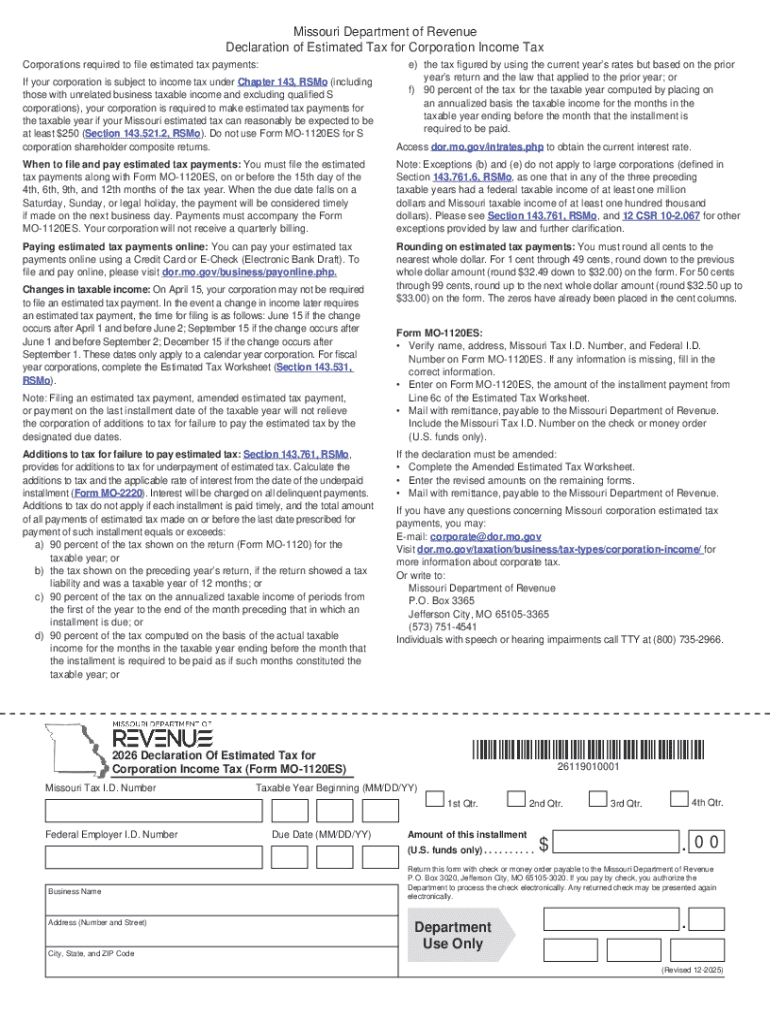

Get the free MO-1120ES - 2024 Declaration of Estimated Tax for Corporation Income Tax - dor mo

Get, Create, Make and Sign mo-1120es - 2024 declaration

Editing mo-1120es - 2024 declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-1120es - 2024 declaration

How to fill out mo-1120es - 2024 declaration

Who needs mo-1120es - 2024 declaration?

