Get the free NACS 403B Annuity Plan

Get, Create, Make and Sign nacs 403b annuity plan

Editing nacs 403b annuity plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nacs 403b annuity plan

How to fill out nacs 403b annuity plan

Who needs nacs 403b annuity plan?

A comprehensive guide to the NACS 403b annuity plan form

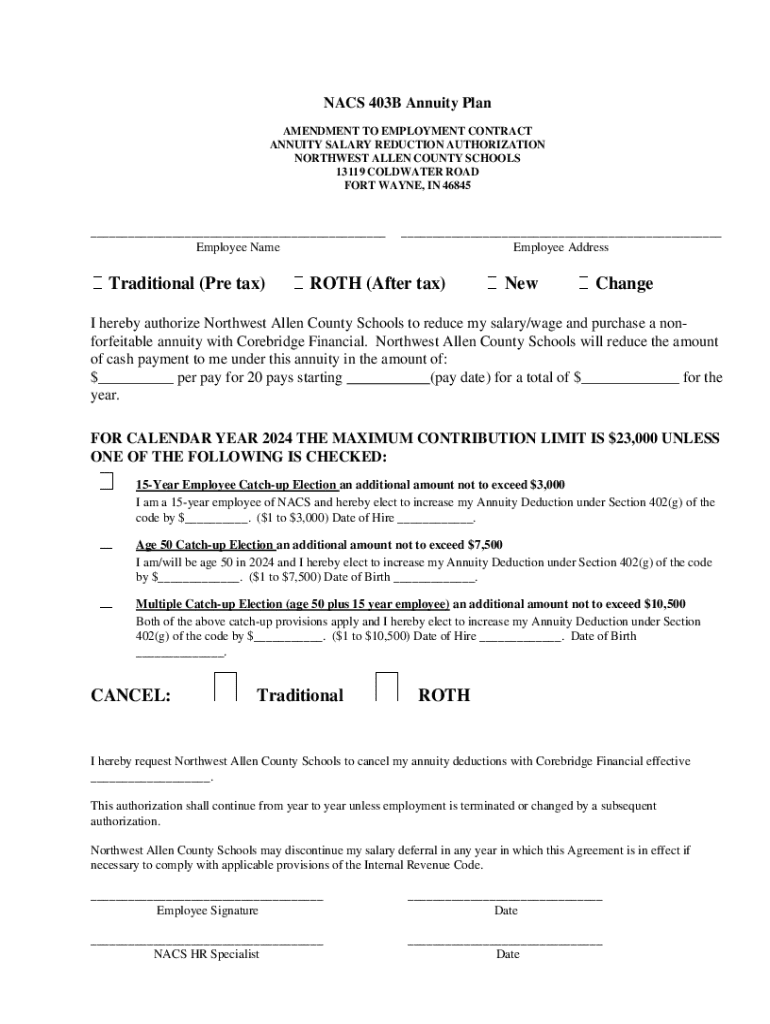

Understanding the NACS 403b annuity plan

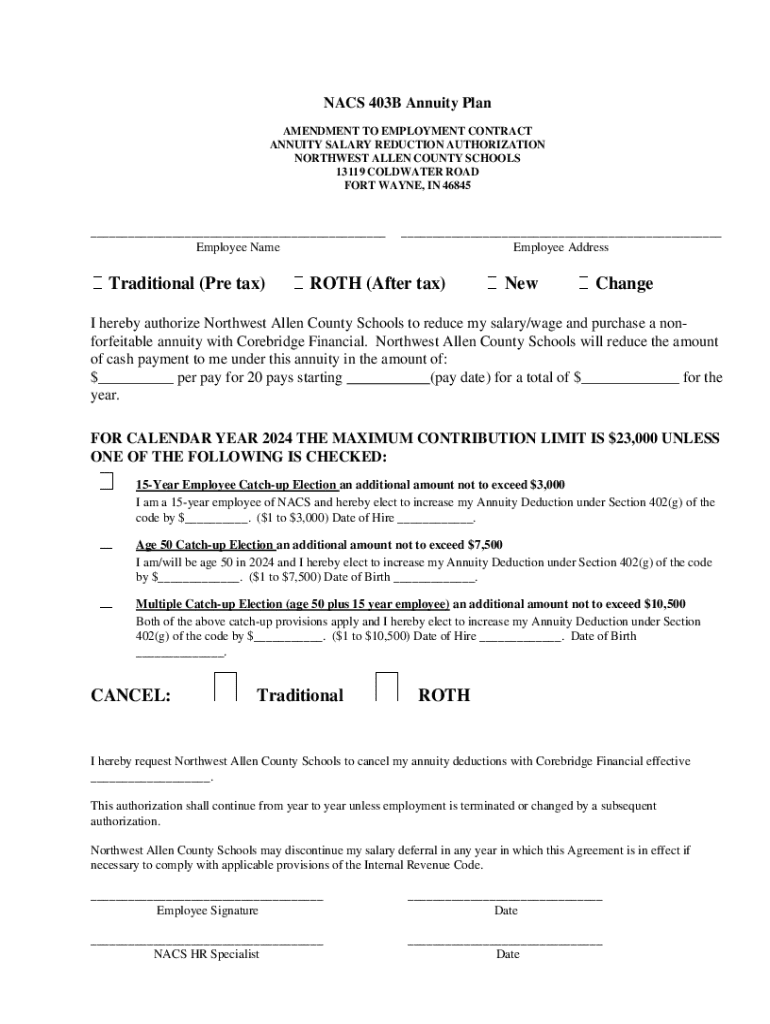

A 403b annuity plan is a retirement savings option available primarily to employees of nonprofit organizations, public schools, and certain religious institutions. The NACS (National Association of College Stores) specifically provides a unique version tailored for its members, allowing them to build financial security through pre-tax contributions, thereby reducing their taxable income.

