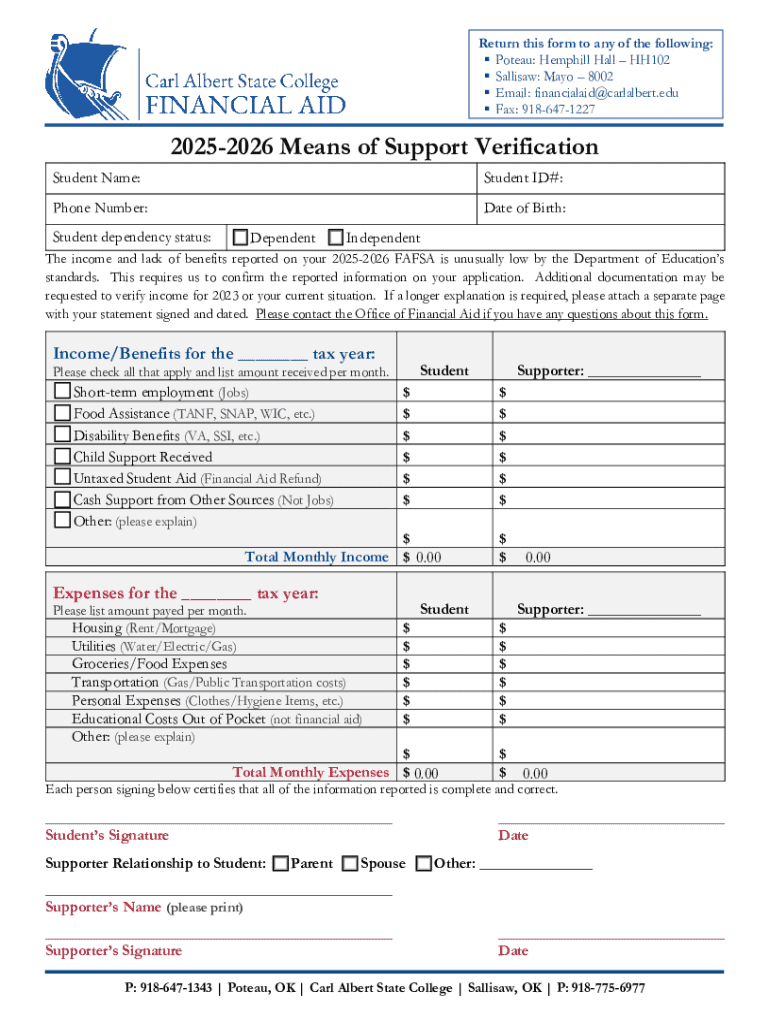

Get the free Student dependency status:

Get, Create, Make and Sign student dependency status

How to edit student dependency status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out student dependency status

How to fill out student dependency status

Who needs student dependency status?

