Get the free The FRS Investment PlanLeaving It to the Kids

Get, Create, Make and Sign form frs investment planleaving

How to edit form frs investment planleaving online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form frs investment planleaving

How to fill out form frs investment planleaving

Who needs form frs investment planleaving?

Filling Out the Form FRS Investment Plan Leaving Form: A Comprehensive Guide

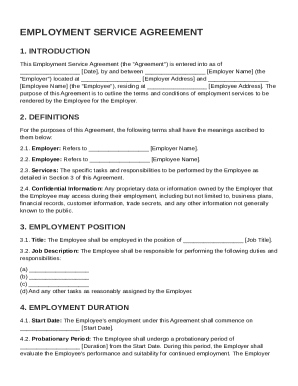

Understanding the Form FRS Investment Plan Leaving Form

The Form FRS Investment Plan Leaving Form plays a crucial role in documenting changes to investment strategies. As financial markets evolve, investors may decide to alter their investment plans for various reasons. This form provides a formal avenue to capture these changes, ensuring that all relevant parties are aware of the updates.

Typically, this form is necessary during transitions such as retirement, account closure, or strategy reallocation. Whether you are an individual investor or part of a team, accurately filling this form is essential in maintaining clarity and transparency in your financial dealings.

Who should use this form?

This form is particularly useful for individuals or groups considering changes to their investment strategies. It serves as a reminder and record of why these changes are being made, helping keep all investment managers and stakeholders informed.

Financial advisors and accountants should also utilize the Form FRS Investment Plan Leaving Form. They can guide their clients through the process, ensuring that all necessary details are captured correctly while complying with regulatory requirements.

Accessing the Form FRS Investment Plan Leaving Form

To get started, access to the Form FRS Investment Plan Leaving Form is a straightforward process using pdfFiller.

Location of the form on pdfFiller

Here’s a step-by-step guide to help you find the form on pdfFiller:

Downloading and preparing the form

Once you have located the form, you have a few options for downloading it. You can either download it directly to your computer as a PDF or fill it out online. For easier access, consider preparing the form directly on pdfFiller using its online features.