The key benefits of the NACS 403b annuity plan include the ability to grow savings tax-deferred until withdrawal, various investment options, and potential employer matching contributions. This plan is designed to help participants save more efficiently for retirement while taking advantage of a flexible investment framework.

Eligibility for participation in the NACS 403b annuity plan generally includes employees of affiliated institutions who meet specific criteria, such as minimum service requirements. Understanding the eligibility can help individuals ascertain their options for retirement planning.

Navigating the NACS 403b annuity plan form

The NACS 403b annuity plan form is an essential document for those looking to enroll or modify their participation in the retirement plan. It serves as a formal request for contributions, beneficiary designations, and investment choices. Completion of this form is critical, as it ensures that your intentions are accurately recorded and executed by the plan administrators.

Common scenarios that might require the NACS 403b annuity plan form include initiating a new plan, adjusting contribution levels, or updating beneficiary information after life events such as marriage or divorce.

For easy access, the NACS 403b annuity plan form can be found and completed on pdfFiller, a convenient online platform designed for document management, allowing you to fill out the form digitally and store it securely.

Step-by-step instructions for completing the NACS 403b annuity plan form

Completing the NACS 403b annuity plan form involves a few straightforward steps that ensure accuracy and completeness. First, gather all necessary information, including personal details such as your full name, Social Security number, and contact information. Moreover, employment information such as your employer’s name and your position may be required.

Filling out the form requires attention to detail. Start with the Employee Information section by entering your details accurately. Next, designate your beneficiaries, ensuring you provide their names, relationships, and contact details. Finally, choose your contribution options, which may vary based on the investment strategies you wish to deploy.

After completing the form, take time to review it thoroughly. Look for any misspelled names, incorrect Social Security numbers, or missing information that may delay processing. This step is crucial for ensuring the smooth handling of your submission.

Tools and features on pdfFiller for managing your NACS 403b form

pdfFiller provides a suite of services that enhance how you manage your NACS 403b annuity plan form. The editing tools allow users to easily fill, modify, and customize their forms as needed. It eliminates the need for printing and scanning, significantly streamlining the process.

eSigning the form is straightforward with pdfFiller's integrated electronic signature feature. Simply follow the step-by-step guide within the platform to insert your signature digitally, which provides authenticity and saves time. Collaboration with HR or financial advisors is also seamless; users can share links to the form for quick input and feedback.

Common mistakes to avoid when filling out the NACS 403b form

While completing the NACS 403b annuity plan form, there are several common pitfalls to be aware of. Ensuring all sections are completed is critical; leaving blank areas may lead to unnecessary processing delays. Double-checking beneficiary information is equally important, as inaccuracies here can lead to issues during distribution.

Additionally, don’t forget to sign or date the form. A simple oversight like this may result in your form being returned or rejected, causing you to miss valuable investment opportunities.

Tracking submission and confirmation of your NACS 403b form

Once your NACS 403b annuity plan form is completed and submitted, the next step is to ensure its successful delivery. Check the submission process as stipulated by your institution's Human Resources or plan administrator to avoid complications. You will typically need to submit your completed form via email or in person.

Following submission, confirming receipt with HR or the plan administrator is essential. This proactive approach can save you from potential issues regarding your enrollment or contributions, ensuring you stay informed about your retirement planning.

Frequently asked questions (FAQs)

Mistakes are inevitable, and users often wonder what happens if they make an error on the form. Generally, you can correct minor mistakes by submitting a new version or contacting HR for guidance. Updating beneficiary information can also be done through the form, making it easy to reflect any life changes.

Many individuals also inquire about when they can access their account details after submission. Typically, account information becomes available shortly after your form is processed, but it’s always best to check directly with your provider for the most accurate timeframe.

Additional insights and best practices

Maximizing your NACS 403b benefits involves more than just signing up; it requires a strategic approach to your financial planning. Regular contributions and staying informed about the latest investment options can enhance your retirement savings significantly.

Additionally, it’s wise to review your annuity plan periodically, particularly after significant life changes or shifts in financial goals. Keeping your plan aligned with your overall financial strategy ensures that you’re on track for a secure future.

Support and assistance

If you encounter challenges while managing your NACS 403b an annuity plan form, help is available. pdfFiller support is ready to assist users with any questions or technical issues they may face, ensuring a smooth experience during form completion.

Moreover, pdfFiller provides ample resources on their platform for effective document management, from instructional guides to live chat support. Users can leverage these tools to streamline their document-related tasks.

Interactive tools available via pdfFiller

The interactive tools offered by pdfFiller enhance your experience when managing the NACS 403b annuity plan form. From advanced editing features that allow for efficient changes to the capability of creating custom templates, pdfFiller ensures that you have everything you need at your fingertips.

This capability streamlines the overall process from filling out, signing, to managing annuity documents. Whether you are an individual user or part of a team, these functionalities simplify collaboration and foster productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nacs 403b annuity plan in Chrome?

Can I create an eSignature for the nacs 403b annuity plan in Gmail?

How do I fill out nacs 403b annuity plan using my mobile device?

What is nacs 403b annuity plan?

Who is required to file nacs 403b annuity plan?

How to fill out nacs 403b annuity plan?

What is the purpose of nacs 403b annuity plan?

What information must be reported on nacs 403b annuity plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.