Get the free What Happens if I Lie on a Statutory Declaration Form?

Get, Create, Make and Sign what happens if i

How to edit what happens if i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what happens if i

How to fill out what happens if i

Who needs what happens if i?

What happens if form: A comprehensive guide

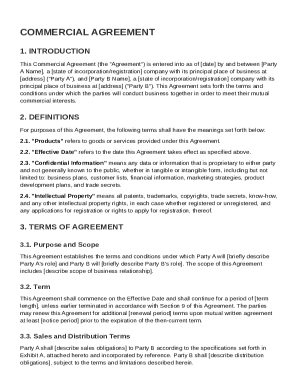

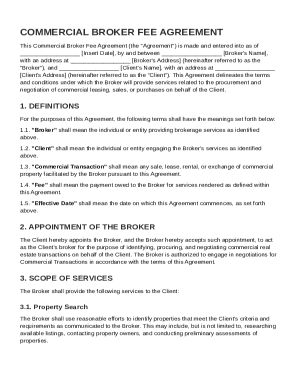

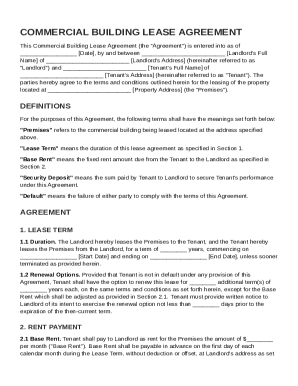

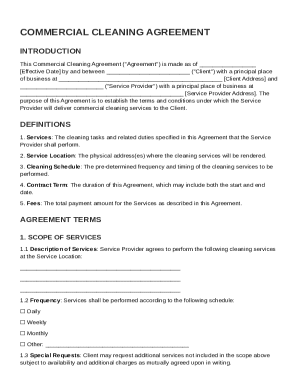

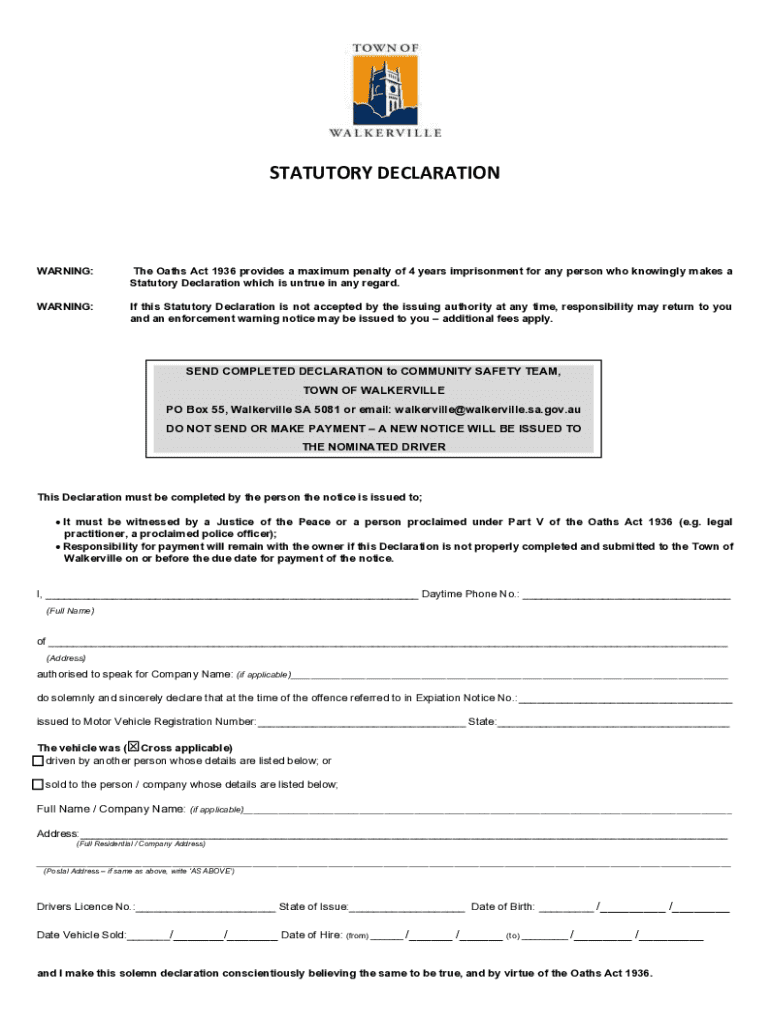

Understanding the form

When you encounter the term 'form' in a business context, it usually refers to a document required by government agencies or financial institutions. This can encompass a range of purposes, from filing taxes to reporting cash transactions. Each form plays a vital role in ensuring compliance with regulations and facilitating proper documentation.

What is the purpose of this form?

The primary purpose of forms is to collect necessary information for various reporting and regulatory requirements. Businesses may need to file forms for activities that involve cash transactions, such as Sales Receipts, Currency Transaction Reports, or even Suspicious Activity Reports. These documents help track financial flows and ensure transparency in trade, helping agencies monitor for any irregularities.

Who is required to file?

Almost anyone engaged in business activities involving cash deals may be required to file these forms. Business owners, financial institutions, and even individual taxpayers must understand their obligations. For instance, businesses involved in high-volume cash transactions must file specific reports to comply with the law. Failure to do so could result in significant penalties.

Types of forms covered

Forms can vary greatly depending on the context. Common types include information returns, such as W-2 or 1099 forms for reporting income, and Currency Transaction Reports for transactions exceeding a certain threshold. Understanding which forms you need to complete is essential for compliance and can vary based on jurisdiction.

The filing process

Filing a form may seem straightforward, but there are crucial steps involved. Understanding these steps ensures that you complete the process correctly and on time, avoiding potential pitfalls associated with incorrect filings.

Step-by-step instructions for completing the form

To complete your form accurately, follow these step-by-step instructions:

Different filing methods

