Get the free Form Nj 1040 Schedule Nj Bus 1Fill Out Printable PDF

Get, Create, Make and Sign form nj 1040 schedule

Editing form nj 1040 schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form nj 1040 schedule

How to fill out form nj 1040 schedule

Who needs form nj 1040 schedule?

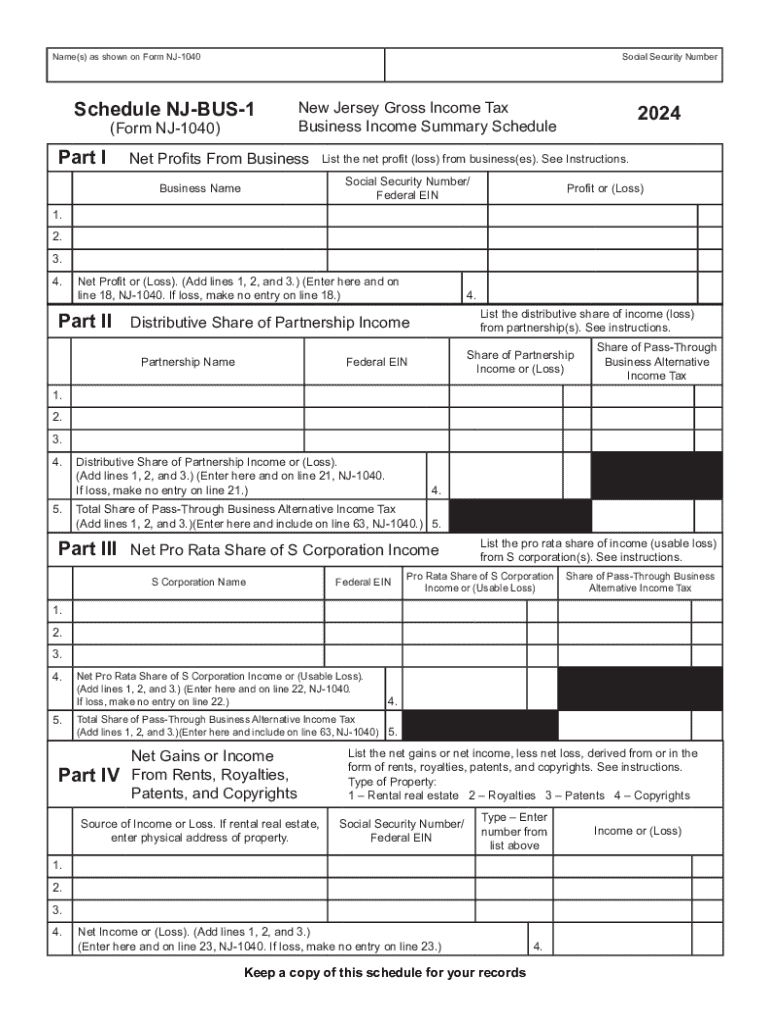

Comprehensive Guide to Form NJ 1040 Schedule Form

Understanding the New Jersey 1040 Schedule Form

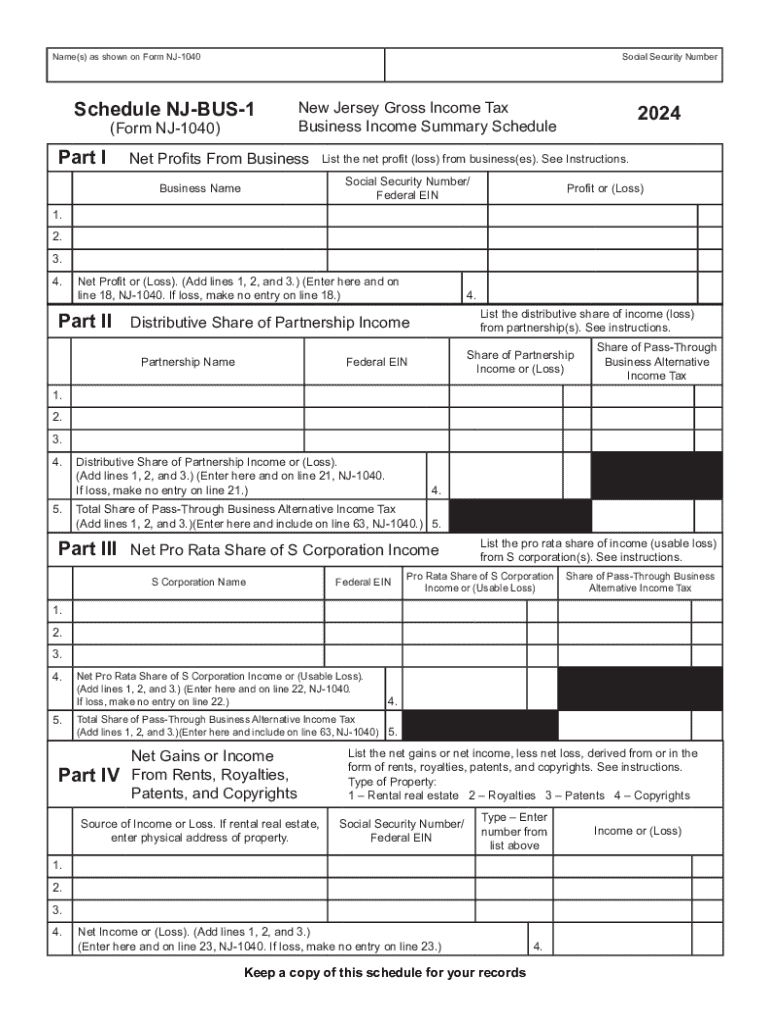

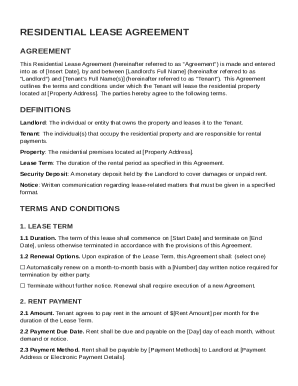

The NJ 1040 Schedule Form is an essential part of the New Jersey state tax filing system, primarily used by residents to report their income and calculate their tax liabilities. Its main purpose is to complement the NJ 1040 form, detailing specific adjustments and deductions that can impact a taxpayer’s overall tax amount. This form plays a critical role in ensuring that New Jersey residents comply with state tax laws while maximizing deductions and credits unique to the state.

What makes the NJ 1040 Schedule Form particularly significant in the New Jersey tax framework is the emphasis on various local tax provisions and the reporting of income earned within and outside the state. With ever-evolving tax laws and credits, understanding this schedule can be the key to a successful and accurate tax return.

Historical Context

Over the years, the NJ 1040 Schedule Form has undergone several transformations in response to changes in both state and federal tax laws. Originally, the form was straightforward, but as tax regulations grew more complex, so did the requirements and structure of the schedule. The importance of these changes cannot be overstated; they reflect not only the growing complexity of tax issues but also the need for taxpayers to remain informed on how to navigate these waters effectively.

Today, with heightened scrutiny over tax filings, the NJ 1040 Schedule Form serves a dual purpose: it ensures that taxpayers accurately report their income and seek eligible deductions while also enabling the state to maintain higher compliance standards. This relevance has made it even more crucial for taxpayers to stay updated about recent amendments to the form in order to optimize their filing experience.

Who needs to use the NJ 1040 Schedule Form?

Identifying who needs to use the NJ 1040 Schedule Form starts with understanding a taxpayer’s status, which can vary significantly between individuals and businesses. While individuals typically fill this form as part of their annual income tax reporting, businesses with New Jersey operations or income may also find aspects of the form applicable to their tax filings. Determining residency is crucial, as only New Jersey residents or those with specific ties to the state are required to use this form to report their earnings.

