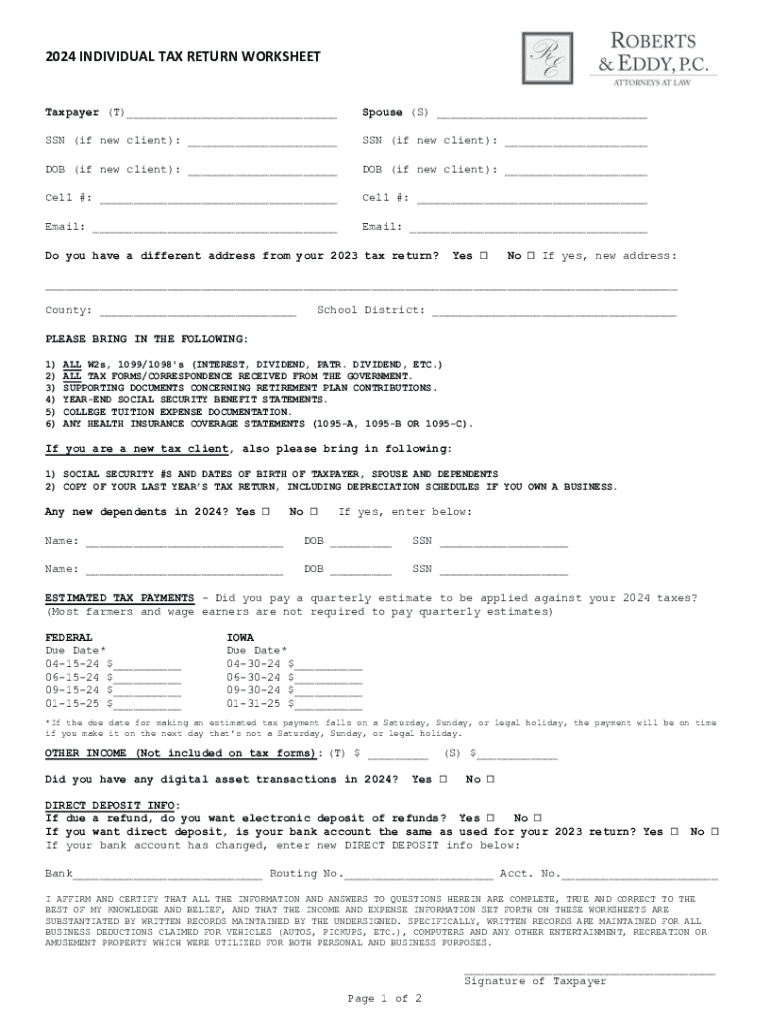

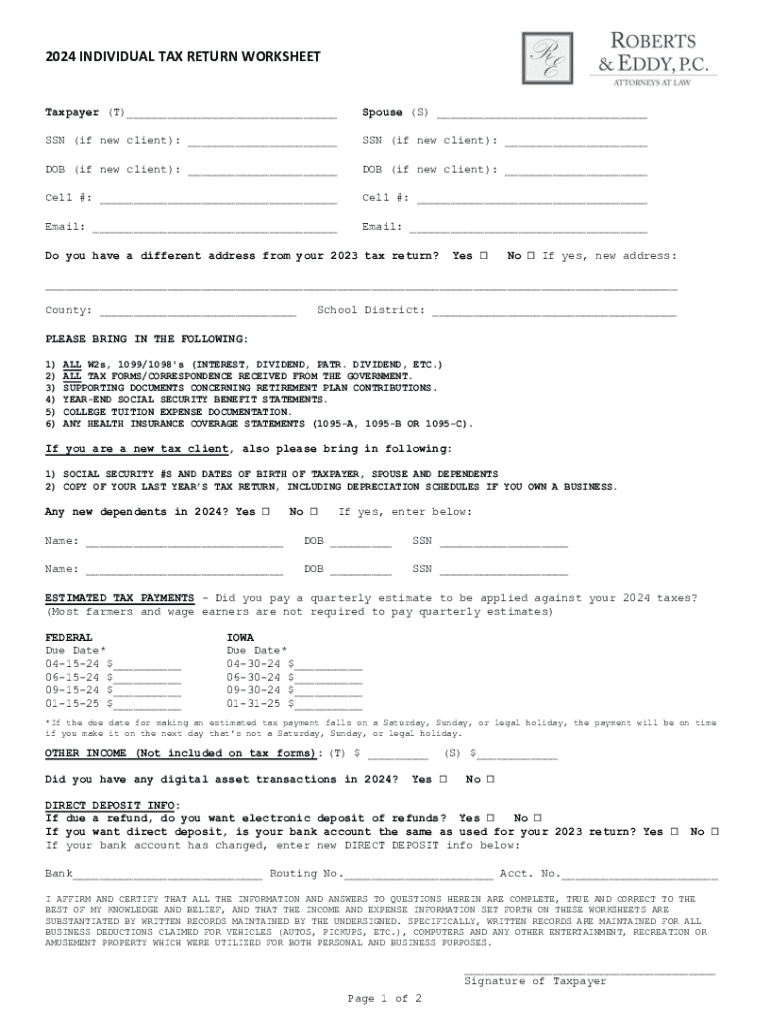

Get the free 2024 INDIVIDUAL TAX RETURN WORKSHEET

Get, Create, Make and Sign 2024 individual tax return

How to edit 2024 individual tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 individual tax return

How to fill out 2024 individual tax return

Who needs 2024 individual tax return?

