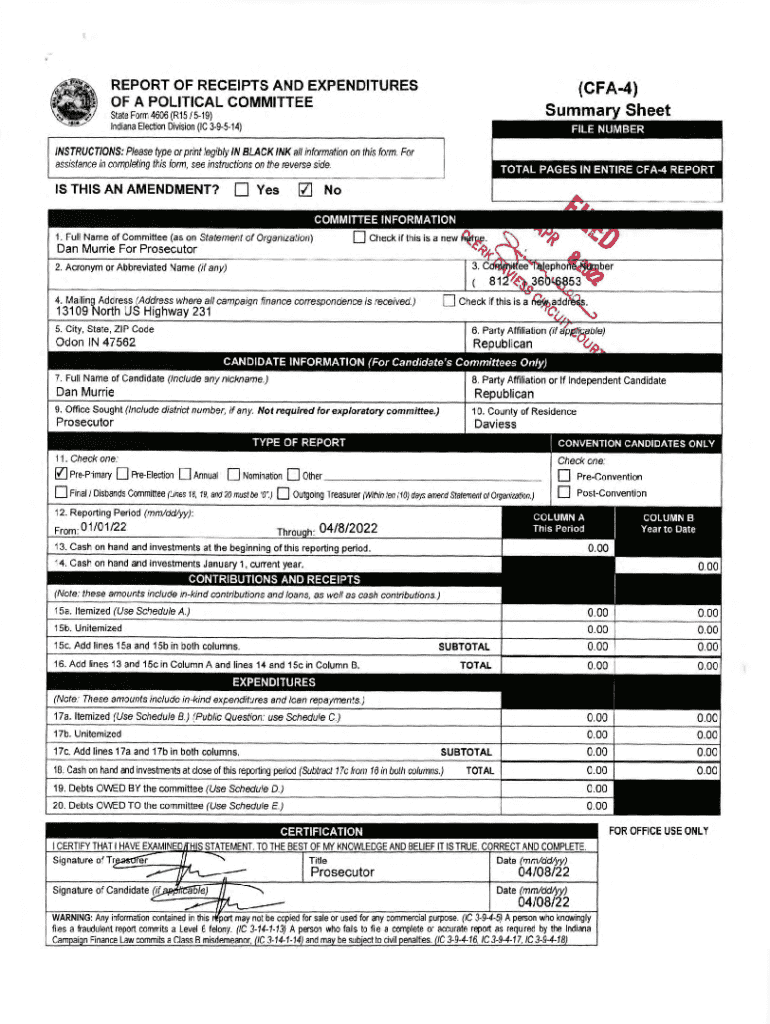

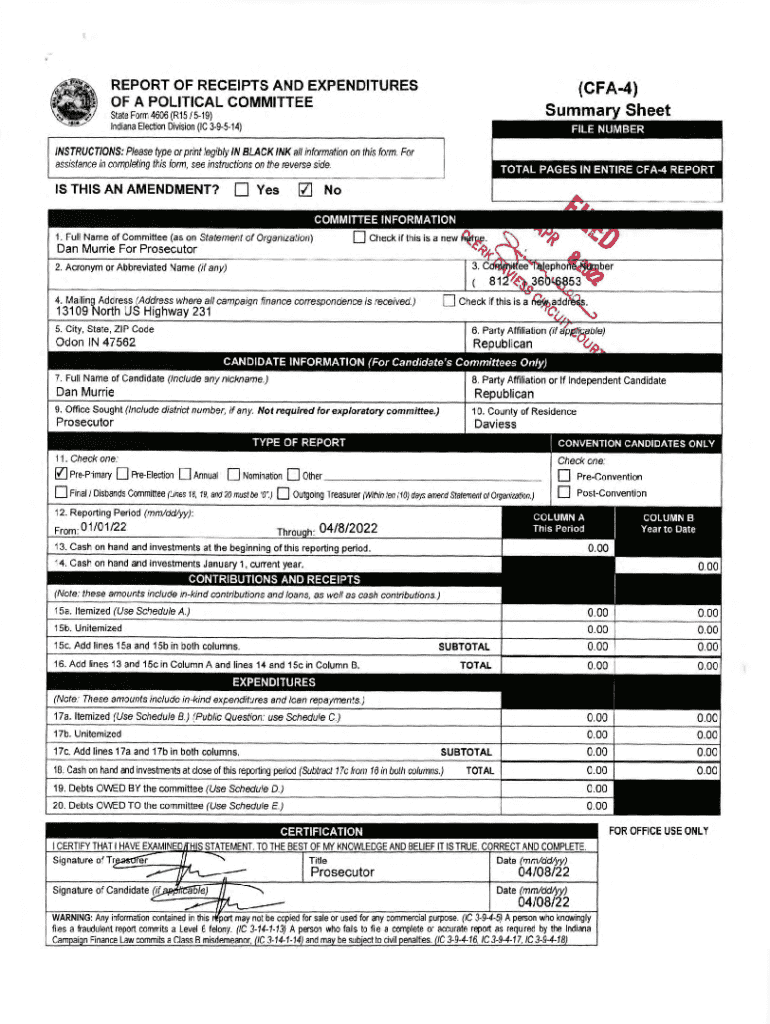

Get the free State Form 4606 (R15 /5-19)

Get, Create, Make and Sign state form 4606 r15

Editing state form 4606 r15 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state form 4606 r15

How to fill out state form 4606 r15

Who needs state form 4606 r15?