Deciding how to file your form is essential. Depending on the agencies and type of form, you can choose between electronic and paper filing.

E-filing

E-filing is the most convenient option, allowing you to submit forms through online platforms quickly. It often facilitates faster processing times and offers additional tools to ensure your form is completed accurately.

Paper filing

Although less common now, paper filing may still be required for specific forms. Remember to mail your finished form to the correct agency, ensuring it is sent at least a week before the deadline to avoid unforgiving delays.

Understanding deadlines and submission guidelines

Each form comes with its own set of deadlines and submission guidelines. Research these timelines to ensure timely filing, as late submissions can result in consequences like fines or even audits. Keeping a calendar of critical dates for all forms will keep your filing organized.

Consequences of filing the form

Once you have submitted your form, it triggers a series of reactions, including various notifications from regulatory bodies. Understanding these can provide clarity on what to expect next.

What happens after you submit the form?

After submission, the form is processed by the respective agencies. You may receive a confirmation or an acknowledgment receipt, indicating your filing has been received.

Notifications and responses from authorities

In some cases, agencies will send further inquiries or requests for additional information. It’s vital to respond promptly to avoid complications.

The importance of accuracy: what errors to watch for

Accuracy is paramount when filing forms. Errors can lead to longer processing times or mismatches in records. Things like typographical mistakes in your Tax Identification Number or missing income information can complicate your filing.

Potential consequences of incorrect or late filing

Filing forms late or with inaccuracies can lead to various consequences, including penalties, increased scrutiny from agencies, or even legal ramifications. Understanding the severity of these repercussions can motivate business owners to uphold compliance and precision.

Keeping your documents organized

Organization of documents related to forms is crucial for both personal ease and compliance. Ideally, you should establish a systematic storage process to find documents quickly when needed.

Best practices for form storage

Implement best practices by leveraging cloud-based document management solutions that offer secure, organized storage. Sorting forms by date or purpose helps simplify retrieval and sharing down the line.

