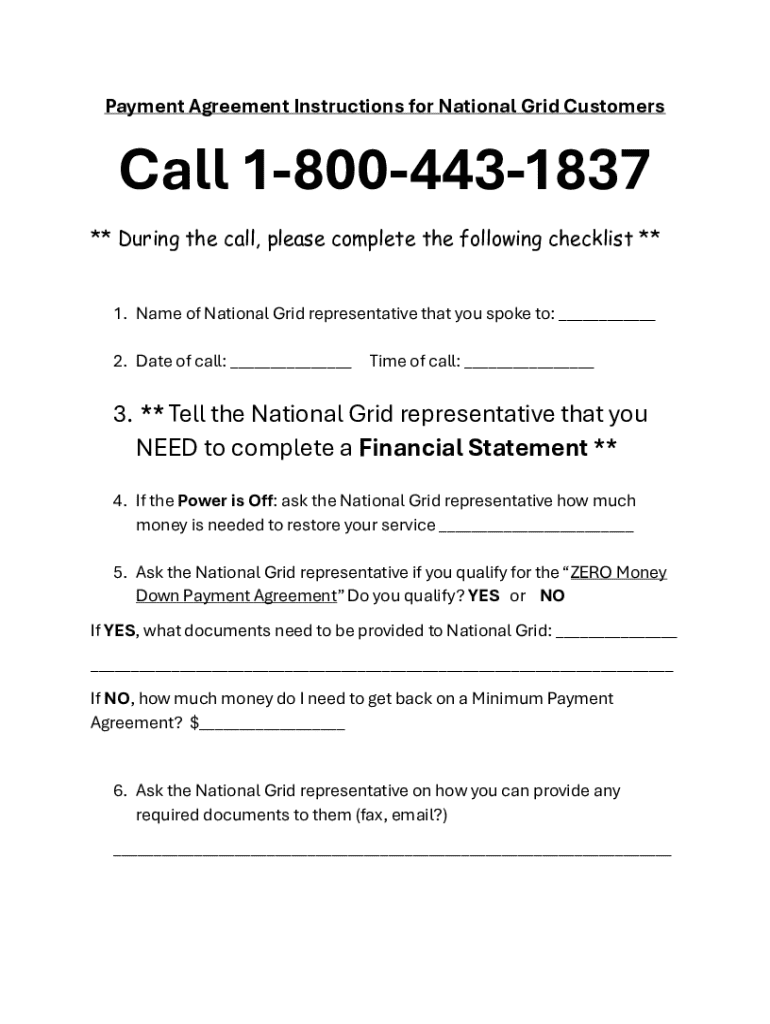

Get the free Payment Agreement Checklist for National Grid

Get, Create, Make and Sign payment agreement checklist for

Editing payment agreement checklist for online

Uncompromising security for your PDF editing and eSignature needs

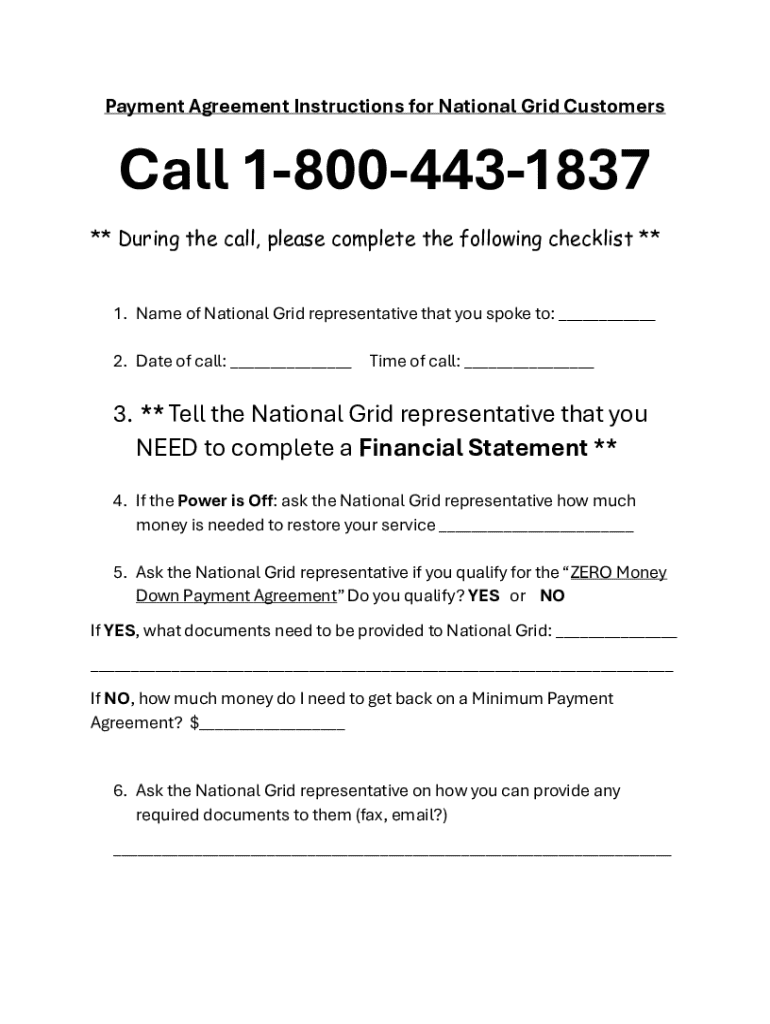

How to fill out payment agreement checklist for

How to fill out payment agreement checklist for

Who needs payment agreement checklist for?

Payment Agreement Checklist for Form

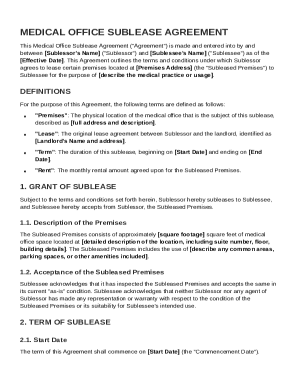

Understanding payment agreements

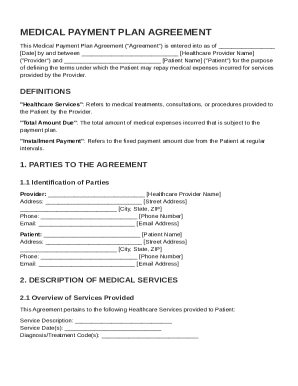

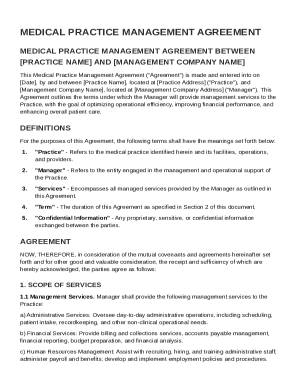

A payment agreement is a crucial document that outlines the terms under which payments are to be made between a creditor and debtor. This document typically includes details such as the amount owed, payment schedule, and potential penalties for late payment. The primary purpose of a payment agreement is to protect both parties by specifying their rights and obligations. For example, if a debtor agrees to pay in installments, the creditor is assured of a set repayment schedule.

The key benefits of using payment agreements include legal protection, clarity, and documented accountability. These contracts help to prevent misunderstandings that can arise during transactions, ensuring that both parties are on the same page regarding their expectations. Additionally, should disputes occur, a well-drafted payment agreement can serve as a reliable reference point in legal matters.

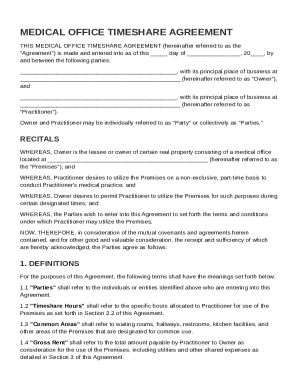

Importance of a comprehensive payment agreement

Having a comprehensive payment agreement is vital for protecting all parties involved. It clearly defines the roles of creditors and debtors, thereby minimizing the risk of disputes. A detailed agreement outlines specific terms and conditions, which helps to avoid ambiguity. For instance, specifying the exact payment methods accepted—be it checks, bank transfers, or online payment platforms—can eliminate confusion and potential disputes.

Essential elements of a payment agreement

A well-structured payment agreement must include several essential elements. First, it should clearly identify the parties involved. The creditor, often referred to as the lender, and the debtor must be named explicitly to eliminate any confusion about who is obligated to perform. Second, payment terms need to be defined, detailing the total amount owed, due dates, and accepted payment methods. Consideration of interest rates and late fees is also critical; these should be clearly articulated to prevent unexpected costs for the debtor.

Additionally, conditions for payment should be spelled out meticulously. For example, if payment is to be made upon delivery of a product or at the completion of a service, those conditions should be explicitly stated. Overall, each of these elements contributes to constructing a clear and enforceable payment agreement that protects both creditor and debtor.

Creating your payment agreement

Creating a payment agreement involves several steps to ensure all necessary information is included. First, gather personal details of all involved parties, including names, addresses, and contact information. Next, determine the payment amount and devise a schedule that suits both parties. This information forms the backbone of your payment agreement.

Utilizing interactive tools for document management

Using interactive tools like pdfFiller can enhance the document creation process significantly. With such platforms, users can easily create and edit forms while accessing a wide array of templates designed for payment agreements specifically. This empowers users to customize documents on the go, ensuring all necessary details are covered.

