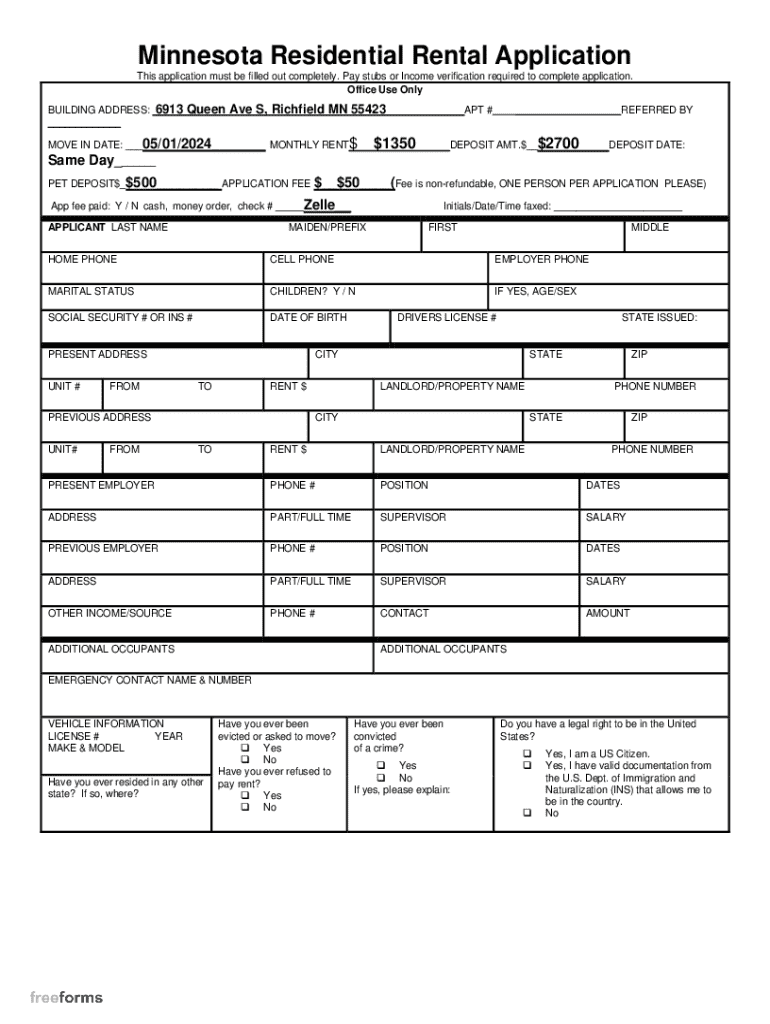

Get the free Pay stubs or Income verification required to complete application

Get, Create, Make and Sign pay stubs or income

How to edit pay stubs or income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pay stubs or income

How to fill out pay stubs or income

Who needs pay stubs or income?

Everything You Need to Know About Pay Stubs and Income Forms

Understanding pay stubs and income forms

A pay stub, also known as a paycheck stub, is a document that employers provide to employees detailing their earnings for a specific pay period. This vital record serves as a transparent breakdown of gross earnings, deductions, and net pay, ensuring employees are fully informed about their compensation. In addition to being a valuable record for personal finance, pay stubs are essential for verifying income when applying for loans or other financial services.

Income forms, however, encompass a broader range of documents. They include any form that provides evidence of income, such as W-2 forms,1099 forms for independent contractors, and even employer letters. Different situations such as applying for housing, loans, or government assistance can necessitate particular types of income forms.

Key components of a pay stub

Understanding the components of a pay stub is crucial for both employees and employers. A well-structured pay stub should contain the following essential elements:

Why pay stubs matter

For employees, pay stubs play a pivotal role in ensuring payroll accuracy and fostering transparency. They allow staff members to spot errors in deductions or earnings quickly. Furthermore, having a clear and accurate pay stub aids in financial planning by providing a clear view of take-home pay and deductions.

From an employer's perspective, providing transparent pay stubs can significantly enhance trust with employees. It simplifies accounting by providing clear records needed for tax preparation and helps avoid potential misunderstandings or disputes over wages.

Generating pay stubs: The pdfFiller advantage

Using pdfFiller allows for an instant and user-friendly method to create pay stubs efficiently. Here’s how you can create a pay stub in just a few steps:

This straightforward process ensures that anyone, regardless of their technical skills, can create a professional pay stub in minutes.

User-friendly editing tools

pdfFiller offers an array of features designed to streamline the process of editing PDF pay stubs. The drag-and-drop interface allows users to add or modify sections effortlessly, while custom field options enable tailoring specific components to fit unique needs.

Furthermore, users don't have to worry about software installations. With pdfFiller being a cloud-based solution, employees and employers can access their documents from anywhere, guaranteeing flexibility and convenience.

eSigning and sharing pay stubs

Electronic signatures are vital for modern business transactions, including pay stubs. Having the option to eSign pay stubs through pdfFiller not only speeds up the process but also ensures that documents are legally binding.

When it comes to sharing pay stubs, pdfFiller offers secure options such as email, direct downloads, or cloud storage links. This confidentiality is essential in maintaining personal financial information.

Managing your pay stub records

Best practices for storing and managing pay stubs are crucial, especially considering their importance for tax purposes and financial tracking. Utilizing cloud storage not only provides secure access but also ensures that documents can be retrieved easily whenever necessary.

pdfFiller also offers capabilities for locating and retrieving historical pay stubs, which can be invaluable come tax season or when verifying employment history.

Frequently asked questions about pay stubs

Many individuals and businesses are often unsure about the necessity and role of pay stubs. Common inquiries include:

Best practices for using pay stubs

Creating accurate and compliant pay stubs is critical. Common pitfalls include errors in tax deductions or employee information, which can lead to confusion or frustration. Thus, it’s essential that all details are verified before handing out pay stubs.

Employees can leverage pay stubs effectively by maintaining a personal file of stubs to simplify loan and lease applications. Knowing how to interpret the detailed entries within pay stubs can empower employees in negotiations for salary increases or understanding their perceived income.

Testimonials: Success stories using pdfFiller

Many users have found significant benefits using pdfFiller for pay stub generation and management. Clients have reported time savings associated with instant pay stub creation, citing the ease of editing and signature features.

Testimonials typically highlight how pdfFiller stands out compared to other solutions, emphasizing the platform's intuitive design and comprehensive tools that make document management a breeze.

Benefits of using pdfFiller for pay stubs

Choosing pdfFiller for your pay stub needs not only simplifies the creation and management process but also ensures comprehensive document management through a cloud-based platform. Users enjoy the freedom of accessing their pay stub templates from anywhere, making it an ideal solution for busy professionals.

Interactivity is a hallmark of pdfFiller’s user tools, giving users the flexibility to customize and enhance their documents. Such customization options empower users to present professional and tailored pay stubs fitting their business or personal needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pay stubs or income in Gmail?

Can I edit pay stubs or income on an iOS device?

How do I complete pay stubs or income on an Android device?

What is pay stubs or income?

Who is required to file pay stubs or income?

How to fill out pay stubs or income?

What is the purpose of pay stubs or income?

What information must be reported on pay stubs or income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.