Navigating the 2024 Individual Tax Return Form: Your Comprehensive Guide

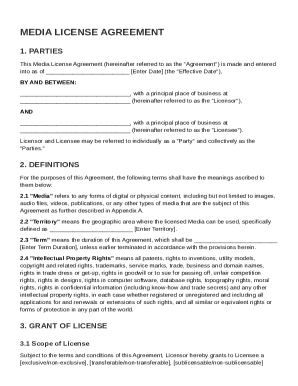

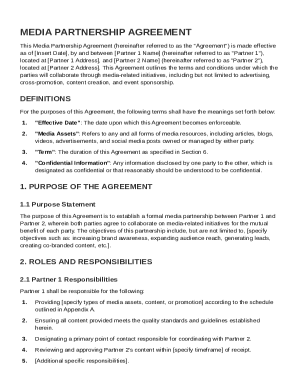

Understanding the 2024 individual tax return form

The 2024 individual tax return form represents a crucial document for every taxpayer in the U.S., allowing individuals to report their income, claim deductions, and determine their tax liability. This year, several adjustments have been made to streamline the process and accommodate recent tax law changes. Understanding these modifications is essential for successful filing and maximizing potential refunds.

Accurate filing not only ensures compliance with IRS regulations but also helps to optimize your tax situation. Errors can lead to penalties or delayed refunds, making it imperative to approach the 2024 filing season well-prepared.

Types of 2024 individual tax return forms

The primary forms for individual tax returns are Form 1040, Form 1040A, and Form 1040EZ. Form 1040 is the standard income tax form for individuals and is now more versatile than ever. Form 1040A was a simplified version primarily for those with straightforward tax situations. Form 1040EZ, while phased out, was designed for young taxpayers with minimal taxes to report.

Choosing the right form depends on various factors, including your income sources, whether you are claiming deductions, and the types of credits available to you. For most, the updated Form 1040 will suffice.

Preparing to fill out your 2024 individual tax return form

Preparation is key to ensuring a smooth filing process. Collecting all necessary documentation in advance simplifies the task of filling out the 2024 individual tax return form. You'll need to gather income statements, such as W-2s and 1099s, as well as records of any deductions and credits you intend to claim.

Creating a tax filing checklist can also help streamline this process. Ensure you have all these essential items before diving into your tax preparation.

Step-by-step guide to completing the 2024 individual tax return form

Completing your 2024 individual tax return form may seem daunting, but by breaking it down into manageable sections, you can tackle each part with confidence. Below is a step-by-step guide to help you through the essential components:

Utilizing interactive tools for a seamless filing experience

Using interactive tools significantly eases the process of filling out the 2024 individual tax return form. Platforms like pdfFiller simplify tax preparation with a user-friendly interface that allows you to edit forms directly. Features like eSignature capabilities enable quick approvals, making the filing process much quicker.

Moreover, pdfFiller’s collaboration tools allow users to invite tax professionals to review and provide input on tax documents. This feature can prove invaluable, particularly if you need a second opinion on complicated tax situations.

Submitting your 2024 individual tax return form

Once your 2024 individual tax return form is complete, you need to decide between electronic and paper filing methods. E-filing is increasingly popular due to its benefits, which include speed and accuracy. The IRS processes electronic returns faster, leading to quicker refunds.

Understanding deadlines is also crucial. The standard filing deadline for the 2024 individual tax return form is April 15, but it can vary due to holidays or weekends. Mark your calendars to avoid late submissions.

After submission: What comes next?

Once your 2024 individual tax return form is submitted, you can track its status via the IRS website. Typically, you’ll receive a confirmation once your return is accepted. If the IRS has any inquiries or needs additional information, you will hear from them directly.

Common FAQs about the 2024 individual tax return form

Taxpayers frequently have questions regarding the 2024 individual tax return form. Understanding these common inquiries enhances your confidence in managing your taxes.

Maximizing your tax refund: Tips and tricks

To make the most out of your tax returns, consider several strategies. Deductions and credits can significantly reduce your tax bill, but it’s crucial to know the available options and eligibility requirements.

Conclusion: Mastering the 2024 individual tax return form with confidence

By familiarizing yourself with the 2024 individual tax return form and utilizing effective tools such as pdfFiller, you can transform tax season from a burden into an opportunity for financial insight and growth. Embrace organized document management and ensure that you meet deadlines without stress. With a diligent approach, mastering your tax duties is well within reach, empowering you with the knowledge to navigate your finances with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 individual tax return without leaving Google Drive?

How do I execute 2024 individual tax return online?

How do I complete 2024 individual tax return on an iOS device?

What is 2024 individual tax return?

Who is required to file 2024 individual tax return?

How to fill out 2024 individual tax return?

What is the purpose of 2024 individual tax return?

What information must be reported on 2024 individual tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.