Get the free tomorrows-scholar-529-roth-ira-rollover-request-form. ...

Get, Create, Make and Sign tomorrows-scholar-529-roth-ira-rollover-request-form

How to edit tomorrows-scholar-529-roth-ira-rollover-request-form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tomorrows-scholar-529-roth-ira-rollover-request-form

How to fill out tomorrows-scholar-529-roth-ira-rollover-request-form

Who needs tomorrows-scholar-529-roth-ira-rollover-request-form?

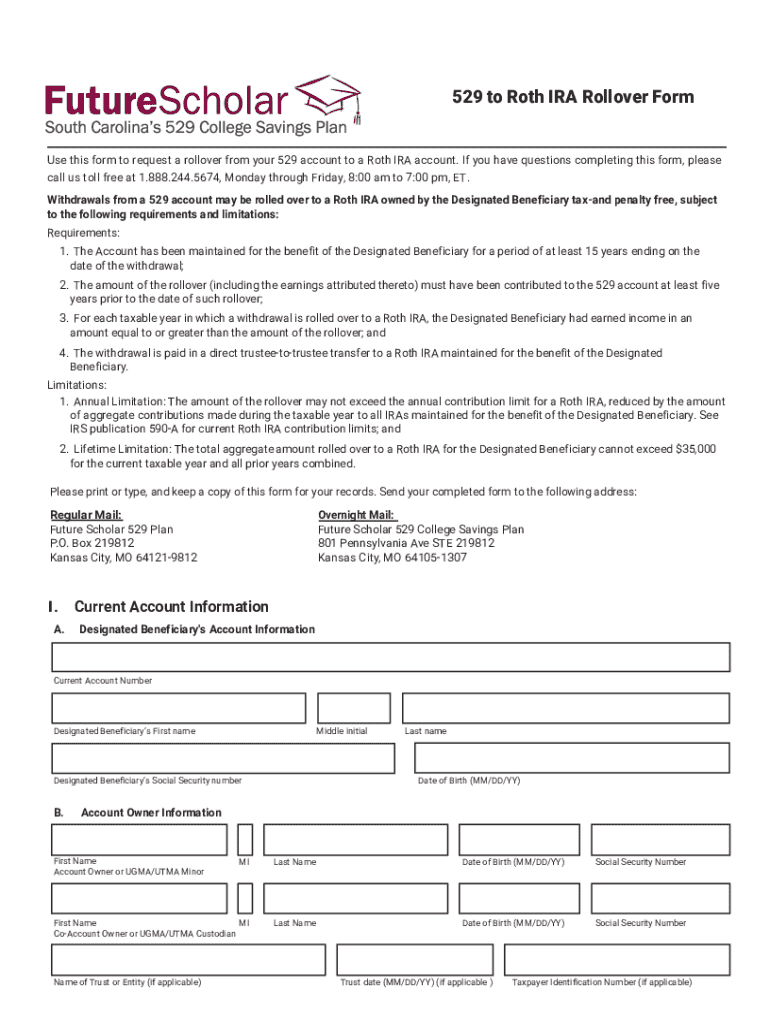

Navigating the Tomorrows Scholar 529 Roth IRA Rollover Request Form

Understanding the 529 plan and Roth IRA rollovers

A 529 plan is a tax-advantaged savings account designed to encourage saving for future education expenses. It features various investment options to increase the value of contributions over time. On the other hand, a Roth IRA rollover allows you to transfer assets from a Roth IRA into a different retirement account or a different type of investment, maintaining the tax-free growth that Roth IRAs offer.

Initiating a rollover request is crucial for maximizing your financial strategy. It can help consolidate accounts, diversify investments efficiently, or adjust your savings goals to align with evolving educational expectations or retirement needs.

When considering 529 plans versus Roth IRAs, both provide advantageous tax benefits but serve different purposes. 529 plans primarily focus on education savings, while Roth IRAs benefit retirement savings. Withdrawals from 529 plans for qualified educational expenses are tax-free, while Roth IRA qualified distributions post 59½ years are also tax-free.

