Get the free Form 1040, U.S. individual income tax return - Quick Search

Get, Create, Make and Sign form 1040 us individual

Editing form 1040 us individual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1040 us individual

How to fill out form 1040 us individual

Who needs form 1040 us individual?

Form 1040 US Individual Form: Your Comprehensive Guide to Filing Taxes

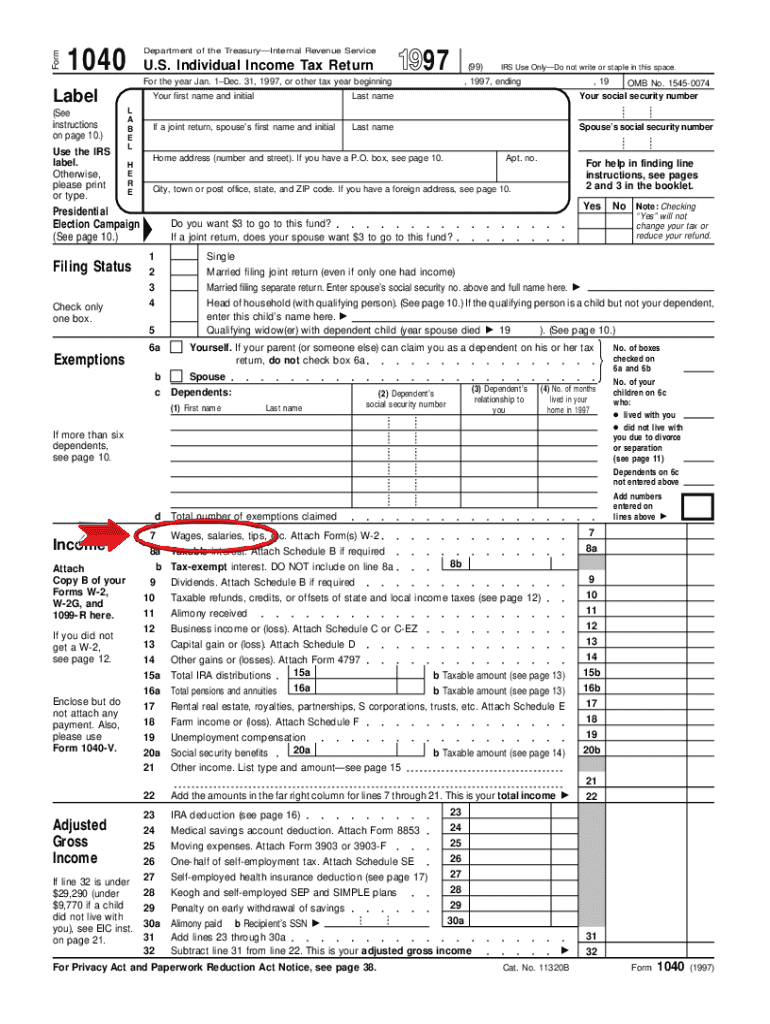

Understanding Form 1040: The backbone of U.S. individual income tax returns

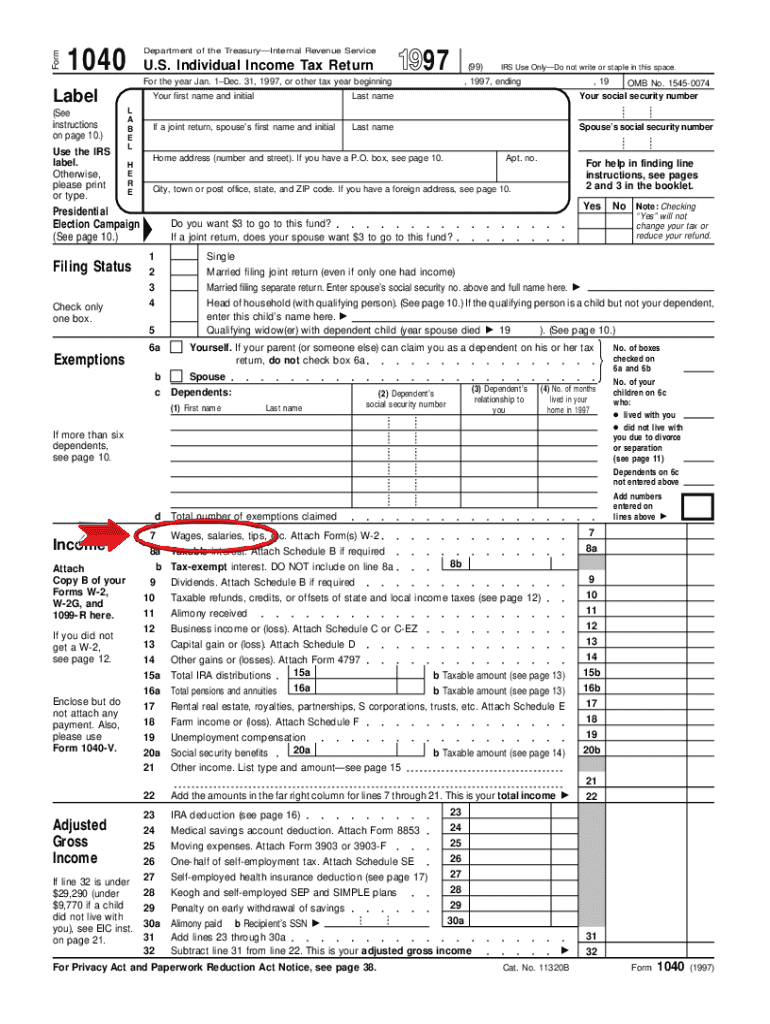

Form 1040 is the primary document used by U.S. citizens and residents to file their individual income tax returns. It serves as a comprehensive summary of a taxpayer's income, deductions, and credits, allowing the IRS to assess individual tax liabilities. As the backbone of the U.S. tax system, this form is crucial for individuals to report their earnings and taxes owed accurately.

Filing Form 1040 is mandatory for anyone who meets specific income thresholds, ensuring compliance with the U.S. tax laws. It's not just an obligation; it's an opportunity for taxpayers to maximize their claims for deductions and credits. By understanding and utilizing Form 1040 effectively, individuals can manage their taxation needs and potentially lower their tax bills.

Who should file Form 1040?

Determining whether you should file Form 1040 hinges on various criteria, predominantly income level and residency status. For most U.S. citizens and residents, if your gross income exceeds the filing threshold — which can vary based on age and filing status — you are required to file. Current thresholds are regularly updated, so staying informed is vital.

Additionally, residency status greatly influences taxation obligations. U.S. expats must also file Form 1040, even if they reside abroad and earn foreign income. However, exceptions exist for dependents or individuals earning below the threshold, and those with certain income types may have different filing requirements.

Components of Form 1040: What you need to know

Form 1040 consists of several critical sections that taxpayers must navigate to complete their tax returns accurately. The first section gathers personal information — such as names, addresses, and Social Security numbers. It's essential to ensure accuracy here, as discrepancies can lead to processing delays or issues.

The income reporting section is where taxpayers disclose all sources of income, from wages to investment earnings. Adjusted Gross Income (AGI) follows that section, representing your total income minus certain deductions. Understanding how AGI is calculated is fundamental, as it often determines eligibility for various tax credits and deductions.

What income needs to be reported on Form 1040?

When preparing Form 1040, accuracy in reporting income is essential to avoid legal complications. Taxpayers must declare all forms of income, which can be varied and include wages, salaries, self-employment income, and more. All sources must be documented to ensure transparent reporting.

Being meticulous about what constitutes income is crucial, especially if you earn money from multiple sources. Misreporting can lead to audits or penalties by the IRS, emphasizing the importance of thorough documentation.