Detailed instructions for filling out the form

Section-by-section breakdown

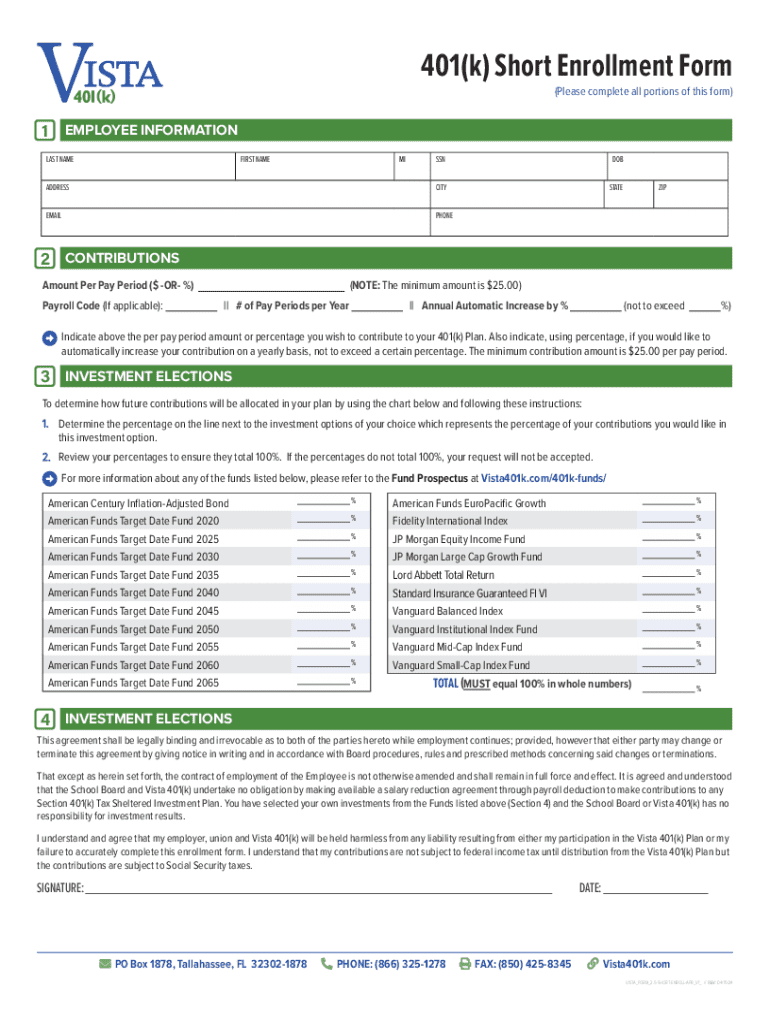

Personal information

In this section, you will need to provide your name, contact information, and possibly your account number. Examples of how to fill this out include entering your full name as it appears on your investment account and ensuring your contact information is current for any follow-up communication.

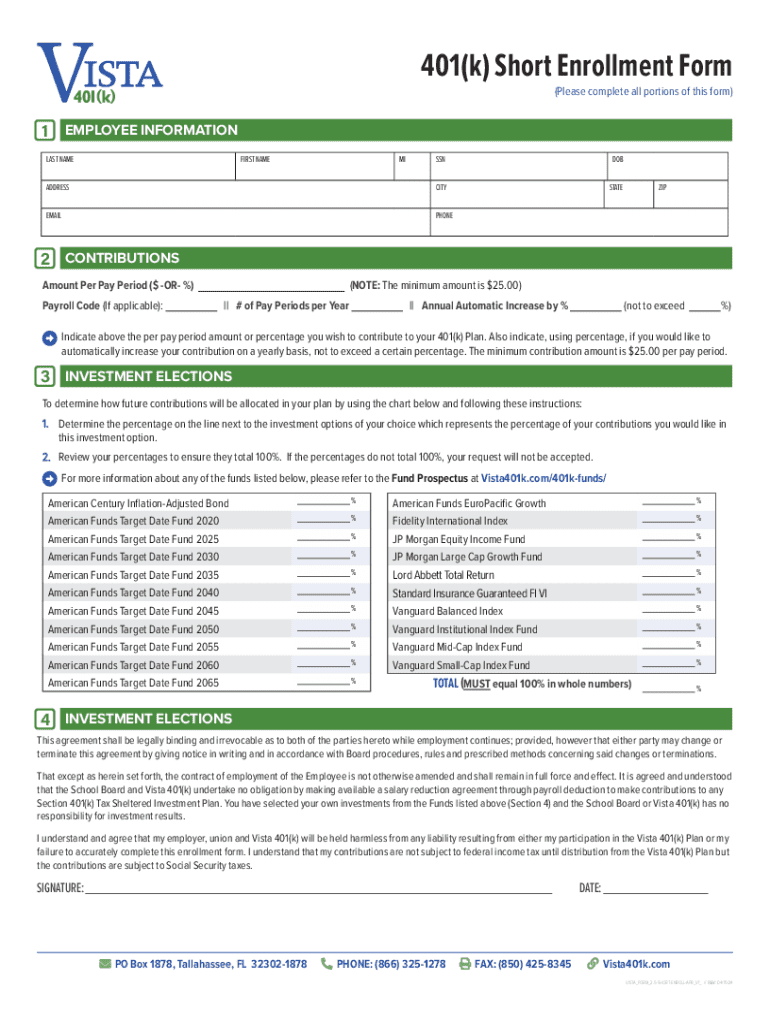

Financial information

The financial information section requires you to disclose essential investment details, such as current asset allocations or the total value of your portfolio. Accurate financial reporting is critical here, so it’s advisable to double-check figures for correctness.

Reason for leaving the investment plan

You may want to indicate the specific reasons for your departure from the investment plan. Common reasons include dissatisfaction with performance, personal financial goals changing, or a shift to another investment strategy. Clarity and professionalism in this section will help convey your intent effectively.

