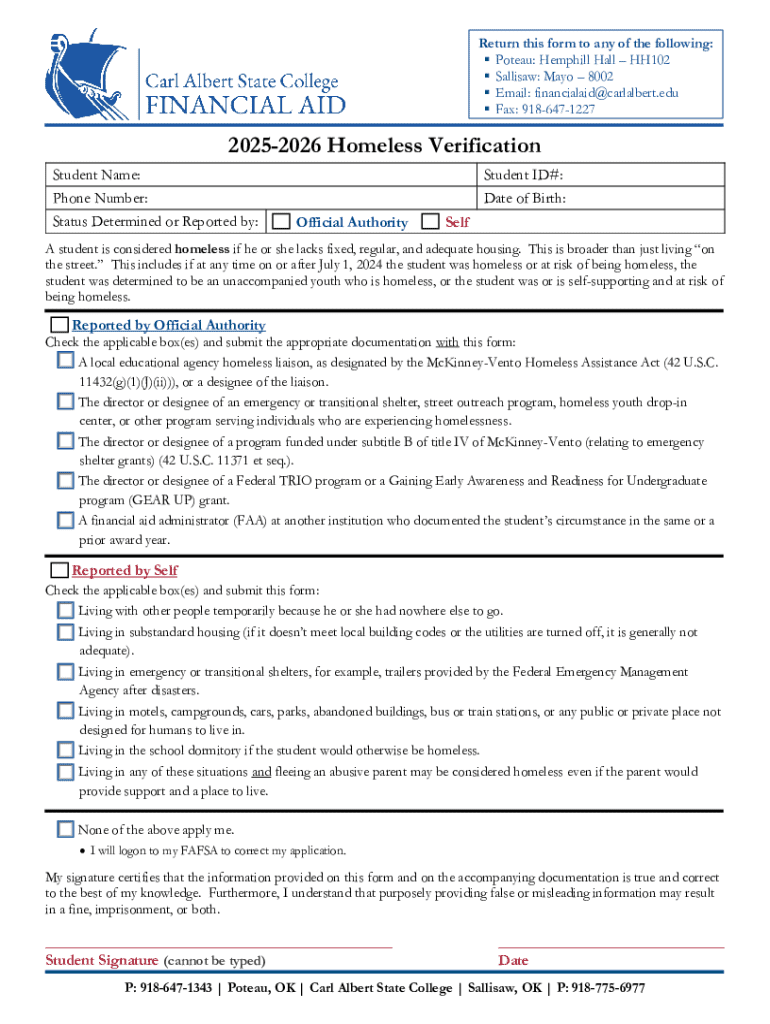

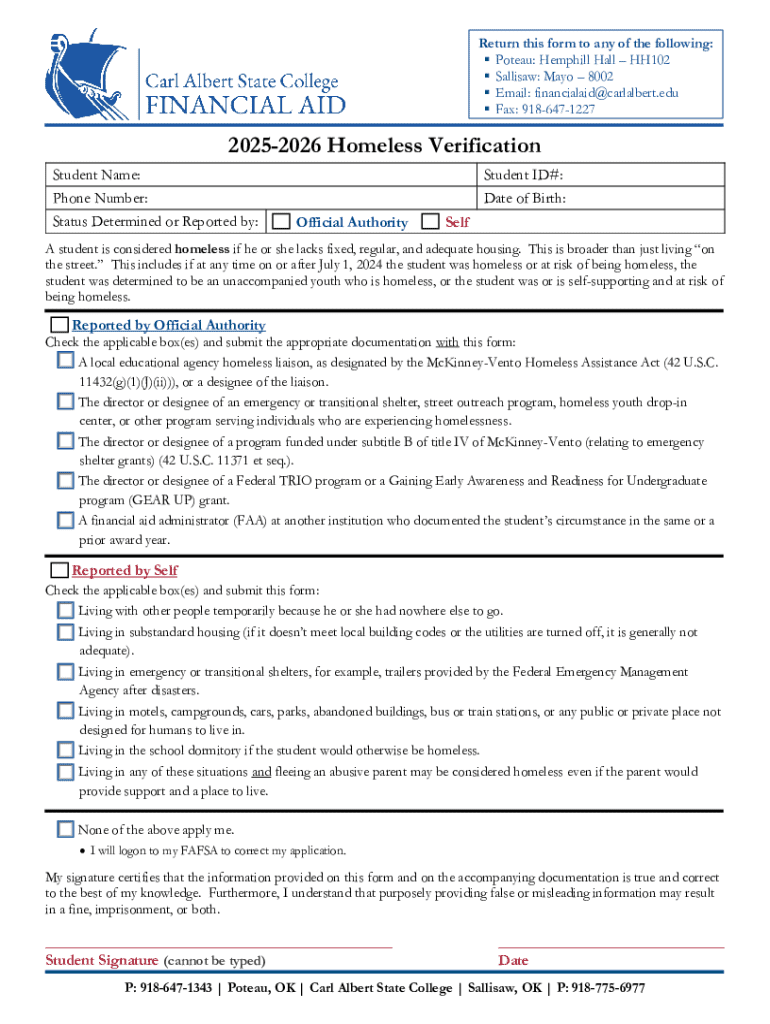

Get the free Status Determined or Reported by:

