Get the free Initial Business Return Filing ChecklistResources

Get, Create, Make and Sign initial business return filing

How to edit initial business return filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out initial business return filing

How to fill out initial business return filing

Who needs initial business return filing?

Initial Business Return Filing Form - How-to Guide Long-Read

Understanding the Initial Business Return Filing Form

The initial business return filing form is a crucial document for new businesses, designed to report income, maintain compliance with tax regulations, and establish the business's tax identity. This form serves as your official entry into the world of business taxation, and understanding its components is essential for any entrepreneur. Key components of this form typically include business identification information, financial data regarding income and expenses, and specific tax information pertinent to your business structure.

Filing this initial return correctly not only marks an accomplishment for new business owners but also sets the stage for future tax compliance. By accurately reporting your income and expenses, you can avoid penalties and audits while establishing a good standing with tax authorities.

Who needs to file this form?

Understanding who is required to file this form is essential. Generally, any business entity that generates income must file an initial business return. Eligibility criteria include various business structures such as sole proprietorships, limited liability companies (LLCs), and corporations. Each structure has unique tax implications and responsibilities; therefore, recognizing your business type is critical when preparing for your initial filing.

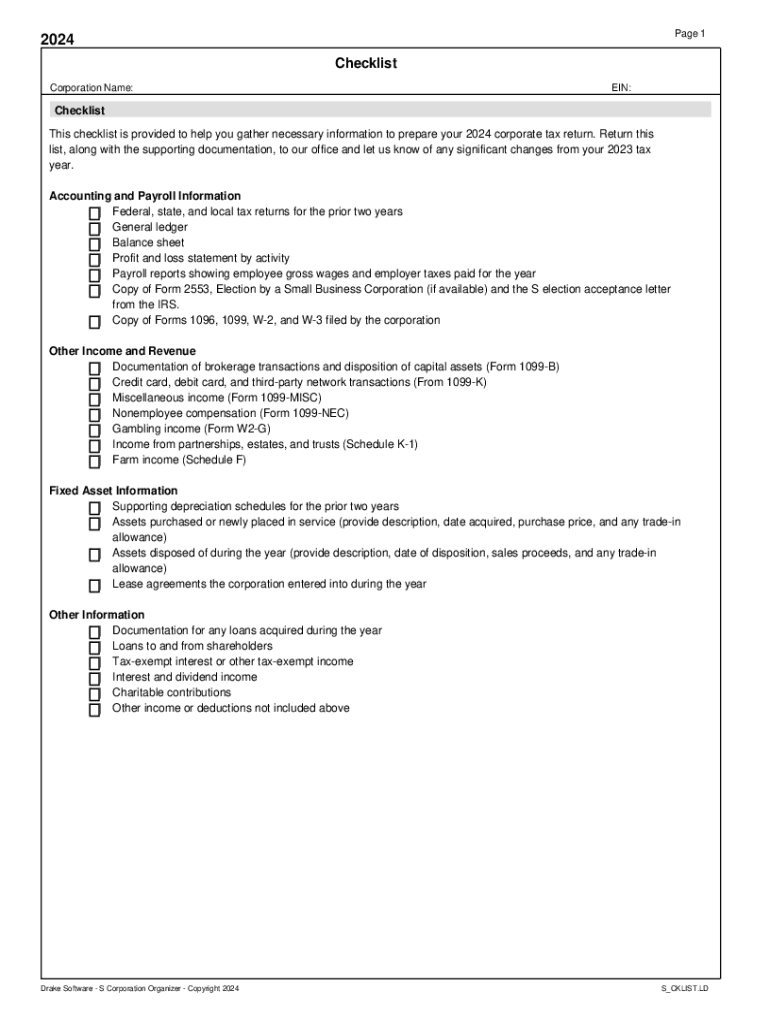