Your Complete Guide to the Student Dependency Status Form

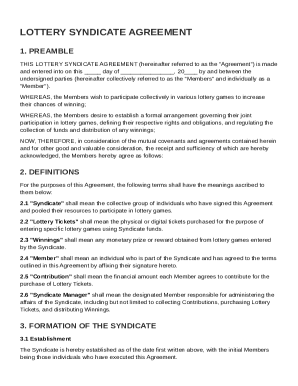

Understanding the student dependency status form

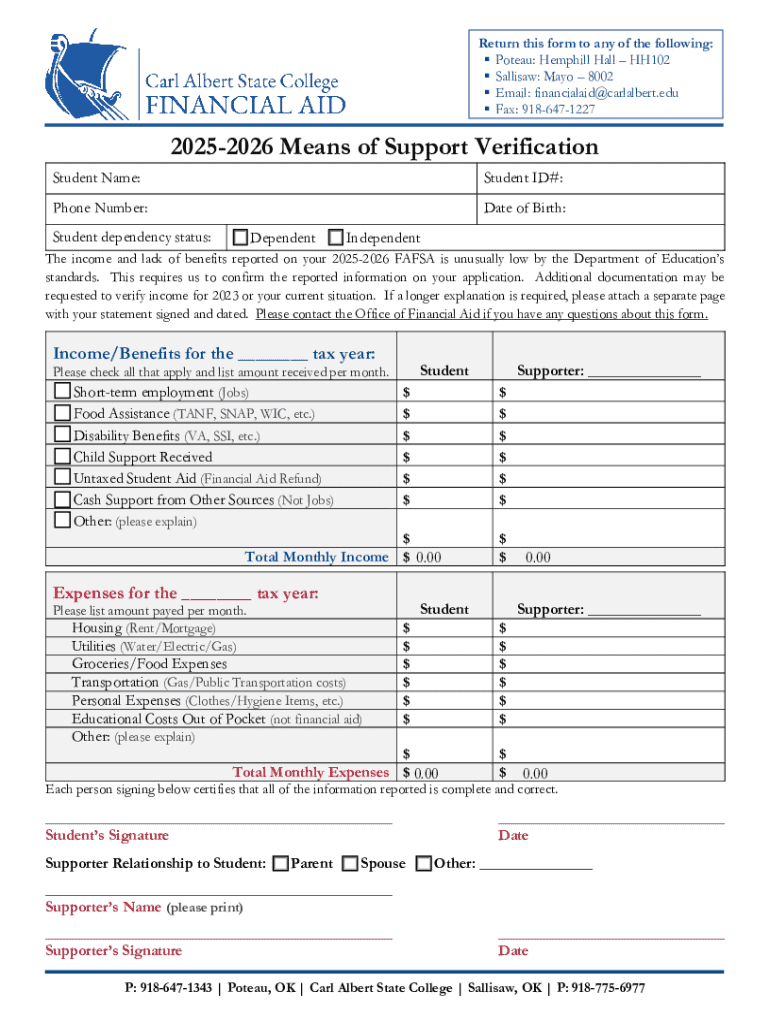

The student dependency status form plays a crucial role in financial aid applications for higher education. This form determines whether a student is classified as 'dependent' or 'independent' for financial aid purposes. This classification is significant because it influences the type and amount of financial assistance a student may receive. For instance, dependent students are required to report their parents' financial information, while independent students do not.

Accurate completion of the student dependency status form is essential, as discrepancies can result in delays or reductions in financial aid. Students must understand the criteria that define their dependency status and ensure their information aligns with the requirements set forth by the Free Application for Federal Student Aid (FAFSA).

Who is considered a dependent student?

A dependent student is generally one who relies on their parents or guardians for financial support. To assess dependency, several criteria are evaluated:

It's important to note that there are exceptions to these standard rules. For example, students who are married, veterans, or have dependents of their own may qualify as independent, even if under the age limit.

Key questions about student dependency

The student dependency status form addresses several key questions that determine financial aid eligibility. It's crucial to understand these inquiries to avoid common pitfalls.

Being informed of common FAQs can help in understanding one’s status and its potential implications on financial aid.

Step-by-step guide to completing the student dependency status form

To complete the student dependency status form accurately, it is advisable to follow a structured approach:

Taking the time to ensure completeness and accuracy can significantly reduce potential issues later during the financial aid process.

Interpreting the results from your dependency status

After submitting the student dependency status form, students eagerly await their results. Understanding these results is critical for making informed financial decisions.

The role of contributors in dependency status

In the context of the student dependency status form, contributors refer to individuals who provide financial support to the student. Understanding who qualifies as a contributor is essential for outlining a comprehensive financial picture.

Keeping an open line of communication with contributors can aid in gathering accurate financial information for the dependency status form.

Financial aid implications of your dependency status

Your dependency status directly affects the types of financial aid available to you. Understanding these distinctions can help you maximize your financial aid package.

Reviewing and understanding financial aid implications can significantly impact a student’s educational budget and long-term financial planning.

Managing your student dependency status

Changes in personal circumstances may necessitate an appeal of your dependency status. Understanding the process is essential for those who find themselves in such situations.

Remaining proactive in managing your dependency status ensures that you can adapt swiftly to changes in your financial situation.

Tips for a smooth application process

To facilitate a seamless experience when completing the student dependency status form, consider these best practices:

Taking a proactive approach and leveraging available resources can greatly enhance your financial aid application experience.

Related topics and resources

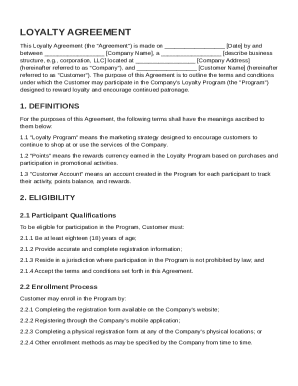

Exploring related documents can also facilitate a better understanding of your financial aid process. Consider the following insights:

Utilizing these resources ensures you will be well-informed as you navigate the complexities of student financial aid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit student dependency status from Google Drive?

How do I execute student dependency status online?

How do I edit student dependency status on an Android device?

What is student dependency status?

Who is required to file student dependency status?

How to fill out student dependency status?

What is the purpose of student dependency status?

What information must be reported on student dependency status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.