Deductions and credits: Maximizing your tax benefits

To reduce taxable income, taxpayers have the option to take deductions or tax credits. Understanding these can significantly impact your tax filing. Deductions lower the amount of income that is subject to tax, while credits directly reduce the amount of tax owed.

Choosing between standard and itemized deductions hinges on which option provides a greater tax benefit. Thoroughly analyzing expenses can help individuals maximize their returns by identifying all eligible deductions.

Special considerations for U.S. expats filing Form 1040

U.S. expats face unique challenges when filing Form 1040, primarily due to income earned abroad. They are still required to file U.S. taxes on their global income, which can be taxing and complex. Fortunately, the IRS provides mechanisms to alleviate double taxation through treaties and credits.

Expatriates may also qualify for the Foreign Earned Income Exclusion, which allows them to exclude a certain amount of foreign income from U.S. taxation. Demonstrating eligibility requires meeting specific tests, such as the physical presence test or the bona fide residence test.

Navigating scheduled forms and attachments

Form 1040 often requires accompanying scheduled forms that provide detailed breakdowns of specific tax situations. Familiarizing yourself with these schedules is crucial to ensure that your return is complete and compliant.

Accurate attachments can significantly affect tax filings. Missing any essential scheduled forms may lead to delays in processing your return or result in unintended consequences—emphasizing the need for diligence.

Steps to complete and submit your Form 1040

Successfully completing and submitting Form 1040 begins with gathering all your necessary documentation. This includes W-2s, 1099 forms, receipts for deductions, and relevant tax information. Taking the time to organize these documents can save you hours of frustration later.

Filling out the form accurately is paramount, and you can choose between electronic filing or paper filing. Electronic filing through authorized software can streamline the process and reduce the chances of errors while adhering to important deadlines, which is vital to avoid fines.

How to edit, sign, and manage your Form 1040 using pdfFiller

pdfFiller offers a seamless way to edit PDF forms online. Utilizing our platform, you can effortlessly fill out Form 1040, making corrections as needed without the hassle of printing and scanning. The editing features allow you to ensure every detail is accurate before submission.

Moreover, pdfFiller allows you to utilize eSignatures, enabling you to submit your form quickly and securely. Collaborating on tax documents is easy within teams, making document management for tax filing a breeze.

Common mistakes to avoid when filing Form 1040

Filing Form 1040 comes with its fair share of pitfalls. One of the most common mistakes individuals make is entering incorrect information, such as social security numbers, names, or addresses. Even minor errors can lead to significant processing delays or audits.

Additionally, missing out on deductions and credits you're entitled to can leave money on the table. Late submissions can result in fines, so it's essential to stay organized and aware of deadlines to ensure your submission is timely and complete.

FAQs about Form 1040

Taxpayers often have questions regarding Form 1040 and the filing process. What happens if I make a mistake on my Form 1040? Typically, you can amend your tax return using Form 1040-X to correct any errors. Can I track the status of my Form 1040? Yes, the IRS provides various online tools for tracking your tax return after submission.

For those who have already filed, amendments can be made if you realize you've missed something crucial. Familiarizing yourself with the IRS guidelines can clarify many of these concerns and simplify your filing process.

Leveraging online tools for an efficient tax filing experience

Utilizing online tools like those offered by pdfFiller can transform your experience with filing taxes. Interactive calculators can help you estimate your tax obligations, while checklists ensure you don't miss any critical steps.

Additionally, online resources for ongoing tax support and guidance provide the information needed to navigate complex tax systems effectively. Dive into these tools to streamline your tax preparation and enhance your overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 1040 us individual to be eSigned by others?

How do I make changes in form 1040 us individual?

How do I complete form 1040 us individual on an Android device?

What is form 1040 us individual?

Who is required to file form 1040 us individual?

How to fill out form 1040 us individual?

What is the purpose of form 1040 us individual?

What information must be reported on form 1040 us individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.