In most cases, any individual earning income within New Jersey must understand the residency requirements for this filing. Residents include those who have established a permanent home in the state or spend a substantial amount of time there during the tax year. Non-residents, however, may also need to file under certain circumstances, especially if they earn income from New Jersey sources.

Special Circumstances

There are special circumstances wherein one must diligently fill out the NJ 1040 Schedule Form. For instance, if you earned income outside New Jersey, you may need to report this on the NJ 1040 to determine your tax obligations accurately. Moreover, various types of deductions—such as property tax credits, charitable contributions, and medical expenses—can apply specifically to New Jersey residents, requiring careful documentation on the schedule.

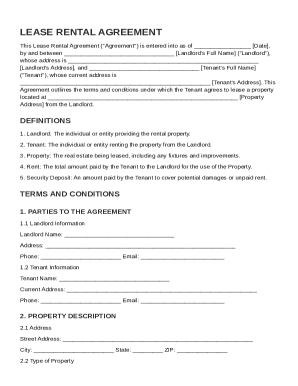

Step-by-step guide to filling out the NJ 1040 Schedule Form

Filling out the NJ 1040 Schedule Form effectively requires systematic preparation. The first step is to gather all necessary documentation to ensure that you have all the information needed to proceed accurately. Key documents typically include W-2s from employers, 1099 forms for any additional income sources, and records of eligible deductions such as personal property taxes.

Importantly, maintaining digital records can enhance organization and accessibility, allowing taxpayers to quickly pull required information during any filing season. Furthermore, using document management tools such as pdfFiller can simplify this process significantly, providing a streamlined approach to data entry.

Detailed instructions on each section

As you begin filling the form, a line-by-line breakdown ensures better clarity and precision in your calculations.

Common pitfalls to avoid

Filing the NJ 1040 Schedule Form can present challenges, and awareness of common pitfalls is necessary for ensuring accuracy. Frequent errors include misreporting income, overlooking deductions, or failing to include all necessary tax documents. These mistakes can lead to complications during processing and possibly result in penalties or delayed refunds.

To optimize your completion process, double-check figures, confirm that you’ve included all required documentation, and utilize checklists to ensure nothing is overlooked. If you find the paperwork daunting, technology like pdfFiller can offer helpful prompts and features that facilitate accurate form completion.

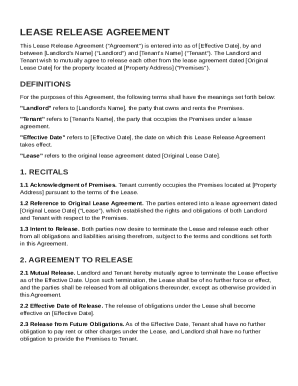

Editing and managing your NJ 1040 Schedule Form

Once your NJ 1040 Schedule Form is drafted, managing and editing the document takes the next step. Tools like pdfFiller allow users to upload their forms and access a suite of editing tools designed for convenience. Being able to modify entries or adjust calculations directly within the document minimizes the hassle of having to reprint or redraft forms repeatedly.

Additionally, the platform provides various features that allow users to save different versions of their draft, ensuring that you can always revert to a previous state if needed. This version control is especially essential in environments where multiple stakeholders may contribute to the document or when prior submissions urgently need review.

Using pdfFiller for document management

Uploading your schedule form to pdfFiller can greatly streamline the editing process. With its user-friendly interface, you can easily navigate your uploaded document, make necessary changes, and even add notes or comments.

The ability to edit directly enhances collaboration, as it allows team members to contribute their insights to specific areas of the form. This process can significantly reduce the likelihood of errors, achieving a higher level of accuracy in your filing.

Electronic signing options

One of the benefits of using pdfFiller is the capability to e-sign documents seamlessly. Once you’ve completed your NJ 1040 Schedule Form, you can easily add your digital signature directly to the document. This feature saves time, eliminating the need for printing, signing, and scanning.