Preparing to file your initial business return

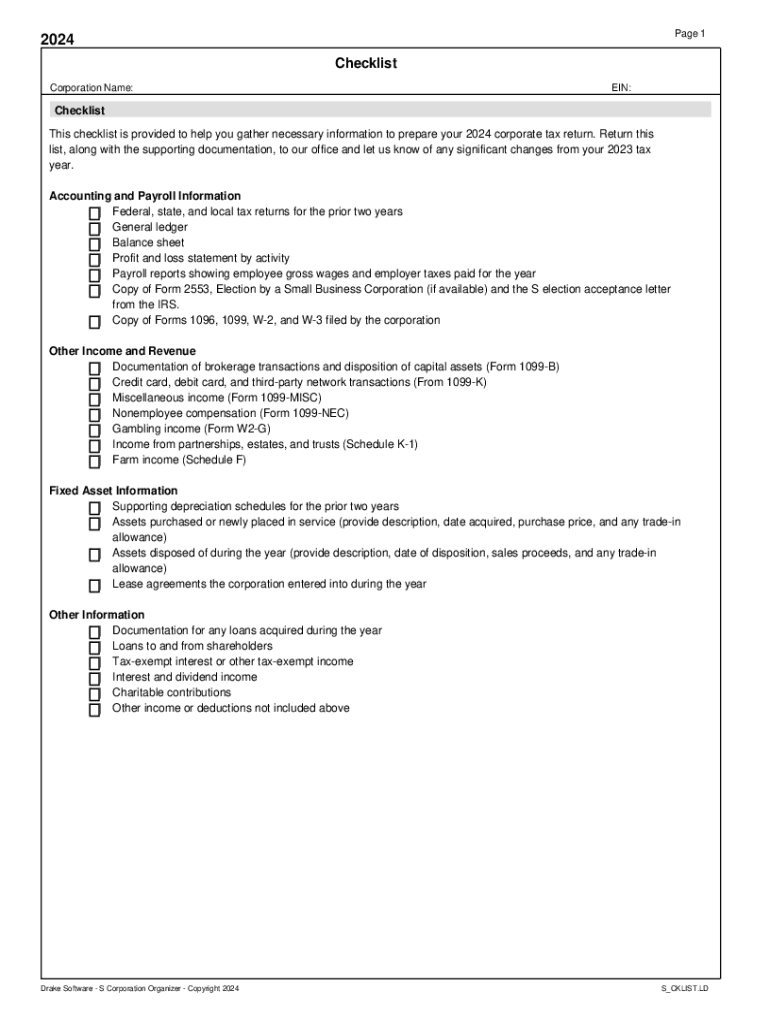

Preparation is key to a successful filing. Begin by gathering necessary information and documentation. This may include your Employer Identification Number (EIN), income records, expense receipts, and any prior tax information relevant to the business period. Ensure that you have a comprehensive understanding of your financials to accurately reflect your business operations. Common mistakes can arise from disorganized records or miscalculating income and expenses, so avoid rushing through this process.

Choosing the right form according to your business structure is vital. For example, sole proprietorships typically file Schedule C, while corporations utilize Form 1120. Understanding the specific form needed ensures compliance with tax filing requirements and helps prevent future complications.

Step-by-step instructions for completing the form

Completing the initial business return filing form can be broken down section by section. Start by filling in your business identity, including the name, address, and EIN. Next, detail your income, including all receipts and recorded earnings. Following this, list any business-related expenses, ensuring to categorize them accurately to maximize deductions. Remember to review each section carefully for accuracy—as minor errors can lead to significant challenges during the review process.

Using tools like pdfFiller can simplify the process considerably. The platform allows you to upload the necessary documentation smoothly, edit the form directly, and ensure you do not miss any essential sections. The auto-fill feature minimizes data entry errors while the document sharing and e-signature options streamline collaboration if working with accounting professionals.