Get, Create, Make and Sign status determined or reported

How to edit status determined or reported online

Uncompromising security for your PDF editing and eSignature needs

How to fill out status determined or reported

How to fill out status determined or reported

Who needs status determined or reported?

Understanding the Status Determined or Reported Form: A Comprehensive Guide

Understanding the status determined or reported form

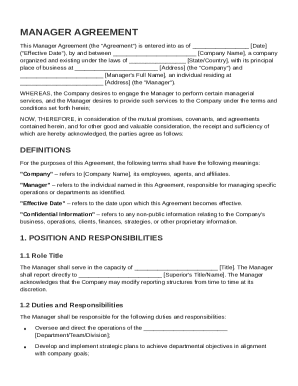

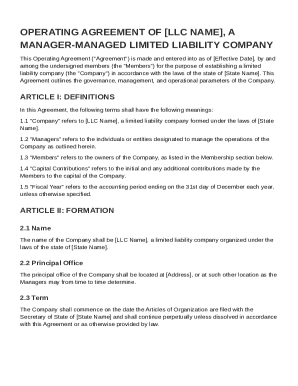

A Status Determined or Reported Form is a vital document used primarily in the context of employment and tax compliance. This form captures an employee's status for unemployment tax purposes, defining whether an employee is eligible or ineligible for unemployment benefits. Understanding its purpose is crucial for employers, payroll departments, and employees alike, as mismanagement can lead to significant liabilities related to tax payments and reporting inaccuracies.

Its importance in document workflows cannot be understated. By ensuring that information is accurately recorded and reported, businesses can mitigate compliance risks with employment laws. This form not only affects the employees but also has long-term implications on a company's unemployment tax rates, making it imperative for organizations to complete it meticulously.

Use cases

Situations in which the Status Determined or Reported Form is typically utilized include hiring and terminating employees, changes in employment status, and during audits by tax authorities. Businesses routinely prepare this form during payroll reporting periods, ensuring that all account information related to employees is kept up to date. The benefits of correctly completing the form include reduced risk of audits, streamlined tax payments, and clear documentation for both employers and employees in case of disputes regarding unemployment claims.

Key components of the status determined or reported form

The Status Determined or Reported Form comprises essential fields that need to be filled out correctly to avoid confusion later. Mandatory fields typically include the employee’s name, Social Security number, employment status, dates of employment, and reason for status determination. These fields are critical for accurate reporting and must be completed with utmost care.

Optional fields may include additional notes or explanations regarding the employment status or circumstances that led to the change. While these fields are not always required, they can enhance clarity and serve as documentation for future reference. Understanding the common terminology used in this form is crucial, as it not only ensures clarity but also prevents misunderstandings.

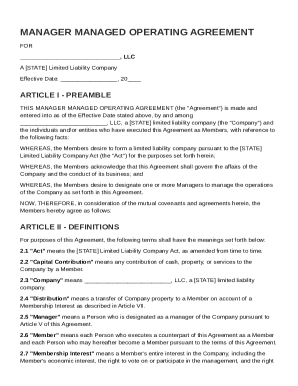

Preparing to complete the form

Before filling out the Status Determined or Reported Form, it is beneficial to gather all required documents and information. Key documents to have on hand include tax records, prior employment paperwork, and any previous payroll reports that provide context around the employee’s history. This preparation helps to ensure that all information is accurate and comprehensive.

In terms of accuracy and compliance, double-checking the information you provide will go a long way. Accuracy in this form is essential, as the wrong data can result in compliance violations and potential liabilities for the employer. It is also crucial to remain aligned with all relevant laws and guidelines related to unemployment taxes and employee benefits, as any discrepancies may lead to disputes or audits.

Step-by-step instructions for filling out the form

Filling out each section of the Status Determined or Reported Form requires careful attention. Start with the employee's personal details such as name and Social Security number in the designated fields. Proceed to specify the dates of employment and the nature of the status determination. When entering information, ensure clarity by using straightforward language and confirming the spelling of names and titles involved.

Avoid common mistakes such as using outdated information or failing to include necessary documentation. Other frequent errors include neglecting to sign the form or skipping over optional fields that may enhance clarity. A good practice when it comes to form filling is to always keep a copy for yourself. This is especially useful for tracking changes or clarifying details in case questions arise in the future.

