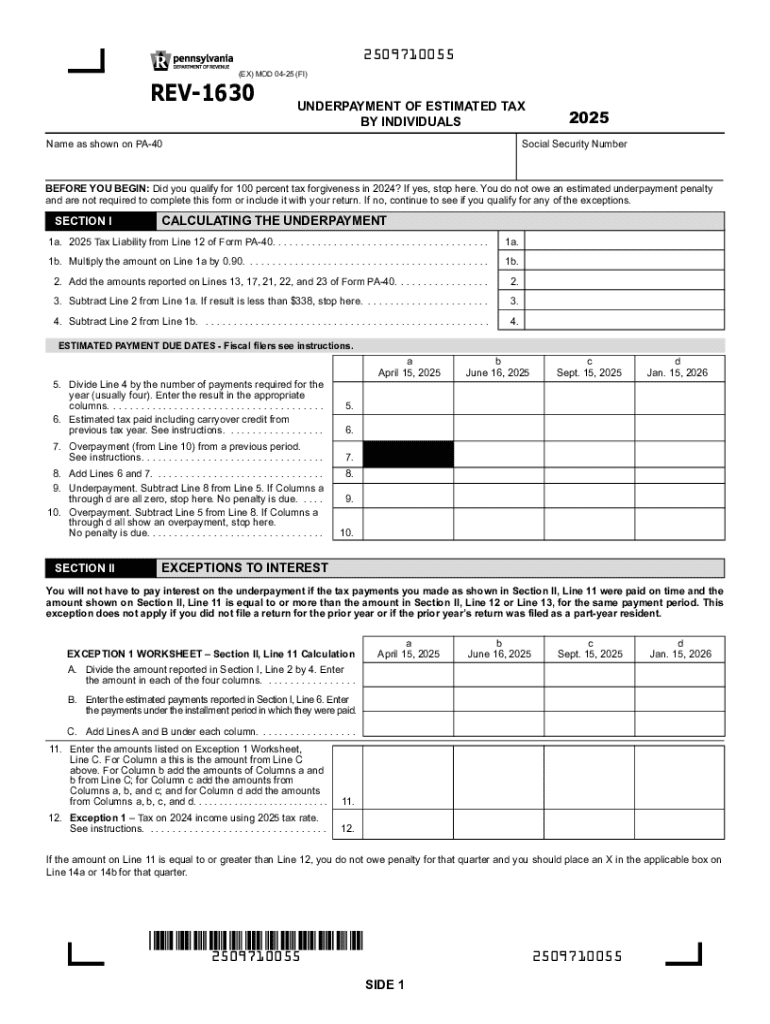

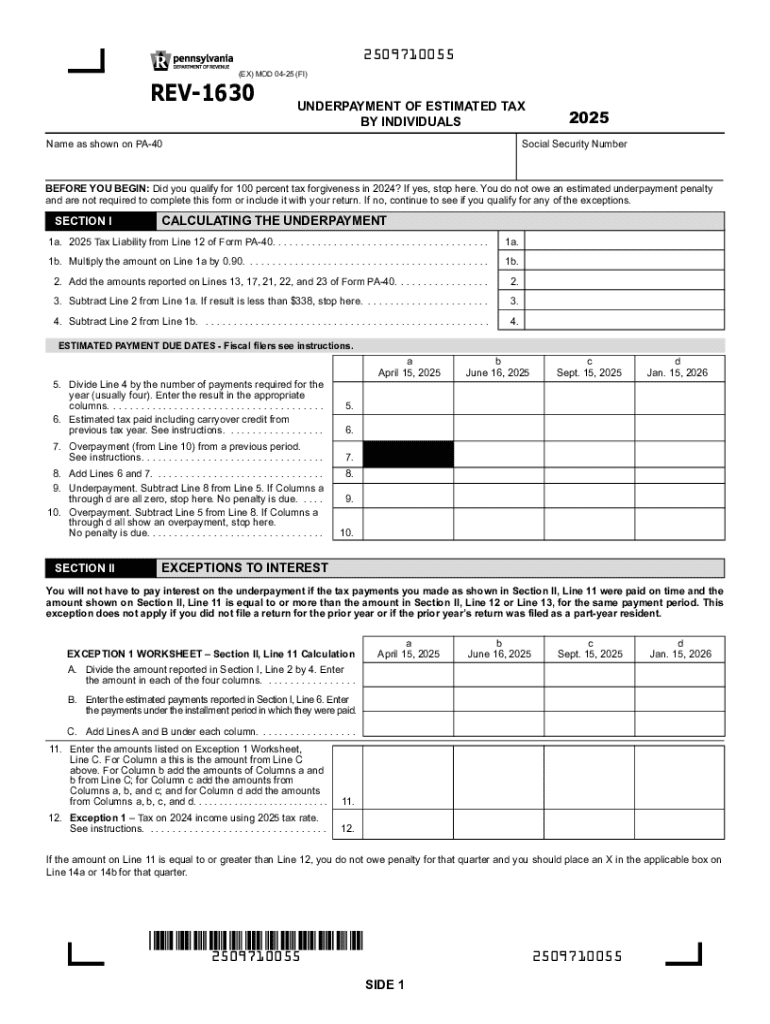

Get the free 2025 Underpayment of Estimated Tax by Individuals (REV-1630). Forms/Publications

Get, Create, Make and Sign 2025 underpayment of estimated

How to edit 2025 underpayment of estimated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 underpayment of estimated

How to fill out 2025 underpayment of estimated

Who needs 2025 underpayment of estimated?

