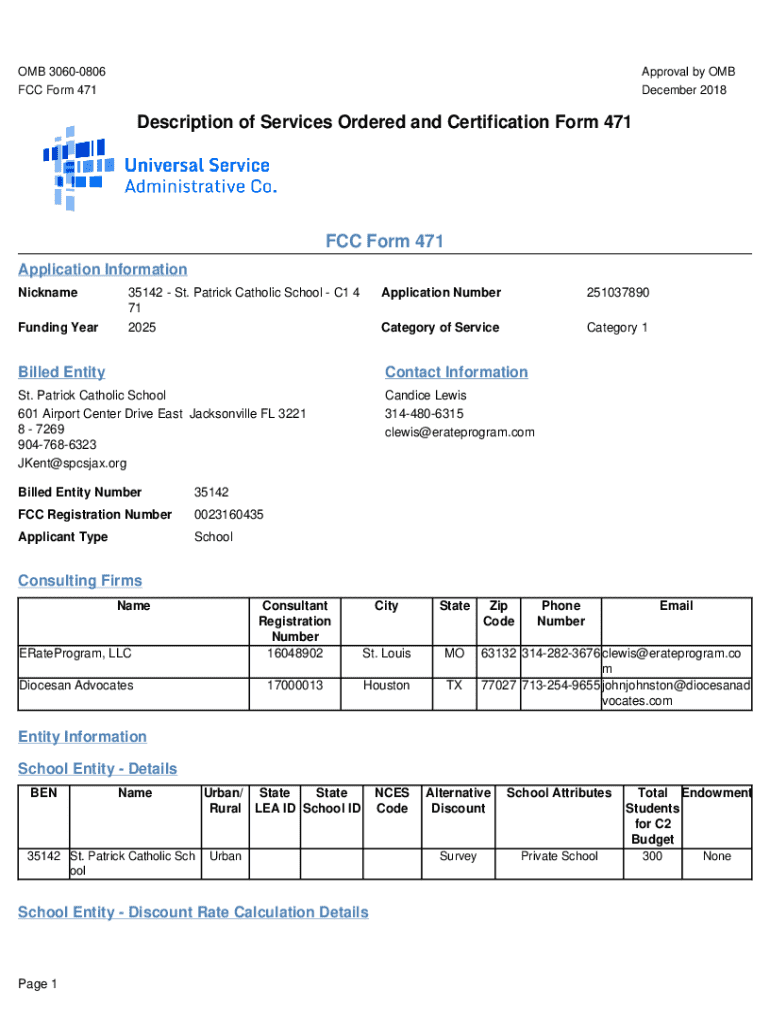

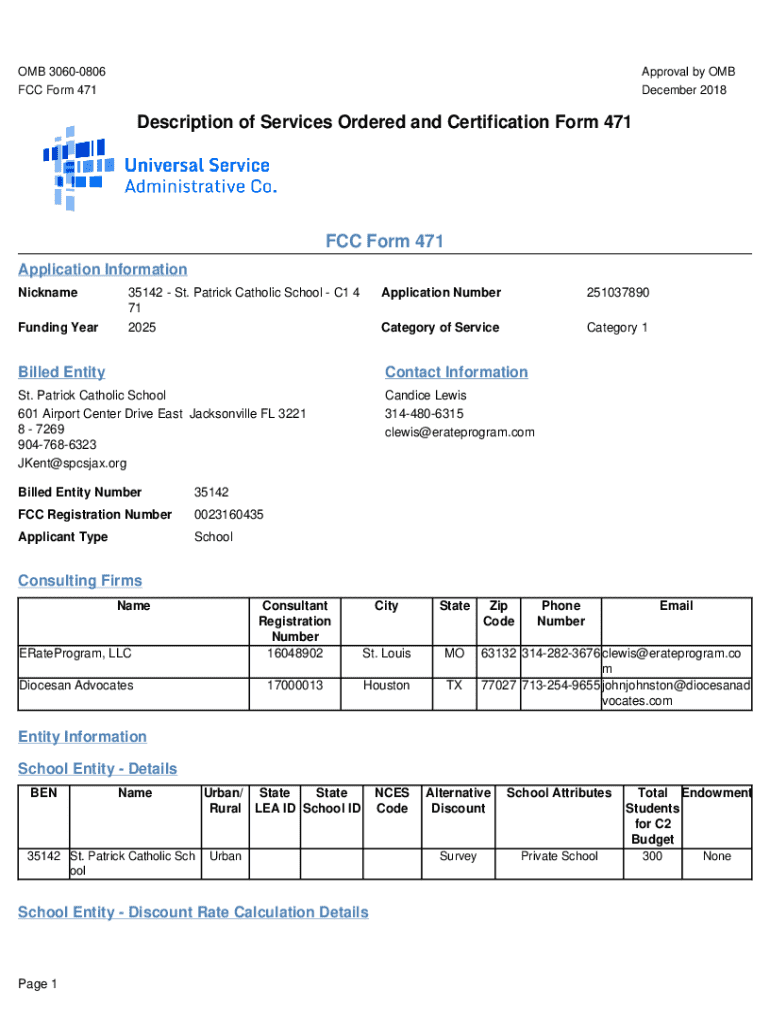

Get the free 35142 - St

Get, Create, Make and Sign 35142 - st

Editing 35142 - st online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 35142 - st

How to fill out 35142 - st

Who needs 35142 - st?

