Get the free Angel Investment Tax Credit in Kentucky

Get, Create, Make and Sign angel investment tax credit

Editing angel investment tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out angel investment tax credit

How to fill out angel investment tax credit

Who needs angel investment tax credit?

Angel Investment Tax Credit Form: A Comprehensive How-to Guide

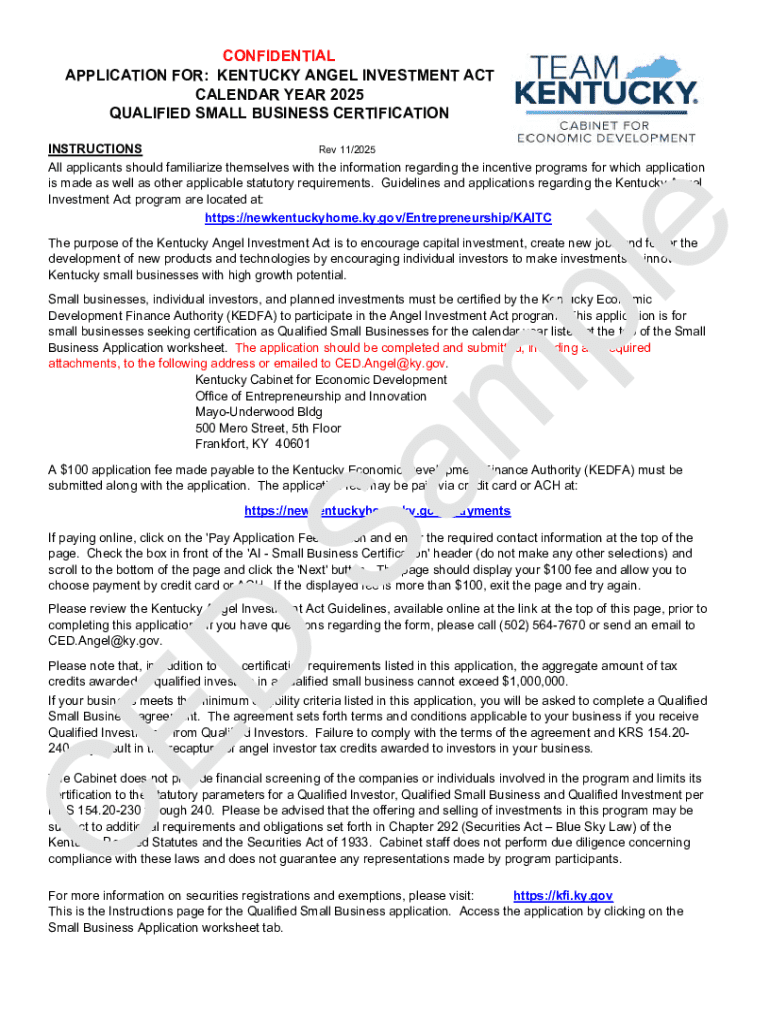

Understanding the angel investment tax credit

The Angel Investment Tax Credit is a program designed to stimulate investment in early-stage companies by providing tax incentives to investors. By offering financial relief through credits, this initiative aims to attract capital towards startups that are often seen as high risk but hold significant growth potential. The core purpose of the credit is to foster innovation and entrepreneurship, thus spurring economic growth in the community.

This tax credit is crucial for both startups and investors. For startups, it provides an essential funding source when traditional financing options may not be available. For investors, it presents an opportunity to mitigate the risks inherent in investing in new ventures while also benefitting from tax relief. Overall, the financial benefits of this credit serve as a bridge, linking visionary entrepreneurs with the capital needed to transform their ideas into reality.

Eligibility criteria for the angel investment tax credit

Before applying for the angel investment tax credit, understanding the eligibility criteria is essential. Qualified investors typically include individuals or entities that meet specific income levels and have a history of investing in startups. For instance, accredited investors, as defined by the SEC, can usually apply, given they possess a net worth exceeding a specified threshold.

Eligible businesses must primarily focus on innovative activities and have been operational for a limited number of years. These companies often operate within technology, healthcare, or other high-growth sectors. Additionally, geographical considerations are significant. Certain states may have individual programs or specific guidelines that detail which local businesses qualify. Hence, reviewing state policies is vital for both investors and entrepreneurs.

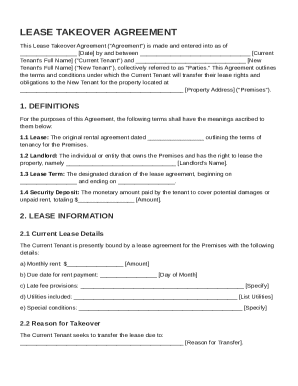

Step-by-step guide to filling out the angel investment tax credit form

Filing the angel investment tax credit form can be a straightforward process if done methodically. Here’s a step-by-step guide to help you fill out the application effectively.

Step 1: Gather necessary documentation

Before you start filling out the form, gather all necessary documentation. This may include proof of investment, tax identification numbers, and any required state-specific documentation. Having these documents ready will streamline the process and reduce the likelihood of mistakes.

Step 2: Complete the application form

Once you have your documents, carefully fill out the application form. Ensure you provide accurate personal information, investment details, and company information. Each section is vital for proper evaluation and approval. It’s essential to double-check your responses and avoid common mistakes such as misspellings, incorrect figures, or omitted sections. Careful attention ensures your form won’t face unnecessary delays due to avoidable errors.

Step 3: Review and confirm your submission

After completing the form, it’s crucial to conduct a thorough review. Use a verification checklist to ensure you have filled out each section accurately. Checking the calculations on any financial sections helps to catch potential mistakes early. Confirm that all required documents are included before submitting to avoid unnecessary delays.