How to Guide on State Form 4606 R15 Form

Understanding state form 4606 R15

State Form 4606 R15 serves as a critical document within specific state contexts, aiding individuals and teams in various administrative processes. This form is integral for effective communication with state authorities, ensuring compliance with regulations that might pertain to taxation, business operations, or civic requirements. Understanding its significance is essential for proper utilization.

Individuals, businesses, and civic organizations often rely on State Form 4606 R15 for crucial declarations or requests. Familiarizing oneself with this form and its purposes can streamline interactions with governmental departments, thereby enhancing efficiency in administrative tasks.

Accessing state form 4606 R15

Accessing State Form 4606 R15 can be done through official state websites or platforms specialized in document management. Official sources ensure that users acquire the most current version of the form, which is necessary for compliance. Users can typically find this form on government portals designated for public submissions.

When utilizing pdfFiller, you can easily navigate via their search functionality. Simply enter 'State Form 4606 R15' in the search bar, and the platform will provide immediate access to the document. Users can download and save the form in various formats, which can greatly enhance efficiency.

Step-by-step guide to filling out state form 4606 R15

Before filling out the State Form 4606 R15, it's imperative to gather necessary information such as identification numbers, personal details, and any relevant documentation that may support your application or request. Ensure you have all supporting evidence ready to avoid common pitfalls associated with incomplete submissions.

When you're ready to fill out the form, start with the first section and follow the instructions carefully. Each field will often have a unique requirement; for instance, personal identification should match exactly with legal documentation to avoid discrepancies. It’s advisable to have a checklist handy as you fill out each part to ensure no section is overlooked.

Editing state form 4606 R15

Editing State Form 4606 R15 can be seamlessly managed through pdfFiller’s powerful editing tools. Whether you need to make corrections or updates, the platform is designed for user convenience, allowing for a streamlined experience. Utilizing features such as text editing, adding comments, or even inserting new fields can make a significant difference.

The collaborative features of pdfFiller allow you to share the document with team members easily, and they can add their input through comments or direct edits. This interactive aspect ensures everyone involved stays informed and can provide real-time feedback, enhancing the overall submission process.

eSigning state form 4606 R15

eSigning is essential for State Form 4606 R15 as it legally binds the signers to the information provided. This digital signature can facilitate faster processing times by eliminating the necessity for physical signatures, thus optimizing the workflow. pdfFiller makes this process straightforward, enabling signatures to be obtained quickly.

The ability to eSign from anywhere means you won't have to worry about delays due to physical mail or in-person meetings. This efficiency is particularly valuable for remote teams or individuals with tight schedules. Ensure that all parties understand the signing flow to prevent any potential confusion.

Submitting state form 4606 R15

Submitting State Form 4606 R15 can be accomplished through various methods, depending on specific state instructions. Electronic submissions are often encouraged for their convenience, allowing for quicker processing times and immediate confirmation of receipt.

Understanding submission deadlines and requirements is critical. Each state may have unique timelines and consequences for late submissions, which can include financial penalties or additional scrutiny on your next filing. Mark these dates on your calendar to ensure compliance.

Managing your state form 4606 R15 documents

Once State Form 4606 R15 has been submitted, proper management of your documents is paramount. Organizing your completed forms in a digital format allows for quick retrieval and review. Best practices include creating folders based on type or submission year, which simplifies future access.

Additionally, accessing previous versions of the form can be crucial, especially if any adjustments need to be made post-submission. Having a history of prior submissions provides clarity and aids in any necessary revisions while maintaining compliance.

Troubleshooting common issues

Common errors when filling out State Form 4606 R15 can include incomplete fields, incorrect information, or failure to adhere to submission guidelines. Such mistakes may lead to delays or rejections, emphasizing the need for careful oversight during the filling process.

For further assistance, utilize pdfFiller’s support resources or engage with community forums that discuss the State Form 4606 R15. Gathering insights or troubleshooting tips from others who have similar experiences can prove invaluable.

Additional features of pdfFiller for document management

pdfFiller offers a robust suite of document management features beyond just form completion. Integrations with other tools streamline workflows and enhance the overall user experience. These integrations can connect with accounting software, cloud storage solutions, and collaboration platforms, further optimizing processes.

As pdfFiller continues to develop, users will benefit from enhancements based on user feedback, fostering an environment designed to meet evolving document management needs. Keeping informed about these updates allows individuals and teams to leverage the latest tools for improved efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my state form 4606 r15 directly from Gmail?

How do I execute state form 4606 r15 online?

How do I edit state form 4606 r15 on an Android device?

What is state form 4606 r15?

Who is required to file state form 4606 r15?

How to fill out state form 4606 r15?

What is the purpose of state form 4606 r15?

What information must be reported on state form 4606 r15?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.