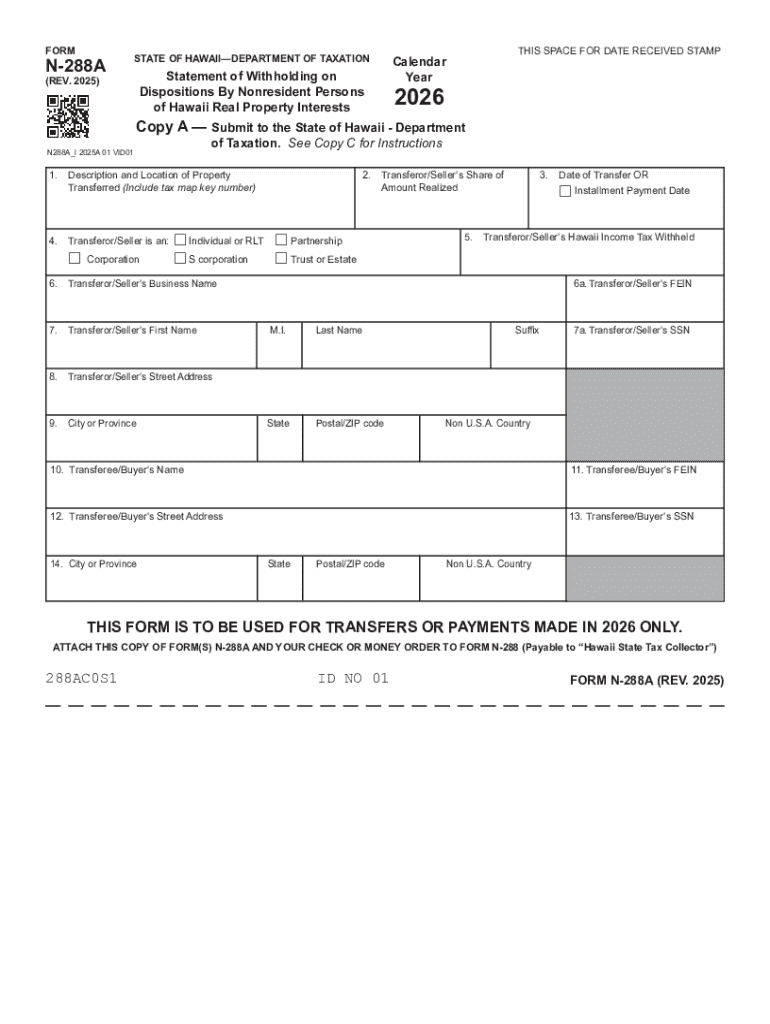

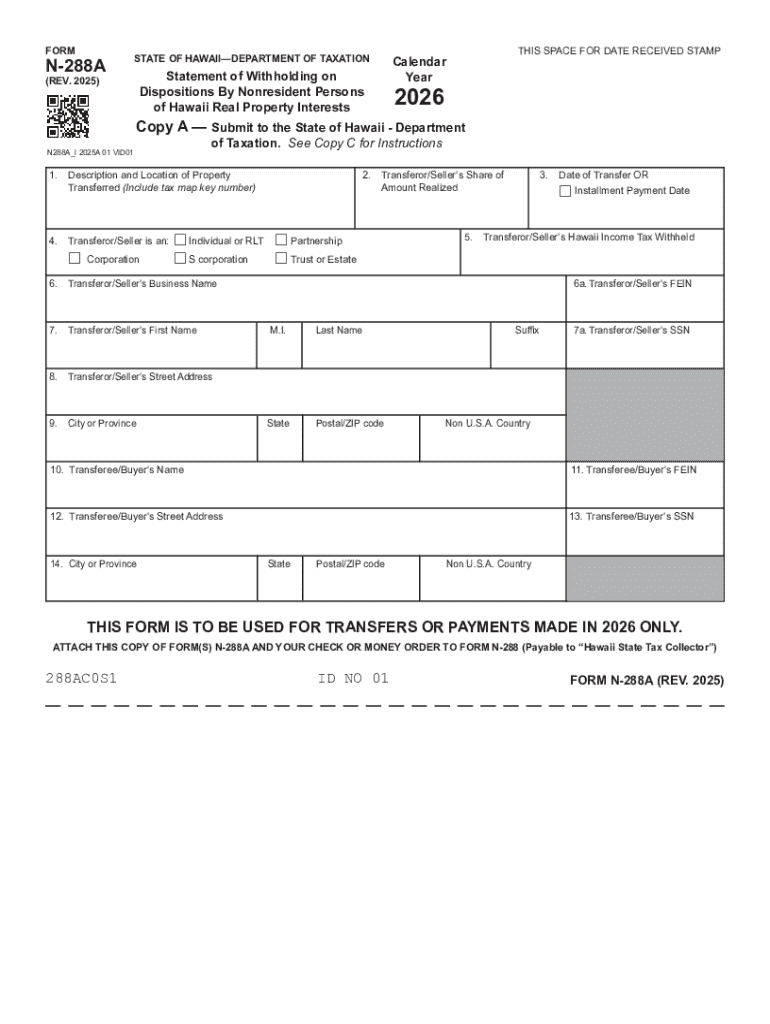

Get the free N-288A (Rev.2025), Statement of Withholding on Dispositions by NonResident Persons o...

Get, Create, Make and Sign n-288a rev2025 statement of

How to edit n-288a rev2025 statement of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out n-288a rev2025 statement of

How to fill out n-288a rev2025 statement of

Who needs n-288a rev2025 statement of?