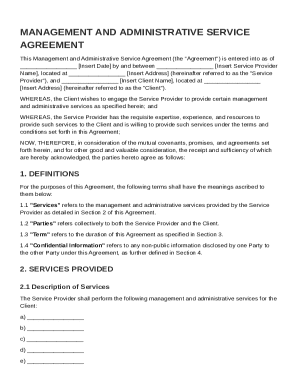

Editing and modifying the form

Having the ability to efficiently edit and modify a Status Determined or Reported Form can significantly improve document management. Tools like pdfFiller facilitate this process, enabling users to import forms into an editable format, allowing easy adjustments. Users can utilize features such as text editing, annotation, and electronic signatures, making the process smoother.

Maintaining version control is equally important. When changes are made, keeping track of those adjustments ensures that everyone involved is aware of the latest information. By organizing changes chronologically or in a version log, you can avoid confusion and potential legal disputes down the line, especially relevant when it comes to compliance with employer documentation laws.

Signing and securing the form

The signing process for the Status Determined or Reported Form has evolved, allowing for electronic signatures through platforms like pdfFiller. This not only speeds up the process but also maintains the legality of the document. E-signatures are generally regarded as valid as traditional signatures under the e-SIGN Act, provided they meet certain conditions that ensure identity verification and intent.

Adding security features such as password protection and document encryption can also contribute significantly to the form's integrity. By safeguarding sensitive data related to employees, businesses can minimize risks associated with internet privacy policies and unauthorized access. Establishing accessible but protected protocols is essential.

Collaborating on the status determined or reported form

Collaboration while handling the Status Determined or Reported Form can be made seamless when using pdfFiller. Users can share the form with team members for real-time collaboration, allowing multiple users to annotate and comment on the document. This ensures everyone is aligned and can contribute valuable feedback, which is crucial for maintaining accurate and compliant records.

When managing feedback and revisions, it's beneficial to adopt best practices like establishing a clear outline for what needs to be addressed. Encourage comments to remain specific and constructive to foster effective communication among team members. Version histories also play a significant role here, as they allow users to trace back alterations, ensuring that every revision process is documented.

Submitting the finished form

Once the Status Determined or Reported Form is complete, it’s time to submit. Organizations often face options on submission methods; these can range from online submissions to mailing hard copies. Each method may have its own verification requirements, so it’s crucial to consult the guidelines associated with each method to ensure it's properly completed and submitted.

To confirm and track the submission status, consider utilizing tracking numbers if the form is mailed or confirm receipt via email for online submissions. This proactive approach can safeguard against issues such as forms being lost in transit or not processed correctly by the receiving organization, which may result in complications regarding unemployment taxes or employee records.

Tips for managing form documentation

Effective document management is key when handling the Status Determined or Reported Form. Utilizing tools like pdfFiller for organizing submitted forms allows teams to maintain a structured repository that is easily accessible. Implementing a clear naming and filing system will aid in managing documents efficiently, reducing retrieval times during audits or when inquiries arise.

Retention of records for future reference is equally important. Depending on local employment laws, businesses must keep accurate records for a defined period. Best practices include creating backups of digital files, ensuring they conform to both internet privacy policies and internal record-keeping procedures. This foresight helps organizations manage compliance risks effectively.

Troubleshooting common issues

Users often encounter various challenges while filling out or submitting the Status Determined or Reported Form. Frequent issues include difficulty in navigating the form, missing fields, or incorrect information leading to rejections. Understanding how to preempt these problems can save users time and reduce frustration.

Resources for obtaining support when difficulties arise are essential. Leverage customer service offered by platforms like pdfFiller or access community forums where users share tips and solutions. These resources can provide valuable insights and often resolve minor issues quickly, minimizing disruptions in workflow.

Expanding your knowledge regarding forms

In the domain of employment and taxation, understanding the Status Determined or Reported Form is only the beginning. Expanding your knowledge regarding related forms and documentation can offer deeper insights into compliance and reporting requirements. Adjacent forms, such as those related to payroll reports and tax payment coupons, can complement your understanding and facilitate better management of employee accounts.

Additionally, investing time in continued education on document management, particularly with tools like pdfFiller, can bolster both personal and organizational efficiency. Many platforms offer tutorials and resources that streamline the process of handling documents, so taking advantage of these can prove substantially beneficial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send status determined or reported to be eSigned by others?

How do I edit status determined or reported on an iOS device?

How do I fill out status determined or reported on an Android device?

What is status determined or reported?

Who is required to file status determined or reported?

How to fill out status determined or reported?

What is the purpose of status determined or reported?

What information must be reported on status determined or reported?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.