A comprehensive guide to the 35142 - st form

Overview of the 35142 - st form

The 35142 - st form is an essential document utilized in various scenarios involving financial reporting and personal data disclosure. This form serves as a vital tool, helping individuals and businesses maintain accurate records and submit necessary information to relevant authorities.

Commonly, the 35142 - st form is used in situations involving financial transactions, tax reporting, or applications for financial assistance. Understanding the nuances and the specific requirements of this form can significantly impact the outcome of the filing process.

Importance of accurate completion

Completing the 35142 - st form accurately is paramount. Errors in such documents can lead to financial discrepancies, missed opportunities for financial aid, or even legal repercussions. Thus, ensuring that every field is filled out correctly is crucial for individuals and businesses alike.

An accurate submission not only fosters trust with authorities but also paves the way for smoother interactions with financial institutions. Those who take the time to use the 35142 - st form correctly are more likely to have their applications approved promptly and without complications.

Key components of the 35142 - st form

The 35142 - st form requires specific pieces of information that can be divided into several categories. Understanding these components is essential for ensuring your form is filled out correctly and completely.

Optional sections and their relevance

While the core sections of the 35142 - st form are mandatory, optional sections are also provided for additional context. These may include supplementary financial information or explanations related to specific entries. Utilizing these sections can enhance the clarity and completeness of your submission, making a strong case for your application or report.

Step-by-step guide to filling out the 35142 - st form

Filling out the 35142 - st form may seem daunting, but with a structured approach, it becomes manageable. Here’s how to prepare and navigate through the form effectively.

Preparing to complete the form

Before diving in, gather all necessary documents such as previous tax returns, financial statements, and identification documents. Having these at your fingertips will streamline the process and ensure accuracy.

Detailed instructions for each section

Section 1: Personal Information. Enter your details accurately to avoid potential miscommunication. Double-check for typos, especially in your name and contact details.

Section 2: Financial Information. Provide detailed income and expense reports, and be vigilant about not misclassifying entries. For example, ensure that all deductions align with tax regulations to prevent issues.

Section 3: Review and Confirmation. This step is crucial. It’s essential to double-check every section of your completed form to catch any mistakes that may have been overlooked.

Final checks before submission

Make sure no fields are left blank unless they are explicitly designated as optional. A complete submission reduces the likelihood of delays or rejections.

Editing and managing the 35142 - st form

Utilizing technology can significantly simplify the process of editing and managing the 35142 - st form. Platforms like pdfFiller offer user-friendly features that make it easier to handle your documents.

Using pdfFiller for easy editing

To edit the PDF version of the form, simply upload it to pdfFiller. The platform provides a straightforward interface for making changes, allowing you to modify any part of the document without hassle.

Collaborative features for team reviews

For teams working together, pdfFiller includes collaborative features that enable real-time edits and reviews. Team members can provide feedback and make necessary changes, leading to a better final product.

Secure document management

Cloud storage within pdfFiller ensures your form and its revisions are stored securely, readily accessible wherever you may need them.

Electronic signing of the 35142 - st form

Signatures validate the authenticity of the 35142 - st form, and with the evolution of technology, electronic signatures are now widely accepted. Understanding the legal implications is essential for valid submissions.

Overview of eSignature legality

Electronic signatures hold the same weight as traditional handwritten signatures, as long as they meet current legal standards. This advancement has simplified the process in fields such as family therapy and marriage counseling, particularly in areas where appointments and paperwork can be managed virtually.

Step-by-step process for signing online

Using pdfFiller, adding your signature is straightforward. Follow the prompt to sign digitally, and ensure that you receive a copy for your records after completing the signing process.

Tracking and managing signed documents

After signing, pdfFiller helps users maintain organized records of submitted forms. You can easily track submissions and access signed copies whenever necessary, ensuring that all parties involved have the correct documents.

Interactive tools to enhance form completion

To make the experience of filling out the 35142 - st form even more efficient, pdfFiller provides several interactive tools that assist users throughout the process.

Utilizing templates for efficiency

Pre-filled templates for the 35142 - st form are available, saving users considerable time in data entry. Utilizing these templates can streamline the process significantly.

Widgets and features to simplify the process

Features such as real-time calculations for the financial reporting section make inputs easier and reduce errors that could arise from manual entry. These features help individuals and businesses enhance their accuracy while completing the form.

FAQs and help section within pdfFiller

For common issues and questions, users can access the FAQs section within pdfFiller, enhancing user experience and providing immediate support.

Tips for managing and storing your completed form

Once the 35142 - st form is completed and submitted, it’s essential to manage it properly for future reference. Implementing best practices for document retention and organization will aid in this task.

Best practices for document retention

Generally, it's advisable to keep completed forms for a minimum of five years for tax purposes and potential future reviews. This helps ensure that you can respond to any inquiries swiftly and substantiate your financial claims.

Organizing your forms for easy retrieval

Create a structured filing system that categorizes your forms based on type, date, or purpose. Establishing a consistent naming convention will make retrieval much easier when you need to revisit or share these documents.

Sharing and distributing the 35142 - st form

When sharing the 35142 - st form, ensure that it is shared securely. Use encrypted email services or cloud platforms like pdfFiller to safeguard sensitive information while distributing the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 35142 - st?

Can I sign the 35142 - st electronically in Chrome?

How do I complete 35142 - st on an iOS device?

What is 35142 - st?

Who is required to file 35142 - st?

How to fill out 35142 - st?

What is the purpose of 35142 - st?

What information must be reported on 35142 - st?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.