation. This form often plays a vital role in documenting various forms of wage tax obligations and ensuring compliance with local regulations. Its accurate completion is crucial for businesses looking to maintain their standing while navigating complex tax landscapes.

Filing the 2c -c039 form allows employers to report wage information for employees, document tax withholdings, and ensure payment of applicable taxes. Errors in this form can lead to financial discrepancies or legal issues, making accuracy paramount.

Preparing to fill out the 2c -c039 form

Before diving into the completion of the 2c -c039 form, it’s crucial to gather all necessary information. This includes payroll records, tax identification numbers, and records of previous filings. Having all documentation organized ensures that the form can be completed without delays or errors.

A well-structured approach to filling out the form involves understanding its various sections. Each part of the 2c -c039 form caters to specific types of information and should be approached methodically. Being clear on what each section requires will prevent confusion and allow for more accurate submissions.

Step-by-step instructions for completing the 2c -c039 form

Filling out personal information on the 2c -c039 form requires careful attention. Each field must be completed accurately, using your employee’s legal name as it appears on relevant identification documents. A common pitfall is misspelling names or entering incorrect social security numbers, which could delay processing.

When reporting errors, the form provides specific sections for corrections. If any fields need to be amended, it's essential to follow the guidelines outlined in the form documentation to indicate these changes. Precision in this part of the form is critical to prevent future complications with tax authorities.

Editing and signing the 2c -c039 form

When it comes to editing your 2c -c039 form, pdfFiller offers an intuitive platform to make adjustments easily. Utilize the editing tools to highlight any errors and make necessary modifications while maintaining the form's integrity. Best practices include saving versions of both corrected and original forms as backups.

Once perfected, adding a digital signature is straightforward with pdfFiller’s eSigning features. This step ensures compliance with legal standards and empowers a smooth submission process. Be aware of local regulations regarding e-signatures; they may vary across different states.

Submitting the 2c -c039 form

There are various options for submitting the 2c -c039 form. For businesses that opt for online submission, follow the guidelines provided by local tax authorities, ensuring all required documents accompany your form. Alternatively, mail-in submissions must be done with care, as tracking your documents through certified mail can provide peace of mind.

Once submitted, knowing how to track the status of your submission is vital. Most tax authorities allow online tracking of submissions, ensuring you can confirm receipt without unnecessary delays. In case issues arise, be prepared to follow up directly with the relevant tax office.

Frequently asked questions about the 2c -c039 form

Understanding what mistakes can be corrected using the 2c -c039 form is helpful for many users. Common errors include incorrect wage reporting, wrong employee details, or missed tax entries. Knowing the scope of the form assists in resolving issues efficiently.

Another common question pertains to whether the form can be voided after submission. Typically, it can be rectified with additional documentation rather than outright voiding it. Guidance on updating incorrect information is also available, helping users navigate the complexities of tax reporting.

Troubleshooting common problems

Filling out the 2c -c039 form can present a range of issues, from digital errors to misinterpretations of the form's requirements. Engaging with the pdfFiller support features can offer clarity and solutions. The platform provides a user-friendly interface that allows interaction with the form, reducing initial frustration.

Common problems include issues with digital signatures and trouble uploading documents. Knowing how to address these issues effectively can save users significant time. Always consult the help section of pdfFiller for strategic troubleshooting, ensuring that users are making the best use of available resources.

Benefits of using pdfFiller for 2c -c039 form management

Using pdfFiller for managing the 2c -c039 form offers numerous advantages. The feature for seamless editing allows users to make real-time adjustments and collaborate with team members efficiently. This functionality is especially beneficial for businesses managing multiple payroll forms that require accurate reporting.

Additionally, cloud-based access allows users to retrieve their documents from anywhere, perfect for teams that require flexibility in their operations. Security remains a key factor, and pdfFiller’s compliance ensures that sensitive tax information is protected, allowing users to focus on their core business functions.

Conclusion on mastering the 2c -c039 form

Accurate management of the 2c -c039 form is integral to successful payroll operations and proactive tax management. By understanding the nuances of the form, users can avoid common pitfalls and ensure compliance with local regulations. Using pdfFiller enables a streamlined approach to filling out, editing, and submitting the form, enhancing overall workflow efficiency.

Embracing these tools allows users to focus on what truly matters — growing their businesses while maintaining tax obligations confidently. Make the most of pdfFiller’s powerful features to ensure a smooth experience with the 2c -c039 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2c -c039 without leaving Google Drive?

How do I edit 2c -c039 in Chrome?

Can I edit 2c -c039 on an Android device?

What is 2c -c039?

Who is required to file 2c -c039?

How to fill out 2c -c039?

What is the purpose of 2c -c039?

What information must be reported on 2c -c039?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.