Overview of the Tomorrows Scholar 529 plan

The Tomorrows Scholar 529 plan stands out by offering a range of features beneficial for long-term education savings. One of the primary benefits includes tax-free growth on contributions allocated to investment vehicles within the plan. Investors can choose from various portfolios, thereby tailoring their approach to risk tolerance and financial goals.

With flexible contribution options, Tomorrows Scholar allows for periodic contributions or lump-sum deposits. Furthermore, account owners can potentially benefit from state tax deductions depending on their residency, enhancing the plan's efficacy in education savings.

Importance of rollover request forms

A rollover request form is a necessary document to facilitate the transfer of funds between a 529 plan and a Roth IRA or vice versa. This form ensures that the rollover process adheres to IRS regulations while maintaining your tax advantages during the transition.

Many people initiate a rollover to simplify their finances, combine multiple accounts into a single entity, or switch providers for improved investment options. Understanding the implications, such as potential tax consequences or penalties, is crucial when proceeding with a rollover.

Step-by-step guide to completing the rollover request form

Completing the rollover request form can feel daunting, but breaking it down into manageable steps will simplify the process. Following these structured guidelines will ensure a smooth transition between accounts.

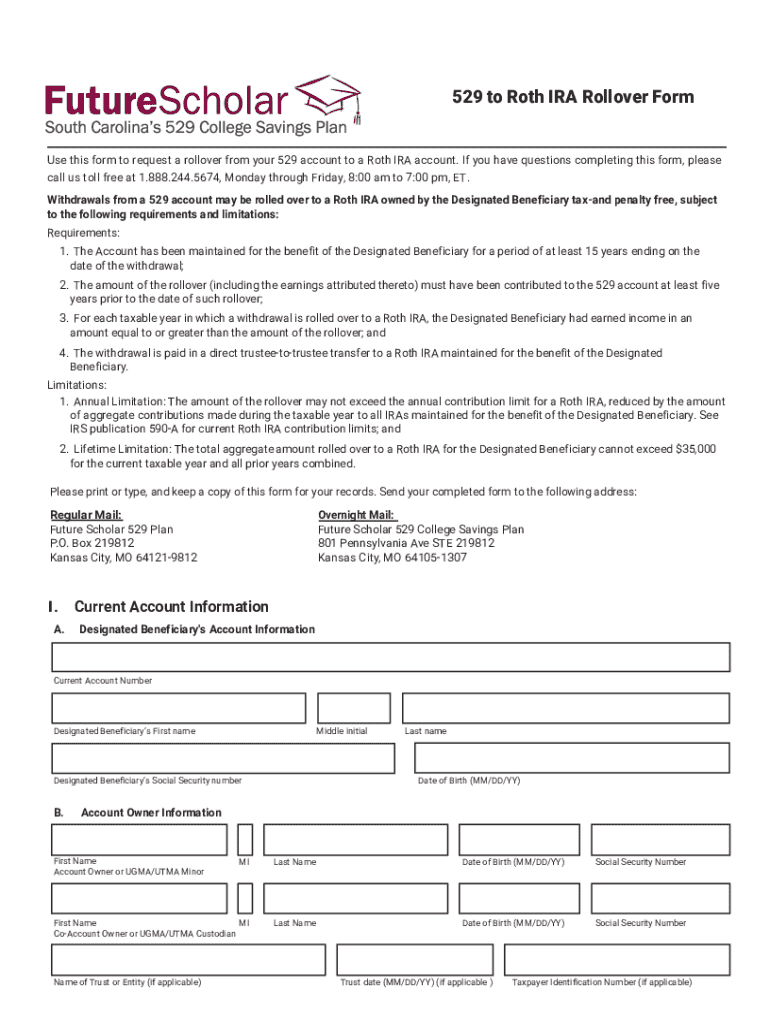

Step 1: Gather necessary information

Start by collecting your personal details, including your name, address, and Social Security number. It’s also essential to have account numbers and details of the existing Roth IRA or 529 plan handy to complete the forms accurately.