Navigating the 2025 Underpayment of Estimated Tax Form

Understanding underpayment of estimated taxes

Underpayment of estimated taxes occurs when taxpayers fail to pay enough tax throughout the year either through withholding or estimated tax payments. For most individuals, this can happen if they do not have sufficient withholding from their wages or haven’t made adequate estimated payments due to fluctuations in income or other unforeseen circumstances. Understanding this concept is essential, especially as we approach the 2025 tax season, where penalties can be significant.

Making timely estimated tax payments is crucial because it helps you avoid owing a large sum during tax filing season. Underpayment can lead to interest and penalties that complicate your overall tax situation. Especially in 2025, as various tax policies may shift, understanding the implications of underpayment is increasingly important to maintain compliance and peace of mind.

Who needs to use the 2025 underpayment of estimated tax form?

Individuals and entities that may be subject to making estimated tax payments include those whose income exceeds certain thresholds or who have income from sources that are not subject to withholding, such as business profits or rental income. Self-employed individuals represent a significant portion of those required to complete the 2025 underpayment of estimated tax form, as they typically do not have taxes automatically withheld from their earnings.

Homeowners who sell their properties at significant gains may also need to account for taxes owed. Moreover, various entities, such as corporations and partnerships, must utilize this form to ensure compliance with tax obligations, thereby managing their financial standing effectively.

Criteria for estimated tax payments in 2025

The general requirement for making estimated tax payments remains consistent, where individuals who expect to owe $1,000 or more in tax after subtracting their withholding and refundable credits must make payments. This is particularly pertinent for 2025, where changes in tax laws or individual financial situations could impact expected tax liability considerably. Special circumstances, such as being part of a disaster relief initiative or certain tax deductions, may also affect payment criteria and amounts due.

When calculating estimated payments, taxpayers can utilize two primary methods: the prior year's tax liability method and the current year's expected tax liability method. The former allows you to base your estimates on the previous year’s taxes, while the latter provides flexibility to adjust for any known changes in income or tax situation for the current year, making it crucial for accurate forecasting.

Key dates for making estimated tax payments

For 2025, knowing the payment schedule is essential to avoid penalties. Estimated tax payments are typically due quarterly, falling on April 15, June 15, September 15, and January 15 of the following year. These dates may vary slightly depending on the day of the week they occur, and it’s important for taxpayers to stay updated on any shifts in the calendar that could affect their obligations.

Timeliness is vital; those who fail to pay by the prescribed deadlines can incur interest charges and penalties which can compound over time. It is prudent for taxpayers to proactively plan their payments and consider any legislative changes that might adjust these deadlines.

Utilizing the 2025 underpayment of estimated tax form

The 2025 underpayment of estimated tax form is structured to facilitate the smooth submission of your estimated payments. The form encompasses several key sections, including personal information, calculation of estimated tax, and the payment section. Each segment offers taxpayers an opportunity to verify accuracy and completeness, essential for the process.

When completing the form, it is vital to accurately fill out the personal information section to avoid delays. Additionally, calculating the estimated tax section requires vigilance to ensure all income sources are accounted for, including those that may not have traditional withholding. Finally, filling out the payment section correctly will guarantee that payments are processed efficiently.

Submitting your 2025 underpayment of estimated tax form

When it comes to submitting the 2025 underpayment of estimated tax form, taxpayers have several options. Electronic filing provides a quick and efficient method to submit your payments and forms, allowing for immediate processing. There are also dedicated online platforms like pdfFiller, where users can securely upload and submit documents seamlessly.

For those opting for paper submission, it's important to follow guidelines correctly. Ensure that forms are sent to the appropriate address for your state to prevent misdirection. Keeping a copy of the submitted form is advised for tracking purposes and allows taxpayers to establish compliance with their estimated tax obligations.

Penalties and interest related to underpayment

Taxpayers who do not meet their estimated tax payment obligations face penalties, which can impact their financial situation substantially. Generally, the IRS imposes a penalty if you owe more than $1,000 when filing your tax return or if you did not pay at least 90% of the current year's tax liability or 100% of the prior year's tax liability, whichever is less. Awareness and timely payments can mitigate these costly consequences.

Interest rates on unpaid taxes change quarterly, and should your payments be late, interest can accrue on the outstanding amount. Estimating taxes accurately and making payments on time will prove vital in avoiding these financial penalties and the associated stress of late payments.

Assistance with your 2025 estimated tax payments

Managing your estimated tax payments can be simplified with the right tools. pdfFiller provides a suite of resources designed for document management, including features for editing, signing, and collaborating on tax forms. These tools help streamline the process, ensuring that taxpayers have ready access to the forms they need, enhancing understanding and accuracy when completing the 2025 underpayment of estimated tax form.

Collaborating with financial professionals is another beneficial strategy. Professionals can offer tailored advice based on your unique situation and help ensure compliance with tax obligations. Additionally, sharing documents securely through platforms like pdfFiller enables efficient communication and management, so nothing falls through the cracks.

Tips for managing your taxes effectively in 2025

Effectively managing your taxes involves a proactive approach. To start, tracking your estimated tax payments throughout the year can help you stay on top of amounts owed and prevent last-minute surprises during tax season. Utilizing digital tools, including tax software and document management systems, can ease this process significantly, allowing for automatic reminders and streamlined workflows.

Establishing a routine to review financial records regularly can also prevent issues down the line. Set reminders aligned with payment deadlines to maintain compliance easily. The right digital tools can provide comprehensive solutions that align with your financial management goals, making tax season less daunting in 2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2025 underpayment of estimated?

How do I fill out the 2025 underpayment of estimated form on my smartphone?

How can I fill out 2025 underpayment of estimated on an iOS device?

What is 2025 underpayment of estimated?

Who is required to file 2025 underpayment of estimated?

How to fill out 2025 underpayment of estimated?

What is the purpose of 2025 underpayment of estimated?

What information must be reported on 2025 underpayment of estimated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.