Understanding the n-288a rev2025 Statement of Form: A Comprehensive Guide

Overview of n-288a rev2025 statement of form

The n-288a rev2025 statement of form plays a vital role in effective document management, particularly for individual taxpayers and business entities navigating various reporting requirements. This form, designed to streamline and clarify specific financial disclosures, emerges as a simple yet powerful tool in the tax landscape.

Understanding its importance is essential, as the n-288a rev2025 can help users fulfill their obligations while ensuring accuracy and compliance with tax regulations. The form is typically utilized for reporting specific income types and financial data necessary for the IRS.

Eligibility criteria for filing n-288a rev2025

Eligibility to file the n-288a rev2025 statement of form is determined by both individual and entity requirements. Individual taxpayers, especially those with specific income considerations, must evaluate if their financial circumstances necessitate this submission. Similarly, business entities, particularly small businesses with unique financial reporting necessities, often find themselves required to complete this form.

Certain conditions, such as unique income sources or varying reporting need, dictate eligibility, meaning it's crucial for taxpayers to understand whether their situation fits within the framework of the n-288a rev2025.

Detailed instructions for completing the n-288a rev2025 form

Completing the n-288a rev2025 is straightforward when you follow a structured approach. Start with the Personal Information Section, where you'll input identifying information such as name, address, and Social Security Number. Accuracy in this area is crucial as it forms the foundation for the entire document.

The next step is the Financial Information Section. Here, you will detail all relevant income and deductions. A thorough understanding of your financial data will help ensure this section is filled out correctly. Lastly, complete the Signature and Submission Details, ensuring you've adhered to all guidelines specified.

As you progress through the form, keep in mind some common pitfalls, such as incorrect identification entries or misreporting figures in the financial section. By double-checking your entries and utilizing the resources provided, such as pdfFiller, you can avoid these errors effectively.

Utilizing pdfFiller for editing and managing the n-288a rev2025 form

Accessing the n-288a rev2025 form through pdfFiller simplifies the editing and management process significantly. This platform enables users to edit the document online, ensuring you have the flexibility to make adjustments as needed without the hassle of traditional paperwork.

pdfFiller's tools for customization, such as adding signatures, inserting text or images, and even annotating documents, enhance the user's ability to create a polished final document. These features are particularly beneficial for teams who may collaborate on the form, requiring streamlined communication and adjustments.

The main advantage of using pdfFiller lies in its comprehensive offerings for document management. You can track changes, save versions, and maintain all your documents in one place, enhancing not only productivity but also organization.

Securing your n-288a rev2025 submission

Security is paramount when submitting sensitive information through the n-288a rev2025 form. In a landscape where data breaches are common, ensuring the integrity and confidentiality of your submission should be a priority. pdfFiller provides robust security features that safeguard your sensitive information from unauthorized access.

Utilizing safe storage practices and employing eSignature for authentication not only secures your submission but also streamlines the verification process. By leveraging these features, users can ensure that their documents remain protected and that they can easily confirm authenticity as needed.

Collaboration features for teams handling the n-288a rev2025

Collaboration on the n-288a rev2025 form can be facilitated seamlessly through pdfFiller. The platform supports real-time editing, allowing multiple team members to contribute to the document simultaneously. This collaboration tool proves essential in enhancing efficiency and accuracy, ensuring that everyone is on the same page.

Feedback features enable teams to review and approve changes quickly, streamlining the workflow and significantly reducing turnaround time for document completion. Best practices involve establishing clear roles and responsibilities within your team to manage the editing and approval process adequately.

Accessibility and mobility with n-288a rev2025

The n-288a rev2025 form can be accessed wherever you are, thanks to pdfFiller’s cloud-based platform. This accessibility eliminates the need for physical storage and allows users to manage their forms on the go, catering perfectly to the needs of today’s mobile professionals.

Whether you're using a laptop, tablet, or smartphone, pdfFiller’s interface is optimized for various devices. This means you can fill out, edit, and sign documents efficiently while ensuring compatibility across all platforms. Mobile access tips include downloading the pdfFiller app, which further enhances the user experience.

Frequently asked questions (FAQ) about n-288a rev2025

It's common for users to have questions surrounding the n-288a rev2025 statement of form, particularly regarding its submission timelines and processing. Understanding how quickly the IRS processes these forms can alleviate concerns and ensure you're planning your submissions in accordance with deadlines.

Many users wonder about follow-up processes after submission. Typically, you can expect acknowledgment from the IRS once your form has been processed; however, having a system in place to track your submissions through pdfFiller can help clarify any uncertainties that may arise.

Additional features of pdfFiller relevant to n-288a rev2025

Beyond the n-288a rev2025, pdfFiller provides a wide array of document templates and tools aimed at enhancing comprehensive document management. Users can explore various templates for different forms, making pdfFiller not just a platform for the n-288a, but a one-stop-shop for all documentation needs.

Integrative solutions within the platform further streamline the paperwork process, ensuring that teams can collaborate efficiently, track changes, and maintain accurate records. By leveraging pdfFiller's tools, users can transform their overall paperwork processes into a more organized and less stressful experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit n-288a rev2025 statement of from Google Drive?

How can I get n-288a rev2025 statement of?

How can I fill out n-288a rev2025 statement of on an iOS device?

What is n-288a rev2025 statement of?

Who is required to file n-288a rev2025 statement of?

How to fill out n-288a rev2025 statement of?

What is the purpose of n-288a rev2025 statement of?

What information must be reported on n-288a rev2025 statement of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.