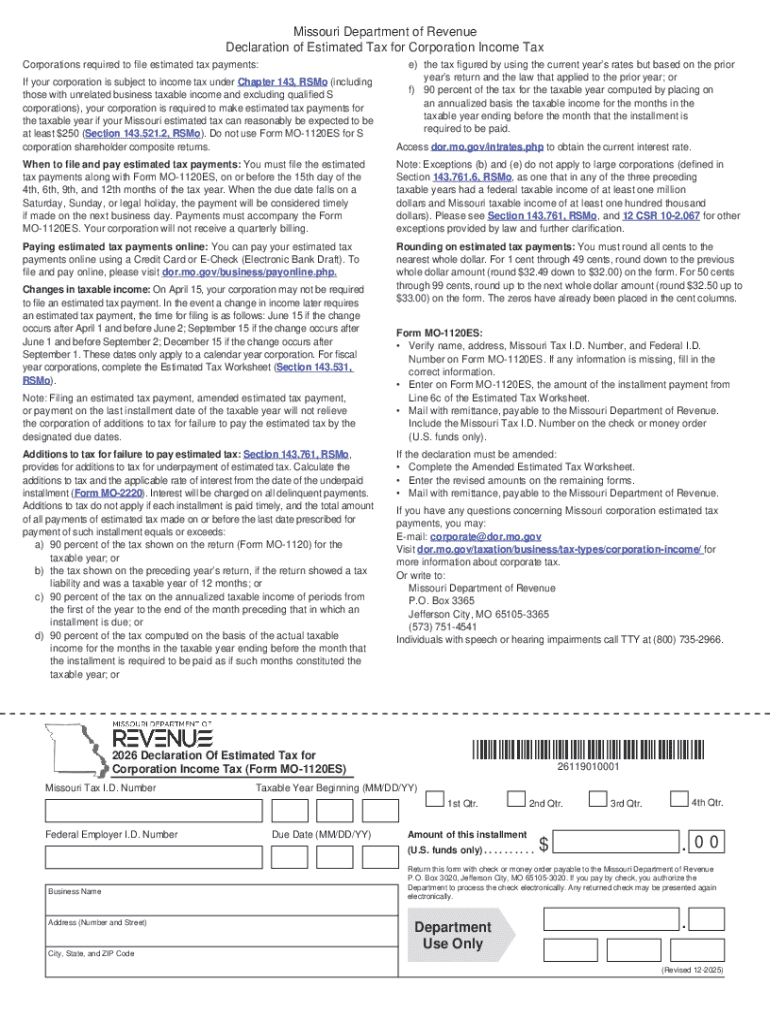

Understanding the mo-1120es - 2024 Declaration Form

Overview of the mo-1120es - 2024 Declaration Form

The mo-1120es - 2024 Declaration Form serves as a crucial document for businesses to declare their expected tax liabilities for the upcoming fiscal year. It is a means for entities operating in Missouri to estimate their state tax obligations, which aids in efficient financial planning and fulfilling state requirements. By filing this form, businesses confirm their commitment to compliance with state tax regulations and avoid potential penalties for non-submission or late filing.

Timely filing of the mo-1120es form is essential. Delays or mistakes in submission can lead to interest and penalties, impacting business cash flow and reputation. Therefore, understanding who needs to submit this form and the specific requirements is critical for maintaining compliance.

Key features of the mo-1120es - 2024 Declaration Form

A well-structured form tends to simplify the filing process. The mo-1120es form comprises several main components that guide the taxpayer through necessary entries. Each section is designed to capture crucial data pertaining to the business's estimated income and deductions.

Key components include identification information, income reporting, tax deductions, and a final calculation of tax liabilities. Filers must provide accurate figures to ensure compliance and avoid penalties. Moreover, utilizing tools such as pdfFiller can make filling out these forms more interactive and accessible through visual aids that guide users through each section.

How to access the mo-1120es - 2024 Declaration Form

Accessing the mo-1120es - 2024 Declaration Form online has never been easier. To locate the form, simply navigate to pdfFiller's website, where you can find the form categorized under state tax documents. Following a step-by-step process, users can search via keywords or browse through the tax-related forms section.

Additionally, pdfFiller provides an efficient platform for filing. By creating an account, users can tap into dedicated resources for managing their tax forms. This includes direct access to templates, past forms, and interactive tools that streamline the filing process, ensuring ease of access and efficient document management.

Step-by-step guide to filling out the mo-1120es - 2024 Declaration Form

Before diving into filling out the form, proper preparation is key. Filers should gather necessary documents like financial records, prior year tax filings, and any applicable forms or statements that outline expected income and deductions. Careful organization will facilitate accuracy and completeness in reporting, minimizing the chances of errors during submission.

Once prepared, follow these detailed instructions for completing the mo-1120es form:

Common mistakes to avoid when filing the mo-1120es form

Filing the mo-1120es form is a straightforward process; however, several common pitfalls can cause delays or complications. Frequent errors include misreporting income, incorrectly calculating deductions, or omitting necessary identification details. Each of these mistakes can result in audit triggers or penalties from the state.

To mitigate the risk of errors, it's advisable to verify each entry thoroughly. Utilize pdfFiller’s features, such as revision history and validation tools, to cross-check the data before submission. This proactive approach not only ensures compliance but also instills confidence in the accuracy of your submissions.

Post-submission guidelines for the mo-1120es - 2024 Declaration Form

After submitting the mo-1120es form, tracking your submission becomes essential for ensuring it has been received and accepted. Users can easily check their filing status through pdfFiller’s platform, which offers tracking tools and notifications for changes or required actions.

Typically, the processing timeline varies; however, understanding what to expect can help manage business expectations. In some cases, taxpayers may need to follow up with the state for additional documentation or clarifications, which is critical for preventing delays in tax processing.

Resources for further assistance with the mo-1120es - 2024 Declaration Form

For those seeking additional help, pdfFiller provides comprehensive support and customer service for users encountering issues with the filing process. Whether it's navigating the form, understanding requirements, or troubleshooting common problems, support is readily available.

Moreover, users can access various other tax tools and interactive forms on pdfFiller, which can greatly aid in managing document requirements throughout the tax season.

Frequently asked questions about the mo-1120es - 2024 Declaration Form

Understanding the nuances of the mo-1120es form raises many questions for first-time filers and seasoned businesses alike. Common queries often revolve around filing deadlines, eligibility criteria, and acceptable deductions. Getting these details correct is vital for compliance and effective planning.

Experienced filers recommend familiarizing yourself with the updated tax laws and keeping a checklist handy. This helps manage filing efficiently and avoids last-minute complications.

Enhanced features of pdfFiller for document management

PdfFiller offers a wealth of features that go beyond simply filling out the mo-1120es form. Users can easily edit, eSign, and collaborate on documents in a cloud-based environment, streamlining workflow for teams and individuals alike.

With pdfFiller, businesses can manage multiple forms, track changes in real-time and leverage features such as comments and collaborative editing. This is particularly beneficial during tax season, where accurate communication and documentation are essential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the mo-1120es - 2024 declaration electronically in Chrome?

How do I fill out the mo-1120es - 2024 declaration form on my smartphone?

How do I edit mo-1120es - 2024 declaration on an Android device?

What is mo-1120es - 2024 declaration?

Who is required to file mo-1120es - 2024 declaration?

How to fill out mo-1120es - 2024 declaration?

What is the purpose of mo-1120es - 2024 declaration?

What information must be reported on mo-1120es - 2024 declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.