Common challenges and how to overcome them

Misunderstanding tax obligations is a hurdle many new businesses face. Common misconceptions include the belief that all expenses are deductible or that certain income streams do not need to be reported. Educating yourself on your specific tax obligations according to your business structure will prevent these pitfalls. Consult reliable resources or tax professionals if in doubt.

Technical errors can occur during form submission, ranging from incorrect information entry to failure to follow submission guidelines. Before finalizing your return, proofread the form carefully to mitigate these issues. In cases of uncertainty, where to seek help is vital. Options include contacting tax professionals, leveraging online forums, or utilizing pdfFiller’s customer support for assistance in navigating the filing process.

Filing deadlines and important dates

Understanding the key deadlines for filing your initial return is paramount. For most businesses, the deadline falls on the 15th day of the fourth month following the end of your tax year. This means that for a business operating on a calendar year, the deadline would typically be April 15. Corporations, however, have different deadlines which need to be noted; for example, C Corps file by the 15th day of the fourth month post tax year end with the same deadline applicable to S Corps.

Failure to observe filing deadlines can lead to severe penalties and potential audits. Businesses may incur fines based on their taxable income and, in some cases, could face higher scrutiny from tax authorities. Hence, it is advisable to maintain a tax calendar and set reminders well in advance to prevent last-minute crunches.

Post-filing actions

After filing your initial business return, patience is needed as your form goes through the processing stage. Processing times can vary depending on the method of submission (e-file versus paper) and the workload of tax authorities. Typically, e-filed forms receive quicker responses, while paper returns can take weeks. Monitoring the status of your submission through your tax account is advisable for peace of mind.

Maintaining accurate records post-filing should be a priority. This includes saving copies of submitted forms, documentation of income and expenses, and logs of any communications with tax authorities. A strong record-keeping system not only aids in future filings but also prepares you for potential audits. Consider establishing a dedicated filing system or leveraging tools like pdfFiller to manage these documents efficiently.

Leveraging pdfFiller for future filings

pdfFiller can seamlessly expand document management beyond just your initial filing. The platform allows users to create and manage various forms, contracts, tax documents, and agreements that businesses routinely encounter. Utilizing pdfFiller’s tools enables users to archive these documents securely in one place while offering easy accessibility.

Establishing an organized workflow for document management is vital. By setting up a structured template system within pdfFiller, you can streamline every aspect of your document processes—from contract signing to tax filings. This organization facilitates proactive compliance and ensures that nothing falls through the cracks. Leveraging these capabilities ultimately leads to improved business efficiency and confidence in maintaining compliance.

FAQs about the initial business return filing form

When it comes to frequently asked questions surrounding the initial business return filing form, several common inquiries often arise. New business owners frequently want to understand the importance of filing timely and what specific information needs to be included. Others may wonder about their obligations concerning state taxes or if they need to consult with a tax professional.

For first-time filers, it is beneficial to seek guidance. Simple inquiries can often be resolved by consulting the IRS website or friendly tax forums. However, when more complicated issues present themselves, reaching out to a certified tax professional is a smart move.

Final thoughts on successfully navigating your initial business return filing

In summary, effectively navigating the initial business return filing form is a necessary step for new business owners. By understanding its components, preparing meticulously, and using tools like pdfFiller for assistance, you can approach this task with confidence. Keeping abreast of common challenges, important deadlines, and post-filing actions prepares you for a smoother journey through your first filing and beyond.

Encouragement for new business owners is key—remain organized, informed, and proactive in all tax matters. Embracing this responsibility not only contributes to your business’s success but also empowers you with a solid foundation for your operations. Taking control of your initial business return filing will result in greater confidence and a more prosperous future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my initial business return filing directly from Gmail?

How can I modify initial business return filing without leaving Google Drive?

Can I edit initial business return filing on an iOS device?

What is initial business return filing?

Who is required to file initial business return filing?

How to fill out initial business return filing?

What is the purpose of initial business return filing?

What information must be reported on initial business return filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.