Step 2: Fill out the rollover request form

The rollover request form typically includes various sections requiring specific information. Be diligent in specifying rollover amounts and the details of both the original and recipient accounts. Clear and concise entries in this section can prevent unnecessary delays.

Step 3: Review the completed form

After filling out the form, review it thoroughly for accuracy and completeness. A checklist can be handy to ensure all required fields have been addressed. Watch out for common mistakes such as incorrect account numbers or missing signatures.

Step 4: Submit your rollover request

Decide on a submission method: online, mail, or fax. If submitting online through pdfFiller, you can track your submission status efficiently. If mailing, ensure you keep a copy for your records.

Interactive tools and resources on pdfFiller

pdfFiller offers an array of tools designed to streamline the editing and management of the rollover request form. Users can edit the document directly within the platform, adding personal information, signatures, and even collaborate with financial advisors seamlessly.

Using features like cloud storage, document analytics, and e-signature integration can significantly simplify the form submission process. The platform’s user-friendly interface makes it easier for individuals and teams to work on documents without the worry of formatting issues.

Managing your accounts post-rollover

Once you have submitted your rollover request, take proactive steps to manage your new accounts effectively. Monitor the performance regularly, ensuring that your investments align with your financial goals and objectives. Additionally, keeping an eye on fees associated with account maintenance can save you money in the long run.

Continue to contribute to your new 529 plan or Roth IRA as finance permits, as regular contributions increase your chances of meeting long-term savings goals. Understand that both account types have different rules regarding withdrawals — knowing when and how to withdraw funds can optimize your financial strategy.

FAQs about the Tomorrows Scholar 529 Roth IRA rollover

As with any financial process, numerous questions frequently arise regarding rollover eligibility, tax implications, and penalties. Common inquiries include whether all contributions made to a 529 plan can be rolled over into a Roth IRA, and if there are limits on how frequently you can perform rollovers.

Additionally, confusion regarding potential tax penalties for early withdrawals often leads individuals to seek clarification. It’s important to know that both Tomorrows Scholar and platforms like pdfFiller offer support resources to navigate these questions effectively.

Additional insights for a successful rollover process

Optimizing your education and retirement savings doesn’t have to be complicated. Utilizing strategies that focus on effective financial planning, such as setting clear savings goals, can maximize both your 529 plan and Roth IRA's potential benefits. For many, consulting a financial advisor can lead to tailored solutions designed for individual circumstances.

It’s also beneficial to explore synergistic strategies between your education and retirement accounts to improve the overall savings outcome. Collaborative planning ensures that you leverage tax advantages while perusing the best account for your specific needs over time.

The pdfFiller advantage

Utilizing pdfFiller bestows users with significant advantages for seamless document management, especially concerning rollover request forms. The platform’s core functionalities empower users to edit PDFs, eSign documents, and collaborate efficiently, eliminating the complications associated with traditional paperwork.

For individuals or teams, pdfFiller creates a controlled environment whereby collaborative work on forms can occur in real-time, thus enhancing productivity. Success stories of users who have effectively facilitated rollovers through pdfFiller illustrate the platform's reliability and user-centric design.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the tomorrows-scholar-529-roth-ira-rollover-request-form in Gmail?

How do I complete tomorrows-scholar-529-roth-ira-rollover-request-form on an iOS device?

Can I edit tomorrows-scholar-529-roth-ira-rollover-request-form on an Android device?

What is tomorrows-scholar-529-roth-ira-rollover-request-form?

Who is required to file tomorrows-scholar-529-roth-ira-rollover-request-form?

How to fill out tomorrows-scholar-529-roth-ira-rollover-request-form?

What is the purpose of tomorrows-scholar-529-roth-ira-rollover-request-form?

What information must be reported on tomorrows-scholar-529-roth-ira-rollover-request-form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.