Using pdfFiller to manage your forms

pdfFiller empowers you in managing forms efficiently. With user-friendly features such as editing capabilities and e-signing, your filing process can become more streamlined and manageable.

Editing capabilities

The pdfFiller platform allows you to edit PDF forms directly in your browser. This functionality can save significant time, especially when correcting minor errors or adjusting information.

eSigning made easy

With pdfFiller, the e-signing process is simple and effective. You can add a legally-binding signature to your documents without the hassle of printing, signing, and scanning.

Collaboration features for teams

pdfFiller enhances team productivity by providing features that allow multiple users to work on a form simultaneously. This is particularly beneficial in business environments where timely submissions are essential.

Tips for easy retrieval and sharing

Establish a clear naming convention for your files and use tags to categorize documents within pdfFiller. By doing this, you'll enhance the ease of retrieval and sharing with stakeholders.

Addressing common concerns

Many individuals and businesses face similar concerns when it comes to filing forms. Addressing these issues can provide clarity and confidence throughout the filing process.

What to do if your form is denied

If your form is denied, immediately address the reasons for the denial. Most agencies provide feedback or clarification regarding what aspects require change or restructuring.

Frequently asked questions about the form

Keep a repository of frequently asked questions related to your forms. Understanding common queries can better inform users about filing requirements and concerns that others have experienced.

Legal implications of not filing

Failing to file required forms can come with legal implications, including fines, audits, and compliance reviews. Businesses must be proactive in ensuring they meet their filing obligations to avoid these potential issues.

Advanced tips for managing your forms

As you become more familiar with filing forms, leveraging technology can significantly improve how you manage your paperwork and obligations.

Streamlining your form-related tasks with technology

Consider using advanced document management solutions that automate reminders for filing deadlines and task updates. Integrating tools like pdfFiller can keep your files organized while maintaining compliance.

Interactive tools offered by pdfFiller

pdfFiller provides interactive templates that make form completion straightforward. Customizing these templates for your specific needs can save time on future submissions.

Customizing templates for future use

Develop a library of custom templates designed specifically for your business’s frequent transactions or filings. This practice can make future form completion quicker and more efficient.

When to seek professional help

Navigating complex form filing requirements can be daunting. Recognizing when to seek professional help can be a game-changer for managing your documents.

Signs that you might need expert guidance

If you are facing complexities with your forms, such as unfamiliar tax codes, highly regulated transactions, or disputes with agency responses, seeking expert guidance can help alleviate these challenges.

How to choose a professional (lawyer/consultant)

When choosing a professional, consider their expertise in the specific area of forms you are dealing with. Ask for referrals from trusted colleagues or check for credentials that pertain to your needs.

Benefits of professional assistance

Experts can help ensure accurate submissions, potentially saving you from costly errors and fines. They can also provide strategic advice tailored to your business activities, increasing overall compliance confidence.

Leveraging pdfFiller for seamless management

Utilizing a platform that centralizes your form management can save time and reduce stress around paperwork. pdfFiller is designed to make this process as fluid as possible.

Overview of pdfFiller features

pdfFiller encompasses features that facilitate document creation, editing, and sharing. With tools for commenting and tracking changes, collaboration is streamlined, making use in team environments particularly efficient.

How pdfFiller enhances your document experience

The ease of use and comprehensive functionality of pdfFiller creates an enhanced user experience. Features like digital signatures speed up processes, making managing forms less of a burdensome ordeal.

User testimonials: success stories with pdfFiller

Many users rave about the advantages pdfFiller brings to their form management processes. Testimonials often highlight increased efficiency, cost savings in legal fees, and reduced stress associated with compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in what happens if i?

Can I create an electronic signature for signing my what happens if i in Gmail?

How do I edit what happens if i on an iOS device?

What is what happens if i?

Who is required to file what happens if i?

How to fill out what happens if i?

What is the purpose of what happens if i?

What information must be reported on what happens if i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.