Moreover, the legal benefits of digital signatures are substantial, providing the same validity and recognition as traditional signatures while enhancing efficiency and security.

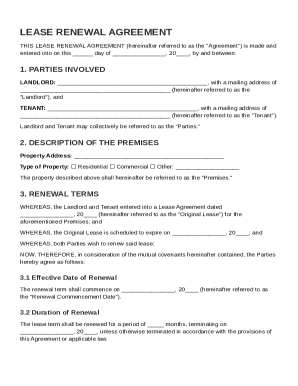

Collaborating on the NJ 1040 Schedule Form

Collaboration can be key when filling out the NJ 1040 Schedule Form, particularly if you have a team or a trusted advisor assisting you in the process. Using pdfFiller, you can invite collaborators to review your completed sections, ensuring further accuracy and transparency in the information reported.

Setting permissions for editing and commenting allows you to control who can modify the document, maintaining the integrity of the original entries while still permitting valuable input from collaborators. This level of teamwork can ease the process for individuals who might find tax filings particularly overwhelming.

Utilizing commenting features

In addition to sharing the document, pdfFiller's commenting feature allows you to leave notes or questions for collaborators. If you encounter areas within the NJ 1040 Schedule Form that require clarification or that raise concerns, you can comment directly alongside the relevant sections.

This interaction fosters improved communication between team members and ensures a more thorough review of each form, which can ultimately streamline the filing process and improve overall compliance.

Frequently asked questions (FAQs) about the NJ 1040 Schedule Form

Questions around the NJ 1040 Schedule Form often arise due to its complexities. One common query relates to what happens if you make a mistake in your filing. Corrections can typically be made by filing an amended return, but it’s best to act quickly to minimize potential penalties.

Another frequent concern pertains to missing filing deadlines. New Jersey imposes penalties for late submissions, which can accumulate based on how late the paperwork is filed. Therefore, remaining mindful of deadlines is critical in avoiding unneeded fees.

Additionally, how the NJ 1040 differs from federal forms is an important aspect for filers to recognize. Notably, certain credits and deductions available to NJ residents—such as the property tax deduction—are specific to state filings and may not appear on federal 1040 forms.

For individuals seeking additional help, resources abound for New Jersey taxpayers. The New Jersey Division of Taxation offers extensive materials, and professionals can provide tailored guidance, particularly in navigating more complex situations.

Tips for efficiently filing your NJ 1040 Schedule Form

Filing your NJ 1040 Schedule Form requires awareness of key deadlines to ensure timely submission. Important dates for tax year 2023 include the due date for filing returns and any extensions. Being proactive and preparing well in advance can save considerable stress as tax day approaches.

Utilizing technology can streamline the process significantly. Programs like pdfFiller not only facilitate filling and editing but also assist with tracking submissions and confirming receipt of your filings, providing every user with peace of mind.

Maximizing your tax benefits with NJ 1040 Schedule

Maximizing tax benefits as a NJ filer can be achieved by proactively identifying eligible deductions. Individuals should familiarize themselves with common deductions available, including deductions for property taxes, charity contributions, and specific credits for low-income residents, which can significantly reduce overall tax liability.

Furthermore, planning for future tax years through strategic financial planning is essential. Maintaining accurate and organized records throughout the year can simplify future filings. Journaling all potential deductible expenses, storing receipts electronically, and consulting with financial advisors will ensure that you capture every possible deduction when filing your next NJ 1040 Schedule Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form nj 1040 schedule in Gmail?

How do I edit form nj 1040 schedule straight from my smartphone?

How do I fill out form nj 1040 schedule on an Android device?

What is form nj 1040 schedule?

Who is required to file form nj 1040 schedule?

How to fill out form nj 1040 schedule?

What is the purpose of form nj 1040 schedule?

What information must be reported on form nj 1040 schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.