Signature and date

Signing and dating the form is essential for its validity. Ensure that you sign as the account holder and type the current date. If you are using pdfFiller, you can also use the eSigning feature, which ensures a secure and legally compliant signing process.

Editing and customizing the form

pdfFiller provides powerful tools for customizing your Form FRS Investment Plan Leaving Form. You can add additional notes or comments that may be relevant to your investment plan changes, which can help clarify your intentions to any reviewing parties.

Using pdfFiller’s tools for customization

Utilize features such as text highlighting, resizing, and comment integration to emphasize key points within the form. This can enhance understanding for anyone who reads the document later, ensuring clarity in your financial narrative.

Collaborating with others

If you're working as part of a team, pdfFiller allows you to invite collaborators to review the form. By sharing access, team members can provide comments and suggestions to improve the accuracy and completeness of the form before final submission.

Managing your investment plan leaving form

Once you have completed the Form FRS Investment Plan Leaving Form, managing it effectively is crucial. pdfFiller offers features that simplify storing and retrieving your form for future reference.

Storing and retrieving your form

When you save your filled form on pdfFiller, it’s easy to organize your documents for future access. Make use of folders or tags to categorize your forms 'by type or by date' for a streamlined retrieval process.

Sharing the form with stakeholders

To share your completed form with stakeholders, pdfFiller allows you to send it via email or generate a shareable link. Ensure you prioritize data privacy while sharing critical documents to keep your investment information secure.

Troubleshooting common issues

While using pdfFiller, users may face various issues, such as difficulty downloading or filling out the form. Understanding a few troubleshooting techniques can empower you to resolve these challenges swiftly.

Frequently asked questions

If you encounter difficulties, first check if you have the latest version of your browser installed, as compatibility can impact form functionality. Should you need to correct mistakes made after filling out the form, pdfFiller’s editing tools enable you to modify any section easily.

Contact support

If assistance is necessary, pdfFiller’s support is readily available. They provide customer service options via chat or email and can guide you through document-related issues professionally.

Best practices for submitting your form

To ensure your submission of the Form FRS Investment Plan Leaving Form proceeds smoothly, adhering to regulatory compliance is essential. This involves understanding any financial regulations that govern your investments as well as specifics related to the form.

Ensuring compliance with regulations

Ensure that the information provided on the form aligns with current legislation and best practices in investment reporting. Familiarity with compliance details can save unnecessary issues when submitting forms.

Timeliness and follow-up

Timely submission of your investment plan leaving form can prevent delays with your financial transitions. After submission, keep track of the process to confirm that your changes are enacted as planned.

Advanced features of pdfFiller for form management

Harnessing the advanced capabilities of pdfFiller can optimize how you manage your Form FRS Investment Plan Leaving Form. Instead of merely filling out forms manually, you can leverage integrations and analytics.

Integrating with other tools

pdfFiller integrates seamlessly with various financial tools, enabling a smooth transition between different stages of financial planning. This can enhance how data is shared across your investment management software.

Leveraging analytics for better decision-making

Utilizing the analytics provided by pdfFiller can also inform better investment decisions. By analyzing patterns in your filled forms over time, you can derive insights that help optimize future investment strategies.

User testimonials and case studies

Engagement with the Form FRS Investment Plan Leaving Form has produced notable success for many users. Individual investors and financial teams have shared their experiences using pdfFiller.

Success stories

Many users report that pdfFiller simplified their documentation processes, especially when making significant changes to their investment strategies. These streamlined experiences have encouraged teams to adopt best practices for compliance and transparency.

User feedback

Real-life user experiences indicate satisfaction with the ease of collaboration through pdfFiller. The ability to invite others to review and edit the Form FRS Investment Plan Leaving Form lends itself to building a comprehensive approach to investment management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form frs investment planleaving to be eSigned by others?

How do I edit form frs investment planleaving in Chrome?

How do I complete form frs investment planleaving on an Android device?

What is form frs investment planleaving?

Who is required to file form frs investment planleaving?

How to fill out form frs investment planleaving?

What is the purpose of form frs investment planleaving?

What information must be reported on form frs investment planleaving?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.