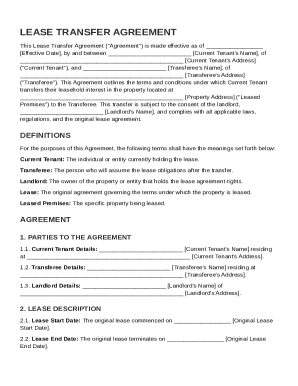

Editing and managing your completed form on pdfFiller

Using pdfFiller can simplify the process of managing your angel investment tax credit form. This cloud-based platform allows you to edit, eSign, and collaborate on your documents easily. The interactive tools available on pdfFiller enable you to enhance your applications quickly and efficiently.

Interactive tools available

pdfFiller offers several features to assist you with document management. PDF editing allows you to modify content, while the e-signing capability lets you add a digital signature seamlessly. Their user-friendly interface promotes easy navigation throughout your forms, ensuring that you can make necessary changes at any time.

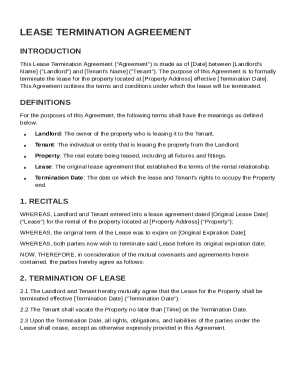

Signing your angel investment tax credit form

Adding your digital signature to the angel investment tax credit form is a crucial step in the submission process. E-signing not only speeds up the process but also enhances security, ensuring that your data remains protected throughout the submission. To e-sign, follow the simple steps outlined in pdfFiller to create an electronic signature that can be easily integrated into your documents.

Step-by-step process to add a digital signature

To add a digital signature in pdfFiller, follow these steps: First, navigate to the signature section of your form. Then, select the e-signature feature and create your signature using your mouse or touchpad. After crafting your signature, simply click to place it on the document at the necessary location. Ensure that your signature is properly aligned and visible. Always remember to save your changes.

Security measures in place to protect your data

pdfFiller employs robust security measures to protect your sensitive information. The platform uses encryption protocols to ensure that your signatures and personal data remain confidential and secure both during the signing process and after submission. You can have peace of mind knowing that your documents and inputs are protected against unauthorized access.

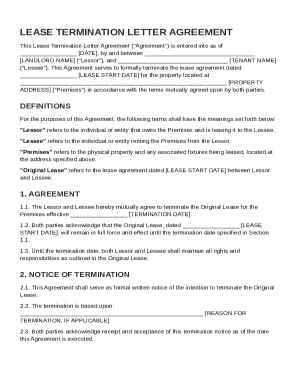

Submitting the angel investment tax credit form

Once your form is complete and signed, submission is your next step. Familiarize yourself with the submission options available, whether online through the pdfFiller platform or via traditional mail. Understanding these options will help you choose the method that best fits your needs and timeline.

Tips for timely submission

To ensure timely submission, be mindful of deadlines associated with the angel investment tax credit program in your state. Submit your form well ahead of the cutoff date to avoid any last-minute issues. Using the online submission option through pdfFiller can expedite the process and deliver instant confirmation of your submission.

Tracking your application status

Once you've submitted your angel investment tax credit form, tracking its status is pertinent to know where you stand. Various methods exist to monitor your submission. Typically, online platforms provide tracking options that allow you to see real-time updates on your application's progress. Additionally, confirm any applicability with local authorities regarding potential follow-ups.

Expectations after submission may include a notification period where your application is reviewed. Familiarize yourself with common processing timelines to help manage your expectations during this waiting period. Preparations for any potential follow-up inquiries can further facilitate the review process.

Common questions and answers about the angel investment tax credit

As an investor or entrepreneur looking to explore the benefits of the angel investment tax credit, it’s essential to have your questions answered. Common inquiries pertain to eligibility requirements, application processes, and how to maximize benefits from the program. Knowing the answers to these questions can enhance your understanding and ensure a successful application.

FAQs for investors

Investors often seek to understand the types of investments that qualify and how to effectively leverage tax credits in their portfolio strategies. Reviewing FAQ sections or consulting with experts in tax or investment can provide insights tailored to your unique situation.

FAQs for entrepreneurs and businesses

Entrepreneurs frequently need clarification regarding which businesses are eligible for the credit and how to communicate these benefits with potential investors. Familiarity with these aspects can strengthen your funding strategies.

Who to contact for further assistance

If you have additional questions or concerns, reaching out to local investment associations, tax professionals, or relevant government agencies can provide the guidance you need. Networking events, seminars, and workshops often host experts who can elucidate complex topics.

Insights on maximizing your tax benefits

To truly maximize your tax benefits through the angel investment tax credit program, it's essential to consider strategic investment choices. Engaging in due diligence before investing will ensure that your chosen startup aligns with your investment goals and can leverage tax credits effectively. This approach not only optimizes your potential returns but also encourages a more informed investment climate.

Studying case studies from previous applicants that successfully navigated the process can offer valuable insights into strategies that may be effective in your situation. Understanding how other investors have leveraged the program can inspire confidence as you pursue your own investments.

Conclusion: The role of angel investment in economic growth

Angel investment plays a critical role in the growth and sustainability of startups. These investments not only provide necessary funding but also contribute to job creation and innovation within the economy. By encouraging collaboration between investors and entrepreneurs, the angel investment tax credit fosters a vibrant ecosystem that benefits society at large, showcasing how tax incentives can yield significant returns on investment for both parties and stimulate economic progress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete angel investment tax credit online?

How do I edit angel investment tax credit on an iOS device?

How do I fill out angel investment tax credit on an Android device?

What is angel investment tax credit?

Who is required to file angel investment tax credit?

How to fill out angel investment tax credit?

What is the purpose of angel investment tax credit?

What information must be reported on angel investment tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.