Additionally, features that allow collaboration are invaluable. With pdfFiller, teams can share drafts, comment on key points, and make necessary adjustments in real-time, facilitating seamless teamwork. This collaborative capability is particularly useful when dealing with complex agreements or when multiple parties are involved in the transaction.

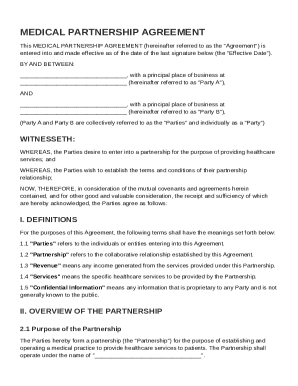

Reviewing and finalizing your payment agreement

Before signing your payment agreement, reviewing it thoroughly is essential. Ensure compliance with local regulations, as these can vary widely and may affect the agreement's enforceability. Also, double-check that all details provided are accurate—including names, amounts due, payment methods, and deadlines—to avoid complications later on.

Pre-signing checks can save both parties from headaches down the line. This review process is especially vital for agreements involving larger sums, as discrepancies can result in significant financial and legal consequences. A meticulous approach to finalizing your agreement lays a solid foundation for a successful transaction.

Signing your payment agreement

Once all details are correct, the payment agreement needs to be signed by both parties. Various signing methods are available, with traditional handwritten signatures being the most common. However, electronic signatures, especially with the rise of digital document handling, have gained popularity. These electronic signatures provide the added convenience of signing documents remotely, making it easier to manage payments and agreements.

Storing signed agreements securely is another critical point. Both technical measures, such as encrypted files, and organizational methods, like digital folders, ensure that the payment agreements remain accessible yet protected from unauthorized access. This security is paramount, especially should any disputes arise in the future.

FAQs about payment agreements

Navigating the landscape of payment agreements can raise various questions. One common query is: What if one party fails to pay? Generally, the agreement should specify the ramifications of missed payments, which can include late fees or acceleration clauses where the entire balance becomes due. Another frequent concern is whether a payment agreement can be modified, and the answer is yes—as long as both parties agree to the changes and document them accordingly.

Troubleshooting common issues

Common issues such as missed payments can be distressing. It is recommended to approach the debtor first to understand their circumstances. Open communication can often resolve misunderstandings without escalating to legal action. If the situation does not improve, the terms of the agreement may provide guidance on the next steps, such as initiating collections or renegotiating the terms.

For serious matters, it may become necessary to initiate legal action. Understanding when to pursue this route is crucial, as managing contracts with legal support can prevent unwarranted losses. Seeking advice from a lawyer familiar with contract law can provide insight into the best path forward.

Additional tips for a seamless experience with payment agreements

Keeping payment agreements updated is essential as circumstances change over time. For ongoing relationships, any changes to payment terms or account information should be documented and agreed upon promptly to prevent future disputes. Utilizing cloud-based solutions such as pdfFiller allows for easy updates and access to agreements, ensuring that all parties can review the most current documents as needed.

Moreover, keeping a digital record of all modifications can provide additional assurance. Regularly auditing these agreements helps maintain clarity in ongoing transactions, benefiting the financial health of both the creditor and debtor. Digital tools also track changes and restorations, thereby enhancing transparency in every interaction.

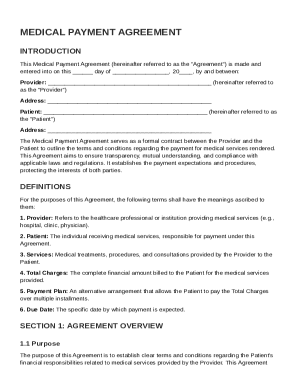

The role of pdfFiller in your payment agreement process

pdfFiller serves as an empowering tool for users looking to manage payment agreements efficiently. With its extensive range of customizable templates, users can seamlessly create, edit, and share documents on a single cloud-based platform. This versatility is ideal for individuals and teams seeking comprehensive document solutions that cater to their specific needs.

By ensuring compliance, pdfFiller allows users to focus on their agreements without worrying about legalities and security. Features like electronic signature capabilities and document tracking provide an additional layer of convenience and legitimacy. Always having access to your documents from any device makes tracking and managing agreements straightforward, thus enhancing the overall experience throughout the payment agreement process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit payment agreement checklist for from Google Drive?

How can I send payment agreement checklist for for eSignature?

How do I make edits in payment agreement checklist for without leaving Chrome?

What is payment agreement checklist for?

Who is required to file payment agreement checklist for?

How to fill out payment agreement checklist for?

What is the purpose of payment agreement checklist for?

What information must be reported on payment agreement checklist for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.